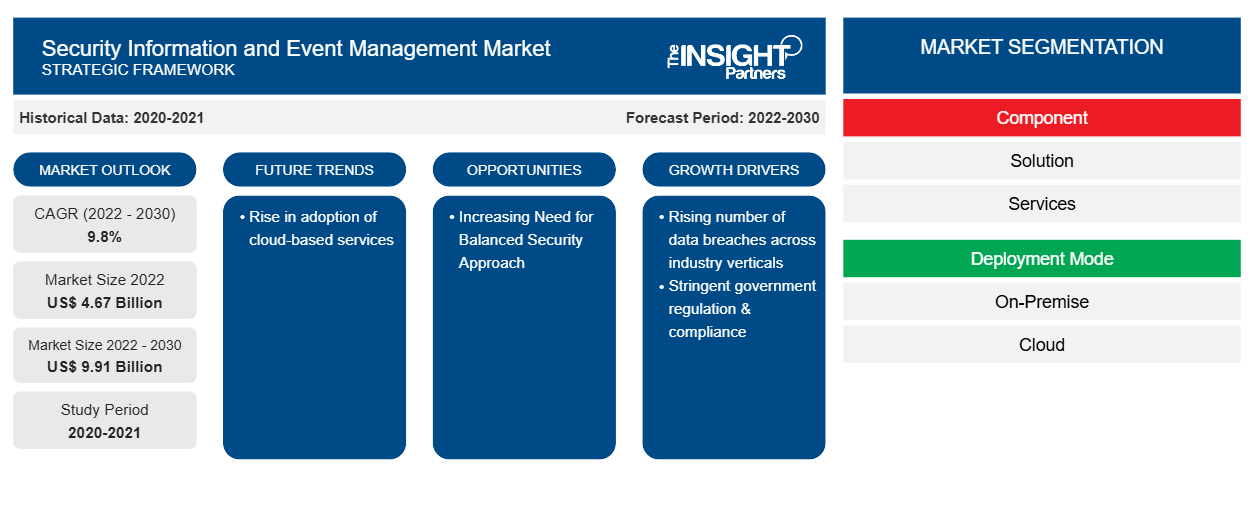

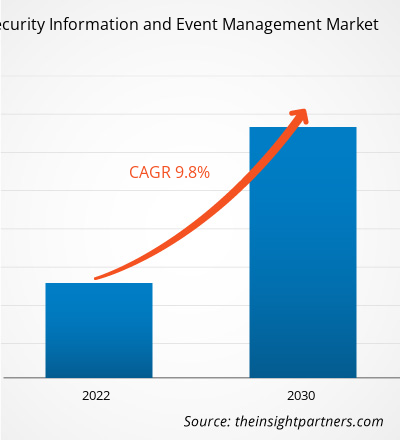

The security information and event management market is projected to grow from US$ 9.91 billion by 2030 to US$ 4.67 billion in 2022; it is expected to expand at a CAGR of 9.80% from 2022 to 2030. The rise in adoption of cloud-based services is expected to be a key trend in the market.

Security Information and Event Management Market Analysis

The global cyber security landscape is changing rapidly. The necessity for effective cybersecurity safeguards is more important than ever in the connected world of today. Systems in the security information and event management market are a crucial part of a thorough cybersecurity strategy. Platforms in the security information and event management market combine the capabilities of security information management (SIM) with security event management (SEM). It gives businesses a consolidated platform to gather, examine, and correlate security-related data from diverse IT infrastructure sources. The security information and event management market growth is attributed to the various features offered by systems in the security information and event management market, such as real-time monitoring, threat detection, and log monitoring. IT & telecommunication and BFSI industries are the major adopters of solutions in the security information and event management market. These industries face multiple threats regarding their IT infrastructure and consumer data.

The security operation centers at various organizations need seamless solutions to streamline the threat detection processes across various platforms. For instance, in October 2022, LogRhythm announced the release of its latest Axon update. It can quickly identify potential dangers, analyze them, and take appropriate action. Security teams use Axon to automate team operations through case management based on incident response at the location.

