North America Servo Motors and Drives Market Analysis and Forecast by Size, Share, Growth, Trends 2031

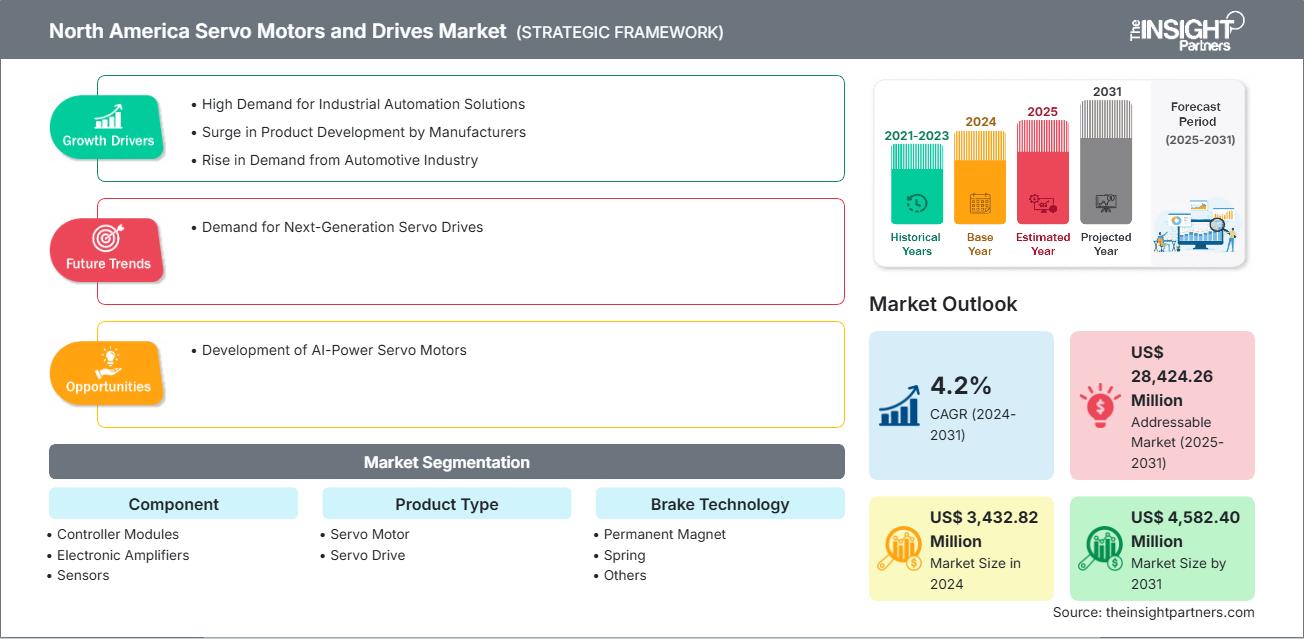

North America Servo Motors and Drives Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Controller Modules, Electronic Amplifiers, Sensors, Encoders, and Others), Product Type (Servo Motor and Servo Drive), Brake Technology (Permanent Magnet, Spring, and Others), and Industry (Automotive and Transportation, Semiconductor and Consumer Electronics, Food Processing Industry, Textile Industry, and Others)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00041308

- Category : Electronics and Semiconductor

- No. of Pages : 169

- Available Report Formats :

