The global Bio-Based Ethylene market size is projected to reach US$ 1,111.54 million by 2034 from US$ 614.87 million in 2025. The market is anticipated to register a CAGR of 6.8% during the forecast period 2026–2034. Key dynamics include an aggressive global pivot toward decarbonizing the plastics value chain, increased regulatory pressure on single-use plastics, and the rapid scale-up of "drop-in" renewable chemical solutions. Furthermore, the market is set to benefit from the rise of sustainable aviation fuel (SAF) production, which generates bio-naphtha as a byproduct, and the growing commitment of global consumer brands to achieve net-zero Scope 3 emissions by 2040.

Bio-Based Ethylene Market AnalysisThe Bio-Based Ethylene market analysis reveals a critical transition from pilot-scale experimental production to industrial-scale commercialization. To succeed, businesses must navigate the "green premium"—the cost gap between bio-ethylene and fossil-based equivalents, which remains approximately 20-40% higher depending on feedstock volatility. Strategic opportunities lie in the integration of Mass Balance accounting, allowing manufacturers to co-process bio-feedstocks in existing steam crackers without massive capital expenditure. This "drop-in" capability is essential for rapid market entry into the high-volume polyethylene (PE) sector.

Decision-makers should focus on securing long-term offtake agreements with brand owners in the packaging and automotive industries, who are willing to absorb price premiums to meet environmental ESG targets. Competitive differentiation is increasingly tied to ISCC PLUS certification, which ensures traceability across the supply chain. Furthermore, the analysis indicates that the market is shifting toward lignocellulosic biomass to avoid the "food vs. fuel" debate associated with first-generation sugars. Successful market participation now requires a dual focus on feedstock security and the utilization of government tax credits, such as the US Inflation Reduction Act, to offset high operational expenses.

Bio-Based Ethylene Market OverviewBio-based ethylene is undergoing a structural transformation, evolving from a niche chemical curiosity into a fundamental pillar of the global circular economy. Historically dependent on sugar-to-ethanol dehydration in regions like Brazil, bio-based ethylene is now diversifying into a multi-feedstock ecosystem. Significant breakthroughs in catalytic conversion and fermentation technologies propel this transition. As the largest bulk chemical by volume, ethylene's shift to renewable sources is viewed as the "holy grail" for decarbonizing the polymer industry.

Large-scale chemical giants are increasingly adopting "drop-in" solutions, where bio-based ethylene is chemically identical to its petroleum counterpart, requiring no downstream equipment modifications. However, the market faces a complex landscape where growth is balanced against high CAPEX requirements and the logistical challenge of biomass collection. Current trends show a massive surge in B2B partnerships between agricultural processors and petrochemical firms, creating integrated value chains that mitigate feedstock price volatility. The US bio-based ethylene market is rapidly evolving, driven by abundant agricultural feedstocks and federal incentives like the Inflation Reduction Act (45Z credits). While traditional ethane cracking dominates, Gulf Coast facilities are increasingly integrating bio-naphtha. Key players are leveraging advanced ethanol-to-jet and dehydration technologies to supply the growing demand for sustainable packaging and automotive components.

Strategic Insights

Bio-Based Ethylene Market Drivers and OpportunitiesMarket Drivers:

- Stringent Carbon Emission Regulations: Global mandates, such as the EU Green Deal and the US EPA's renewable fuel standards, are forcing chemical manufacturers to lower their carbon intensity. Bio-based ethylene offers a carbon-neutral or even carbon-negative profile (when combined with CCUS), making it a primary tool for regulatory compliance.

- Corporate Sustainability Commitments: Major consumer-facing giants (e.g., Coca-Cola, IKEA, and Unilever) have pledged to transition to 100% renewable or recycled plastics. This massive "pull" demand from the end-user level provides a guaranteed market for bio-ethylene derivatives like Bio-PE and Bio-PET.

- Advancements in Ethanol Dehydration Technology: Modern catalytic processes for converting bio-ethanol into ethylene have achieved yields exceeding 99%. These technological refinements, pioneered by companies like Lummus Technology and Braskem, have significantly improved the energy efficiency and economic viability of the dehydration route.

Market Opportunities:

- Utilization of Second-Generation (2G) Feedstocks: Moving beyond food-based sugars to lignocellulosic biomass (agricultural residues, forestry waste) presents a major opportunity to reduce feedstock costs and improve the environmental profile, appealing to eco-conscious consumers and avoiding land-use conflicts.

- Expansion into Bio-Based Ethylene Oxide (EO) and Glycols: While polyethylene is the primary outlet, there is an underserved opportunity in the detergents and lubricants sector. Bio-based EO serves as a precursor for renewable surfactants, allowing "green" cleaning brands to claim 100% bio-based formulations.

