Inertial Sensor for Land Defense Systems Market Share and Forecast by 2030

Inertial Sensor for Land Defense Systems Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

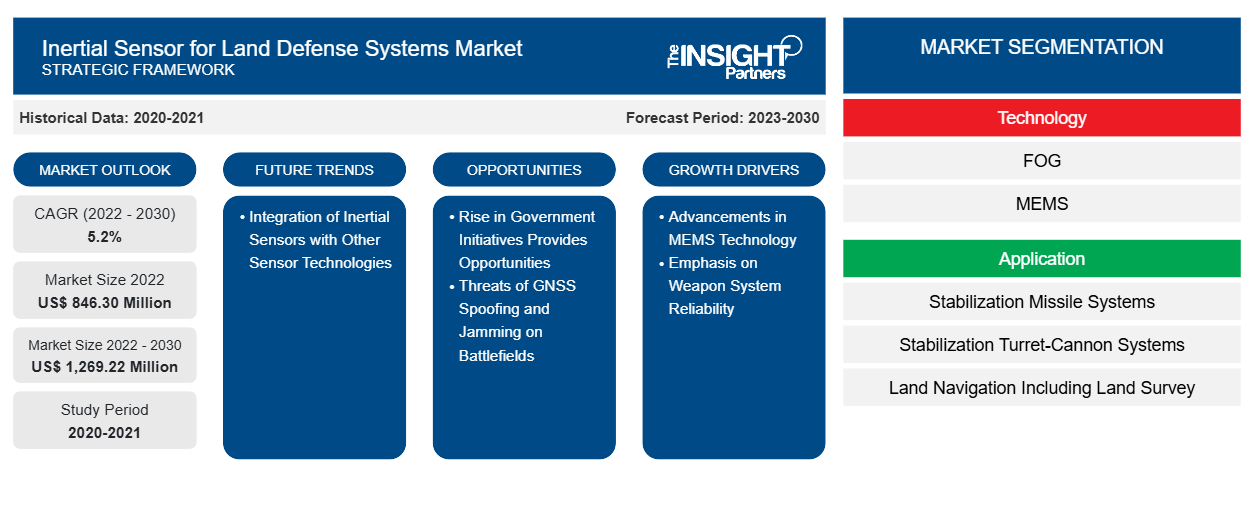

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00038957

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 161

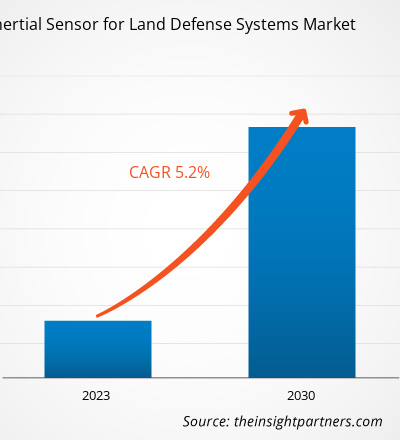

[Research Report] The inertial sensor for land defense systems market size is projected to reach US$ 1,269.22 million by 2030 from US$ 846.30 million in 2022; it is estimated to record a CAGR of 5.2% from 2022 to 2030.

The report includes growth prospects in light of current inertial sensor for land defense systems market trends and driving factors influencing the market growth.

Analyst Perspective:

The reliability and precision of weapon systems are of utmost importance in land defense, which can be achieved through the use of inertial sensors. By accurately measuring the specific force and angular rate of the weapon system, these sensors provide real-time data that helps maintain the system's stability and accuracy. Inertial sensors find applications in various land defense systems, including artillery systems, missile guidance systems, unmanned ground vehicles (UGVs), and autonomous weapon platforms. These sensors provide critical data for navigation stabilization and other targeting purposes, enhancing the overall performance and reliability of these systems. Thus, the emphasis on weapon system reliability is boosting the demand for inertial sensors in land defense systems, which drives the inertial sensor for land defense systems market.