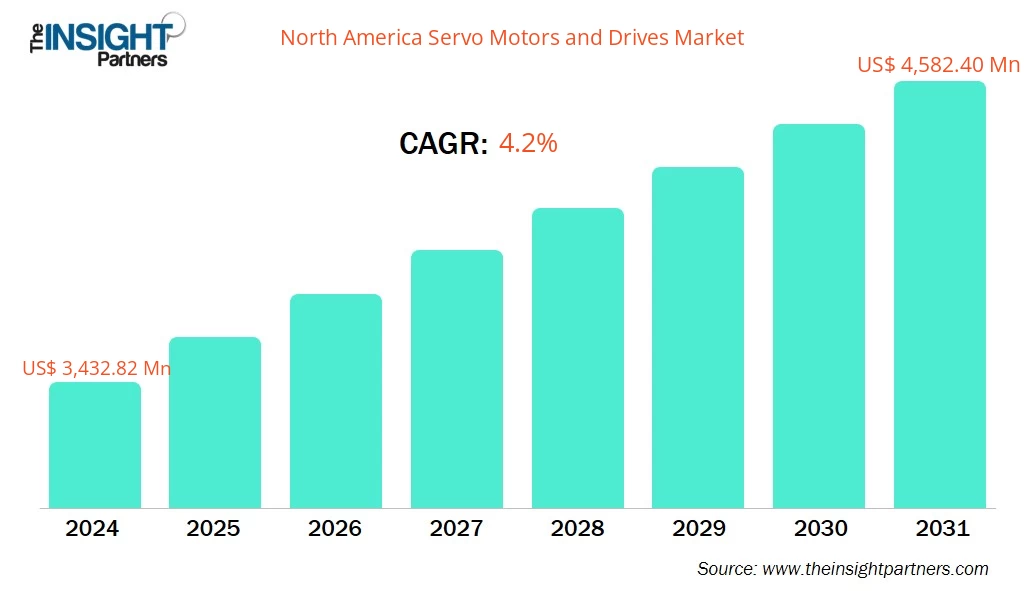

The North America servo motors and drives market size is expected to reach US$ 4,582.40 million by 2031 from US$ 3,432.82 million in 2024. The market is estimated to record a CAGR of 4.2% from 2024 to 2031.

Executive Summary and North America Servo Motors and Drives Market Analysis:

The US, Canada, and Mexico are among the major economies in North America. The region contributes a noteworthy share to the global servo motors and drives market owing to the growing investments by industries toward the adoption of automation solutions such as robots, computer numerical control (CNC) machines, automated guided vehicles (AGVs), conveyor systems, packaging machines, and pick-and-place systems. Servo motors enable high-speed mobility, allowing the robot to work fast while maintaining precision. Many industries, such as automotive, electronics, and manufacturing, are increasingly adopting robots to automate repetitive tasks, reduce manual work, and improve workers' safety at hazardous locations. For instance, according to the International Federation of Robotics (IFR) data published in April 2024, industries in the US, Canada, and Mexico are investing in the adoption and installation of robots for automating industrial processes. Automotive, electrical, electronics, and manufacturing are the major industries in North America that are investing significantly in robotics technologies, increasing the demand for servo motors and drives to precisely maintain and control the speed, position, and motion of robotic parts. US's automotive market sales increased by 1%, with a record of 14,678 robots installed in 2023, which increased by 47% with 14,472 units installed in 2022. In 2023, automotive and component manufacturers account for 33% of all industrial robot deployments in the country. Similarly, robot installations in Canada increased by 43% to 4,616 units in 2023. The automotive industry accounted for 55% of the country's robot installations, and sales of the automotive sector increased by 99%, with 2,549 units installed in 2023. On the other hand, the number of robots installed in Mexico's manufacturing industry reached 5,868 units in the automotive industry in 2023. The automotive industry is the largest adopter of robots in the country, accounting for 69% of total installations in which sales totaled 4,068 units in 2023. The growing adoption of automation solutions such as robots and the expansion of the automotive and electronics industry surged the adoption of servo motors and drives in the automotive and electronics production lines. Servo motors and drives are used in automotive manufacturing lines to maintain consistent precision, ensure repetitive actions for robots, and decrease errors. Robots in the automotive industry perform tasks such as part installation, assembling, welding operations, quality inspection, painting, and coating application. Servo motors and drives allow robots to handle repetitive tasks continuously to ensure smooth and jerky-free motion, allowing robots to react in real-time to any positional changes by optimizing efficiency and maintaining the quality of processes.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Servo Motors and Drives Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Servo Motors and Drives Market Segmentation Analysis:

Key segments that contributed to the derivation of the North America servo motors and drives market analysis are component, product type, brake technology, and industry.

- Based on component, the North America servo motors and drives market is segmented into controller modules, electronic amplifiers, sensors, encoders, other. The controller modules segment held the largest share of the market in 2024.

