Gene Therapy Market Trends and Growth Insights 2025-2031

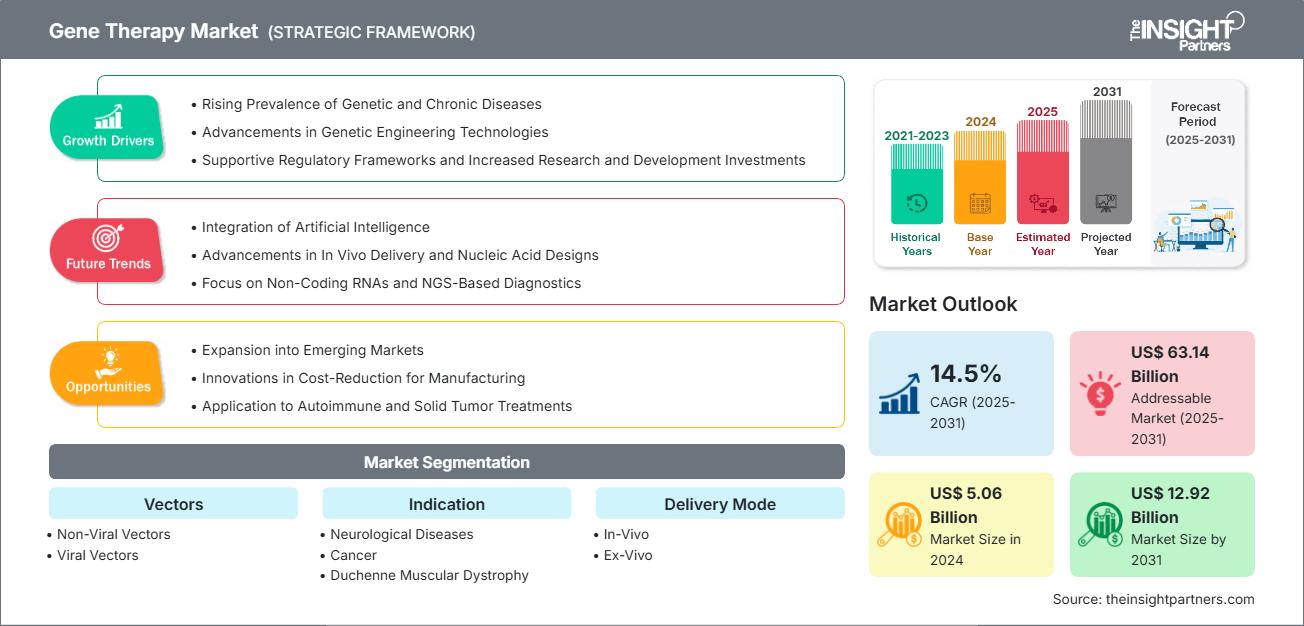

Gene Therapy Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Vectors (Non-Viral Vectors and Viral Vectors), Indication (Neurological Diseases, Cancer, Duchenne Muscular Dystrophy, Hepatological Diseases, and Other Indications), Delivery Mode (In-Vivo and Ex-Vivo)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPHE100001165

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 300

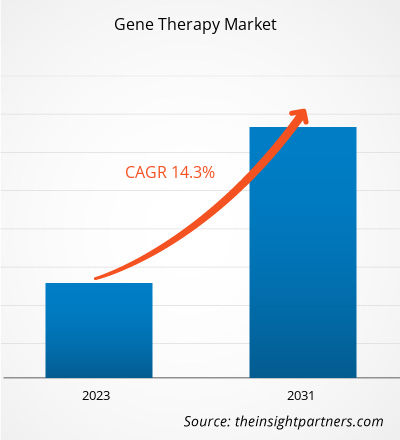

The Gene Therapy Market size is projected to reach US$ 12.92 billion by 2031 from US$ 5.06 billion in 2024. The market is expected to register a CAGR of 14.50% during 2025–2031.

Gene Therapy Market Analysis

The rise in chronic and genetic disease prevalence, increasing advancements in genetic engineering technologies, supportive regulatory frameworks, and increased research and development investments favor the growth of the gene therapy market. Integrating artificial intelligence (AI) into personalized medicine contributes to market development. Opportunities lie in emerging economies where disease prevalence and healthcare infrastructure are improving.

