Digital Forensics Market Forecast & Industry Trends 2024-2031

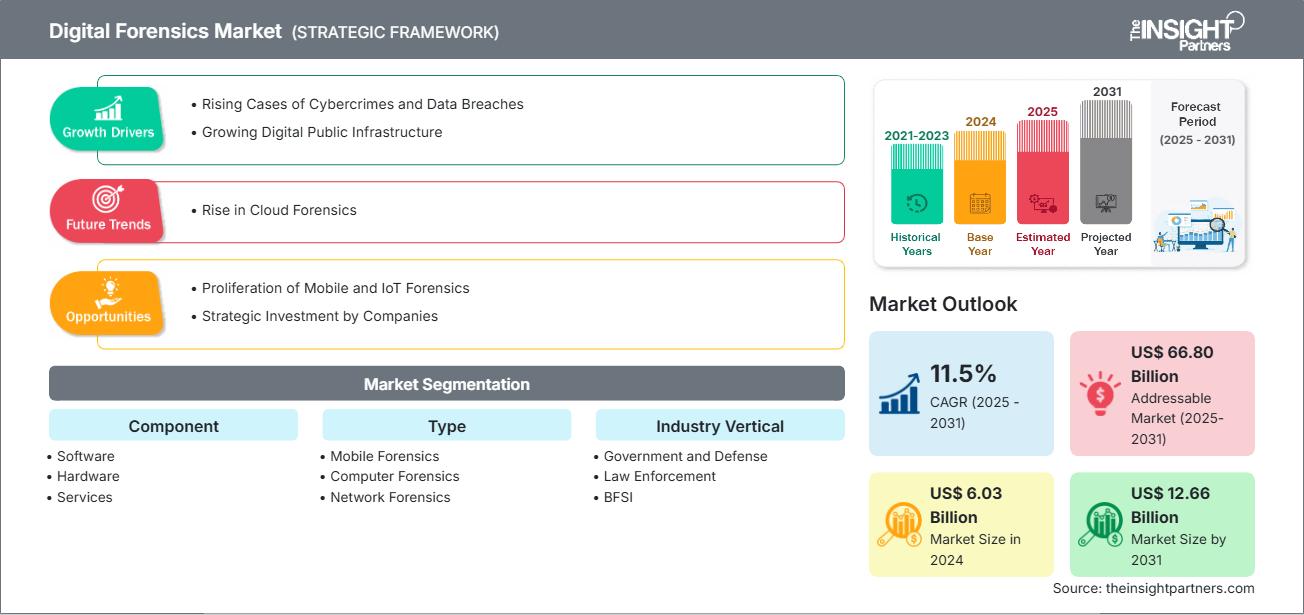

Digital Forensics Market Forecast (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware and Services), Type (Mobile Forensics, Computer Forensics, Network Forensics, and Others), Industry Vertical (Government and Defense, Law Enforcement, BFSI, IT and Telecom, Healthcare, Retail, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPTE100000698

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 245

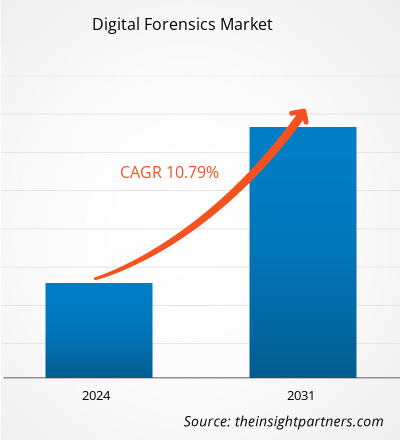

The Digital Forensics Market size is projected to reach US$ 6.03 billion in 2024 and is projected to reach US$ 12.66 billion by 2031. The market is expected to register a CAGR of 11.5% during 2025–2031.

Digital Forensics Market Analysis

The rising cases of cybercrimes and data breaches and the growing digital public infrastructure are driving the digital forensics market. The market is expected to grow during the forecast period owing to the proliferation of mobile and IoT forensics and strategic investments by various companies. The rise in cloud forensics is likely to be one of the key trends in the market. However, the high cost of digital forensic tools and services may hamper the market growth.

