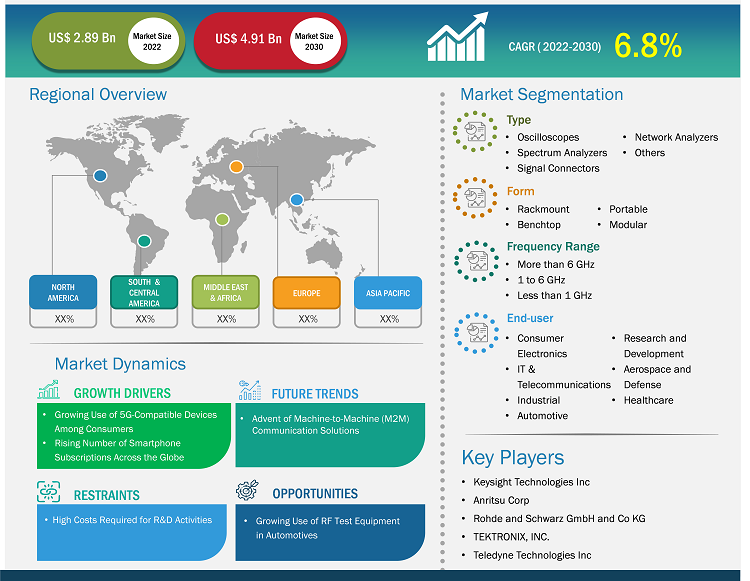

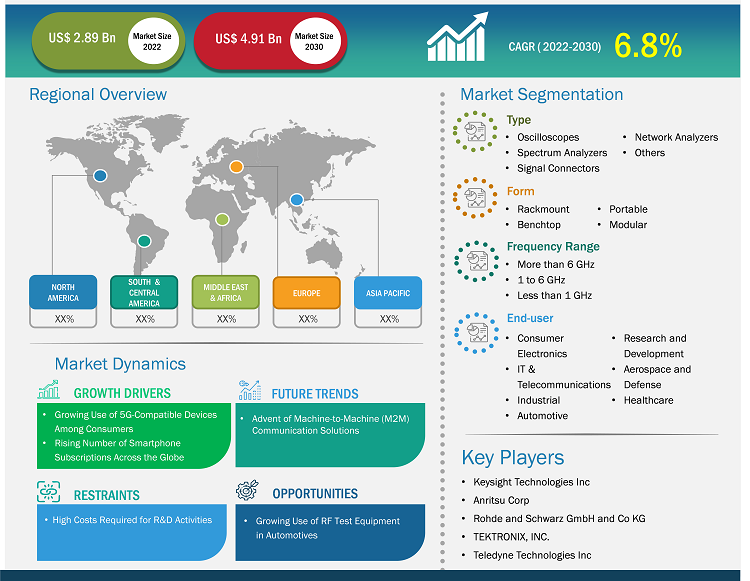

The RF Test Equipment Market size is expected to grow from US$ 2.89 billion in 2022 to US$ 4.91 billion by 2030; it is estimated to grow at a CAGR of 6.8% from 2022 to 2030.

Analyst Perspective:

The RF test equipment market has witnessed significant growth in recent years, driven by the expansion of numerous industries such as consumer electronics, telecommunication, aerospace and defense, automotive, and healthcare. The rising implementation of 5G networks and technologies is driving the market. Major developing and developed countries like the US, Germany, China, the UK, Japan, India, Singapore, France, and others have increased their adoption of 5G networks, and technologies are boosting the market. Surging demand for wireless systems in commercial and residential buildings and a growing number of smartphone subscriptions across the globe are fueling the market. Moreover, the advent of machine-to-machine (M2M) communication solutions and the Industrial Internet of Things (IIoT), especially for telecommunications applications, the growing use of RF Test Equipment in Automotives, and the increasing use of IoT-connected devices are creating opportunities for the market growth during the forecast period.

