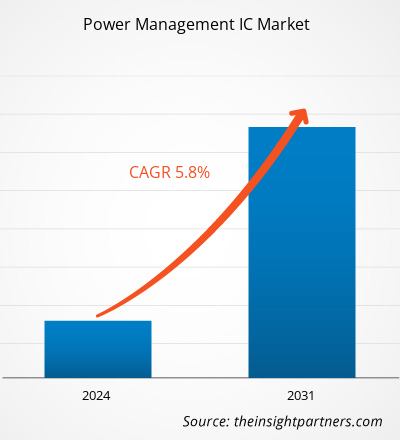

The power management IC market size is projected to reach US$ 59.04 billion by 2031 from US$ 37.73 billion in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. The rising sales of consumer electronics products and growing inclination toward electric vehicles are likely to be the key drivers and trends of the market.

Power Management IC Market Analysis

The power management IC market is experiencing significant growth globally. This growth is attributed to the rising sales of consumer electronics products growing inclination toward electric vehicles. Moreover, increasing demand for battery-powered devices and deployment of next-generation 5G networks is anticipated to hold several opportunities for the market in the coming years.

Power Management IC Market Overview

Power management integrated circuits (PMICs), which integrate multiple voltage regulators and control circuits into a single chip, are excellent options for implementing complete power supply solutions. They reduce component count and board space while easily and cost-effectively managing system power.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Management IC Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Management IC Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Power Management IC Market Drivers and Opportunities

Increasing Sales of Consumer Electronics Products to Favor Market

Consumer electronics, such as smartphones, tablets, smart glasses, virtual reality headsets, smartwatches, and fitness wristbands, are becoming increasingly popular among consumers. These devices serve various purposes, including activity tracking and health monitoring. The demand for consumer electronics drives the need for power management ICs. The application areas of wearable devices are expanding beyond consumer electronics to include medical devices and wireless communication devices. In the medical sector, there is significant growth potential for the power management IC market in wearable medical devices and wireless healthcare monitoring systems as the sector undergoes a technological transformation.

Increasing Demand for Battery Powered Devices.

The increasing demand for battery-powered devices is anticipated to hold several opportunities for the market in the coming years. Devices such as cell phones, cell phone battery charging cases, laptops, cameras, smartphones, electronics, data loggers, PDAs containing lithium batteries, games, tablets, watches, etc. Devices containing lithium metal or lithium-ion batteries (laptops, smartphones, tablets, etc.) These devices need to maximize their energy to extend battery life. PMICs are essential in optimizing power distribution and reducing energy wastage.

Power Management IC Market Report Segmentation Analysis

Key segments that contributed to the derivation of the power management IC market analysis are product type and end-use.

- Based on product type, the power management IC market is divided into voltage regulators, motor control, battery management, multi-channel ICs, and others. The voltage regulators segment is anticipated to hold a significant market share in the forecast period.

- Based on end use, the power management IC market is divided into consumer electronics, automotive, healthcare, it & telecom, industrial, and others. The consumer electronics segment is anticipated to hold a significant market share in the forecast period.

Power Management IC Market Share Analysis by Geography

The geographic scope of the power management IC market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the power management IC market. High technology adoption trends in various industries in the North American region have fuelled the growth of the power management IC market. Factors such as increased adoption of digital tools, high technological spending by government agencies, rising sales of consumer electronics products, and growing inclination toward electric vehicles are expected to drive the North American power management IC market growth. Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to bring technologically advanced solutions into the market. In addition, the US has many power management IC market players who have been increasingly focusing on developing innovative solutions. All these factors contribute to the region's growth of the power management IC market.

Power Management IC Market Regional Insights

The regional trends and factors influencing the Power Management IC Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Power Management IC Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Power Management IC Market

Power Management IC Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 37.73 Billion |

| Market Size by 2031 | US$ 59.04 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Power Management IC Market Players Density: Understanding Its Impact on Business Dynamics

The Power Management IC Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Power Management IC Market are:

- NXP Semiconductors

- Analog Devices Inc.

- Infineon Technologies AG

- ROHM CO, Ltd

- Microchip Technology Inc.

- Vishay Intertechnology, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Power Management IC Market top key players overview

Power Management IC Market News and Recent Developments

The power management IC market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the power management IC market are listed below:

- Nordic Semiconductor announced the launch of its nPM1300 PMIC (power management integrated circuit). With its two buck converters, two load switches/low drop-out voltage converters (LDOs), and integrated battery charging, the nPM1300 is ideal for battery-operated applications. (Source: Nordic Semiconductor Company Website, June 2023)

- Magnachip Semiconductor Corporation announced that the company has launched its first Power Management Integrated Circuit (PMIC) for IT devices equipped with OLED screens. (Source: Magnachip Semiconductor Corporation Company Website/November 2023)

Power Management IC Market Report Coverage and Deliverables

The “Power Management IC Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Power management IC market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Power management IC market trends as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST/Porter’s Five Forces and SWOT analysis.

- Power management IC market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the power management IC market.

- Detailed company profiles.

Frequently Asked Questions

What would be the estimated value of the power management IC market by 2031?

The global power management IC market is expected to reach US$ 59.04 billion by 2031.

What are the future trends of the power management IC market?

The deployment of the next-generation 5G network is anticipated to drive the market in the forecast period.

Which are the leading players operating in the power management IC market?

The key players holding majority shares in the global power management IC market are NXP Semiconductors, Analog Devices Inc., Infineon Technologies AG, ROHM CO, Ltd, Microchip Technology Inc., Vishay Intertechnology, Inc., Renesas Electronics Corporation, STMicroelectronics, Texas Instruments Incorporated. Qorvo, Inc.

What are the driving factors impacting the power management IC market?

The rising sales of consumer electronics products growing inclination toward electric vehicles are some of the factors driving the power management IC market.

Which region dominated the power management IC market in 2023?

North America is anticipated to dominate the power management IC market in 2023.

What is the expected CAGR of the power management IC market?

The expected CAGR of the power management IC market is 5.8%.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For