- Strategic Integration with SAF Production: As the aviation industry scales Sustainable Aviation Fuel (SAF), the resulting bio-naphtha byproduct can be fed into existing crackers. This synergy allows petrochemical companies to diversify their feedstock mix with minimal infrastructure changes, creating a stable supply of bio-attributed ethylene.

The Bio-Based Ethylene Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Raw Material:

- Sugars: Currently the dominant segment, primarily utilizing sugarcane and sugar beet. It benefits from well-established fermentation-to-ethanol pathways, particularly in Brazil and India, offering the highest yield and commercial maturity.

- Starch: Derived mainly from corn and wheat. This segment is prominent in North America; however, it faces scrutiny regarding food security, leading to a shift toward industrial-grade starch sources.

- Lignocellulosic Biomass: The fastest-growing niche, utilizing non-food residues like corn stover and wood chips. It is highly favored for its superior sustainability profile and is the focus of intense R&D for commercial scaling.

By End-User Industry:

- Packaging: The largest consumer segment. It utilizes bio-polyethylene for bottles, films, and containers, driven by the global retail shift away from fossil-based single-use plastics.

- Detergents: Bio-ethylene is converted into bio-based surfactants. This segment is expanding as home care brands look to replace petrochemical ingredients in liquid soaps and laundry pods.

- Lubricant and Additives: A specialized high-value segment. Bio-based ethylene is used to produce synthetic esters and polyalphaolefins (PAOs), offering superior biodegradability and performance for industrial and automotive lubricants.

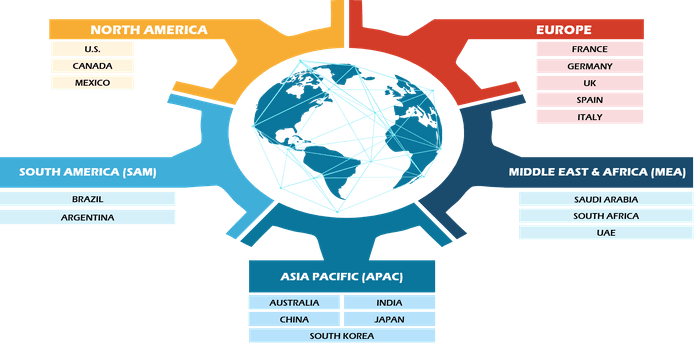

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Market Report Scope

Bio-Based Ethylene Market Share Analysis by GeographyThe bio-based ethylene market is undergoing a significant transformation, moving from a niche renewable alternative to a global high-value industrial chemical. Growth is driven by the rising regulatory pressure on carbon footprints, a surge in "net-zero" corporate commitments, and the expansion of the sustainable packaging sector. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a leading position globally, serving as a primary hub for technological innovation and commercial-scale production.

- Key Drivers: Significant federal support and tax incentives focused on decarbonizing the industrial chemical sector.

- Wide availability of agricultural feedstocks and a highly integrated petrochemical infrastructure that facilitates bio-blending.

- Strong domestic demand from consumer-facing brands seeking to reduce the carbon intensity of their plastic supply chains.

- Trends: Rapid adoption of mass balance accounting models and a transition toward utilizing agricultural waste and residues to produce second-generation renewable chemicals.

2. Europe

- Market Share: Accounted for a substantial portion of the global market, led by advanced sustainability policies and legislative frameworks.

- Key Drivers: Stringent environmental mandates and circular economy initiatives that prioritize renewable carbon sources over fossil-based inputs.

- High carbon costs and emissions trading systems that encourage chemical manufacturers to adopt bio-attributed feedstocks.

- Government-backed research and development aimed at establishing sustainable chemical clusters.

- Trends: A strategic focus on waste-to-ethylene technologies and a heavy reliance on rigorous third-party certifications to ensure supply chain transparency and carbon traceability.

3. Asia-Pacific

- Market Share: Recognized as the fastest-growing region, driven by massive capacity expansions and the rapid industrialization of emerging economies.

- Key Drivers: Strategic government initiatives aimed at reducing dependence on imported fossil fuels through the development of a local bio-economy.

- Growing middle-class demand for eco-friendly consumer goods and sustainable packaging in high-volume retail sectors.

- Favorable partnerships between regional agricultural producers and international chemical firms to secure stable feedstock supplies.

- Trends: Intensive investment in large-scale ethanol dehydration facilities and the integration of renewable energy sources to power bio-refinery operations.

4. Central and South America

- Market Share: Holds a specialized and significant share, particularly as a global exporter of low-carbon building blocks.

- Key Drivers: Natural competitive advantage due to the world's most efficient production of high-yield sugar crops used for fermentation.

- Established vertical integration where companies manage the entire lifecycle from biomass cultivation to polymer manufacturing.

- Strong orientation toward international markets that require premium-grade renewable resins.

