Europe Generic Drugs Market Analysis and Forecast by Size, Share, Growth, Trends 2031

Europe Generic Drugs Market Size and Forecast (2021 - 2031) Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Molecule Type (Antidepressants, Antihistamines, Analgesics, Antibiotics, Antivirals, Diuretics, and Other Molecule Types), Indication (Metabolic Diseases, Cancer, Immunology, Respiratory Disorder, Cardiovascular Disorder, Neurology Disorder, Rare Diseases, and Other Indications), Type (Prescription and OTC Drugs), and Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00040934

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 210

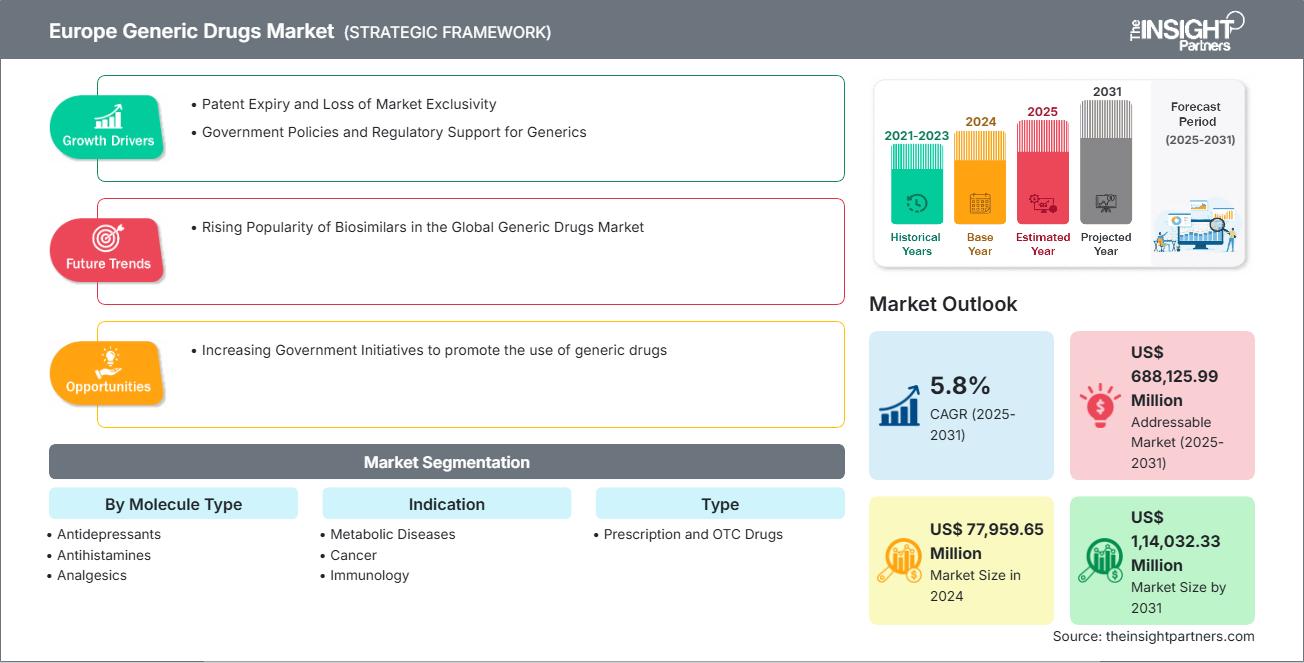

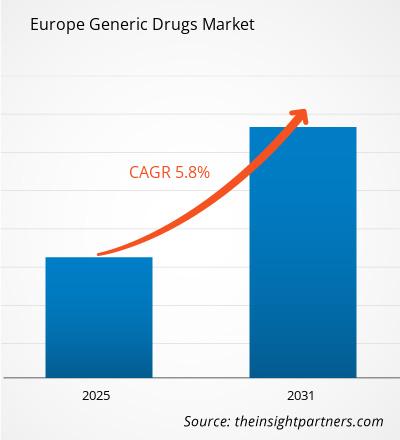

The Europe generic drugs market size is expected to reach US$ 1,14,032.33 million by 2031 from US$ 77,959.65 million in 2024. The market is estimated to record a CAGR of 5.8% from 2025 to 2031.