Gene Therapy Market Overview

Gene therapy is a medical approach that treats diseases by either inactivating a faulty gene, replacing it with a healthy copy, or introducing a new or modified gene into the body to help treat or prevent the condition. It can be classified into in vivo and ex vivo gene therapy. Gene therapy is used to cure cancers, neurological disorders, cardiovascular disease, infectious diseases, and rare diseases. Gene therapy encompasses the manipulation of genes to fight or prevent diseases. The therapy works by introducing a functional gene into individuals affected by a disease caused by a defective or mutated gene. Among the treatments are biosimilars, vaccines, complex generics, gene therapies, immuno-therapies, and novel drugs.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGene Therapy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gene Therapy Market Drivers and Opportunities

Market Drivers:

- Growing Prevalence Of Genetic Diseases And Cancer: In the US, ~ 25 to 30 million individuals suffer from rare diseases, many of which are genetic and suitable for gene therapy.

- Advancements in Genetic Engineering Technologies: Recent innovations in genetic engineering technologies, such as CRISPR/Cas9, base editing, and enhanced viral vectors, accelerate the development and application of therapies.

- Supportive Government Initiatives: From 2024 to 2025, the FDA has expedite the approval process for cell and gene therapies, focusing on innovation and ongoing monitoring.

- Expanding Healthcare Infrastructure: Research and development investments have surged, with global funding reaching billions due to public-private partnerships and grants, which have enabled over 3,000 clinical trials worldwide.

- Expansion of Gene Therapy CDMOs: RoslinCT and Lykan Bioscience, prominent CDMOs in the cell and gene therapy industry, have formed a unified company operating under the RoslinCT brand.

Market Opportunities:

- Expansion into Emerging Markets: Adoption of advanced gene editing technologies, such as CRISPR and gene delivery systems, enable more effective and precise treatments. As these innovations become more accessible, they pave the way for gene therapies to address unmet medical needs, making treatment options smarter, more reliable, and more cost-effective.

- Personalised Medicine: Developing treatment that can be customized for different genetic profiles supports approaches in precision medicine. Healthcare professionals can optimize treatments, cut down on wasteful spending, and make it simpler to upgrade therapeutic protocols by attending to the needs of each individual patient.

- R&D Activities by the Market Players: Investing in research for gene therapy techniques that utilize non-viral delivery methods, improve safety profiles, and enhance patient outcomes provides a competitive advantage.

- Emerging Applications Such as Autoimmune and Solid Tumor Treatment: The increasing demand for innovative treatments in fields such as oncology, rare genetic disorders, and chronic diseases drives growth in the gene therapy market.

Gene Therapy Market Report Segmentation Analysis

The gene therapy market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest gene therapy market trends. Below is the standard segmentation approach used in industry reports:

By Vectors:

- Non-Viral Vectors: The increasing preference for non-viral vectors is influencing the dynamics of the gene therapy market by broadening its therapeutic potential.

- Viral Vectors: Viral vectors derived from adeno-associated viruses (AAV), lentiviruses, adenoviruses, and retroviruses constitute the backbone of FDA-approved gene therapies.

By Indication:

- Neurological Diseases: The development of gene therapies offers potential one-time cures rather than lifelong symptom management of conditions such as neurodegenerative diseases and spinal muscular atrophy (SMA).

- Cancer: The rising prevalence of cancer is increasing the demand for advanced, targeted treatments like gene therapies.

- Duchenne Muscular Dystrophy: The urgency for curative options such as gene therapies, which tackle the root causes, including mutations in the dystrophin gene, rather than merely alleviating symptoms increases as the number of DMD cases grows

- Hepatological Diseases: Rising cases of hepatological diseases have spurred investment in the pharmaceutical sector, with companies accelerating clinical trials and regulatory submissions to seize an expanding market.

- Other Indications: The increasing incidence of rare diseases propels the use of gene therapy techniques, such as antibody-drug conjugates.