- Trends: Expansion of dedicated production facilities and the development of "carbon-negative" materials that leverage sustainable land-use practices.

5. Middle East and Africa

- Market Share: An emerging market currently focusing on long-term economic diversification and strategic pilot projects.

- Key Drivers: Regional visions targeting a shift away from oil dependency and toward advanced, sustainable manufacturing.

- Strategic investments in agriculture and chemical technologies suited for arid climates.

- Increasing interest in the production of high-value specialty chemicals and renewable additives for urban infrastructure.

- Trends: Implementation of pilot programs for carbon-capture-to-chemical conversion and the upgrading of existing industrial facilities to process bio-based naphtha.

Competition is intensifying due to the presence of established leaders such as Braskem S.A., The Dow Chemical Company, LyondellBasell Industries Holdings B.V., SABIC, Enerkem, Linde, Shell Global, TotalEnergies, and Axens, which also contribute to a diverse and rapidly expanding market landscape.

This competitive environment pushes vendors to differentiate through:

- Premiumization and Sustainability Branding: Positioning bio-based ethylene as a superior, low-carbon alternative to fossil-derived equivalents. Companies leverage ISCC PLUS certification to offer "I'm green™" polymers, emphasizing carbon sequestration and fossil-free credentials to appeal to global FMCG brands.

- Diverse Derivative Portfolios: Bio-based ethylene products now include more than just polyethylene (PE). Companies offer renewable precursors for bio-based surfactants (detergents), specialty glycols, and high-end renewable elastomers used in the automotive and medical sectors.

- Vertical Integration and Feedstock Security: Producers manage the entire supply chain, from sourcing sugarcane and agricultural residues (corn stover) to local chemical conversion. This approach ensures supply chain transparency and meets the ethical, clean-label standards demanded by sustainable finance regulators.

- Advanced Processing Technologies: New processing technologies, like catalytic ethanol-to-ethylene (E2E) dehydration and direct CO2-to-ethylene photosynthesis, help create high-purity bio-ethylene used in high-performance polymers and cosmetic ingredients worldwide.

- Partner with High-End Retail and Consumer Brands: Tap into the surging demand for sustainable, plant-based packaging in the Asia-Pacific and North American markets by forming strategic offtake agreements with leaders in the food, beverage, and personal care sectors.

- Incorporate Sustainable Farming and Regenerative Practices: Implement agricultural sourcing and waste-valorization certifications (e.g., RSB, Bonsucro) to appeal to environmentally conscious stakeholders seeking ethical alternatives to traditional petrochemicals.

- Braskem S.A.

- The Dow Chemical Company

- LyondellBasell Industries Holdings B.V.

- SABIC

- Enerkem

- Linde

- Shell Global

- TotalEnergies

- Axens

Disclaimer: The companies listed above are not ranked in any particular order.

Bio-Based Ethylene Market News and Recent Developments- In November 2025, LanzaTech Global, Inc., a leader in industrial carbon recycling, was awarded a €40 million grant from the European Union's Innovation Fund. The project featured the first commercial deployment of the company's second-generation bioreactor, which aimed to produce 23.5 kt of ethanol per year by consuming smelter furnace greenhouse gases from the Porsgrunn Manganese Smelter. This renewable ethanol was intended to serve as a critical precursor for the production of Bio-Based Ethylene, providing a sustainable alternative for the European plastics and chemical industries.

- In July 2024, Dow announced at the German Rubber Conference (DKT) the launch of NORDEL™ REN Ethylene Propylene Diene Terpolymers (EPDM), which functioned as a renewable version of their established rubber material. This innovation utilized Bio-Based Ethylene as a primary feedstock to create a high-performance material suitable for automotive, infrastructure, and consumer applications.

The "Bio-Based Ethylene Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Bio-Based Ethylene Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Bio-Based Ethylene Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Bio-Based Ethylene Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Bio-Based Ethylene Market.

- Detailed company profiles

Have a question?

Shejal

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Raw Material and End-User Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to reach approximately US$ 1,111.54 million by 2034 from US$ 614.87 million in 2025. The market is anticipated to register a CAGR of 6.8% during the forecast period 2026–2034.

Trends include the use of Mass Balance models in North America, waste-to-feedstock initiatives in Europe, and the expansion of large-scale ethanol-to-ethylene joint ventures in Southeast Asia.

Asia-Pacific is the fastest-growing region, fueled by massive investments in infrastructure and a rising consumer base for sustainable products in China, Thailand, and India.

Primary challenges include higher production costs relative to petroleum routes, fluctuations in raw material availability, and the complexity of biomass logistics.

Key players include Braskem S.A., The Dow Chemical Company, LyondellBasell Industries Holdings B.V., SABIC, Enerkem, Linde, Shell Global, TotalEnergies, and Axens.

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For