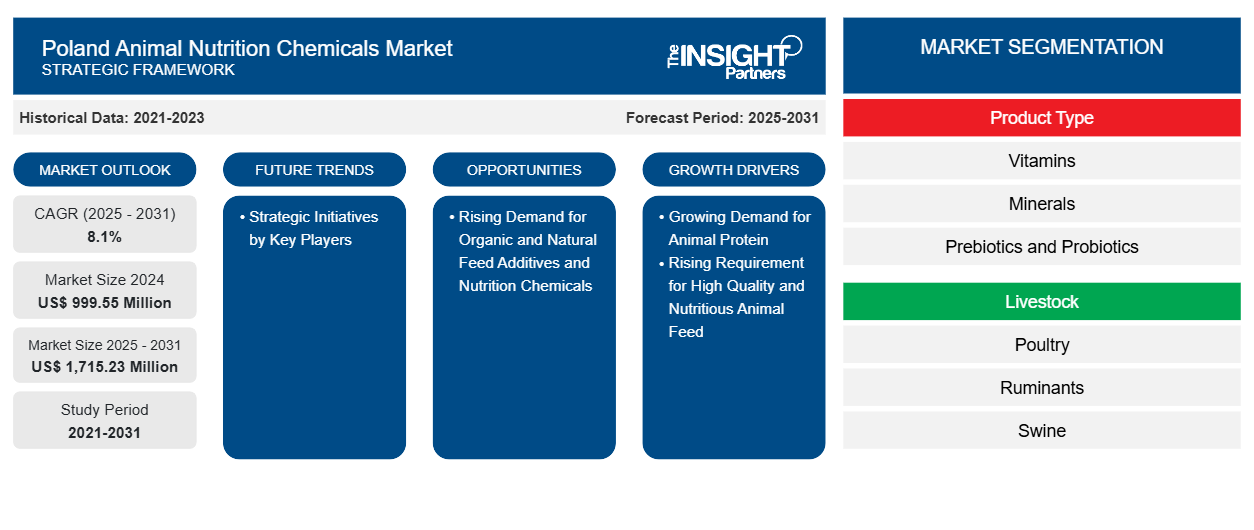

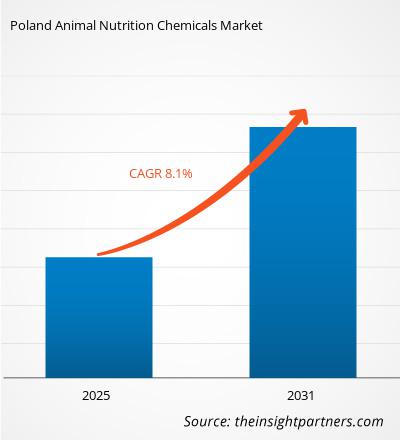

The Poland animal nutrition chemicals market size is projected to reach US$ 1,715.23 million by 2031 from US$ 999.55 million in 2024. The market is expected to register a CAGR of 8.1% during 2025–2031. The rising demand for high-quality and nutritious animal feed is driving the market growth.

Poland Animal Nutrition Chemicals Market Analysis

Poland's animal nutrition chemicals market is experiencing a significant surge in demand for high-quality and nutritious feed, driven by both domestic consumption and export growth. Furthermore, government initiatives play a pivotal role in fostering this expansion. The "National Program for Sustainable Feed Production" aims to reduce greenhouse gas emissions, minimize antibiotic use, and enhance feed quality. Additionally, the "National Veterinary Program" focuses on ensuring feed safety and preventing the spread of animal diseases. The Poland animal feed market is experiencing a significant shift toward organic and natural feed additives, driven by evolving consumer preferences, stringent regulatory frameworks, and strategic industry developments. Due to the growing demand for organic and non-GMO feed solutions, Polish farmers are increasingly recognizing the importance of animal health in enhancing productivity and profitability.

Poland Animal Nutrition Chemicals Market Overview

Animal nutrition chemicals are additives used in animal feed production to promote growth, enhance overall livestock health, and improve various aspects of livestock production. These include vitamins, minerals, prebiotics and probiotics, enzymes, flavors, antioxidants, and other chemicals. These chemicals optimize the nutrition intake of livestock animals, such as poultry, ruminants, and swine, along with aquatic animals. The Poland animal nutrition chemicals market is highly competitive, with the presence of various regional and international manufacturers having strong distribution networks and well-established customer bases. These players compete based on product differentiation, quality, and price. The increasing demand for sustainable and organic feed ingredients is adding new dynamics to the rivalry, with companies striving to lead in these sectors. Thus, to cater to this increasing demand, manufacturers are extensively investing in research & development to launch innovative products.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poland Animal Nutrition Chemicals Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Poland Animal Nutrition Chemicals Market Drivers and Opportunities

Rising Requirement for High-Quality and Nutritious Animal Feed

Poland's animal nutrition chemicals market is experiencing a significant transformation, driven by a rising demand for high-quality and nutritious feed. The export value of animal food has also consistently risen, reaching US$ 2.53 billion (€2.22 billion) in 2023, marking a 15% increase from the previous year. This upward trend is further supported by the Animal Nutrition Act, which sets quality standards for animal feed to ensure they meet nutritional needs without compromising human or animal health.

