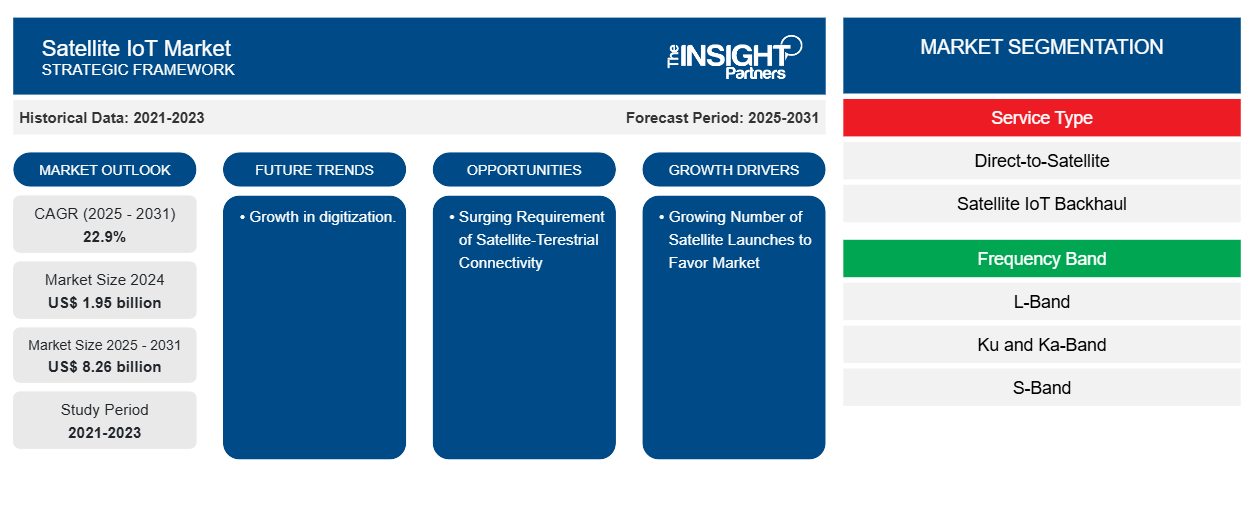

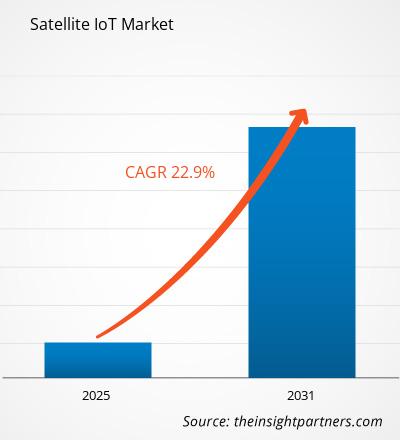

The satellite IoT market size is projected to reach US$ 8.26 billion by 2031 from US$ 1.59 billion in 2023. The market is expected to register a CAGR of 22.9% in 2023—2031. The rising number of satellite launches and the rising demand for the internet are likely to remain key satellite IoT market trends.

Satellite IoT Market Analysis

The rising number of satellite launches is one of the major factors fueling the growth of the market. Also, the rising demand for high-speed internet connectivity for homes and offices is one of the major factors boosting the growth of the satellite IoT market. In addition, the need to track, monitor, and manage assets in different remote locations to ensure the safety of their workers and improve overall remote operations is further boosting the demand for satellite IoT worldwide. Moreover, the growing use of satellite IoT solutions for defense applications, such as protecting borders, communication in remote areas, and real-time data transfer, is further fueling the growth of the satellite IoT market. Furthermore, the rising demand for satellite IoT for transforming corporate sustainability by reducing the travel time of the worker to manage and track the devices at remote sites will prevent millions of tons of C02 emissions, creating an opportunity for the growth of the satellite IoT market.

