Presence of government policies, and regulatory support for generics to Bolster Europe Generic Drugs Market Growth During 2025–2031

According to our new research study on "Europe Generic Drugs Market Forecast to 2031 – Regional Analysis – by Product Type, Technology, Application, and End User," the market is projected to reach US$ 114032.33 million by 2031 from US$ 77959.6 million in 2024. The market is expected to register a CAGR of 5.8% during 2025–2031.

The report emphasizes the Europe Generic Drugs market trends, along with drivers and deterrents affecting the market growth. The rising chronic disease burden, increasing demand for cost-effective treatments, government policies, and regulatory support for generics contribute to the growing Europe Generic Drugs market size. However, intense price competition and thin profit margins hamper the market growth. Further, the expansion of biosimilars is expected to emerge as a new europe generic drugs market trend in the coming years.

Europe Generic Drugs Market, by region, 2024 (%)

Europe Generic Drugs Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Small Molecule and Biosimilar Products), Small Molecule (Capecitabine, Carboplatin, Asparaginase, Mitomycin, Doxorubicin, Methotrexate, Fluorouracil (5-FU) and Others), Drug Class (Central Nervous System, Cardiovascular, Urology, Rheumatology, Oncology, Hematology, and Others), Route Of Administration (Oral, Injectable, Topical and Others), Type (Prescription Drugs and Over-the-Counter Drugs), Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), and Country

Europe Generic Drugs Market Growth Report 2021 to 2031

Download Free Sample

Source: The Insight Partners Analysis

Rising Chronic Disease Burden and Increasing Demand for Cost-Effective Treatments Bolsters Europe Generic Drugs Market Growth

Europe is facing an increase in the prevalence of non-communicable diseases (NCDs). 1 in 6 individuals succumb to these conditions before reaching the age of 70, with cardiovascular diseases, cancer, diabetes, and chronic respiratory illnesses being the primary contributors. As per the World Health Organization (WHO), in July 2024, ~64 million adults and ~300,000 children and adolescents had diabetes in the region, with one in three cases undiagnosed. By 2045, 1 in 10 Europeans may have diabetes, and Europe already carries the highest burden of type 1 diabetes globally. Also, the WHO reported over 4.47 million new cases and ~2 million cancer-related deaths in Europe in 2022.

According to the Organization for Economic Cooperation and Development (OECD) research conducted on OECD member countries in the European Union (EU), such as France, Spain, the Netherlands, Romania, and Portugal, published in February 2025, more than 70% of individuals in these countries living with multiple chronic conditions are prescribed with least three medications, and over one-third take four or more. France and the Czech Republic have the highest percentages of people with two or more chronic conditions, including mental health issues, at 77.24% and 70.13%, respectively.

The surging prevalence of chronic diseases in Europe is propelling healthcare systems and patients to seek affordable solutions to manage long-term conditions. Generic medications offer cost-effective alternatives to brand-name drugs, making them attractive options for healthcare providers and patients. According to Generics and Biosimilar Initiative, generic medicines are generally 20–80% cheaper than brand-name medicines, resulting in significant savings in Europe. 67% of dispensed medicine prescriptions are for generics, yet they account for just 29% of total expenditure on medicines. Without competition from generic manufacturers, maintaining this level of access would cost Europe an additional US$ 113.82 billion (€100 billion) each year.

According to an article published by the European Federation of Pharmaceutical Industries and Associations (EFPIA) in 2025, cancer spending varies from less than US$ 169.75 (€150) per capita in Hungary, Croatia, Romania, Latvia, and Bulgaria to more than US$ 452.68 (€400) in Germany and Switzerland. The high cost of biologics for cancer treatment is contributing to the adoption of biosimilars which are relatively cost-effective options available in the market. According to WHO, biosimilars are ~ 60 % cheaper than their reference counterparts. Thus, the rising chronic disease burden is increasing the adoption of cost-effective generic medications for treatment, fueling the europe generic drugs market growth.

Europe Generic Drugs Market Report Scope:

The Europe Generic Drugs market analysis has been carried out by considering the following segments: product type, drug class, route of administration, type, and distribution channel.

