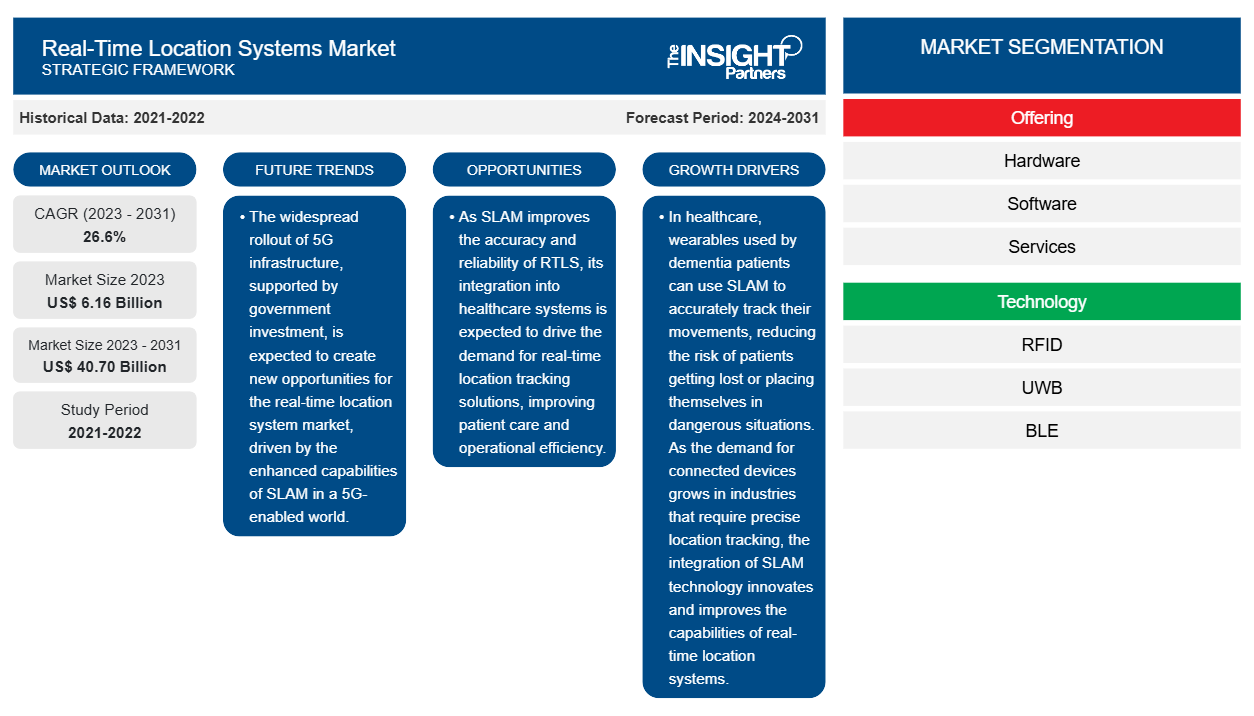

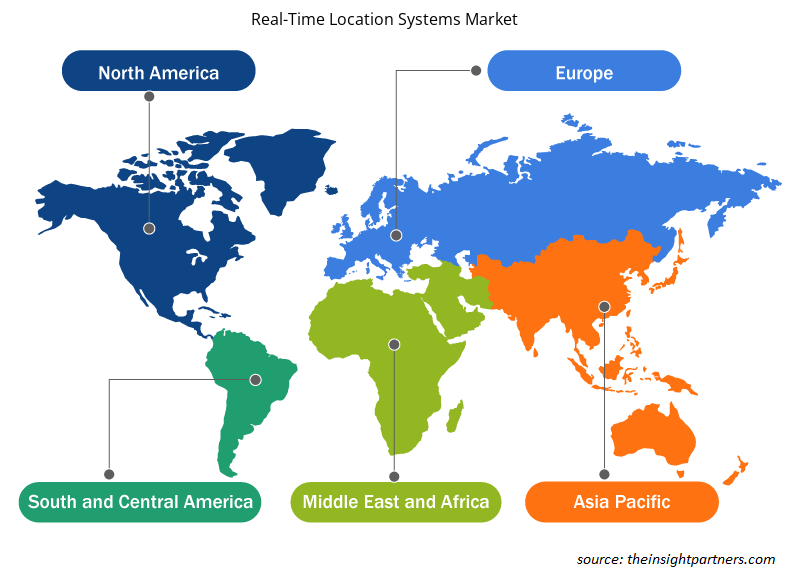

The real-time location systems market size is projected to reach US$ 40.70 billion by 2031 from US$ 6.16 billion in 2023. The market is expected to register a CAGR of 26.6% during 2023–2031. The growing use of RTLS in the healthcare sector is likely to trend in the market.