Satellite IoT Market Overview

Satellite IoT is an IoT service provided by networks of satellites. It enables interconnectivity between objects so that they can communicate and relay orders without requiring any human-to-human or human-to-computer interaction. The satellite Internet of Things provides organizations the ability to reliably monitor, track, and manage application connectivity. Its usage can be found across all industry verticals, from the maritime market to machine-to-machine (M2M) applications, as well as in agriculture, transportation, oil and gas, utilities, construction, and others. Furthermore, various largest heavy equipment original equipment manufacturers (OEMs) in the world rely on satellite IoT devices to remotely monitor and manage deployed assets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite IoT Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite IoT Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Satellite IoT Market Drivers and Opportunities

Growing Number of Satellite Launches to Favor Market

The number of satellite launches is increasing globally because of the rising need for satellites in various applications, which includes tracking, monitoring, and managing assets to ensure the safety of the workers and improve remote operations. According to several space agencies, on average, 466 SmallSats were launched per year during 2012—2021, and it is expected to increase to 1,846 SmallSats launches per year during 2022—2031. For this launch, SmallSats, the governments of various countries, and companies invested US$ 23.1 billion, and it is expected that they will be further investing US$ 84 billion during 2022—2031. In addition, the number of space rockets launched, primarily for deploying satellites in space, is also rising rapidly. For instance, in 2023, SpaceX notched 98 total orbital launch attempts in 2023 between the Falcon 9, Falcon Heavy, and Starship, representing 90% of US launches. Thus, the growing number of satellite launches is fuelling the growth of the satellite IoT market.

Surging Requirement of Satellite-Terrestrial Connectivity

The surging requirement for satellite-terrestrial connectivity is offering various opportunities for the satellite IoT market. A hybrid satellite/terrestrial system is a system employing satellite and terrestrial components where the satellite and terrestrial components are interconnected but operate independently of each other. In such systems, the satellite and terrestrial components have separate network management systems and do not necessarily operate in the same frequency bands. Moreover, various companies are launching hybrid satellites. For instance, Sidus Space, one of the multi-faceted Space and Data-as-a-Service companies, announced the successful completion of launch processing of LizzieSat at the Astrotech Space Operations facility at Vandenberg Space Force Base in California. Thus, the requirement of satellite-terrestrial connectivity is offering several opportunities to the market.

Satellite IoT Market Report Segmentation Analysis

Key segments that contributed to the derivation of the satellite IoT market analysis are service type, enterprise size, end use industry.

- Based on service type, the satellite IoT market is divided into direct-to-satellite, satellite IoT backhaul), and frequency band (L-band, KU and KA-band, S-band, and others). The direct-to-satellite segment is anticipated to grow in the forecast period.

- By enterprise size, the market is segmented into large enterprises and SMEs. The SMEs segment is anticipated to grow in the forecast period.

- By end use industry, the market is segmented into oil and gas, transportation and logistics, energy and utilities, agriculture, healthcare, military and defense, maritime, and others. The oil and gas segment is anticipated to grow in the forecast period.

