Sawmill Machinery Market Segments and Growth by 2031

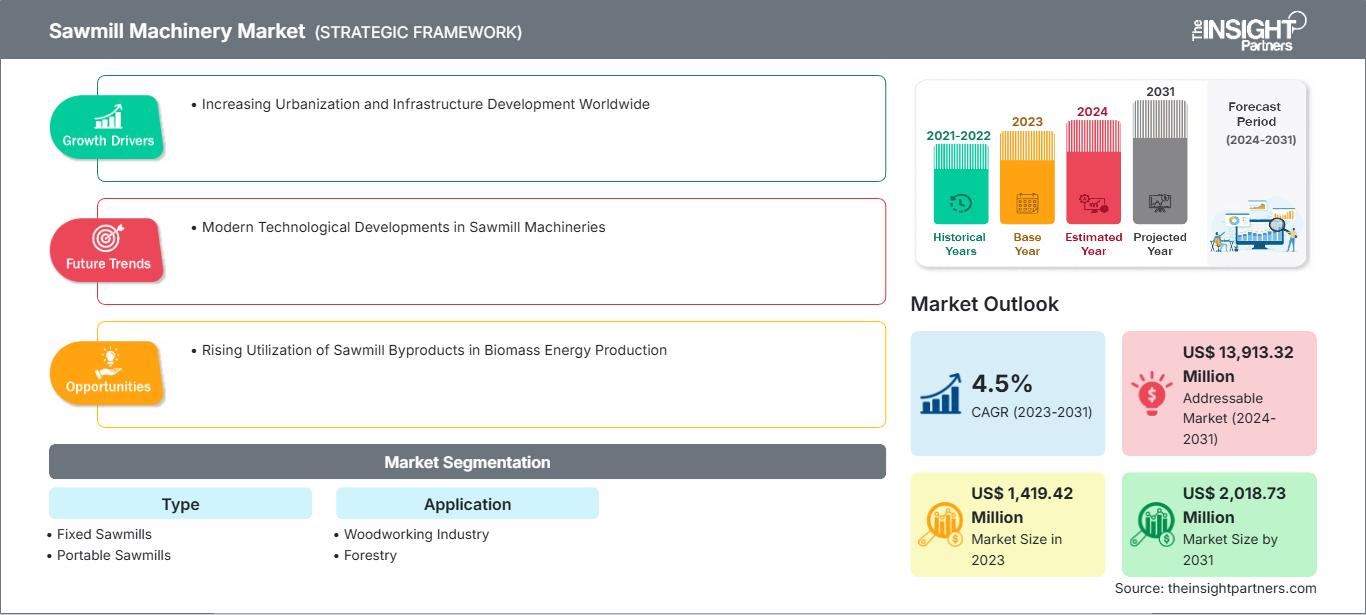

Sawmill Machinery Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fixed Sawmills and Portable Sawmills), Application (Woodworking Industry and Forestry), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Aug 2024

- Report Code : TIPRE00010633

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 275

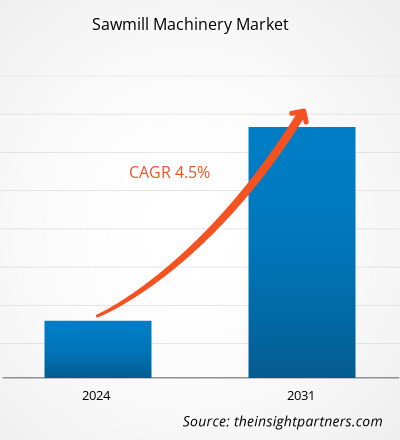

The sawmill machinery market size is projected to reach US$ 2,018.73 million by 2031 from US$ 1,419.42 million in 2023. The market is expected to register a CAGR of 4.5% during 2023–2031. Initiatives taken to promote technological developments in sawmill machinery are likely to bring in new trends in the market in the future.

Sawmill Machinery Market Analysis

Wood is primarily used in the construction industry in the form of sawn wood and wood panels. The demand for wood panels is increasing in Europe owing to growth in the construction industry. As per the data provided by the European Organization of Sawmill Industry (EOS) in 2022, sawn wood production reached an all-time high (86 million cu. m.) in 2021 in EOS member countries. Further, continuous growth in the pulp & paper industry is another factor that drives the demand for wood and wood processing tools in Europe. As per the data published by the European Commission, the pulp & paper industry in Europe reached US$ 130,226 million in 2022, recording 21% growth from 2020. Thus, the need for wood processing tools is increasing owing to the surging demand for wood in the construction and paper & pulp industries, ultimately fueling the sawmill machinery market in Europe.

Government initiatives toward net zero emissions and energy transition goals across the world are expected to boost the demand for biomass-based energy production in the coming years. In June 2023, the US Department of Agriculture announced an investment of US$ 43 million to promote innovation in wood products and wood energy sectors. The fund will be distributed among wood innovation grants and community wood grants to propel the wood-based renewable energy sector in the US. Thus, a rise in government initiatives toward the promotion of wood biomass to produce bioenergy from wood biomass products is expected to create opportunities for companies operating in the sawmill machinery market from 2023 to 2031.

