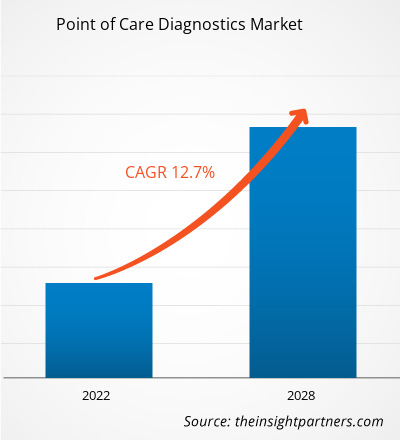

The Point of Care Diagnostics Market size is projected to reach US$ 88.83 billion by 2031 from US$ 37.93 billion in 2024. The market is estimated to register a CAGR of 13.0% during 2024–2031. The Integration Of Artificial Intelligence (AI) and Machine Learning (ML) is likely to bring new trends to the market in the coming years.

Point of Care Diagnostics Market Analysis

The Point of Care (POC) Diagnostics Market growth is driven by the increasing prevalence of infectious diseases, which has heightened the demand for rapid and accurate diagnostic solutions. Technological advancements and the integration of artificial intelligence and machine learning are enhancing the efficiency and accuracy of testing methods. Additionally, the growing need for self-diagnostic tools and the shift toward decentralized healthcare are expected to create future opportunities for market expansion. However, challenges such as the standardization between POC testing and centralized laboratory methods impact the broader adoption of these diagnostic solutions.

Point of Care Diagnostics Market Overview

The Point of Care (POC) Diagnostics Market is evolving, with the increasing demand for immediate and accurate diagnostic solutions. POC testing is conducted near the site of patient care, allowing for quick results that facilitate timely decision-making in clinical settings. This demand for this testing is influenced by the rising prevalence of infectious diseases and chronic conditions, which necessitate rapid diagnostic capabilities.

Innovations such as portable diagnostic devices and integrated digital health solutions enhance testing efficiency and accessibility. The shift toward decentralized healthcare models propels patients and healthcare providers to seek more convenient testing options that can be performed outside traditional laboratory settings.

Overall, the POC diagnostics market is poised for substantial growth, driven by the need for rapid testing solutions and the ongoing advancements in diagnostic technologies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Point of Care Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Point of Care Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Point of Care Diagnostics Market Drivers and Opportunities

Key Product Launches and Developments

The number of point-of-care tests has increased since its introduction. It is expected to grow with new product launches intended at delivering inexpensive care at the facilities at the closest possible distance from the patients' location. New products or technologies are being introduced to enhance the effectiveness of devices with incremental improvements in analytical performance. The growth of the point of care diagnostics market is driven by the introduction of new devices to perform molecular tests. New devices launched in the recent years include:

• In June 2023, Sysmex Corporation launched a point-of-care testing system in Europe to detect antimicrobial susceptibility. The system identifies the presence or absence of bacteria and evaluates the effectiveness of antimicrobials using patient urine samples suspected of having UTIs.

• In January 2023, Cipla Limited launched Cippoint, a point-of-care testing device. This device provides testing parameters such as cardiac markers, infectious diseases, diabetes, fertility, thyroid function, inflammation, metabolic markers, and coagulation markers. The device is CE IVD approved, which indicates that the device is approved by the European In-Vitro Diagnostic Device Directive, providing reliable testing solutions.

• In July 2021, QuantuMDx launched the Q-POC rapid PCR point-of-care diagnostic system, with its first test, a SARS-CoV-2 detection assay, now CE-IVD marked for use in Europe under the In Vitro Diagnostics Directive (98/79/EC).

Thus, increasing product launches by the market players propels the growth of the POC diagnostics market.

Rising Product Launches and Advancements by Market Players in Emerging Economies

For business expansion, market players are focusing on emerging nations, such as India, China, and Brazil, due to the large population suffering from HIV and other infectious diseases. According to the Press Information Bureau 2023 report, ~2.5 million people are living with HIV in India, with a prevalence rate of 0.2%, and 66,400 new HIV infections are reported in India annually. The increasing product launches indicate a potential environment for the adoption of advanced point-of-care diagnostic kits. In January 2022, Mylab launched the CoviSwift POC testing solution in India, which can be used in small labs, in-hospital labs, airports, and villages and allows gold-standard testing at high throughputs anywhere. The solution encompasses the CoviSwift assay and Compact-Q machines that process 16 samples within 40 minutes, which is approximately 4 times faster than traditional RT-PCR testing while maintaining high precision.

Advancements in nanotechnology and genomics are increasing the demand for diagnostics in the healthcare sector, encouraging the introduction of a greater number of point-of-care test systems and facilitating the shift toward personalized medicine. There are new opportunities in infectious disease testing, molecular oncology, and pharmacogenomics in emerging countries. The development of nanomaterials and nanotechnology has promoted the progress of POCT platforms, which are used in colorimetric, optical, electrochemical, magnetic, and catalytic approaches. The point of care testing platforms are used to detect nucleic acids, proteins, pesticides, viruses, bio-markers in disease diagnosis, and even heavy-metal species. Thus, rising product launches and advancements in emerging countries are anticipated to provide ample growth opportunities for the point-of-care diagnostics market during the forecast period.

Point of Care Diagnostics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Point of Care Diagnostics Market analysis are product, purchase mode, sample, end user, and geography.

