Increasing Use of Material Handling Products in Manufacturing Industry to Provide Opportunities for Automated Material Handling Equipment Market During 2022–2028

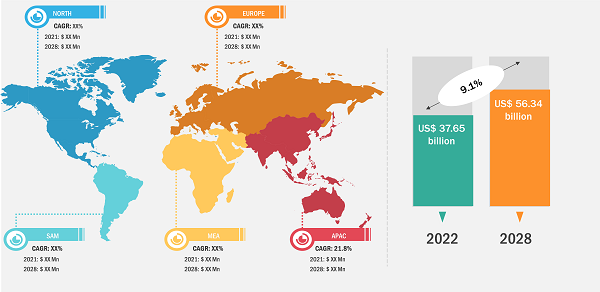

According to our latest study on "Automated Material Handling Equipment Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product, System Type, Component, Function, and Industry," the market is expected to grow from US$ 37.65 billion in 2022 to US$ 56.34 billion by 2028; it is anticipated to register a CAGR of 9.1% from 2022 to 2028.

The expansion of the manufacturing industry is highly driven by economic growth across the world. The industry is in the middle of a technological renaissance, which is changing the outlook, systems, and processes of the modern factory. The manufacturing industries invest in emerging technologies to enhance their productivity and production cycle. Currently, the manufacturing sector is using Robotic Process Automation (RPA) for error-free and streamlined procedures. Manufacturing companies are replacing human sources with industrial robots in their production units to assemble, quality check, and pack products. With more convenience provided through automated material handling, the scope of automated material handling equipment market will continue to grow.

Automated Material Handling Equipment Market – by Region, 2022

Automated Material Handling Equipment Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Product (Robots, Automated Storage & Retrieval System, Automated Conveyors & Sortation System, Automated Cranes, and Automated Guided Vehicles), System Type (Unit Load and Bulk Load), Component (Hardware, Software, and Services), Function (Storage, Transportation, Assembly, Packaging, Distribution, and Waste Handling), and Industry (Automotive, Electronics, Food & Beverages, E-Commerce, Aerospace, Logistics, Pharmaceuticals, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Automated Material Handling Equipment Market Growth by 2031

Download Free Sample

Material handling plays a crucial role in the manufacturing industry. It includes protection & safety, transportation, material control, and product handling across different steps such as manufacturing, disposal, distribution, warehousing, and storage. Processes from delivering raw materials to dispatching the final products from the factory rely on material handling equipment. Massive benefits of automated material handling products are propelling their use. Modern manufacturing facilities depend on state-of-the-art technologies and innovations to create high-quality products at minimum costs with high speeds. Conveyors, automated guided vehicles, and shuttle systems are among the key products used within manufacturing plants for product transport.

North America comprises developed nations, including the US and Canada, and developing countries, such as Mexico. The region is a potential market to increase automated material handling equipment implementation as the region is strategically strong in terms of technology. Automotive, e-commerce, aerospace, and pharmaceutical are among the major demand generators of AMH equipment in North America, which in turn will fuel the automated material handling equipment market. The manufacturing industry plays a vital role in the economy of North America. The availability of efficient infrastructure in developed nations has enabled manufacturing companies to explore the limits of science, technology, and commerce. North America is a hub of technological developments that compliances with economically robust countries. As a result, the manufacturing industry in North America pertains to developing and remaining the principal factor for driving prosperity and innovation. The companies are continuously enhancing the overall business processes to meet the customers demand for high-quality products and services in the best possible way.

Impact of COVID-19 Pandemic on Automated Material Handling Equipment Market Size

The manufacturing industries showed a decline in production due to various restrictions and limitations during the peak of COVID-19 outbreak, which adversely affected related trading activities, leading to an economic slowdown. Moreover, due to the imposition of strict containment measures, business activities were operational with a limited number of employees. This hampered the production activities across key manufacturing countries. Owing to the restriction on trade operations, the region experienced a significant decline in the adoption of automated material handling equipment in 2020, which resulted into negative impact on automated material handling equipment market growth. On the contrary, because pandemic caused disruptions in the manufacturing industries and resulted into working with minimal human resources, a huge surge in robotic working style and assembly automation was witnessed. To bring automation, the inclination toward material handling was high. The surge in warehouse automation is projected to endure in the coming years due to the rising e-commerce industry, increasing technological advancements, decreasing cost of computing power, and unavailability of labor/high labor cost in many regions across the world. The mentioned aspects are projected to offer lucrative business opportunities to the automated material handling equipment market.

Since the e-commerce and food & beverages industries witnessed additional demand from end users, the demand for advanced material handling equipment increased to avoid human contact. Moreover, as economies reopened and trade restrictions relaxed, a steady trend is observed in the automated material handling equipment market growth across the globe.

Based on product, the automated material handling equipment market size is segmented into robots, automated storage & retrieval system, automated conveyors & sortation system, automated cranes, and automated guided vehicles. The robots segment dominated the automated material handling equipment market share in 2022. In the manufacturing and warehousing industries, robots are used to perform functions such as up and down motions and pick and take out components from machines. Many robots are controlled by programs to perform different types of jobs such as transportation, searching, targeting, assembly, and inspection. Robotics technology has been applied to a wide variety of sectors with a higher economic and social impact. In the last decades, it has been one of the main elements of industrial manufacturing automation, where about 1.5 million robots are currently operating, which means that 4 to 5 million workers are operating those systems. Spot welding, spray painting, and continuous arc welding are a few common robotic processing operations gaining momentum across industries. Spot welding applications of automobile bodies are among the common applications of industrial robots observed in the US. Spot welding is prominently used in automotive, rail, aerospace, metal furniture, white goods, medical building, and electronics industries. Growing spot welding in mentioned industries will fuel the demand for robots during the forecast period.

Daifuku Co. Ltd.; Hyster-Yale Material Handling, Inc.; Jungheinrich AG; Kion Group AG; Toyota Industries Corporation; Hanwha Corporation; John Bean Technologies Corporation; Kuka AG; Beumer Group GmbH & Co.; and Fives Group are among the key automated material handling equipment market players operating in the industry.

- In December 2022, Lodige Industries, an air cargo terminal solution provider, announced that it had completed the installation of an automated cold chain pallet-cargo system at the Hong Kong International Airport. AAT COOLPORT is the first on-airport cold chain facility providing a temperature-controlled environment in Hong Kong. The customized and automated material handling system is developed for a safe and quick transport of temperature-sensitive goods inside the cold chain facility.

- In December 2022, SJK Innovations, headquartered in India, announced that it aims to deploy cross-dock material handling conveyors in West Bengal. As per the company officials’ statement, they have received an order from the country’s government to establish a cross-dock material handling conveyor system for the goods movement near India–Bangladesh border at Petrapole.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com