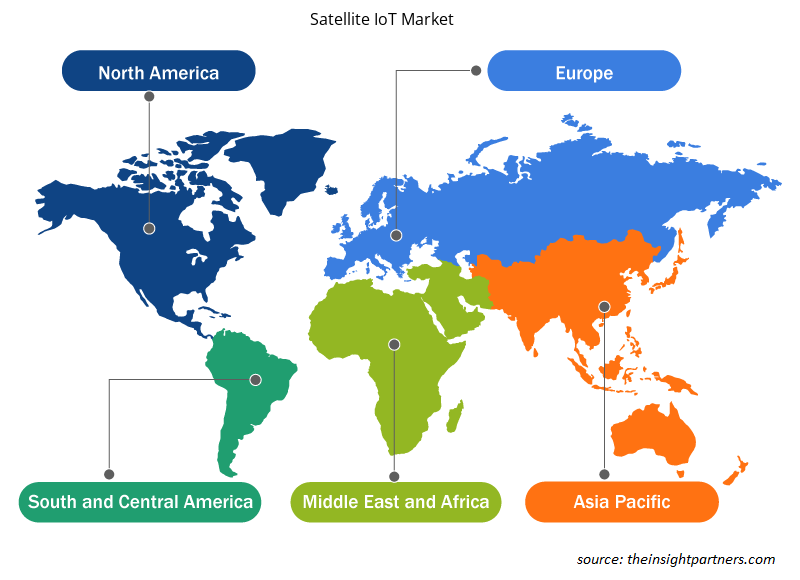

Satellite IoT Market Share Analysis by Geography

The geographic scope of the satellite IoT market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America has dominated the satellite IoT market. North America is expected to witness significant growth in the satellite IoT market in the forecasted period. The US holds the largest satellite IoT market share in 2023. The market is witnessing tremendous growth due to the presence of various key satellite internet companies in the region, which include Orbcomm, Iridium Communications, Globalstar, and others. These market players are continuously working on providing innovative solutions to provide high-speed connectivity in the region. All these factors contribute to the region's growth of the satellite IoT market.

Satellite IoT Market Regional Insights

The regional trends and factors influencing the Satellite IoT Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Satellite IoT Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Satellite IoT Market

Satellite IoT Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.95 billion |

| Market Size by 2031 | US$ 8.26 billion |

| Global CAGR (2025 - 2031) | 22.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

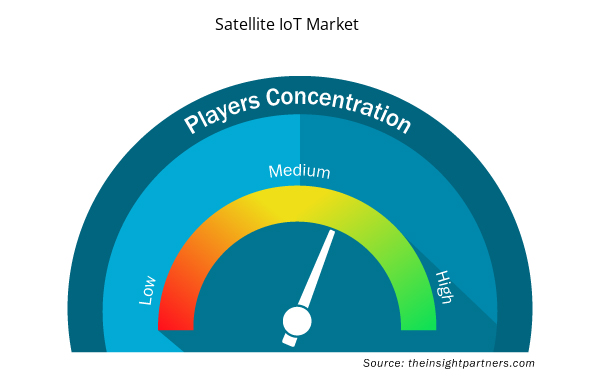

Satellite IoT Market Players Density: Understanding Its Impact on Business Dynamics

The Satellite IoT Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Satellite IoT Market are:

- Astrocast

- Iridium Communications Inc

- Inmarsat Global Limited

- Globalstar

- Thales

- EchoStar Mobile

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Satellite IoT Market top key players overview

Satellite IoT Market News and Recent Developments

The satellite IoT market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In May 2024, European firms OQ Technology and Transatel announced their collaboration to achieve global satellite 5G IoT connectivity. Transatel offers global 5G roaming, enabling NB-IoT deployment worldwide. This collaboration empowers businesses with reliable IoT services, even in previously inaccessible areas.

(Source: OQ Technology, Press Release, 2024)

- In March 2024, Sateliot announced that it would launch four satellites in the summer of 2024 to connect just under 7 million IoT devices, marking the commercial launch of the company’s LEO constellation. The satellites will be launched aboard a SpaceX rocket and join Sateliot’s two existing Low-Earth Orbit (LEO) 5G satellites already orbiting Earth. Sateliot said it would begin billing the US$204 million worth of binding orders, serving more than 350 clients in more than 50 countries worldwide.

(Source: Sateliot, Press Release, 2024)

Satellite IoT MarketReport Coverage and Deliverables

The “Satellite IoT Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Satellite IoT Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Satellite IoT Market Trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Satellite IoT covers key market trends, Global and regional frameworks, major players, regulations, and recent market developments.

- Satellite IoT industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rugged Phones Market

- HVAC Sensors Market

- Water Pipeline Leak Detection System Market

- Smart Grid Sensors Market

- Advanced Planning and Scheduling Software Market

- Hummus Market

- Airport Runway FOD Detection Systems Market

- USB Device Market

- 3D Mapping and Modelling Market

- Integrated Platform Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service Type, Frequency Band, Enterprise Size, End Use Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For