RF Test Equipment Market Overview:

Radio Frequency (RF) test equipment accurately measures and tests wireless communication devices operating at different frequencies. These communication devices consist of smartphones, satellite communication systems, and routers. RF test equipment depends on the transmission and reception of radio waves to provide accurate results. This equipment helps engineers and technicians evaluate the performance of wireless devices by monitoring the frequency response, signal quality, power output, and other essential aspects of wireless devices. Every RF instrument is made to carry out particular measurements and testing. Additionally, RF testing instruments constitute an all-inclusive equipment set for technicians and engineers that test wireless communication devices and networks. Increasing demand for precise and dependable radio frequency testing equipment associated with growing requirements for wireless communication among consumers and the rapidly changing technological environment is driving the market. Furthermore, market players are continuously developing new RF test tools and technologies to keep engineers and technicians updated with the latest advancements in the field, propelling market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

RF Test Equipment Market: Strategic Insights

Market Size Value in US$ 2.89 billion in 2022 Market Size Value by US$�4.91 billion by 2030 Growth rate CAGR of 6.8% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

RF Test Equipment Market: Strategic Insights

| Market Size Value in | US$ 2.89 billion in 2022 |

| Market Size Value by | US$�4.91 billion by 2030 |

| Growth rate | CAGR of 6.8% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

RF Test Equipment Market Driver

:Growing Use of 5G-Compatible Devices Among Consumers is Driving the Market

5G technology is highly used for broadband cellular networks. In recent years, the demand for 5G-compatible devices has increased worldwide due to the expansion of industries. Growing 5G deployment in cellular devices among manufacturing and telecommunications industries drives the market. For instance, according to Telefonaktiebolaget LM Ericsson, more than 1,000 5G smartphone models will be launched in 2023. The 5G-based smartphones are expected to hold 62% of the share in 2023, compared to 57% in 2022 in the global smartphone market. Growing adoption of 5G smartphones among consumers drives the market during the forecast period. 5G wireless network is a highly complex technology that requires installing a more significant number of transmitters, antennas, and receivers. This complexity requires more sophisticated RF test equipment for measuring, analyzing, and handling the signal characteristics of each component. Moreover, the growing implementation of 5G wireless technology is increasing the use of RF test equipment for measuring and analyzing different parameters like frequency, power, modulation, and latency. The RF test equipment ensures the optimal performance of 5G networks and devices, fueling the market. The increased complexity, high frequencies, and denser deployment of network components in the 5G infrastructure increase customer adoption of RF test equipment.

Furthermore, 5G networks use massive multiple-input, multiple-output (MIMO) technology, which increases the demand for RF testing equipment for testing multiple antennas simultaneously. 5G technology also uses millimeter-wave technology that operates at extremely high frequencies. RF test equipment can operate at extremely high frequencies to validate millimeter-wave component’s performance. Rapid developments associated with 5G technology and increasing demand for mobile data services drive the market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

RF Test Equipment Market Segmental Analysis:

Based on form, the market is segmented into rackmount, benchtop, portable, and modular. The modular segment is projected to expand during the forecast period, due to the availability of multiple architectural designs, such as Advanced Telecommunications Computing Architecture Extensions for Instrumentation and Test (AXIe), PCI eXtensions for Instrumentation (PXI), and peripheral component interconnect (PCI) Express. They are intended to evaluate testing settings in manufacturing plants and RF device designs and may produce data considerably more quickly than other instruments. Modular signal analyzers are highly demanded by applications that require quick and accurate measurements including large-scale production where quality control, product compliance, and test optimization are crucial. A modular oscilloscope system achieves substantially higher synchronization accuracy using a single integrated trigger circuit to drive the entire system and a single-time base for all acquisition modules. However, the growing usage of modular RF test equipment in various industries including aerospace and defense, telecommunication, and electronics manufacturing, is driving the segment.

RF Test Equipment Market Regional Analysis:

The Aisa Pacific RF test equipment market was valued at US$ XX billion in 2022 and is projected to reach US$ XX billion by 2030; it is expected to grow at a CAGR of XX% during the forecast period. The market in Asia Pacific is expected to dominate soon owing to the presence of well-known connectivity solution providers including Renesas Electronics Corp (Japan), MediaTek Inc (Taiwan), and Huawei Technologies Co Ltd (China). These players are constantly engaged in developing new solutions for their customers, such as growing smartphone subscriptions, which are one of the key factors driving the market in Asia Pacific. Moreover, China is a global manufacturing hub for consumer electronic products, which provides growth opportunities for market players. Growing adoption and rising implementation of 5G technology are creating opportunities in the market. 5G technology service providers such as ZTE Corporation, Huawei Technologies Co. Ltd., Rohde and Schwarz GmbH and Co KG, Telefonaktiebolaget LM Ericsson, Nokia Corporation, and Qualcomm Technologies Inc. are quickly updating their testing infrastructure to fulfill their customers’ requirements of 5G technology. For instance, in July 2022, Rohde and Schwarz GmbH and Co KG launched a comprehensive 5G over-the-air test product for testing Huge MIMO antennas and mmWave.