Feed formulations increasingly include additives such as amino acids, probiotics, enzymes, and trace minerals to enhance nutrient absorption and reduce methane emissions. As dairy and beef exports rise, so does the need for scientifically formulated feed that supports optimal milk yield, meat quality, and animal welfare. The adoption of precision feeding technologies and tailored nutritional programs for ruminants further highlights the shift toward more sustainable and efficient animal farming practices in Poland.

Rising Demand for Organic and Natural Feed Additives and Nutrition Chemicals

The Poland animal feed market is experiencing a strong demand for organic and natural feed additives. Key industry players are actively responding to this demand by expanding their operations and launching natural, GMO-free additives. In January 2024, Protix, a Netherlands-based company, started the construction of a production plant in Poland, focusing on alternative protein sources for sustainable pet and livestock feed. Similarly, ForFarmers, a leading feed producer, acquired Poland-based Piast Pasze in July 2023, expanding its production capacity and strengthening its position in the broiler farming segment. These strategic moves highlight the industry's commitment to meeting the rising demand for organic and natural feed additives.

Poland Animal Nutrition Chemicals Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Poland animal nutrition chemicals market analysis are product type and livestock.

- Based on product type, the market is segmented into vitamins, minerals, prebiotics and probiotics, enzymes, flavors, amino acids, antioxidants, and others. The flavors segment held the largest share of the market in 2024.

- In terms of livestock, the market is segmented into poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 999.55 Million |

| Market Size by 2031 | US$ 1,715.23 Million |

| CAGR (2025 - 2031) | 8.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Poland

|

| Market leaders and key company profiles |

|

Poland Animal Nutrition Chemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Poland Animal Nutrition Chemicals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Poland Animal Nutrition Chemicals Market top key players overview

Poland Animal Nutrition Chemicals Market News and Recent Developments

The Poland animal nutrition chemicals market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Dutch feed producer De Heus Voeders acquired poultry processor Kessels Holding B.V. and its underlying activities, including Van der Linden & Co. B.V., Van der Linden & Co. Beheer B.V., Van der Linden Diervoeders B.V., Van der Linden Poultry Farms B.V., and Van der Linden Poultry Products B.V. (Source: De Heus Voeders, Press Release, January 2025)

- BASF expanded the production capacity of its enzyme plant in Ludwigshafen, Germany. Through the expansion of the existing plant, BASF has significantly increased the annual number of feasible fermentation runs. The larger production capacity enables BASF to meet the growing global demand from customers for a reliable, high-quality supply of the BASF feed enzymes Natuphos E (phytase), Natugrain TS (xylanase and glucanase), and the recently launched Natupulse TS (mannanase). The expanded enzyme plant has already started production and larger quantities of BASF feed enzymes. (Source: BASF SE, News Release, January 2022)

- At Song May Industrial Park, Trang Bom District, Dong Nai, De Heus organized the Inauguration Ceremony of the De Heus Premix Factory, with a capacity of 60,000 tons. This is the first Premix Factory of De Heus in Asia. The inauguration of De Heus' Premix Factory contributes to the supply of key nutritional ingredients to the animal husbandry sector, ensuring quality for farmers in Dong Nai as well as neighboring provinces. (Source: De Heus, Company News, November 2022)

Poland Animal Nutrition Chemicals Market Report Coverage and Deliverables

The "Poland Animal Nutrition Chemicals Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Poland animal nutrition chemicals market size and forecast at country levels for all the key market segments covered under the scope

- Poland animal nutrition chemicals market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Poland animal nutrition chemicals market analysis covering key market trends, national framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Poland animal nutrition chemicals market

- Detailed company profiles

Frequently Asked Questions

Which product type segment dominated the Poland animal nutrition chemicals market in 2024?

What are the factors driving the Poland animal nutrition chemicals market growth?

What are the future trends of the Poland animal nutrition chemicals market?

Which are the leading players operating in the Poland animal nutrition chemicals market?

What would be the estimated value of the Poland animal nutrition chemicals market by 2031?

What is the expected CAGR of the Poland animal nutrition chemicals market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For