Real-Time Location Systems Market Analysis

The demand for connected devices, including smartphones, tablets, and different wearable devices, such as smartwatches, fitness trackers, VR headsets, web-enabled glasses, smart jewelry, and Bluetooth headsets, is increasing across the world. Smartphones and tablets help users accurately track location information in real time. The devices help the user to know the real-time traffic scenario and find the fastest route to the destination. It also assists parents to monitor the movement of their children through different location-tracking apps. Therefore, the adoption of smartphones and tablets is increasing tremendously. According to the Groupe Speciale Mobile Association (GSMA), smartphone adoption across the world was 76% in 2022, totaling 6.4 billion smartphone connections. The adoption is expected to rise to 92% by 2030, making 9 billion connections globally. According to the same report, smartphone adoption in North America was 84% in 2022 and is expected to spur to 90% by 2030. Similarly, the smartphone adoption rate in Europe would increase from 84% in 2022 to 91% by 2030. In Sub-Saharan Africa, an underpenetrated market, the smartphone adoption rate is predicted to grow from 51% in 2022 to 87% by 2030.

Real-Time Location Systems Market Overview

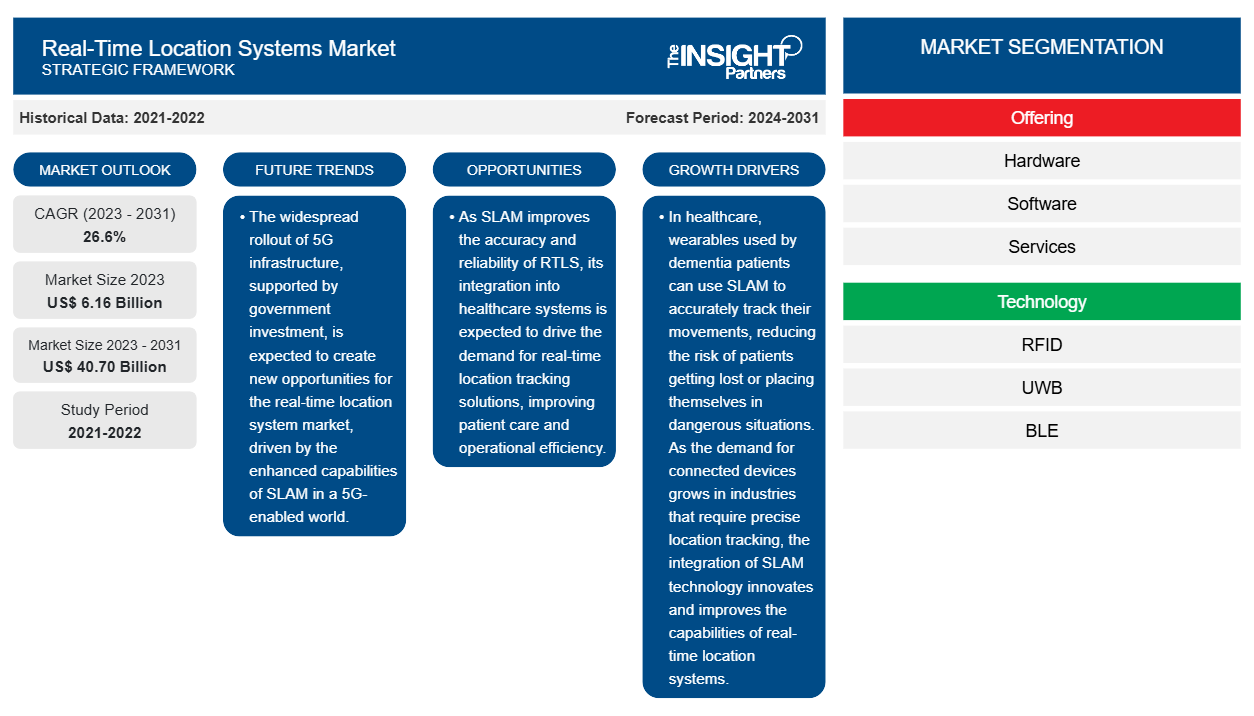

The real-time location systems market is broadly segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). North America held the largest market share in 2023, followed by Europe and APAC. APAC is expected to register the highest CAGR in the market from 2023 to 2031.

