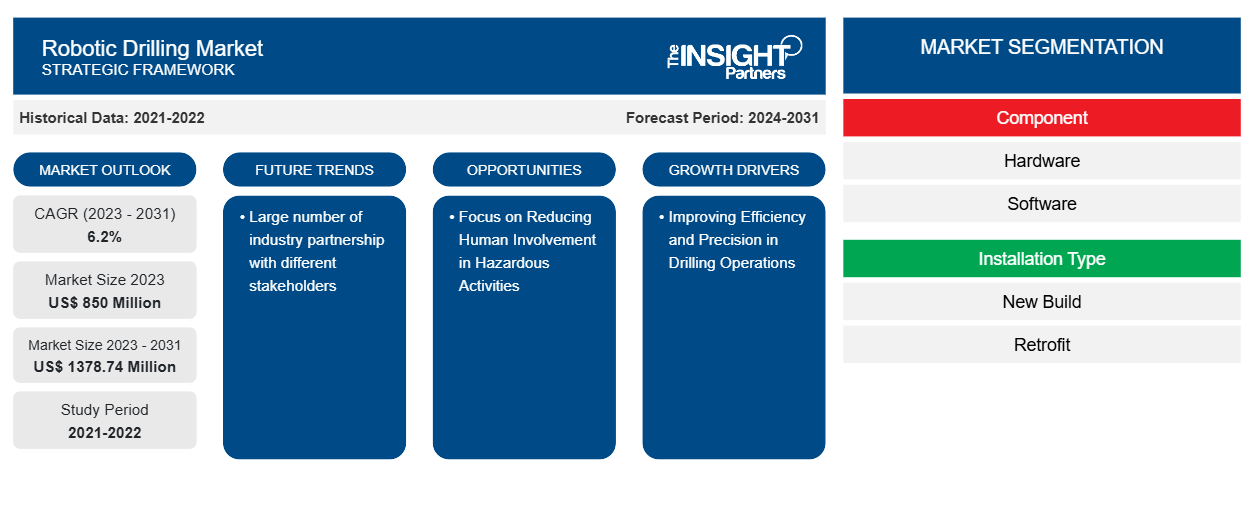

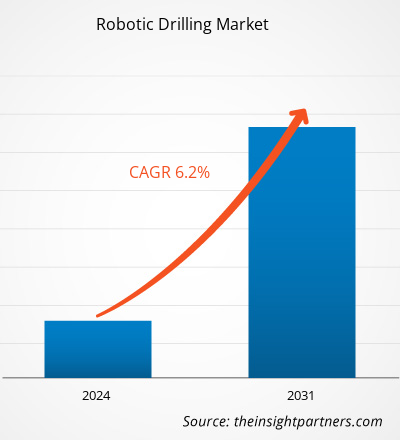

The robotic drilling market size is projected to reach US$ 1378.74 million by 2031 from US$ 850 million in 2023. The market is expected to register a CAGR of 6.2% in 2023–2031. Increased drilling activities primarily drive market expansion due to the development of exceptional hydrocarbon resources and the implementation of automation and robots in oil and gas drilling. This leads to higher efficiency and improved rig safety.

Robotic Drilling Market Analysis

Increased exploration activities, as well as a focus on developing new oil & gas fields in a risk-free, cost-effective, and time-efficient manner, are projected to drive the market for robotic drilling systems. However, the volatility of oil prices in recent years, cybersecurity concerns, and high beginning costs have stifled the growth of the robotic drilling industry.

Robotic Drilling Market Overview

Robotic drilling is a leading technology for autonomous drilling operations. Drilling robot controls ensure safe and efficient operations while reducing human error. As populations and cities grow, the world's reliance on fossil fuels has led to a rapid increase in demand for oil and gas. This has led to an upsurge in drilling activity. The use of robotic drilling in oil and gas exploration is on the rise, with the industry likely to expand due to increased industrialization and the exploitation of unconventional hydrocarbon reserves. The expansion of power generation, particularly in emerging economies, is expected to boost market growth. Furthermore, developments in robotic technology operate as an indirect driver, accelerating the growth trajectory of the robotic drilling market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robotic Drilling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robotic Drilling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Robotic Drilling Market Drivers and Opportunities

Improving Efficiency and Precision in Drilling Operations to Favor Market

The constant pursuit of operational efficiency and precision in drilling operations throughout a wide range of industries, including oil & gas, mining, and production. Robotic drilling systems improve accuracy, reduce human errors, and increase standard productivity. The most important factor in drilling operations is safety, as robotic structures reduce human exposure to dangerous settings, particularly offshore and in difficult terrains.

Focus on Reducing Human Involvement in Hazardous Activities

To limit human exposure to dangerous drilling scenarios, firms prioritize safety and risk mitigation in the robotic drilling sector. Traditional drilling operations, typically industries such as oil and gas exploration, mining, and construction, rely on human workers to perform physically demanding and risky tasks. Robotic drilling technology has made drilling operations safer and more secure, transforming the business landscape. Robotic drilling lowers the need for humans to participate in dangerous drilling activities. These operations are often carried out in challenging or remote places, such as dangerous mines, offshore oil rigs, or deep-sea platforms.