- By product type, the North America servo motors and drives market is bifurcated into servo motor and servo drive. The servo motor segment held a larger share of the market in 2024.

- Based on brake technology, the North America servo motors and drives market is segmented into permanent magnet, spring, and others. The permanent magnet segment held the largest share of the market in 2024.

- Based on industry, the North America servo motors and drives market is segmented into automotive and transportation, semiconductor and consumer electronics, food processing industry, textile industry, and others. The automotive and transportation segment held the largest share of the market in 2024.

North America Servo Motors and Drives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,432.82 Million |

| Market Size by 2031 | US$ 4,582.40 Million |

| CAGR (2024 - 2031) | 4.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Servo Motors and Drives Market Players Density: Understanding Its Impact on Business Dynamics

The North America Servo Motors and Drives Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

North America Servo Motors and Drives Market Outlook

The new generation of small servo drive systems is fueling the servo motors and drives market growth. These modern and compact technologies are designed to provide higher precision and greater energy efficiency, which are critical in applications such as robotics, automation, and packaging. The next generation and small servo drives enable smoother operation and reduce maintenance requirements of industries. The demand for cutting-edge technology, such as innovative algorithms, real-time feedback control, and improved heat management with a focus on lower operational expenses, encouraged market players to develop new-generation small servo drive systems. For instance, in January 2024, Siemens AG innovated the Sinamics S210 servo drive system with new hardware and software that are suitable for a larger range of applications. Siemens is updating the well-known Sinamics S210 servo drive system with a new hardware design and V6 software generation, expanding its range of applications. The servo drive system is ideal for high-dynamic applications with power outputs ranging from 50 W to 7 kW, such as packaging machines, pick-and-place applications, and digital printing. Moreover, as businesses demand greater precision, flexibility, and economy from automation, the use of high-performance servo systems such as the Sinamics S210 is increasing among industries. Moreover, the increasing focus of market players on product development to attract new customers is boosting the market. For instance, WITTENSTEIN SE's newly designed cyber simco drive 2 servo drives are 30% more compact and offer maximum connectivity with their multiple ethernet interfaces. They also include real-time CIP sync, decentralized intelligence, and STO safety features suitable for flexible programming of applications. Thus, the evolution of these advanced and compact servo drive systems is inextricably related to the overall expansion of the servo motors and drives market.

North America Servo Motors and Drives Market Country Insights

Based on country, the North America servo motors and drives market comprises the US, Canada, and Mexico. The US held the largest share in 2024.

The automotive sector leads servo motors and drives market growth in the US. According to the US Energy Information Administration data of August 2024, the US share of electric and hybrid car sales increased in the second quarter of 2024 from the first quarter. According to Wards Intelligence, the sale of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEVs) increased from 17.8% of total new light-duty vehicle (LDV) sales in Q1 to 18.7% in Q2 of 2024. Similarly, the sale of luxury electric vehicles accounted for 32.8% of total luxury sales in Q2 of 2024. Luxury car sales in the US accounted for 16.6% of the entire light-duty market in the year 2Q 2024, with luxury vehicles accounting for 73.8% of total battery electric sales, which consists of 8.3% of hybrid vehicle sales and 29.2% of plug-in hybrid vehicle sales. This surge reflects an increasing demand for sustainable, more energy-efficient vehicles. The growing EV adoption encourages market players to improve vehicle performance. In electric and modern vehicle production, servo motors are used for the assembly and operation of door mechanisms, such as powered sliding doors, trunk lids, and window lifters. The precise control of servo motors ensures the smooth and consistent operation of its components. Furthermore, the growing adoption of EVs and autonomous vehicles among consumers is expected to flourish in the servo motors and drives market in the near future.

North America Servo Motors and Drives Market Company Profiles

Some of the key players operating in the market include ABB Ltd, Delta Electronics Inc, Fanuc Corp, Mitsubishi Electric Corp, Fuji Electric Co Ltd, Nidec Corp, Rockwell Automation Inc, Schneider Electric SE, Siemens AG, and Yaskawa Electric Corp, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Servo Motors and Drives Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For