Offshore Oil and Gas Pipes Fittings and Flanges Market Analysis, Size, and Share by 2030

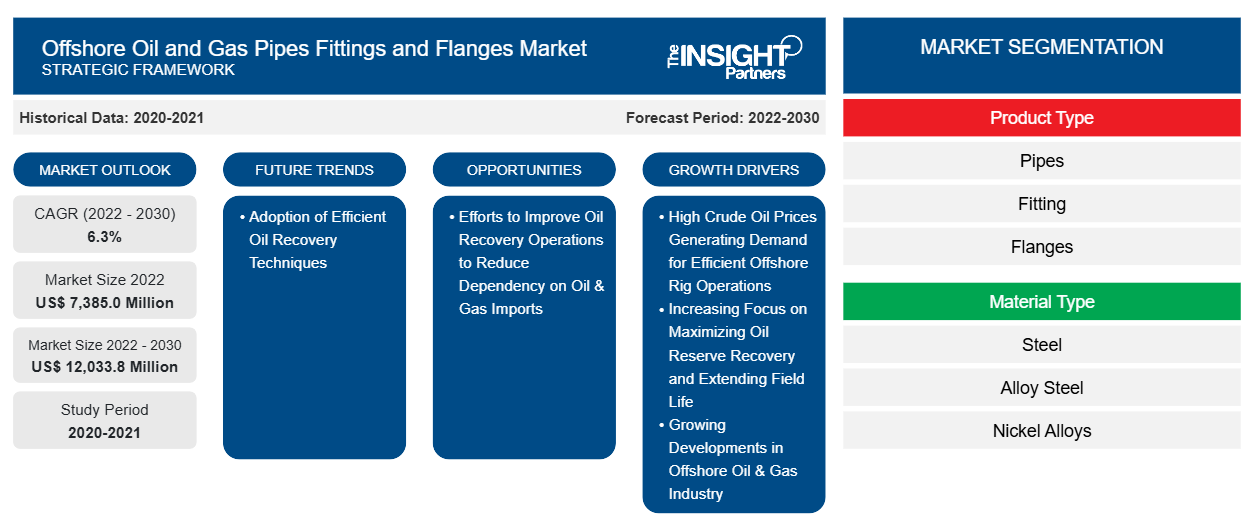

Offshore Oil and Gas Pipes Fittings and Flanges Market Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Pipes, Fitting, and Flanges), Material Type (Steel, Alloy Steel, Nickel Alloys, and Copper Alloys); and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Dec 2023

- Report Code : TIPRE00032624

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 140

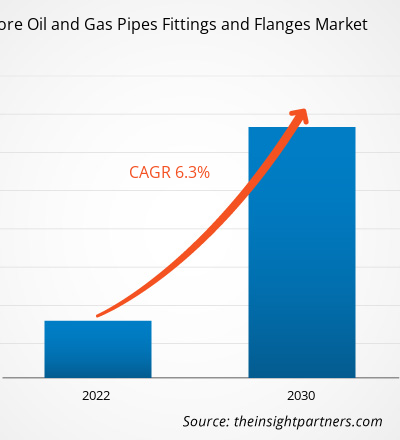

The offshore oil and gas pipes fittings and flanges market size is projected to reach US$ 12,033.8 million by 2030 from US$ 7,385.0 million in 2022. The market is expected to register a CAGR of 6.3% in 2022–2030. Increasing offshore oil & gas production, rising production of new offshore oil rigs, and reconstruction of existing and old offshore oil & gas rigs are among the key trends driving the offshore oil and gas pipes fittings and flanges market.

Offshore Oil and Gas Pipes Fittings and Flanges Market Analysis

The offshore oil and gas pipes fittings and flanges market is expected to experience considerable growth during the analyzed timeframe owing to the rising number of offshore natural gas projects as well as the discovery of new offshore oil fields, particularly in remote locations. Additionally, the depletion of existing oil & gas reserves in various countries has created a demand for cross-border pipelines for the supply of oil & gas-related products, which is boosting the growth of the offshore oil and gas pipes fittings and flanges market. The increasing demand for cost-effective transportation methods for oil and gas is one of the major factors that is expected to boost the demand for offshore pipes fittings and flanges in the overseas oil & gas sector across the globe.

Offshore Oil and Gas Pipes Fittings and Flanges Market Overview

With the mounting population and industrialization, the demand for energy is also rising at the global level. The rise in energy consumption also boosted the need for oil and gas in developing and developed economies. This has resulted in driving the demand for offshore infrastructure across the globe which in turn is projected to drive the offshore oil and gas pipes fittings and flanges market. In addition, the large population, high per capita income, and rapid industrialization are driving the demand for oil and gas, which in turn is expected to drive the offshore oil & gas pipes, fittings, and flanges market in the world.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOffshore Oil and Gas Pipes Fittings and Flanges Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Offshore Oil and Gas Pipes Fittings and Flanges Market Drivers and Opportunities

The Raising Demand for Natural Gas and Crude Oil is expected to be the Prime Driver for the Offshore Oil and Gas Pipes Fittings and Flanges Market

The demand for oil & natural gas is witnessing a constant increase across the world. The US and UK have registered the most considerable growth. The robust increase in petrochemical demand in the US resulted in increased consumption. The surge in industrial production, along with the high demand for trucking services, is boosting the demand for petrochemicals, thereby fuelling the offshore oil and gas pipes fittings and flanges market growth. Moreover, the growth in air traffic volumes worldwide, particularly in Asia's developing economies, is another significant factor resulting in increased oil consumption.

