Pharmacogenomics Market Key Players and Opportunities by 2028

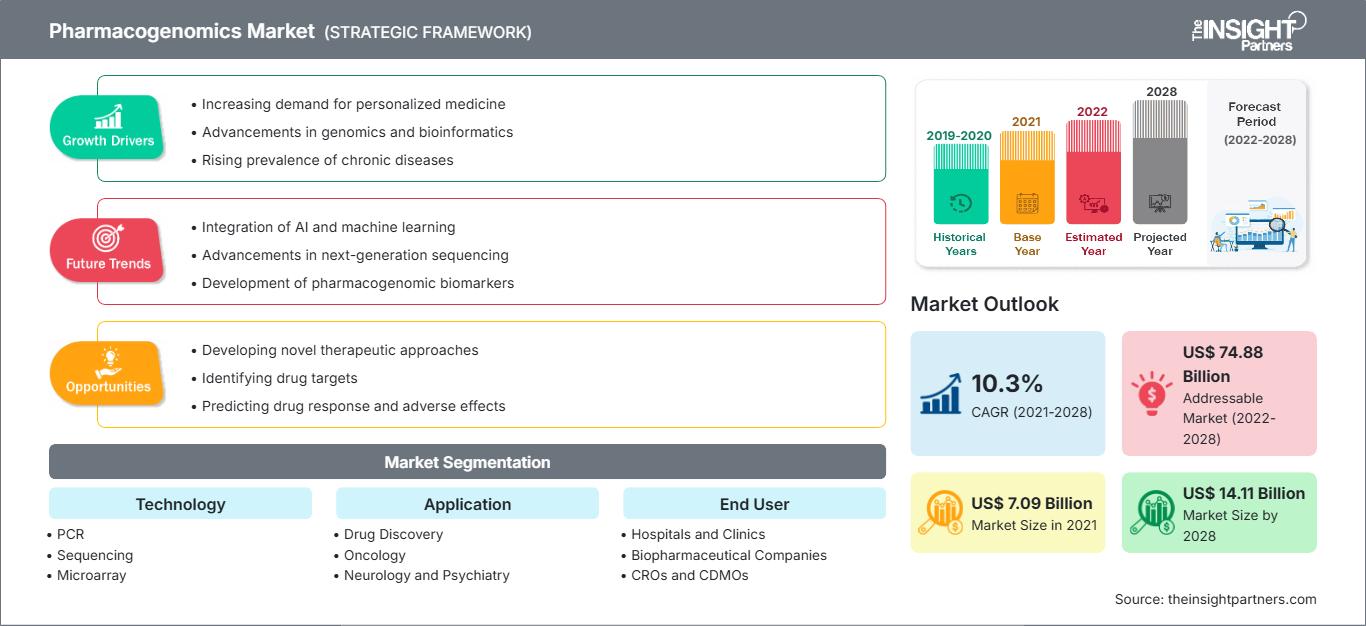

Pharmacogenomics Market Forecast to 2028 - Analysis By Technology (PCR, Sequencing, Microarray, Gel Electrophoresis, Mass Spectrometry, and Others), Application (Drug Discovery, Oncology, Neurology and Psychiatry, Pain Management, Cardiovascular Diseases, and Others), and End User (Hospitals and Clinics, Biopharmaceutical Companies, CROs and CDMOs, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Feb 2022

- Report Code : TIPRE00007564

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 239

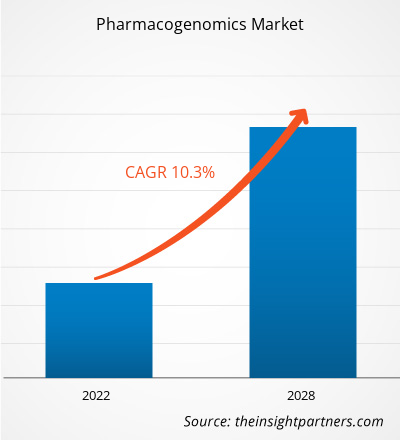

The pharmacogenomics market is projected to reach US$ 14,107.80 million by 2028 from US$ 7,087.81 million in 2021; it is expected to grow at a CAGR of 10.3% from 2021 to 2028.