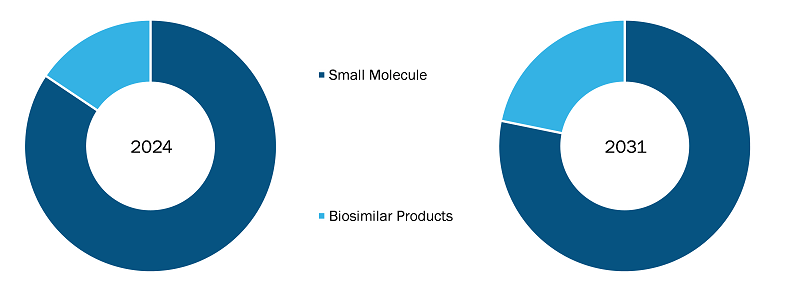

Based on product type, the Europe Generic Drugs market is segmented into Small Molecule (Fluorouracil (5-FU), Methotrexate, Doxorubicin, Mitomycin, Asparaginase, Carboplatin, Capecitabine, Others) and biosimilar products. The small molecule segment held a larger Europe Generic Drugs market share in 2024. Biosimilars are evaluated and approved based on the same standards of pharmaceutical quality, safety, and efficacy that apply to biological medicines. The EMA oversees the evaluation of applications to market biosimilars in the EU. Biologics and biosimilars are becoming popular in Europe, driven by the expiration of patents for blockbuster biologics, strong regulatory support, cost savings, and rising demand for affordable treatment options for complex diseases such as cancers, immunological diseases, and rheumatic diseases.

The loss of exclusivity by biologics over the past 15 years has created opportunities for biosimilar manufacturers to offer lower-cost alternatives. As of 2025, EMA has recommended the approval of 126 biosimilars across product classes.

A few of the recent product approvals by the EMA in the European market are:

- In February 2025, the European Commission (EC) granted marketing authorization for Eydenzelt, an aflibercept biosimilar produced by Celltrion, along with two of the company's denosumab biosimilars, Stoboclo and Osenvelt.

- In October 2024, Accord Healthcare received a positive opinion from EMA's CHMP for Imuldosa (development code: DMB-3115), a biosimilar to Stelara, marketed by Janssen Biotech Inc., indicated for immunological conditions.

- In March 2024, EMA's human medicines committee (CHMP) issued positive opinions for three biosimilar medicines — Jubbonti (denosumab) for osteoporosis and bone loss, Omlyclo (omalizumab) for the treatment of asthma, severe chronic rhinosinusitis with nasal polyps, and chronic spontaneous urticaria, and Wyost (denosumab) for the prevention of skeletal-related illness in patients with advanced malignancies.

An increasing number of biosimilar drug approvals drive their adoption. However, the cost gap remains stark, with the average daily dose of a biologic being 22 times more expensive than that of a small molecule. While biologics are revolutionizing treatment landscapes, the patient accessibility of biosimilars is still rising.

By drug class, the Europe Generic Drugs market is segmented into Drug Class (central nervous system, cardiovascular, urology, rheumatology, oncology, hematology, and others). The others segment held the largest Europe Generic Drugs market share in 2024. Other drug classes include drugs for respiratory disorders, rare diseases, and metabolic disorders. As per WHO, in July 2024, ~64 million adults and ~300,000 children and adolescents had diabetes in the WHO European Region, with one in three cases undiagnosed. By 2045, 1 in 10 Europeans may have diabetes, and Europe already carries the highest burden of type 1 diabetes globally. Europe remains a hub for pharmaceutical and biotech firms, which are actively developing treatments such as pharmaceuticals, immunotherapies, and vaccine technologies for chronic diseases such as diabetes and rare diseases.

This increasing patient burden has fuelled a surge in pharmaceutical research and development, particularly in novel diabetes and obesity treatments. The rise of glucagon-like peptide-1 (GLP-1) receptor agonists, such as semaglutide (Ozempic and Wegovy) and tripeptide (Mounjaro), has reshaped the metabolic drug market. These drugs, initially developed for diabetes, have gained traction for weight management, demonstrating weight loss benefits and prompting pharmaceutical companies to expand their focus beyond diabetes. The increasing cost of branded orphan drugs and biologics has driven governments and healthcare systems to seek affordable alternatives without compromising quality, making generics and biosimilars attractive options. For instance, initially classified as an orphan drug, imatinib's exclusivity was carefully managed by Novartis. However, the introduction of generic versions since 2016 has reduced treatment costs and improved accessibility across Europe. Successful examples of generic or biosimilar orphan drugs in Europe are emerging as market exclusivities for original orphan biologics expire, enabling more affordable alternatives. While fully generic small-molecule orphan drugs are less common due to the complexity and rarity of conditions, biosimilars represent a significant category of generics for orphan biologics.