By Delivery Mode:

- In-Vivo

- Ex-Vivo

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Gene Therapy

Gene Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.06 Billion |

| Market Size by 2031 | US$ 12.92 Billion |

| Global CAGR (2025 - 2031) | 14.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Vectors

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Gene Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The Gene Therapy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Gene Therapy Market Share Analysis by Geography

The gene therapy market in Asia Pacific is witnessing the fastest growth. The need for faster order fulfilment, the booming e-commerce ecosystem, and investment in the booming e-commerce ecosystem are factors driving market expansion. Emerging markets in Latin America, the Middle East, and Africa have untapped opportunities for gene therapy providers to expand. The gene therapy market grows differently in each region. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers: The increasing research and development of innovations contribute to the region's growing gene therapy market size. The US FDA has approved 7 cell and gene therapy drugs, with the pipeline of new products reaching ~1,200 experimental therapies. Half of these are in Phase 2 clinical trials, with estimates of annual sales growth accounting for 15% for cell therapies and ~30% for gene therapies, as per the Chemical & Engineering News report 2023 estimates.

- Trends: Adoption of AI in gene editing by market players.

2. Europe

- Market Share: Substantial share due to early adoption of CRISPR/Cas9, base editing, and improved viral vector technologies.

- Key Drivers: The availability of advanced research facilities and the high demand for technologically advanced genetic engineering tools for research and development of gene therapies contribute to the region's market growth.

- Trends: Investments in smart gene editing solutions.

3. Asia Pacific

- Market Share: Region is fastest-growing with increasing market share each year.

- Key Drivers: A strong and supportive research infrastructure and government regulations fuel the adoption of gene therapies. Countries is the region are facing a growing burden of chronic and genetic diseases, escalating the demand for innovative therapies. The rising business expansion strategies by the market players in this region are propelling the gene therapy market share.

- Trends: Increasing investment in gene therapy and collaboration with CDMOs in Asia Pacific.

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- The increasing prevalence of genetic and rare diseases in the region is creating urgent demand for advanced therapies. Further, the government initiatives for the development of healthcare infrastructure are fueling the adoption. Fiocruz, a research foundation under the Brazilian Ministry of Health, partnered with Caring Cross in March 2024 to establish local production of CAR-T therapies. This collaboration is anticipated to reduce the cost to US$ 35,000 per dose in Brazil.

- Trends: Expanding clinical trials supporting the development of gene therapies.

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Growing investment in infrastructure under government initiatives such as the Emirati Genome Programme is vital in increasing the demand for gene therapies.

- Robust regulatory approval frameworks supporting the research and development of innovations fuel the growth of the gene therapy market.

- Trends: Public and private partnerships to adopt new gene editing technologies.

Gene Therapy Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as BEUMER Group GmbH & Co KG and Bastian Solutions LLC. Regional and niche providers such as Orchard Therapeutics (Europe), Passage Bio (US), and Yapan Bio (India) add to the competitive landscape across regions.

This high level of competition urges companies to stand out by offering:

- Advanced security features

- Value-added services such as analytics & predictive maintenance, real‑time operational analytics, and installation

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Manufacturers and CDMOs collaborate to develop new gene therapies with advanced genetic engineering tools.

- Regulatory bodies such as the US FDA, Canada Health, and ANVISA have streamlined the approval process for the fast and easy launch of innovations.

- Academic and research institutes are expanding research capabilities with government grants and funds.

Additional companies analyzed during the course of research:

- Intellia Therapeutics

- Sana Biotechnology

- Caribou Biosciences

- Editas Medicine

- Beam Therapeutics

- Sangamo Therapeutics

- Freeline

- Orchard Therapeutics

- uniQure

- Pfizer

- Takara Bio Inc

- PTC Therapeutics

- Adaptimmune Therapeutics

- Adverum Biotechnologies

- Bayer

- eGenesis

Gene Therapy Market News and Recent Developments

- AGC Biologics Launched a New Dedicated Cell and Gene Business Division. The new Cell and Gene Technologies Division launched byAGC Biologics will focus on elevating AGC Biologics’ existing capabilities and supporting developers who need capacity, scientific capabilities, and technically qualified cell and gene CDMO operators. The site offers 30 years of experience in cell and gene therapy, with nine commercial approvals and hundreds of GMP batches produced successfully

- FDA Approved Casgevy and Lyfgenia to Treat Patients with Sickle Cell Disease Casgevy is the first FDA-approved therapy utilizing CRISPR/Cas9, a genome editing technology. Patients’ hematopoietic (blood) stem cells are modified by genome editing using CRISPR/Cas9 technology.

Gene Therapy Market Report Coverage and Deliverables

The "Gene Therapy Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Gene Therapy Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gene Therapy Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gene Therapy Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the gene therapy Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For