Digital Forensics Market Overview

Digital forensics is a specialized branch within forensic science focused on the investigation and analysis of digital evidence. While it plays a crucial role in addressing cybercrime, its utility extends beyond to encompass both criminal and civil investigations. For example, cybersecurity professionals often rely on digital forensics to trace the origins and perpetrators of malware attacks.

Additionally, law enforcement agencies utilize it to extract and examine data from electronic devices associated with suspects in serious crimes such as homicide. The discipline treats digital evidence with the same rigor and procedural integrity as traditional physical evidence, adhering to stringent protocols—commonly referred to as the chain of custody—to ensure the authenticity and admissibility of the evidence throughout the investigative process.

Digital forensics involves the systematic identification, preservation, thorough analysis, and careful presentation of electronic data in ways that comply with legal standards. It spans multiple subfields, including computer forensics, mobile device forensics, network forensics, and cloud forensics, each addressing different aspects of digital evidence.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDigital Forensics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Digital Forensics Market Drivers and Opportunities

Market Drivers:

- Rising Cases of Cybercrimes and Data Breaches: As the global threat landscape becomes increasingly sophisticated, the demand for advanced digital forensics solutions is accelerating at an unprecedented pace. Organizations across sectors are under mounting pressure to protect their digital infrastructure from escalating cyberattacks, data breaches, and advanced persistent threats (APTs). The 2023 Cost of a Data Breach Report, sponsored by IBM, revealed that the global average cost of a data breach rose to US$ 4.45 million, marking a 15% increase over the past three years.

- Growing Digital Public Infrastructure: The rapid expansion of digital public infrastructure—comprising data centers, AI hubs, cloud platforms, and advanced connectivity networks—is fundamentally reshaping the global digital landscape. This transformation is being driven by the surging demand for data processing, AI computing, and cloud-native operations. On May 15, 2025, Blue Owl Capital Inc. announced the final close of its latest investment vehicle, the Blue Owl Digital Infrastructure Fund III (ODI III), with US$ 7 billion in capital commitments, surpassing its original US$ 4 billion target.

Market Opportunities:

- Proliferation of Mobile and IoT Forensics: In today’s interconnected world, the rapid expansion of Internet of Things (IoT) devices has transformed how consumers interact with technology, creating new conveniences as well as unprecedented cybersecurity challenges. As smart devices become ubiquitous in homes and workplaces, ensuring their security has become a critical priority for manufacturers, regulators, and users alike.

- Growing Digital Public Infrastructure: Strategic investment by key industry players is emerging as a pivotal opportunity for growth and innovation within the digital forensics market. On May 15, 2025, Scottish digital forensics firm Cyacomb announced the securing of £2.25 million (US$ 3.07 million) in funding aimed at scaling its platform and expanding into international markets. Cyacomb’s mission to combat online child abuse is underpinned by advanced technology that swiftly scans digital devices for known harmful content, enabling law enforcement agencies globally to identify evidence of child sexual abuse and terrorist activity more efficiently than ever before.

Digital Forensics Market Report Segmentation Analysis

The digital forensics market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Component:

- Software: Digital forensics software includes applications and platforms designed to analyze, visualize, report, and manage digital evidence. The software segment in digital forensics encompasses tools specifically designed for the acquisition, analysis, and decryption of data across a wide range of devices.

- Hardware: The hardware segment includes specialized devices such as forensic servers and workstations, write blockers, disk duplicators, and mobile device analysis kits. The market for this segment continues to evolve rapidly due to ongoing advancements in computing technology.

- Services: The services segment in the digital forensics market refers to the professional expertise and support provided for the identification, preservation, analysis, and presentation of digital evidence. This includes incident response, forensic investigations, litigation support, expert witness testimony, and consulting services offered by specialized firms or internal teams within organizations.