In terms of route of administration, the Europe Generic Drugs market is segmented into oral, injectable, topical, and others). The oral segment held the largest share of the Europe Generic Drugs market in 2024. The demand for oral generics is soaring due to their ease of manufacturing, distribution, and administration, particularly when compared to other forms, such as injectables or inhalers. For chronic diseases that require long-term medication, including diabetes, CVDs, and central nervous system disorders, oral medications are the preferred choice. CVDs are the leading cause of disability and premature death in Europe. According to a report published by WHO/Europe in May 2024, men in the region are nearly 2.5 times more likely to die from CVDs than women. Additionally, there is a geographic disparity: the likelihood of dying from a CVD at a young age (30–69 years) is nearly five times greater in Eastern Europe and Central Asia compared to Western Europe.

Innovations in oral drug formulations, such as fixed-dose combinations, extended-release formulations, and improved bioavailability, enhance therapeutic outcomes and patient adherence and propel the demand for oral generics. In Europe, diabetes medications, which are primarily manufactured as oral medications, lead the super generics category.

Favorable regulatory frameworks by the EMA facilitate the approval and market entry of oral generics, encouraging manufacturers to invest in this segment. Companies including Sandoz, Viatris, and Sun Pharmaceuticals have introduced advanced oral formulations of anti-diabetic drugs, which improve patient compliance and help expand their market share. In October 2021, Sun Pharmaceutical received a positive opinion from the EMA's CHMP for their generic Sitagliptin SUN (sitagliptin fumarate). Sitagliptin SUN is an oral antihyperglycaemic agent that enhances glycaemic control in patients with type-2 diabetes by increasing the levels of active incretin hormones.

By Type, the market is bifurcated into prescription drugs and over-the-counter drugs. The prescription drugs segment held a larger Europe Generic Drugs market share in 2024.

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of the europe generic drugs market in 2024.

Europe Generic Drugs Market Analysis: By Region

The regional scope of the Europe Generic Drugs market includes the assessment of the market performance in Germany, the UK, France, Italy, Spain, Poland, the Nordic region, and the Rest of Europe. Germany dominated the Europe Generic Drugs market in 2024, and it will continue to dominate the market during the forecast period. With ~22% of the population aged 65 and above as of 2024 and projected to exceed 25% by 2030, the need for cost-effective treatments for age-related and chronic diseases such as cardiovascular conditions, diabetes, respiratory illnesses, and cancer is growing steadily. Generic drugs account for over 75% of prescriptions dispensed in Germany by volume, underscoring their importance in reducing healthcare expenditure while maintaining quality standards. The market is supported by robust healthcare regulations, particularly the reference pricing system and generic substitution policies that encourage physicians and pharmacists to prefer generics over higher-cost originator drugs.

Germany has one of the strongest pharmaceutical manufacturing ecosystems in Europe, making it both a significant producer and exporter of generic drugs and active pharmaceutical ingredients (APIs). According to Germany Trade & Invest, pharmaceutical sales in Germany reached US$ 64.78 billion (EUR 59.8 billion) in 2023, with generics comprising a substantial share, particularly in outpatient care. The country's manufacturing strength, supported by state-of-the-art R&D centers and highly skilled talent, allows for the development of conventional generics as well as complex generics, biosimilars, and value-added formulations. In 2022 alone, the German pharmaceutical industry invested US$ 10.4 billion (EUR 9.6 billion) in research and development and filed over 600 pharmaceutical patents, some of which are tied to innovation in delivery mechanisms, extended-release formulations, and combination therapies for generics.

Germany’s generics market is shaped by digital health initiatives and e-prescription adoption, which are streamlining prescribing and reimbursement processes. The rise of electronic health records and real-time prescription data is enabling more efficient generic substitution at pharmacies. The country’s position within the EU provides seamless market access, allowing German generic manufacturers to export widely across the region and beyond. With increasing global attention on medicine affordability and supply chain resilience, Germany is emerging as a reliable supplier of high-quality, cost-effective generic drugs to international markets.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com