Sawmill Machinery Market Overview

Sawmills are power-driven machines that aid in the sawing of rough-squared sections of planks and boards. A sawmill is equipped with planning, tenoning, and molding machines. A sawmill works by cutting logs into lumber with the help of large circular blades. The same process is repeated log by log to produce high volumes of rough-cut lumber. The European wood-based industries include a wide range of downstream operations, such as woodworking, as well as applications in the substantial sectors of the furniture industry, pulp & paper manufacturing and converting industries, and the printing industry. The EU's wood-based industries were the enablers of the highest gross value addition (GVA) in the production of pulp, paper, and paper products (34% or US$ 49.79 billion). Printing and printing-related service activities accounted for 16% of the GVA of wood-based industries, while furniture manufacturing, and wood and wood product manufacturing each accounted for between 23% and 27% of GVA, respectively.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSawmill Machinery Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sawmill Machinery Market Drivers and Opportunities

Increasing Urbanization and Infrastructure Development Worldwide Bolster Market

According to the World Bank Group, currently, more than 55% of the total population across the world lives in cities, which is expected to increase by 1.5 times by 2045. Urban areas generate more than 80% of the global GDP and can contribute to sustainable growth through better productivity and innovation. Adequate infrastructure, including elements such as roads, water supply, electricity, and sanitation, is a prerequisite for the growth and prosperity of urban areas. Government initiatives toward the development of smart cities and infrastructure have propelled urbanization in different countries worldwide. For example, the Smart City Mission project launched by the Government of India in 2015, which is still underway, completed 74% of the smart city projects as of August 2023, as per the data published by the Ministry of Housing and Urban Affairs. 26% of the total 7,978 smart city projects are under construction. Rising infrastructure development projects fuel the demand for wood products such as cabinets, doors, windows, and others, which drives the growth of the sawmill machinery market.

Rising Utilization of Sawmill Byproducts in Biomass Energy Production to Create Opportunities in Market in Coming Years

Sawmilling operations, notably converting wood logs into lumber, result in the production of byproducts such as hog fuel, wood chips, shavings, sawdust, trim blocks, and cross-cut timbers. From the byproducts mentioned above, the wood pellets and compressed wood bricks are produced and burned with high efficiency and lower carbon emissions to produce combined heat and power for various industrial applications. In addition, the demand for power generated from renewable energy sources such as solar, wind power, hydroelectricity, wood biomass, and geothermal power is expected to increase in the coming years, which will eventually fuel the requirement for wood biomass products. According to the US Energy Information Administration, the electricity generated from biomass and waste in the world totaled 3,024 trillion British thermal units (BTU) in 2022, which increased from 2,988 trillion (BTU) in 2021. Such a rise in power generation from wood biomass fuels the demand for wood biomass raw materials, which is anticipated to fuel the demand for sawmill machinery during the forecast period.

Sawmill Machinery Market Report Segmentation Analysis

Key segments that contributed to the derivation of the sawmill machinery market analysis are type and application.

- Based on type, the sawmill machinery market is segmented into fixed sawmills and portable sawmills. The fixed sawmills segment held a larger market share in 2023.

- Based on application, the market is divided into woodworking industry and forestry. The woodworking industry segment held a larger share of the market in 2023.

Sawmill Machinery Market Share Analysis by Geography

The geographic scope of the sawmill machinery market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The growing export of wood and wood-based products and the rising number of new construction projects boost the growth of the sawmill machinery market globally. The significant presence of sawmill machinery manufacturers and suppliers in North America—including BID Group; USNR; OI.INNOVATION Co. Ltd.; Salem Equipment, Inc.; and HewSaw—drive the sawmill machinery market growth in the region. The increasing demand for wood and wood-based products, including wooden furniture and artifacts, in the commercial and residential sectors fuels the market growth in North America.

In 2023, Wood-Mizer, Indianapolis, introduced its WB2000 industrial sawmill at LIGNA 2023 in Hannover, Germany. The sawmill is equipped with a hydraulic log loading deck that is a unified automatic board removal conveyor. In addition, companies operating in sawmill machinery production are focusing on incorporating advanced technologies such as artificial intelligence and automation to boost the overall performance of the machines and offer improved operational efficiencies. For instance, in 2023, the BID Group participated in a tech event and presented an idea of incorporating the industrial Internet of Things (IIoT), robotics, artificial intelligence, and augmented reality and designing the next generation of sawmill machinery.

The development of the construction sector and rising advancements in the paper & pulp industry across different countries in Asia Pacific, such as China, India, Australia, South Korea, and Japan, propel the demand for sawmill machinery. The expanding demand for wood in different end-use applications bolsters the growth of wood-related industries such as furniture and paper & pulp in the Middle East & Africa, which positively impacts the sawmill machinery market. Rising construction activities boost the demand for sawmill machinery in the region as the application of wooden products is growing for home renovation.

The expanding production of timber, pine, and eucalyptus, and the burgeoning demand for South American wooden products in the international market signify a conducive environment for the sawmill machinery market growth in South American countries, including Brazil, Argentina, and Chile. Population growth and urbanization, which fuels the development of residential and commercial infrastructure, foster the demand for wooden products, which drives the sawmill machinery market growth in South America.

Sawmill Machinery Market Regional Insights

The regional trends and factors influencing the Sawmill Machinery Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Sawmill Machinery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Sawmill Machinery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,419.42 Million |

| Market Size by 2031 | US$ 2,018.73 Million |

| Global CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Sawmill Machinery Market Players Density: Understanding Its Impact on Business Dynamics

The Sawmill Machinery Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Sawmill Machinery Market top key players overview

Sawmill Machinery Market News and Recent Developments

The sawmill machinery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the sawmill machinery market are listed below:

Real Performance Machinery, LLC. (NYSE: RPM) has officially commenced operations of its Innovation Center of Excellence in Greensboro, North Carolina. This 60,000-square-foot, state-of-the-art facility became the first shared research and development center for RPM companies. It is designed to foster partnership and harness collective expertise among these companies to accelerate innovation. The facility represents a continuation of a collaboration that has been developed through MAP 2025 initiatives. (Source: Real Performance Machinery, LLC, Press Release, January 2024)

Sawmill Machinery Market Report Coverage and Deliverables

The "Sawmill Machinery Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Sawmill machinery market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Sawmill machinery market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Sawmill machinery market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the sawmill machinery market

- Detailed company profiles

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For