Increased demand for real-time location systems in developing economies, such as India and China, is expected to create lucrative opportunities for market players in Asia Pacific during the forecast period. The growing manufacturing, retail, and logistics industries are raising the need for asset tracking, fueling the demand for real-time locating systems in the region. The rising demand for RTLS and SLAM in the above industries is encouraging the market players to provide advanced solutions to customers. According to the State Council of China, the retail industry is booming in the country, with an increased sales of 11% in 2023, accounting for US$ 2.24 trillion compared to the previous year. The growing demand for advanced technologies in these countries is expected to fuel the growth of the real-time location systems market in APAC.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Real-Time Location Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Real-Time Location Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Real-Time Location Systems Market Drivers and Opportunities

Growing E-Commerce Sector

Since the COVID-19 pandemic, there has been a surge in online shopping across the world. E-commerce sales have witnessed a significant growth rate over recent years. According to the International Air Transport Association (IATA), in 2021, 2.14 billion people (i.e., ∼27.6% of the world’s population) shopped for products from online portals. In addition, APAC leads the global e-commerce market, where China accounts for a significant percentage of the regional market growth. As per the International Trade Administration, China is the largest e-commerce market in the world, generating ∼50% of the world’s transactions. In 2021, the country generated ∼US$ 1.5 trillion in revenue through the e-commerce sector, becoming the largest e-commerce market in the world. Also, Europe is a key region supporting e-commerce growth. According to Eurostat, in 2022, 91% of people aged 16–74 years in the European Union (EU) countries used the Internet, of which ∼75% ordered goods or services online. Also, the proportion of e-shoppers grew to 75% in 2022 from 55% in 2012, an increase of 20% over the last decade. Many shoppers in Europe prefer online shopping platforms such as Amazon, Target, and Walmart, which majorly drives the growth of the e-commerce sector in Europe. The growing demand for online shopping is compelling companies to make retail cost-efficient and faster, which raises the need to optimize supply chain management and build robust solutions to meet the demands. In the e-commerce sector, the real-time location system helps monitor and locate goods; it provides resourceful insights to distribution center operators to make data-driven decisions rather than relying on educated guesses.

Emergence of 5G

The 5G network is ∼100 times faster than the 4G network, making real-time data acquisition easier. As the 5G network provides strong connectivity and high-speed data transfer, its demand is increasing across the world. According to the Groupe Speciale Mobile Association (GSMA), 5G penetration across the world is expected to reach 54% by 2030 from 17% in 2022. North America has the highest 5G penetration, with 39% in 2022; it is expected to reach 91% by 2030. 5G penetration in Asia Pacific (except China) and Europe is expected to increase from 4% and 11% in 2022 to 41% and 87% by 2030, respectively. As 5G is the critical new-generation network technology that can enable innovation and support digital transformation, its demand is increasing across the world. Therefore, the governments of various countries are investing in 5G infrastructure. In July 2021, the government of France announced its plan to invest about US$ 2.06 billion (EUR 1.7 billion) in its 5G market by 2025 via public and private investments. Through this, the government aims to accelerate the development of 5G in the country. Similarly, in January 2021, the government of South Korea announced that they would increase the coverage of the next-generation mobile networks, particularly 5G, to 85 cities this year from the current seven major cities. It invested around US$ 115.89 million (127.9 billion won) in 2021 to encourage the use of private 5G networks. Growing investments in 5G will help improve connectivity and acquire real-time data, including real-time location tracking, which can be used for various applications, from navigation to emergency services. Therefore, the emergence of the 5G network is expected to create lucrative opportunities for the real-time location systems market during the forecast period.

Real-Time Location Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the real-time location systems market analysis are offering, technology, industry vertical, and application.

- Based on offering, the global real-time location systems market is segmented into hardware, software, and services. The hardware segment held the largest market share in 2023.

- By technology, the market is divided into radio frequency identification (RFID), ultra-wideband (UWB), Bluetooth low energy (BLE), ultrasound, infrared (IR), global positioning systems (GPS), Wi-Fi, and ZigBee. The Bluetooth low energy (BLE) segment held the largest share of the market in 2023.

- In terms of industry vertical, the market is divided into retail, government and defense, manufacturing, healthcare, logistics, heavy industries, construction, oil and gas, automotive, and others. The healthcare segment held the largest share of the market in 2023.

- Based on application, the market is divided into personnel/staff locating and monitoring, access control and security, environmental monitoring, warehouse management and monitoring, supply chain management and operational automation/visibility, and others. The supply chain management and operational automation/visibility segment held a larger share of the market in 2023.

Real-Time Location Systems Market Share Analysis by Geography

The geographic scope of the real-time location systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

North America held the largest real-time location systems market share in 2023 and is projected to maintain its dominance during the forecast period. The real-time location systems market in North America is segmented into the US, Canada, and Mexico. North America is a technologically advanced region owing to factors such as a positive outlook for advanced hardware adoption, a high inclination toward technological innovation, high GDP, developed infrastructure, and favorable economic policies. The region has a highly developed manufacturing sector. According to the National Institute of Standards and Technology, the manufacturing industry in the US accounted for a revenue of US$ 2.3 trillion in 2022, contributing to 11.4% of the total GDP of the country. The sector integrates RTLS and simultaneous localization and mapping (SLAM) to maintain a robust supply chain across verticals. The retail sector in North America is a major adopter of tracking hardware, which facilitates data transfer and details from tags attached to objects using scanning systems, thereby enabling automatic identification and tracking. According to the International Trade Administration (ITA), in 2022, there were ~27 million e-commerce users in Canada, accounting for 75% of the Canadian population, and the number is expected to reach 77.6% by 2025. In March 2022, e-commerce sales were ~US$ 2.34 billion and are estimated to reach US$ 40.3 billion by 2025.