The Organization of the Petroleum Exporting Countries (OPEC) published ‘The 2020 OPEC World Oil Outlook’ in October 2020. As per the outlook, the outbreak of the COVID-19 pandemic led to a downturn in oil demand; however, it was expected that global energy demand would register constant growth in the future, rising by a noteworthy 25% to 2045. The outlook further anticipates oil to be the largest contributor in the energy mix market, contributing 27% of the overall energy share by 2045. The demand for oil products is estimated to rise at more than ~47 mb/day during 2022–2025 in OECD countries. On the other hand, the demand in non-OECD countries is projected to hike by 22.5 mb/day during the forecast period to 2045.

Efforts to Improve Oil Recovery Operations to Reduce Dependency on Oil & Gas Imports

The steam injection method has been exploited commercially over recent decades to improve recovery from conventional heavy oil reservoirs in their later stages of development. The injected steam increases the overall pressure of an offshore oil reservoir, which helps improve the mobility ratio of crude oil and allows it to flow efficiently. As a result, the enhanced oil recovery methods help revitalize extraction processes in existing offshore oil wells. Various countries are investing in efforts to rejuvenate their existing oil resources to boost domestic oil production and decrease their dependence on oil imports. Thus, the projected expansion of their oil & gas operations is anticipated to offer promising growth opportunities for the offshore oil and gas pipes fittings and flanges market players in the coming years.

Offshore Oil and Gas Pipes Fittings and Flanges Market Report Segmentation Analysis

Key segments that contributed to the derivation of the offshore oil and gas pipes fittings and flanges market analysis are product type and material type.

- Based on product type, the offshore oil and gas pipes fittings and flanges market has been divided into pipes, fitting, and flanges. The pipes segment held a larger market share in 2022.

- Based on the material type, the offshore oil and gas pipes fittings and flanges market has been divided into steel, alloy steel, nickel alloys, and copper alloys. The steel segment held a larger market share in 2022.

Offshore Oil and Gas Pipes Fittings and Flanges Market Share Analysis by Geography

The geographic scope of the offshore oil and gas pipes fittings and flanges market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Europe has dominated the offshore oil and gas pipes fittings and flanges market in 2023. The European region includes Germany, Norway, Italy, Russia, the UK, and the Rest of Europe. The growth in offshore activities is opportunistic for pipeline market growth in Europe. Further, the recovery of the economies across Europe is expected to drive growth in the demand for oil & gas in the coming years. Europe is the 2nd largest producer of petroleum products globally, persisting with an oil refining capacity of more than 15% of the total. The gas industry in Europe has observed various shifts owing to the rising European LNG demand. The government bodies have taken various steps to offer notices including ample of UK industries, comprising of oil and gas. Norway and Russia still maintained their position as natural gas suppliers, whereas Germany, France, and Italy are the main importers of natural gas. Thus, a large number of offshore projects for oil & gas would accelerate the demand for pipes, fittings & flanges, and services as well.

Offshore Oil and Gas Pipes Fittings and Flanges Market Regional Insights

The regional trends and factors influencing the Offshore Oil and Gas Pipes Fittings and Flanges Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Offshore Oil and Gas Pipes Fittings and Flanges Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Offshore Oil and Gas Pipes Fittings and Flanges Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7,385.0 Million |

| Market Size by 2030 | US$ 12,033.8 Million |

| Global CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Offshore Oil and Gas Pipes Fittings and Flanges Market Players Density: Understanding Its Impact on Business Dynamics

The Offshore Oil and Gas Pipes Fittings and Flanges Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Offshore Oil and Gas Pipes Fittings and Flanges Market top key players overview

Offshore Oil and Gas Pipes Fittings and Flanges Market News and Recent Developments

The offshore oil and gas pipes fittings and flanges market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for offshore oil and gas pipes fittings and flanges market and strategies:

- In July 2023, Vallourec won two major orders for supplying line pipes for phases 6 & 8 of the Buzios oil field development which is operated by Petrobras. These orders are in addition to the previous contract for phase 7, representing a total of 48,000 tons of line pipe.

- In June 2021, AFG Holdings, Inc. announced that it had acquired the shares of Maass Flange Corporation and its affiliated businesses in Mexico and Canada. Maass Flange Corporation is the largest domestic manufacturing supplier of stainless and nickel alloy flanges in North America.

Offshore Oil and Gas Pipes Fittings and Flanges Market Report Coverage and Deliverables

The “Offshore Oil and Gas Pipes Fittings and Flanges Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, & country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For