China is the foremost provider of RF test equipment in the global and Asia Pacific markets due to the presence of high-end technologies for designing, manufacturing, and developing RF testing products, which is driving the market. Moreover, increasing government spending for expanding electronics and semiconductor industries generates significant market opportunities. For instance, in December 2022, the government of China approved the funding of US$ 143 billion for the modernization and promotion of electronics and semiconductor industries. RF test equipment is used to test, measure, and analyze the performance of various devices including smartphones, Bluetooth devices, Wi-Fi routers, integrated circuits (ICs), and others operating within the RF spectrum. These factors are anticipated to fuel the China market during the forecast period.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

RF Test Equipment Market Key Player Analysis:

The market analysis consists of players such as Keysight Technologies Inc, Anritsu Corp, Rohde and Schwarz Gmbh And Co Kg, Tektronix, Inc., Teledyne Technologies Inc, Berkeley Nucleonics Corporation, B&K Precision Corporation, National Instruments Corp, Viavi Solutions Inc, And Teradyne Inc, among the key market players profiled in the report.

RF Test Equipment Market Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the market. A few recent key market developments are listed below:

- In October 2023, Anritsu Corp partnered with AnaPico AG to develop an end-to-end IQ Capture and playback system for RF signals. Anritsu Corp enhances its IQ Signal Master MX280005A PC application to integrated Field Master Pro MS2090A spectrum analyzer for capturing RF IQ signals and then loading the IQ data file into the AnaPico AG VSG for playback within frequency range up to 40 GHz. The IQ data and playback process is an ideal solution for in-depth testing of receivers' responses to a wide range of signals.

- In September 2023, Rohde and Schwarz GmbH and Co KG continued their research by using new dedicated W and D band test solutions for developing 6G and sub-THz. The company is also focusing on advancing RF test and measurement solutions by adding three additional products to its portfolio including a new R&S SFI100A wideband IF vector signal generator, R&S FE110ST/SR TX/RX frontends, and R&S NRP170TWG thermal power sensor.

- In August 2023, Anritsu Corp launched the new RF Conformance Test System ME7873NR Lite Model that supports 5G RF Conformance Test System (5G Sub-6 GHz (FR1) TRx tests). The test system is an efficient and cost-effective solution for 5G services.

- In September 2022, Rohde and Schwarz GmbH and Co KG launched R&S MXO 4 series oscilloscopes with the fastest update rate for over 4.5 million acquisitions per second. The R&S MXO 4 series oscilloscopes are available in four-channel models, with bandwidths ranging from 200 MHz to 1.5 GHz.

- In August 2022, Anritsu Corp expanded its VectorStar Vector Network Analyzer product portfolio by launching the world’s first single sweep VNA-spectrum analyzer. The spectrum analyzer supports a frequency range from 70 KHz to 220 GHz and is highly suitable for effectively testing and verifying active and passive devices.

- In June 2022, TEKTRONIX, INC. launched a 2 Series Mixed Oscilloscope to strengthen its test and measurement equipment portfolio. The 2-Series Mixed Oscilloscope is extremely thin and highly portable and can seamlessly transition from the bench to the field and back.

- In April 2022, Keysight Technologies Inc. launched the M9484C VXG Vector Signal Generator to foster the development of advanced and innovative electronic devices. M9484C VXG Vector Signal Generator is highly suitable for wideband multi-channel mmWave Applications.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Form, Frequency Range, and End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1. Schneider Electric S.E.

2. Honeywell International

3. ABB Group

4. Siemens AG

5. Legrand SA

6. Ingersoll-Rand PLC

7. Qualcom

8. AISense

9. Near Pte. Ltd

10. Assisted Living Technologies Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to RF Test Equipment Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)