The increasing prevalence of chronic diseases is one of the most critical factors driving the growth of the market. Many older adults (>60%) suffer from two or more chronic conditions. Twin studies stated that genes can cause chronic conditions, such as cardiovascular disease (CVDs), diabetes, obesity, RA, Alzheimer's disease (AD), and depression. Using molecular genetic data from genome-wide association studies (GWAS), it is now possible to measure individual-level risks for these chronic diseases. According to the Centers for Disease Control and Prevention (CDC), in 2020, nearly 6 in 10 people in the US suffered from at least one chronic disease, and 4 in 10 people had two or more chronic conditions. The increasing incidence of chronic diseases is triggering the demand of pharmacogenomic technologies for developing novel therapies.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPharmacogenomics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America is likely to dominate the pharmacogenomics market during 2021–2028. The US holds the largest share of the market in North America and is expected to continue this trend during the forecast period. The pharmacogenomics market in the US is expected to grow in the coming years due to rising research activities for developing precision medicine to treat cancer, increasing presence of leading biopharmaceutical and pharmaceutical companies, and growing pharmacogenomic research in the country. The adoption rate of pharmacogenomics-based cancer treatment is rising continuously, and the leading market players are introducing several novel products associated with this approach. Also, the support of the regulatory agencies is expected to drive the market in the US during the forecast period. Currently, several clinical trials are investigating pharmacogenomics technology for developing precise medications and improving the overall response rate of the treatment. In May 2021, US Food and Drug Administration (FDA) approved Lumakras (Sotorasib) for a targeted therapy for non-small cell lung cancer patients with tumors that express the G12C mutation in the KRAS gene.

Market Insights

Growing Funding for Pharmacogenomic Research Drives Market Growth

Genomic sequencing is increasingly used in clinical practice, and over the next five years, genomic data from over 60 million patients are expected to be generated within the healthcare system. Pharmacogenomics is rapidly transitioning into clinical practice, and implementation into healthcare systems supported by government investment is totaling over US$ 4 billion in at least 14 countries.

The UK has announced the world’s largest genome project as a part of EURO200 million public–private collaboration between charities and pharma. The country has already developed the largest genome database in the world through the 100,000 genome projects led by Innovate UK as a part of the UK Research and Innovation. The project will fund researchers and industries to combine data and real-world evidence from the UK healthcare services and create new products and services that can diagnose diseases efficiently.

Moreover, in August 2018, Boston Scientific Corporation, a Massachusetts-based company, announced it landed US$ 4.3 million in seed funding and partnered with Veritas Genetics. The funds will support the company’s mission to enter the era of personal genome sequencing by creating a trusted, secure, and decentralized marketplace for genomic data.

Technology-Based Insights

Based on technology, the pharmacogenomics market is segmented into PCR, sequencing, microarray, gel electrophoresis, mass spectrometry, and others. The market for the PCR segment is further segmented into standard PCR, real time PCR, and digital PCR. The PCR segment is expected to account for the largest share of the pharmacogenomics market during 2021–2028. Polymerase chain reaction (PCR) is a commonly used technology to rapidly produce millions to billions of copies of a specific DNA sample, allowing scientists to take a small sample of DNA and amplify it to a significant enough amount to investigate in detail. The PCR technologies plays a key role in gene cloning and manipulation, DNA cloning, gene mutagenesis, functional analysis of gene, detection of pathogens, and drug resistence assay. Various pharmaceutical and biopharmaceutical companies offer PCR solutions for pharmacogenomic and drug development applications. For instance, Thermo Fisher Scientific, Inc offers real time PCR solutions for the pharmacogenomic application.

