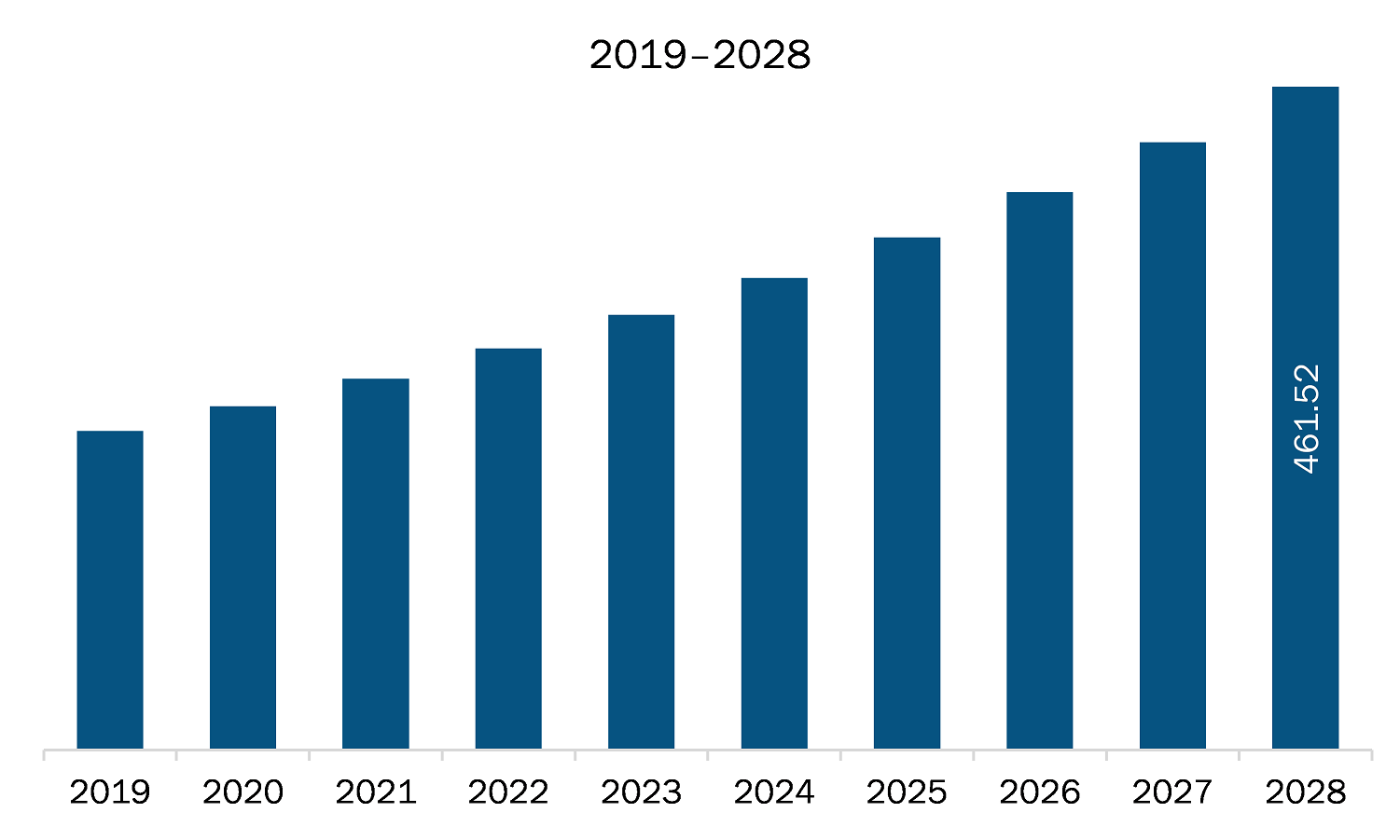

The veterinary rapid test market in North America is expected to grow from US$ 258.39 million in 2021 to US$ 461.52 million by 2028; it is estimated to grow at a CAGR of 8.6% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. An increase is zoonotic diseases is likely to drive the veterinary rapid test market. Animals can sometimes carry harmful germs that can spread to people and cause illness; these are known as zoonotic diseases or zoonoses. Zoonotic diseases are caused by harmful germs like bacteria, viruses, parasites, and fungi. These germs can cause many different types of illnesses in people and animals, ranging from mild to severe illness and even death. As per CDC, it estimates that more than six out of every ten known infectious diseases in people can be spread from animals and three out of every four new or upcoming infectious diseases in people come from animals. Outbreaks such as severe acute respiratory syndrome (SARS) and avian influenza have shown once again the potential of microorganisms from animal reservoirs to adapt to human hosts. During the past decades, many earlier unknown human infectious diseases have emerged from animal reservoirs, from agents such as Ebola virus, human immunodeficiency virus (HIV), Nipah virus, West Nile virus, and Hantavirus. More than three-quarters of the human diseases that are new, emerging, or re-emerging at the beginning of the 21st century are caused by pathogens which are originated from animals or products of animal origin. According to WHO, it is estimated that, some 60% of emerging infectious diseases that are reported are zoonoses and about one billion cases of illness and millions of deaths occur every year from zoonoses. Over 30 new human pathogens have been detected in the last three decades, 75% of which have originated in animals. Hence, emerging, and re-emerging zoonotic diseases will become a progressively more significant factor in the demand for veterinary rapid testing and has triggered companies to produce advanced diagnostic kits, which is contributing to the growth of the overall market for veterinary rapid testing.

The outbreak of COVID-19 has impacted all the industries including veterinary sector. There was an increase in pet adoption reported due to social isolation. For instance, shelters, nonprofit rescues, private breeders all reported high consumer demand during COVID 19 in the US. Most of the consumers in the market grappled with the onset of the pandemic. The retail e-commerce platforms witnessed high growth due to several restrictions on the brick-and-mortar stores and the disruption of the overall supply channel. Sales have spiked for pet care products at home, driven by the closure of veterinary clinics. Also, the pet population has increased in the region because of lockdown and people wanting a companion. Home isolation have driven the short-term pet fostering programs that may translate into long-term pet population growth in the future. Despite some disruptions caused by COVID-19 containment measures, the long-term growth potential of the sector remains intact. Also, the COVID-19 pandemic has highlighted the adaptability and response by veterinary diagnosticians to an emerging infectious disease and their role in maintaining animal health and protecting human public health. In addition, the market players have witnessed rise in sales. For instance, IDEXX’s companion animal group (CAG) diagnostics revenue increased by 23% in Q3 2020 as compared to last year. The recent surge in ownership, driven by an increase in adoption and fostering by people confined to their homes, offers lucrative opportunities for the growth of the market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive veterinary rapid test market. The North America veterinary rapid test market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Veterinary Rapid Test Market Segmentation

North America Veterinary Rapid Test Market – By Product

- Rapid Test Kits

- Rapid Test Readers

North America Veterinary Rapid Test Market – By Application

- Viral Diseases

- Bacterial Diseases

- Parasitic Diseases

- Allergies

- Other Applications

North America Veterinary Rapid Test Market – By Animal Type

- Livestock Animals

- Cattle

- Poultry

- Swine

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Others

North America Veterinary Rapid Test Market- By Country

- US

- Canada

- Mexico

North America Veterinary Rapid Test Market-Companies Mentioned

- HESKA CORPORATION

- IDEXX LABORATORIES, INC.

- Virbac

- Woodley Equipment Company Ltd

- Zoetis Inc.

North America Veterinary Rapid Test Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 258.39 Million |

| Market Size by 2028 | US$ 461.52 Million |

| CAGR (2021 - 2028) | 8.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For