Executive Summary and Europe Generic Drugs Market Analysis:

The generic drugs market in Europe is poised for strong growth, supported by a well-established healthcare infrastructure, an aging population, and increasing investments in innovative therapies. Europe remains a hub for pharmaceutical and biotech firms, which are actively developing treatments for chronic diseases such as diabetes and cancer. As per WHO, in July 2024, ~64 million adults and ~300,000 children and adolescents had diabetes in the WHO European Region, with one in three cases undiagnosed—creating a clear need for affordable treatment solutions such as generics. By 2045, 1 in 10 Europeans may have diabetes, and Europe already carries the highest burden of type 1 diabetes globally. Cancer is another major health concern, with the WHO reporting over 4.47 million new cases and ~2 million cancer-related deaths in Europe in 2022. As populations age and chronic disease rates rise, the demand for cost-effective alternatives is intensifying.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Generic Drugs Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Generic Drugs Market Segmentation Analysis:

Key segments that contributed to the derivation of the Europe generic drugs market analysis are molecule type, indication, type, and distribution channel.

- Based on molecule type, the Europe generic drugs market is segmented into antidepressants, antihistamines, analgesics, antibiotics, antivirals, diuretics, and others. The antibiotics segment held the largest share of the market in 2024.

- By indication, the Europe generic drugs market is segmented into metabolic diseases, cancer, immunology, respiratory disorder, cardiovascular disorder, neurology disorder, rare diseases, and others. The cancer segment held the largest share of the market in 2024.

- Based on type, the Europe generic drugs market is bifurcated into prescription and OTC drugs. The prescription segment held a larger share of the market in 2024.

- By indication, the Europe generic drugs market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of the market in 2024.

Europe Generic Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 77,959.65 Million |

| Market Size by 2031 | US$ 1,14,032.33 Million |

| CAGR (2025 - 2031) | 5.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By By Molecule Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Generic Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Generic Drugs Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Europe Generic Drugs Market Outlook

A significant opportunity in the generic drugs market arises from the digital transformation of healthcare systems and the expansion of public procurement platforms, especially in developing and middle-income countries. As governments and insurers increasingly adopt value-based care and focus on cost containment, there is a growing demand for high-quality, low-cost alternatives to branded medications. This trend provides opportunities for generic manufacturers to integrate into national health supply chains, win bulk tenders, and secure long-term contracts.

Additionally, the rise of e-pharmacies and telemedicine platforms creates new retail channels for generic drugs, particularly in underserved and remote areas. Companies that invest in digital distribution, ensure local regulatory compliance, and engage in public-private partnerships can capitalize on these trends to expand their reach and foster trust in generics as first-line therapies.

Europe Generic Drugs Market Country Insights

Based on country, the Europe generic drugs market comprises the UK, Germany, France, Italy, Spain, and the Rest of Europe. The Rest of Europe held the largest share in 2024.

Norway, Denmark, Sweden, Poland, Ukraine, Romania, Belgium, and the Czech Republic are among the prominent countries in the generic drugs market in the Rest of Europe. The region is experiencing steady growth owing to increasing healthcare demands, cost-containment policies, and expanding chronic disease burdens. These countries benefit from robust healthcare infrastructure, rising investment in biotechnology, and active collaboration between public institutions and private sector players. Amid growing pressure on national healthcare budgets, generic drugs are being adopted as a strategic solution to ensure affordable and sustainable access to medicines. Countries such as the Netherlands and Belgium, which play a central role in the EU's pharmaceutical ecosystem, are increasingly supporting the use of generics and biosimilars to manage treatment costs while maintaining high standards of care. A key demand driver is the rising prevalence of chronic diseases such as cancer and hepatitis. According to Eurostat, over 26% of deaths in several EU countries in 2021 were attributed to cancer-28.2% in Denmark, 27.7% in Ireland, 27.1% in Slovenia, and 26.6% in the Netherlands. These countries also reported a substantial number of new cancer cases: 48,840 in Denmark, 31,242 in Ireland, 14,402 in Slovenia, and 132,319 in the Netherlands. Such statistics highlight the need for cost-effective treatment options, with generic oncology drugs playing an increasingly important role in national health systems. In parallel, local companies are enhancing innovation in low-cost drug development. For example, AstriVax Therapeutics (Belgium), although primarily focused on vaccine development, showcases the region's scientific capabilities. While not directly producing generics, companies such as AstriVax highlight the strong biotech environment that could also be leveraged for generic biologics and biosimilar development in the near future.

Europe Generic Drugs Market Company Profiles

Some of the key players operating in the market include Teva Pharmaceutical Industries Ltd, Viatris Inc, Dr. Reddy's Laboratories Ltd, Novartis AG, Sun Pharmaceutical Industries Ltd, AbbVie Inc, AstraZeneca Plc, Sanofi SA, Aurobindo Pharma Ltd, and Glenmark Pharmaceuticals Ltd, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Europe Generic Drugs Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For