Security Information and Event Management Market Industry Overview

Security information and event management (SIEM) is a security system that assists organizations in identifying and addressing potential security threats and vulnerabilities before they interrupt business operations. SIEM solutions assist organizational security teams in detecting abnormal user activity and using artificial intelligence (AI) to automate several manual operations associated with threat identification and incident response. SIEM software has expanded over time to include user and entity behavior analytics (UEBA), as well as other sophisticated security analytics, Artificial Intelligence (AI), and Machine Learning (ML) capabilities for detecting unusual behaviors and advanced threat indicators.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Security Information and Event Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Security Information and Event Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Security Information and Event Management Market Driver and Opportunities

Rising Number of Data Breaches Across Industry Verticals to Favor Market Growth

Organizations face a wide range of cybersecurity dangers as the average cost of a data breach rises to an all-time high of US$ 4.45 million in 2023. These dangers could lead to data breaches and range from ransomware assaults to phishing schemes and insider threats. Businesses must employ cutting-edge security solutions to safeguard their sensitive data and digital assets since cybercriminals are becoming sophisticated and their strategies are becoming more diversified. For instance, according to a 2022 report by HackerOne, over 65,000 vulnerabilities were found by ethical hackers in 2022, a 21% increase from 2021. According to a 2022 Official Cybercrime report, the cost of cybercrime would reach US$ 8 trillion in 2023 and reach US$ 10.5 trillion by 2025. The importance of protecting vast amounts of data that support new product development and innovation while also enhancing customer service grows as the number of cyberattacks rises globally. By tracking, recognizing, and analyzing incidents and events, as well as providing real-time warnings and reports, security analysts are greatly aided by solutions in the security information and event management market.

Increasing Need for a Balanced Security Approach

A balanced security approach combines and maintains three key elements: technology, procedure, and people. A delicate balance between the three is essential to achieve disciplined implementation of security plans. SIEM provides organizations with a holistic view of their security posture by centralizing and analyzing security event data, detecting possible attacks in real time, and improving incident response capabilities. It is critical in strengthening an organization's cybersecurity defense and protecting sensitive data and assets from cyber threats. Thus, the increasing need for a balanced security approach is expected to create lucrative growth opportunities for the security information and event management market.

Security Information and Event Management Market Report Segmentation Analysis

The key segments that contributed to the derivation of the security information and event management market analysis are installation and end user.

- By component, the market is divided into solutions and services.

- Based on deployment mode, the market is segmented into on-premise and cloud segments.

- based on enterprise size, the market is divided into large enterprises and SMEs.

- Based on end users, the market is divided into IT and telecommunication, BFSI, government, education, and others.

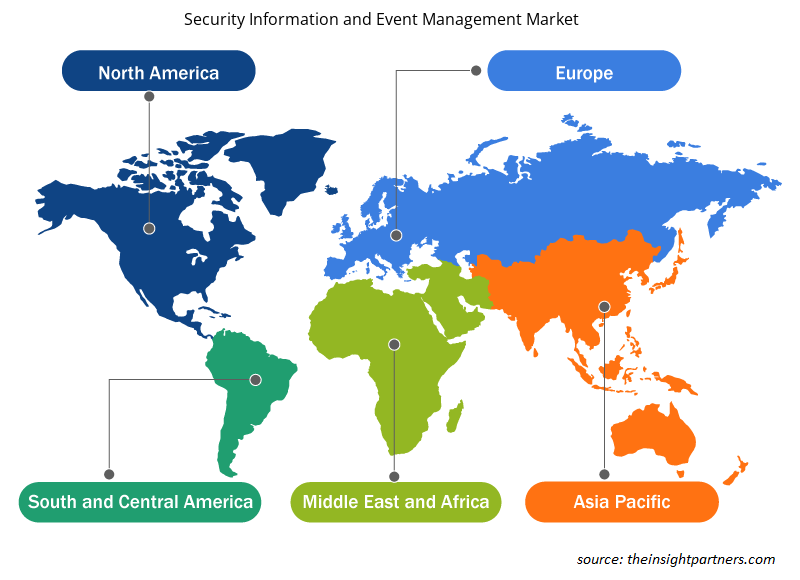

Security Information and Event Management Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

North America holds the largest global security information and event management market share. The region is home to a few of the major tech giants of the world. For instance, according to an article by BestColleges.com, more than 500,000 IT companies are based in the US, which also controls 35% of the worldwide tech market. Also, according to a report by the BC Tech Association, the tech sector was directly responsible for US$ 117 billion, or 7.1%, of Canada's economic output. The thriving IT industry, which is the major end-user of SIEM solutions, is driving the growth of the system information and event management market.