Inertial Sensor for Land Defense Systems Market Overview:

The inertial sensor, also recognized as the inertial navigation system (INS), uses an accelerometer and gyro to determine the spacecraft's attitude in relation to the inertial system. These range from microelectromechanical systems (MEMS) inertial sensors, measuring only a few mm, to ring laser gyroscopes that are high-precision devices with a size of up to 50 cm. Advancements in microelectromechanical systems (MEMS) have significantly impacted the miniaturization, cost reduction, and improved performance of inertial sensors. MEMS devices can play key roles in designing and developing military sensors to meet specific mission requirements. Because of their low power consumption, compact size, and ultrahigh reliability, MEMS are most suitable in the development of sensors for battlefield tanks, surveillance for hostile territory, drone electronics, covert communications, unmanned air vehicles (UAVs), and missiles to shoot down hostile targets.

Reliability and precision of weapon systems are of utmost importance in land defense. Growing government initiatives to use unmanned vehicles for various defense applications create significant opportunities for integrating inertial sensors in land defense systems. Moreover, the threats of global navigation satellite system (GNSS) spoofing and jamming on the battlefields drive the adoption of inertial navigation systems. These threats can severely affect military operations, creating the need for reliable and high-performance inertial navigation systems. These factors are driving the inertial sensor for land defense systems market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInertial Sensor for Land Defense Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Inertial Sensor for Land Defense Systems Market Driver:

Advancements in MEMS Technology to Boost the Inertial Sensor for Land Defense Systems Market Growth

Microelectromechanical Systems (MEMS) refers to the fabrication of microscopic sensors, actuators, and transducers with moving mechanical parts at the microscopic scale. The utilization of MEMS technology in inertial sensors for land defense systems has expanded their range of applications. MEMS technology enables the production of inertial sensors on a microscopic scale, allowing for their integration into smaller land defense systems such as unmanned ground vehicles and soldier-worn devices. Additionally, the adoption of MEMS technology has led to cost reduction in sensor manufacturing, making inertial sensors more accessible and affordable. MEMS-based inertial sensors offer superior performance characteristics, including high sensitivity, accuracy, and stability, enhancing their suitability for precise motion sensing and navigation in land defense systems. For instance, in September 2023, EMCORE Corporation, a leading provider of inertial navigation solutions to the aerospace & defense industry, announced the launch of the TAC-440 MEMS Inertial Measurement Unit (IMU). This IMU is recognized as the world's smallest 1°/hour IMU and is available in an ultra-compact package of less than 5 cubic inches. Furthermore, the TAC-440 is designed to be a higher-performance replacement for the Honeywell 1930 and 4930 IMUs, offering improved form, fit, and function compatibility.

Overall, the introduction of the TAC-440 MEMS Inertial Measurement Unit by EMCORE Corporation represents a significant advancement in the field of inertial navigation technology. Its small size, cost-effectiveness, improved performance, integration possibilities, and mass production capability make it a valuable asset for various land defense applications. MEMS technology also enables the integration of multiple sensors on a single chip, providing multi-axis motion sensing capabilities. Furthermore, the mass production capability of MEMS technology has substantially contributed to the widespread adoption of inertial sensors in land defense systems. Thus, advancements in MEMS technology have had a significant impact on the miniaturization, cost reduction, and improved performance of inertial sensors, which drives the inertial sensor for land defense systems market.

Inertial Sensor for Land Defense Systems Market Report Segmentation and Scope:

The “inertial sensor for land defense systems market analysis” has been carried out by considering the following segments: technology, application, and geography. Based on technology, the market is segmented into MEMS, FOG, and others. In terms of application, the market is segmented into stabilization active protection systems, stabilization turret/cannon systems, stabilization missile systems, stabilization of optronic systems, missile GGM/SSM, land navigation including land survey, and others. Based on geography, the inertial sensor for land defense systems market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Inertial Sensor for Land Defense Systems Market Segmental Analysis:

By application, the inertial sensor for land defense systems market is segmented into stabilization active protection systems, stabilization turret/cannon systems, stabilization missile systems, stabilization of optronic systems, missile GGM/SSM, land navigation including land survey, and others. The stabilization missile systems segment is anticipated to hold a significant inertial sensor for land defense systems market share by 2030. Inertial sensors play a crucial role in the stabilization of missile systems. These sensors are part of an inertial navigation system (INS), which is a navigation device that uses motion sensors (accelerometers) and rotation sensors (gyroscopes) to uninterruptedly calculate the position, orientation, and velocity of a moving object without the need for external references. Inertial sensors are used to stabilize sensor systems in missiles. By measuring the motion and rotation of the missile, the sensors help compensate for the high-rotation motion and maintain the stability of the sensor system. This stabilization is crucial for accurate target tracking, surveillance, and missile guidance. Inertial sensors are used to achieve high-precision navigation in missile systems. They provide accurate measurements of the missile's angular velocity and acceleration, which are essential for guidance and control functions. For example, an accurate inertial reference system is needed to stabilize target line-of-sight measurements for the computation of missile guidance commands. In some missile systems, a novel Semi-strap-down Stabilized Platform (SSP) is used to mount the sensors. This platform isolates the high-rotational motion of the missile, reducing the range requirements of the sensors and enabling high-precision navigation; thus, these factors boost the inertial sensor for land defense systems market growth.