Application – Based Insights

Based on application, the pharmacogenomics market is segmented into drug discovery, oncology, neurology and psychiatry, pain management, cardiovascular diseases, and others. The oncology segment holds a considerable market share and is projected to continue its dominance during the forecast period. Cancer pharmacogenomics has contributed several essential discoveries to current cancer treatment, changing the paradigm of treatment decisions. World Health Organization (WHO) stated that cancer reckoned for roughly 10 million demises in 2020. Furthermore, as per the data of American Cancer Society, the global burden of carcinoma is anticipated to rise to 27.5 million fresh cases and 16.3 million cancer deaths by year 2040. Such high figures denote that the rising incidence of cancer is creating a requirement for primitive diagnosis and preventive cure. There are numerous methods, such as PCR, INAAT, and NGS, to diagnose carcinoma comprehending. The conception of PCR (polymerase chain reaction) led to an enormous advancement in clinical DNA testing. PCR-based methodologies demand straightforward instrumentation and infrastructure, exploit only minute quantities of biological material, and are extensively harmonious with clinical routine. The application of pharmacogenomics in oncology is significant because of the tapered therapeutic index of chemotherapeutic drugs and the risk for life-threatening adverse effects.

End User – Based Insights

Based on end user, the pharmacogenomics market is segmented into hospitals and clinics, biopharmaceutical companies, CROs and CDMOs, and others. The CROs and CDMOs segment holds a considerable market share and is projected to continue its dominance during the forecast period. The contract research organization (CRO) helps various companies and organization by conducting the clinical trial of their developed products and technologies, whereas the contract development and manufacturing organizations (CDMO) assist the companies in development and manufacturing of the products. The CROs offer services, such as project management, database design and build, data entry and validation, clinical trial data management, medicine and disease coding, quality and metric reporting, statistical analysis plans and reports, validation programming, and safety and efficacy summaries and final study reports. CROs also provides some other services such as gene services, cloning services, and expression.

Companies operating in the pharmacogenomics market adopt the inorganic growth strategy to meet the evolving customer demands across the world, which involves acquisitions, mergers, and collaborations with local and international players in the global market.

Pharmacogenomics

Pharmacogenomics Market Regional InsightsThe regional trends and factors influencing the Pharmacogenomics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Pharmacogenomics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Pharmacogenomics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.09 Billion |

| Market Size by 2028 | US$ 14.11 Billion |

| Global CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Pharmacogenomics Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmacogenomics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Pharmacogenomics Market – Segmentation

- Based on technology, the pharmacogenomics market is segmented into PCR, sequencing, microarray, gel electrophoresis, mass spectrometry, and others. The market for the PCR segment is further segmented into standard PCR, real time PCR, and digital PCR.

- By application, the pharmacogenomics market is segmented into drug discovery, oncology, neurology and psychiatry, pain management, cardiovascular diseases, and others.

- Based on end User, the pharmacogenomics market is segmented into hospitals and clinics, biopharmaceutical companies, CROs and CDMOs, and others.

- By Geography, the intradermal injection market is segmented in North America (the US, Canada, and Mexico), Europe (France, Germany, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, India, Japan, South Korea, and the Rest of APAC), Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of MEA), and South and Central America (Brazil, Argentina, and the Rest of SCAM).

F. Hoffmann-la Roche Ltd; Abbott; Oxford Nanopore Technologies; Thermo Fisher Scientific Inc; Illumina, Inc; QIAGEN; Agilent Technologies, Inc; Myriad Genetics, Inc; Admera Health; and Dynamic DNA Laboratories are a few companies operating in the pharmacogenomic market.

Frequently Asked Questions

The Asia Pacific region is expected to account for the fastest growth in the pharmacogenomics market. In Japan, India and South Korea, the market is expected to grow owing to the rapid development of research organizations and biopharmaceutical companies.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For