The patient simulators market size is expected to reach US$ 4,284.03 million by 2028; registering at a CAGR of 15.2% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Adult Patient Simulators Segment by Product to Account for Largest Share in Patient Simulators Market During 2022–2028

The report highlights the key factors driving the market and prominent players with their developments in the market. The global patient simulators market is majorly driven by the use of patient simulators for training purposes and an increase in demand for minimally invasive treatment methods. However, the high cost of patient simulators is hampering the market growth.

Based on product, the patient simulators market is segmented into adult patient simulator, infant simulator, and childbirth simulator. In 2021, the adult patient simulator segment held the largest market share. Also, the same segment is anticipated to register the highest CAGR during the forecast period. Based on end user, the patient simulators market is segmented into academic institutes, hospitals, and military organizations. In 2021, the academic institutes segment accounted for the largest market share. Also, the same segment is expected to register the highest CAGR from 2022 to 2028.

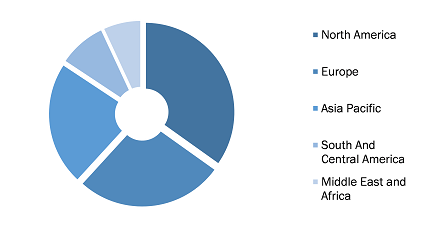

Patient Simulators Market, by Region, 2021 (%)

Patient Simulators Market Forecast to 2028 - COVID-19 Impact and Global Analysis by Product (Adult Patient Simulator, Infant Simulator, and Childbirth Simulator) and End User (Academic Institutes, Hospitals, and Military Organizations)

Patient Simulators Market Size & Share | Report 2022, 2028

Download Free Sample

Source: The Insight Partners Analysis

A patient simulator is a manikin used to train healthcare professionals and students to study human anatomy or function (physiology). Patient simulators can also be combined with computer software, replicating normal and abnormal bodily reactions to events, such as asthma attacks, and therapeutic interventions, including drug side effects. Simulated blood can be pumped into the veins through an intravenous (IV) tube. Patient simulators are life-like manikins that react physiologically like a normal human being. The simulators are specifically designed, keeping respiratory therapy, nursing, and emergency medical students in mind.

The COVID-19 pandemic positively impacted the global patient simulators market. The research and development for studying COVID-19 with the help of manikin have fueled the demand for patient simulators. Simulators also played a significant role in preparing medical professionals to treat COVID-19 patients. At the onset of the pandemic, the rapid escalation in cases caught many facilities and staff unprepared. Because healthcare professionals working in critical care have vastly different skillsets from those in the emergency department or the medical surgery floor, many did not have the skills to treat patients with COVID-19 properly. This resulted in increased demand for simulators and skills trainers, not only to train new providers but also to cross-train healthcare professionals from other departments who were helping to meet the demands of COVID-19. Due to the pandemic, there has been an increased reliance on robot-like patient simulators for training.

CAE Inc, Laerdal Medical AS, Gaumard Scientific Co Inc, Kyoto Kagaku Co Ltd, Surgical Science Sweden AB, Simulab Corp, Simulaids Ltd, Mentice AB, Limbs & Things Ltd, and VirtaMed AG are among the leading companies operating in the global patient simulators market.

Various organic and inorganic strategies are adopted by companies operating in the patient simulators market. Organic strategies mainly include product launches and product approvals. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the patient simulators market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall patient simulators market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios. A few of the significant developments by key market players are listed below.

- In February 2022, VirtaMed released simulation training modules for arthroscopic knee surgeries. These latest training modules will be available on simulators with two different skin tones. The new model and additional software upgrades were unveiled at the American Academy of Orthopaedic Surgeons (AAOS) conference in Chicago in March 2022.

- In January 2022, Gaumard Scientific Co. launched HAL S5301 the world’s most advanced multidisciplinary patient simulator at the International Meeting on Simulation in Healthcare (IMSH) held during January 15-19 at the Los Angeles Convention Center.

- In February 2021, VirtaMed launched a surgical gynecology simulation suite to benefit from a combined mixed reality training platform for hysteroscopy and gynecological laparoscopy. Combining the highlights of the new LaparoS with all the experience from GynoS Hysteroscopy helped in safe, realistic, proficiency-based healthcare simulation training for surgical gynecology. The simulator is aligned with the Accreditation Council for Graduate Medical Education and European Board and College of Obstetrics and Gynecology training guidelines and milestones.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com