Security Information and Event Management Market Regional Insights

The regional trends and factors influencing the Security Information and Event Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Security Information and Event Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Security Information and Event Management Market

Security Information and Event Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.67 Billion |

| Market Size by 2030 | US$ 9.91 Billion |

| Global CAGR (2022 - 2030) | 9.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

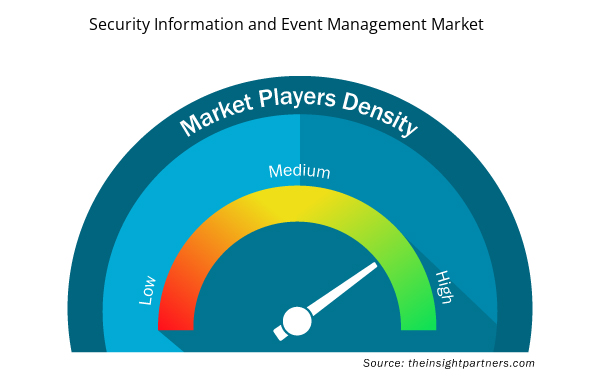

Security Information and Event Management Market Players Density: Understanding Its Impact on Business Dynamics

The Security Information and Event Management Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Security Information and Event Management Market are:

- AT&T Inc.

- International Business Machines Corp

- LogRhythm Inc.

- SolarWinds Worldwiden LLC

- Splunk Inc.

- Fortinet Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Security Information and Event Management Market top key players overview

Security Information and Event Management Market News and Recent Developments

The security information and event management market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the security information and event management market are listed below:

- Eutelsat Communications announced a partnership with Can Marine Systems, a well-known supplier of maritime systems in Asia. The partnership offers marine firms operating at sea in Asia access to next-generation security information and event management services, enhancing connectivity and capabilities. (Source: Eutelsat Communications, Press Release, September 2023)

Security Information and Event Management Market Report Coverage & Deliverables

The security information and event management market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Security Information and Event Management Market Size and Forecast (2020–2030)" provides a detailed analysis of the market covering below areas-

- Security information and event management market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Security information and event management market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Security information and event management market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Security Information and Event Management Market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment Mode, Enterprise Size, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Which region dominated the security information and event management market in 2022?

North America is expected to dominate the security information and event management market with the highest market share in 2022.

What is the expected CAGR of the security information and event management market?

The global security information and event management market was estimated to grow at a CAGR of 9.8% during 2022 - 2030.

What would be the estimated value of the security information and event management market by 2030?

The security information and event management market size is projected to reach US$ 4.67 billion by 2030.

What is the expected CAGR of the security information and event management market?

The global security information and event management market was estimated to grow at a CAGR of 10.9% during 2023 - 2031.

What are the driving factors impacting the security information and event management market?

The rising number of data breaches across industry verticals and stringent government regulation & compliance are the major factors that drive the global security information and event management market.

What are the future trends in the security information and event management market?

The rise in the adoption of cloud-based services is a major trend in the market.

Which are the leading players operating in the security information and event management market?

AT&T Inc., International Business Machines Corp, LogRhythm Inc., SolarWinds Worldwiden LLC, Splunk Inc., Fortinet Inc., Zoho Corporation Pvt Ltd., Logpoint AS, and Exabeam Inc. are the major market players.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Security Information and Event Management Market

- AT&T Inc

- International Business Machines Corp

- LogRhythm Inc

- SolarWinds Worldwiden LLC

- Splunk Inc

- Fortinet Inc

- Zoho Corporation Pvt Ltd

- Logpoint AS

- Exabeam Inc

- Logsign Inc

Get Free Sample For

Get Free Sample For