Inertial Sensor for Land Defense Systems Market Regional Analysis:

The Asia Pacific inertial sensor for land defense systems market is segmented into Australia, China, India, Japan, South Korea, and the rest of Asia Pacific. China accounted for the largest inertial sensor for land defense systems market share in Asia Pacific. The region is experiencing substantial growth in the inertial sensor for the land defense systems market. Asia Pacific (APAC) is home to some of the world's most powerful militaries, with several countries investing heavily in their land defense capabilities. Militaries across APAC are investing in modern weapons systems, such as long-range missiles, precision-guided munitions, cyberwarfare capabilities, and other military projects. For instance, in July 2020, India earmarked US$ 5.2 billion to design and develop military equipment. The Ministry of Defence announced that the approved proposals involved acquisitions worth US$ 4.1 billion from domestic defense industry firms. Additionally, in December 2023, the US military announced the deployment of intermediate-range ground-based missiles in the Indo-Pacific in 2024, establishing its first arsenal in the region since the end of the Cold War to enhance deterrence against China.

Inertial Sensor for Land Defense Systems Market Key Player Analysis:

The inertial sensor for land defense systems market forecast can help stakeholders plan their growth strategies. Collins Aerospace, Advanced Navigation Pty Ltd, Honeywell International Inc, Aeron Systems Pvt Ltd, Northrop Grumman Corp., SBG Systems SAS, Thales SA, Emcore Corp, GEM Elettronica SRL, and Exail SAS are among the prominent players profiled in the inertial sensor for land defense systems market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem.

Inertial Sensor for Land Defense Systems

Inertial Sensor for Land Defense Systems Market Regional InsightsThe regional trends and factors influencing the Inertial Sensor for Land Defense Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Inertial Sensor for Land Defense Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Inertial Sensor for Land Defense Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 846.30 Million |

| Market Size by 2030 | US$ 1,269.22 Million |

| Global CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Inertial Sensor for Land Defense Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Inertial Sensor for Land Defense Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Inertial Sensor for Land Defense Systems Market Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the inertial sensor for land defense systems market. As per company press releases, below are a few recent key developments:

- In September 2023, Advanced Navigation, a globally recognized leader in artificial intelligence (AI) for robotic and navigation technologies, inaugurated a state-of-the-art robotics facility at UTS Tech Lab. Situated in Botany, New South Wales, this facility aims to expand the production capabilities of Advanced Navigation, specifically for their groundbreaking AI navigation systems designed for GPS-denied environments. Notably, this includes their cutting-edge digital fiber-optic gyroscope (DFOG) technology known as Boreas.

- In September 2023, EMCORE Corporation made a significant announcement regarding the release of the TAC-440 MEMS Inertial Measurement Unit (IMU), which stands as the world’s smallest IMU, boasting an impressive accuracy of 1°/hour. With its remarkably compact design occupying less than 5 cubic inches, the TAC-440 represents a superior option that aligns seamlessly with the form, fit, and function of the Honeywell 1930 and 4930 IMUs, offering enhanced performance. This unveiling underscores EMCORE’s commitment to delivering cutting-edge solutions that excel in the industry.

- In May 2023, SBG Systems introduced Ekinox Micro, a state-of-the-art compact GNSS-aided inertial navigation solution specifically designed for mission-critical applications. This cutting-edge technology is characterized by its miniature size and exceptional performance, making it an ideal choice for demanding scenarios where precise and reliable navigation is crucial. By integrating high-performance GNSS and inertial sensors, Ekinox Micro offers unparalleled accuracy and stability, ensuring optimal navigation performance even in challenging environments.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For