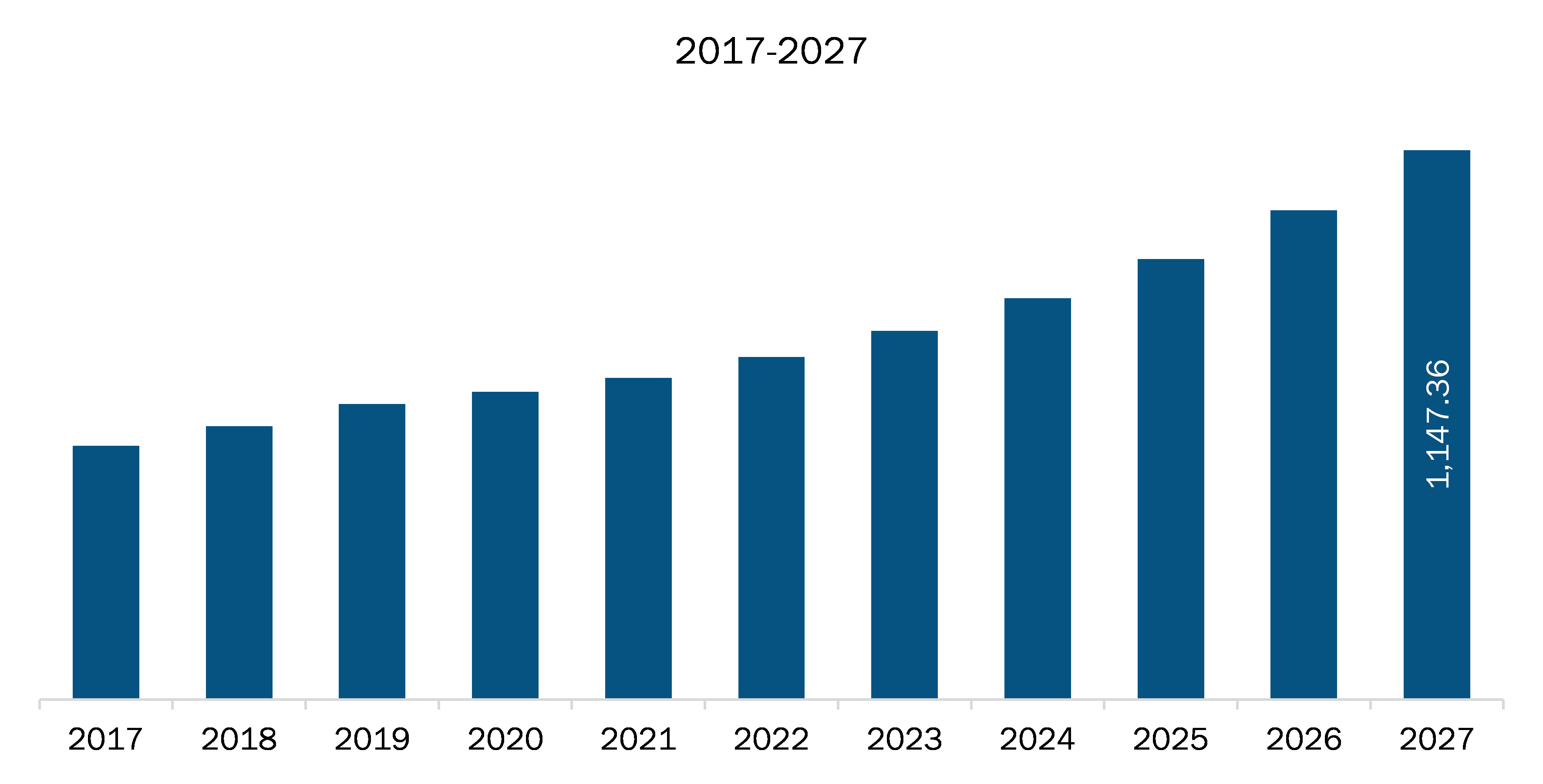

The North America surety market was valued at US$ 8,573.43 million in 2019 and is expected to grow at a CAGR of 6.4% during the forecast period from 2020–2027 to reach US$ 13,498.40 million by 2027.

The surety market penetration rates in North America region is higher than any other markets across the globe. This is attributed to most of US State governments’ laws that mandate surety bonds. Both the US and Canada Surety markets are ruled by insurers, and banks play only a minor role. As per the Surety & Fidelity Association of America, the surety industry has witnessed growth consecutively for two years. The direct premium written accounted to US$ 6.2 million in 2017 from US$ 5.9 million in 2016. The Surety & Fidelity Association of America’s statistical department studied the data from the year 2013 to 2016 and reported that judicial court guarantee bonds and private contract bonds witnessed the largest premium increases. Also, airport buildings at state/municipal, federal and private level, private building and building related construction; private completion bonds; state/municipal subdivision bonds; coal reclamation bonds; and mechanic’s lien bonds were the other areas with noteworthy premium increase.

Moreover, according to the Mexican Construction Industry Chamber, the construction sector of the country grew by 2% in the year 2016 and expects a growth of 1% to 1.5% in 2017. This growth is primarily driven by constant investments by the private sector in the residential and commercial building projects. Also, the Canadian government is taking several initiatives to enhance the public and residential infrastructure. For instance, the government of Canada has plans to invest US$ 6 million in its social infrastructure by 2020 with an aim to provide affordable housing to the lower class and middle class population in the country by spending of new housing buildings construction as well as renovation of old buildings. The growth of construction sector as well as renovation of buildings are anticipated to positively influence the growth of surety market in the North American region

Market initiative is a strategy basically adopted by the companies to expand its footprint across the region and meet the growing demand of its customers. The market players present in surety market are mainly focusing towards signing partnership, contracts, joint ventures, funding, and inaugurating new offices across the world which permit the company maintain its brand name globally. Most of the market initiative were observed in North America, which have high density of surety market players.

The North American economies are devastated by the outbreak of COVID-19 since March 2020. As the number of infected patients continue to grow, the uncertainty towards economic revival continues to surge. Since, the outburst, the US recorded the highest unemployment rates across industries. The COVID-19 outbreak has resulted in closure of several construction sites thereby delaying in completing the projects; numerous new construction project funding have been put on hold, which is impacting negatively on the construction market players. In addition, the supply chain of various materials in the US construction industry is highly disrupted, leading the contractors to temporarily terminate their ongoing projects. Labor shortage as a result of lockdown measure. These are some of the factor responsible for the downfall of the construction industry caused by COVID-19. The impact of downfall of construction industry is directly to surety writers, which has been analyzed while estimating the market size of surety market during 2020.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Surety Market–Segmentation

North America Surety Market, by Bond Type

- Contract Surety Bond

- Commercial Surety Bond

- Court Surety Bond

- Fidelity Surety Bond

North America Surety Market, by Country

- US

- Canada

- Mexico

North America Surety Market -Companies Mentioned

- CRUM & FORSTER

- CNA Financial Corporation

- American Financial Group, Inc.

- The Travellers Indemnity Company

- Liberty Mutual Insurance Company

- The Hartford

- HCC Insurance Holdings, Inc.

- CHUBB

- AmTrust Financial Services

- IFIC Security Group

North America Surety Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 8,573.43 Million |

| Market Size by 2027 | US$ 13,498.40 Million |

| CAGR (2020 - 2027) | 6.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Bond Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For