Employees in these situations face various risks, including accidents, exposure to toxic products, and extreme weather. Businesses can use robotic drilling equipment to reduce risks and improve employee safety.

Robotic Drilling Market Report Segmentation Analysis

Key segments that contributed to the derivation of the robotic drilling market analysis are component, installation type, and application.

- Based on component, the robotic drilling market is divided into hardware and software.

- By installation type, the market is segmented into new build and retrofit

- In terms of application, the market is segmented into onshore and offshore.

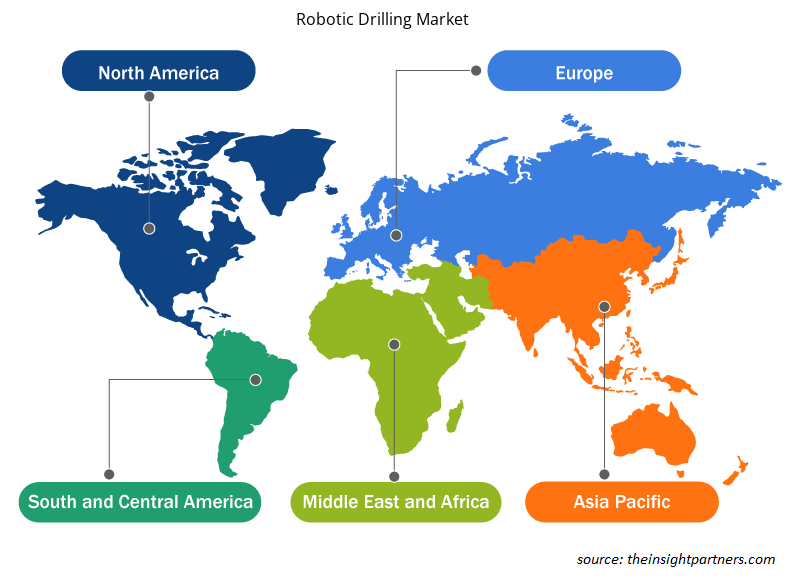

Robotic Drilling Market Share Analysis by Geography

The geographic scope of the robotic drilling market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. Because of the recent shale gas development in North America, the market for robotic drilling equipment has grown dramatically. Exploration in the Gulf of Mexico is also increasing, which is driving the regional robotic drilling systems market. Higher lower drilling costs and oil prices have resulted in a large increase in offshore rig count and oil output in the US, signaling to expand offshore drilling, which is projected to be a major driver for the country's robot drilling market.

Robotic Drilling Market Regional Insights

The regional trends and factors influencing the Robotic Drilling Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Robotic Drilling Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Robotic Drilling Market

Robotic Drilling Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 850 Million |

| Market Size by 2031 | US$ 1378.74 Million |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Robotic Drilling Market Players Density: Understanding Its Impact on Business Dynamics

The Robotic Drilling Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Robotic Drilling Market are:

- Baker Hughes

- Schlumberger

- Halliburton

- Caterpillar

- National Oilwell Varco

- Atlas Copco

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Robotic Drilling Market top key players overview

Robotic Drilling Market News and Recent Developments

The robotic drilling market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In March 2021, Schlumberger received a USD 480 million contract to drill 96 oil wells in southern Iraq for Basra Oil Company and ExxonMobil, which run the massive West Qurna-1 field with partners from Iraq, Japan, Indonesia, and China.

(Source: Schlumberger, Company Website, 2021)

- In October 2021, Nabors Industries Ltd unveiled the PACE-R801 fully automated land drilling rig equipped with Canrig robotics. It achieved complete depth with its first well in the Permian Basin. It designed an autonomous rig floor to eliminate crews from red zone locations and provide constant drilling performance.

(Source: Nabors Industries Ltd, Company Website, 2021)

Robotic Drilling Market Report Coverage and Deliverables

The "Robotic Drilling Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

What will be the market size of the global robotic drilling market by 2031?

The global robotic drilling market is expected to reach US$ 1378.74 million by 2031.

Which are the key players holding the major market share of the robotic drilling market?

The key players holding the majority of shares in the global robotic drilling market are Baker Hughes, Schlumberger, Halliburton, Caterpillar, and National Oilwell Varco.

What are the future trends of the global robotic drilling market?

A large number of industry partnerships with different stakeholders to play a significant role in the global robotic drilling market in the coming years.

What are the driving factors impacting the global robotic drilling market?

Improving efficiency and precision in drilling operations are the major factors that propel the global robotic drilling market.

What is the estimated market size for the global robotic drilling market in 2022?

The global robotic drilling market was estimated to be US$ 850 million in 2023 and is expected to grow at a CAGR of 6.2% during the forecast period 2023 - 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For