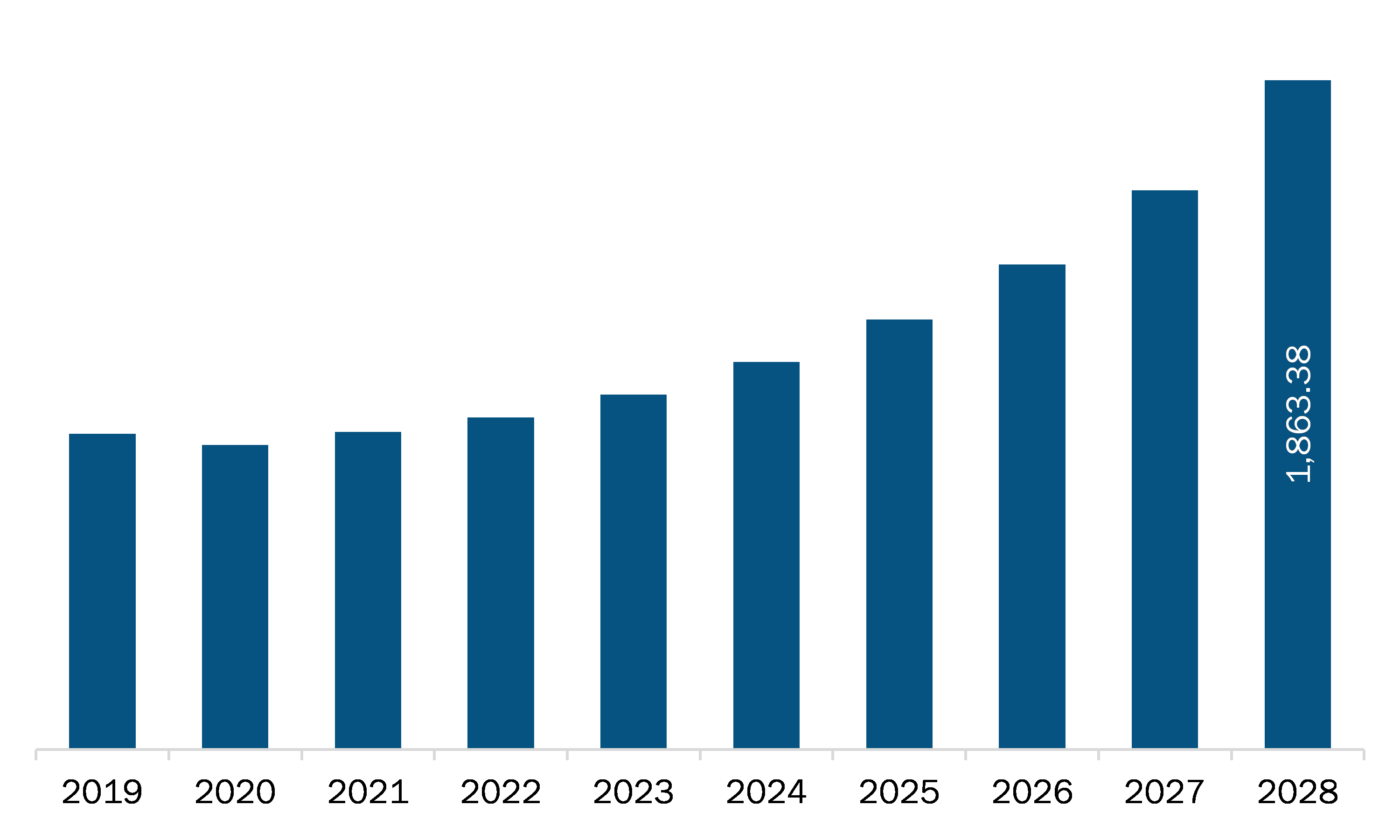

The recovered carbon black market in North America is expected to grow from US$ 884.67 million in 2021 to US$ 1,863.38 million by 2028; it is estimated to grow at a CAGR of 11.2% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Producing recovered carbon black from waste generated by rubber goods, specifically tires is an ecologically beneficial process. Moreover, the outcome is also finer than virgin carbon black, allowing for better cuts in the finished product. To produce 1 kg of virgin carbon black, ~1.5–2 kg of crude oil is required. Moreover, recovering carbon black also entails reusing valuable raw materials, propelling one higher up the recycling hierarchy. Thus, replacing virgin carbon black, produced out of traditional furnace processes, with recovered carbon black considerably reduces the carbon footprint. The use of recovered Carbon Black (rCB) alone can reduce the size of the carbon footprint by 80%, which is why many large tire manufacturers are trying to use significantly more recovered carbon black. For instance, in October 2018, Pyrolyx USA began constructing a plant in Terre Haute, Indiana, USA. It is expected to be fully completed in May 2019 and will start production in June 2019. The plant will have the capacity to process 40,000 tons of used tires per year and produce about 13 kilotons of recycled carbon black and 17.5 kilotons of pyrolysis oil, and 6.2 thousand tons of steel. Thus, the cost and environmental advantages associated with recovered carbon black are propelling the market growth.North America is one of the worst affected economies due to COVID-19 pandemic. The US has the highest number of confirmed cases of COVID-19, compared to Canada and Mexico. The unprecedented rise in number of COVID-19 cases across the US and Canada and the subsequent lockdown of its numerous manufacturing facilities has negatively influenced the growth of various markets. The significant disruption in manufacturing facilities along with raw material sourcing have had a negative impact upon the demand for recovered carbon black in the country. However, the market is reviving on account of significant measures undertaken by the governments such as vaccination drives. With the state of economic recovery, several industrial sectors are strategically planning to invest in advanced products to maximize revenue. This is expected to provide impetus to market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the recovered carbon black market. The North America recovered carbon black market is expected to grow at a good CAGR during the forecast period.

North America Recovered Carbon Black Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Recovered Carbon Black Market Segmentation

North America Recovered Carbon Black Market – By Application

- Tire

- Non-Tire Rubber

- Plastics

- Others

North America Recovered Carbon Black Market- By Country

- US

- Canada

- Mexico

North America Recovered Carbon Black Market-Companies Mentioned

- Bolder Industries

- Delta Energy LLC

- ENRESTEC

- Klean Carbon

- Pyrolyx AG

- SR2O Holdings, LLC

North America Recovered Carbon Black Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 884.67 Million |

| Market Size by 2028 | US$ 1,863.38 Million |

| CAGR (2021 - 2028) | 11.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For