North America has a well-established healthcare industry. Inventory management operations are efficiently performed using advanced technologies, which act as a prerequisite for several decision-making processes. Hospitals in the region are highly inclined toward implementing the best practices in the hospital supply management system to allow efficient inventory management. They are deploying RTLS and SLAM to help healthcare professionals in the institution quickly search for the required equipment. In addition, the RTLS and SLAM technologies can help track and monitor critical patients in the ICU or patients with dementia and mental distress. The rising use of these technologies in healthcare infrastructure is supporting the growth of the real-time location system market. Several companies in North America are investing in new technologies in RTLS and SLAM. For instance, in September 2024, Litum, a provider of RTLS technology, announced the launch of an infant security RTLS that features the Little Tag, specifically designed for newborn children. This technology prevents abductions and mismatches of infants in healthcare facilities.

Real-Time Location Systems Market Regional Insights

The regional trends and factors influencing the Real-Time Location Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Real-Time Location Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Real-Time Location Systems Market

Real-Time Location Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.16 Billion |

| Market Size by 2031 | US$ 40.70 Billion |

| Global CAGR (2023 - 2031) | 26.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Real-Time Location Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Real-Time Location Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Real-Time Location Systems Market are:

- Aruba Networks

- AiRISTA Flow Inc

- Qorvo Inc

- Impinj Inc

- Siemens AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Real-Time Location Systems Market top key players overview

Real-Time Location Systems Market News and Recent Developments

The real-time location systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the real-time location systems market are listed below:

- Houston Airports partnered with HPE Aruba Networking solution to adopt a Wi-Fi 6E-enabled HPE Aruba Networking solution. (Source: Aruba Networking, Press Release, 2024)

Siemens and NVIDIA collaborated to create the industrial metaverse, utilizing NVIDIA Omniverse Cloud APIs for immersive visualization on the Siemens Xcelerator platform, demonstrating the potential of AI-driven digital twin technology. (Source: Siemens, Press Release, 2024)

Slamcore released its latest SDK, 23.04, which includes Perceive functionality and supports the NVIDIA Jetson Orin family of embedded systems for edge AI and robotics, aiming to accelerate vision integration in autonomous mobile robots. (Source: Slamcore, Press Release, 2023)

Real-Time Location Systems Market Report Coverage and Deliverables

The "Real-Time Location Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Real-time location systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Real-time location systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time location systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the real-time location systems market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the real-time location systems market?

Growing use of RTLS in healthcare sector is expected to drive the growth of the real-time location systems market in the coming years.

What will the real-time location systems market size be by 2031?

The real-time location systems market is expected to reach US$ 40.70 million by 2031.

Which are the leading players operating in the real-time location systems market?

The key players operating in the real-time location systems market include Aruba Networks, AiRISTA Flow Inc, Qorvo Inc, Impinj Inc, Siemens AG, Zebra Technologies Corp, Sonitor Technologies AS, Stanley Black & Decker Inc, TeleTracking Technologies Inc, Ubisense Ltd, Slamcore Ltd, Kudan Inc, Microsoft Corp, Sevensense Robotics AG, and NavVis GmbH.

Which is the leading offering segment in the real-time location systems market?

The hardware segment led the real-time location systems market with a significant share in 2023.

What is the estimated global market size for the real-time location systems market in 2023?

The real-time location systems market was estimated to be valued at US$ 6.16 billion in 2023 and is anticipated to grow at a CAGR of 26.6% over the forecast period.

What are the driving factors impacting the real-time location systems market?

The demand for connected devices, including smartphones, tablets, and different wearable devices, such as smartwatches, fitness trackers, VR headsets, web-enabled glasses, smart jewelry, and Bluetooth headsets, is increasing across the world. As the demand for connected devices grows in industries that require precise location tracking, the integration of SLAM technology innovates and improves the capabilities of real-time location systems.

Which is the fastest-growing region in the real-time location systems market?

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Real-Time Location Systems Market

- Aruba Networks

- AiRISTA Flow Inc

- Qorvo Inc

- Impinj Inc

- Siemens AG

- Zebra Technologies Corp

- Sonitor Technologies AS

- Stanley Black & Decker Inc

- TeleTracking Technologies Inc

- Ubisense Ltd

- Slamcore Ltd

- Kudan Inc

- Microsoft Corp

- Sevensense Robotics AG

- NavVis GmbH

Get Free Sample For

Get Free Sample For