- Based on product, the point of care diagnostics market is segmented into glucose monitoring, infectious disease testing, cardiometabolic testing, pregnancy and fertility testing, coagulation testing, tumor/cancer marker testing, cholesterol testing, urinalysis testing, hematology testing, thyroid testing, and others. The glucose monitoring segment held the largest share of the point of care diagnostics market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By purchase mode, the market is categorized into OTC and prescription. The prescription segment held a larger share of the point of care diagnostics market in 2024.

- As per sample, the point of care diagnostics market is segmented into blood, urine, and others. The blood segment held the largest share of the point of care diagnostics market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- Per end user, the Point of Care Diagnostics Market is segmented into healthcare facilities, homecare, and others. The healthcare facilities segment held the largest share of the Point of Care Diagnostics Market in 2024, and it is expected to register a significant CAGR during 2024–2031.

Point of Care Diagnostics Market Share Analysis by Geography

The geographic scope of the Point of Care Diagnostics Market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. North America region is leading the market due to its robust healthcare infrastructure and early adoption of innovative diagnostic technologies. Canada ranks eighth among the largest medical device markets. According to the Government of Canada 2023 report, the prevalence of diabetes is rising at a significant pace. ~3.7 million population of the country (which is 9.4% of the total population) are living with diabetes or prediabetic conditions. The association has stated that every three minutes, a person is diagnosed with diabetes. Additionally, according to a report published by the government of Canada, the prevalence of HIV in Canada has grown by ~35.2% since 2022, and 2,434 new HIV cases reported in 2023. As per the Canadian Cancer Society, cancer was one of the primary reasons for deaths in the country, as the condition caused ~30% of deaths in 2023. Lung, breast, colorectal, and prostate cancer conditions predominated the diagnoses and deaths, with more than 46% share.

In July 2023, Fortis Life Sciences, LLC acquired Toronto-based International Point of Care, Inc. (IPOC). IPOC develops and manufactures components used in diagnostics, including lyophilized reagents, membranes, recombinant proteins, and controls. With this acquisition, Fortis can provide its customers with a customizable, end-to-end solution to advance their immunodiagnostic and molecular diagnostic products. IPOC’s recently expanded 36,000 sq. ft. facility is Fortis’ third GMP and ISO 13485-compliant manufacturing site in North America. Thus, the surging prevalence of cancer, the rising incidence of other diseases, and strategic collaborations fuel the growth of the point of care diagnostics market in the country.

Digital PCR and Real-Time PCR Point of Care Diagnostics Market Regional Insights

The regional trends and factors influencing the Point of Care Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Point of Care Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Point of Care Diagnostics Market

Point of Care Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 37.93 Billion |

| Market Size by 2031 | US$ 88.83 Billion |

| Global CAGR (2024 - 2031) | 13.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Point of Care Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Point of Care Diagnostics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Point of Care Diagnostics Market are:

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories Inc

- Abbott Laboratories

- QIAGEN NV

- Siemens AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Point of Care Diagnostics Market top key players overview

Point of Care Diagnostics Market News and Recent Developments

The Point of Care Diagnostics Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- bioMérieux, a leader in the field of in vitro diagnostics, announced that it has entered into an agreement to acquire SpinChip Diagnostics ASA (“SpinChip”). This privately held Norwegian diagnostics company has developed a game-changing immunoassay diagnostics platform. The small benchtop analyzer is adapted to near patient testing as it can deliver a result from a whole blood sample within 10 minutes with the same high-sensitivity performance as the laboratory instruments. bioMérieux has held a minority stake in SpinChip since March 2024. (Source: bioMérieux, Company Website, January 2025)

- Roche announced the completion of the acquisition of LumiraDx’s Point of Care technology following the receipt of all required antitrust and regulatory clearances. Roche will now integrate the company’s multi-assay point of care platform and the related R&D, operational, and commercial sites into its global organization. (Source: Roche, Company Website, July 2024).

Point of Care Diagnostics Market Report Coverage and Deliverables

The "Point of Care Diagnostics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Point of Care Diagnostics Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Point of Care Diagnostics Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Digital PCR and real-time PCR market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the digital PCR and real-time PCR market

- Detailed company profiles

Frequently Asked Questions

What would be the estimated value of the digital PCR and real-time PCR market by 2031?

The market value is expected to reach US$ 88.83 billion by 2031.

Which are the leading players operating in the digital PCR and real-time PCR market?

BD, Abbott, Johnson and Johnson Services, Inc., F. HOFFMANN-LA ROCHE LTD, Siemens AG, Danaher, BIO-RAD LABORATORIES INC, BioMerieux SA, Polymer Technology Systems, Inc. (PTS), Nova Biomedical are key players in the market.

What are the future trends in the digital PCR and real-time PCR market?

Integration of artificial intelligence (AI) and machine learning (ML) is expected to be a prime trend in the market in the coming years.

What are the factors driving the digital PCR and real-time PCR market growth?

The increasing prevalence of infectious diseases and key product launches and developments fuel the market growth.

Which region dominated the Point of Care Diagnostics Market in 2024?

North America dominated the market in 2024.

What is the expected CAGR of the digital PCR and real-time PCR market?

The market is expected to register a CAGR of 13.0% during 2024–2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Point of Care Diagnostics Market

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories Inc

- Abbott Laboratories

- QIAGEN NV

- Siemens AG

- BD

- bioMerieux SA

- Polymer Technology Systems, Inc. (PTS)

- Nova Biomedical Corporation

- Danaher Corp

Get Free Sample For

Get Free Sample For