By Type:

- Mobile Forensics: Mobile device forensics is a specialized area of digital forensics that focuses on the recovery, preservation, and analysis of digital evidence from mobile devices. This includes any device with internal memory and communication capabilities, such as smartphones, tablets, personal digital assistants (PDAs), and GPS units.

- Computer Forensic: Computer forensic science, or computer forensics, involves the investigation and analysis of digital evidence found on computers and storage devices to uncover, preserve, recover, and present factual information in a legally admissible manner.

- Network Forensic: Network forensics is a specialized branch of digital forensics focused on monitoring, capturing, and analyzing network activity to investigate cybersecurity incidents. Given the dynamic and often volatile nature of network data, which can disappear once transmitted, this field typically involves proactive, real-time data collection and analysis.

- Others: Others include several emerging and specialized branches that address the growing complexity of digital environments. Cloud forensics focuses on identifying, collecting, and analyzing data stored in cloud infrastructures, often involving multiple service providers and jurisdictions, making it crucial for investigations involving remote data storage.

By Industry Vertical:

- Government and Defense

- Law Enforcement

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The North America digital forensics market is the largest globally, driven by the region’s advanced technological infrastructure, stringent regulatory environment, and high incidence of cybercrime. The US, in particular, is a major contributor owing to its well-established government agencies, law enforcement bodies, and private sector firms investing heavily in cybersecurity and forensic capabilities.

Digital Forensics Market Regional InsightsThe regional trends and factors influencing the Digital Forensics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Digital Forensics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Digital Forensics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6.03 Billion |

| Market Size by 2031 | US$ 12.66 Billion |

| Global CAGR (2025 - 2031) | 11.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Digital Forensics Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Forensics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Digital Forensics Market top key players overview

Digital Forensics Market Share Analysis by Geography

The Asia Pacific region is emerging as one of the fastest-growing markets for digital forensics, fueled by rapid digital transformation, increasing internet penetration, and rising cyber threats. Nations such as China, India, Japan, Australia, and South Korea are witnessing growing investments in cybersecurity infrastructure, driven by the need to protect critical industries, government agencies, and expanding digital economies. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for digital forensics providers to expand.

The digital forensics market grows differently in each region. This is because of factors like rising cases of cybercrimes and data breaches and the growing digital public infrastructure. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a major share of the global digital forensics market

-

Key Drivers:

- High rate of cybercrime and data breaches

- Strong presence of law enforcement and federal cybersecurity initiatives

- Established digital infrastructure and tech companies specializing in cybersecurity and forensics

- Trends: Increasing use of cloud-based forensics, AI-driven investigation tools, and incident response automation

2. Europe

- Market Share: Substantial share

-

Key Drivers:

- Strict regulatory environment (e.g., GDPR, NIS Directive)

- Cross-border data transfer regulations

- Adoption of advanced cybersecurity frameworks in corporate and government sectors

- Trends: Focus on compliance-driven digital investigations and forensic readiness, rising demand for mobile and cloud forensics

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

-

Key Drivers:

- Rapid digitization and increase in cyberattacks

- Government-led cybersecurity initiatives (e.g., India’s CERT-IN, Japan’s Cybersecurity Strategy)

- Expanding digital economy and IT sector

- Trends: Growing demand for mobile device forensics, real-time monitoring tools, and digital forensics-as-a-service (DFaaS)

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Rising cyber threats and organized digital crime

- Government and corporate investments in cybersecurity infrastructure

- Trends: Adoption of open-source forensic tools and regional training initiatives to build investigative capacity

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Cybersecurity threats in sectors like oil & gas, finance, and government

- Investments in digital forensics labs and smart city security initiatives (e.g., UAE, Saudi Arabia)

- Trends: Growing use of AI and big data in investigations, increased collaboration with international cybersecurity firms.

Digital Forensics Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as OpenText, Cellebrite, Magnet Forensics, Exterro, and AccessData. In addition, regional and specialized vendors like Oxygen Forensics (Eastern Europe), CCL Solutions Group (UK), and Binalyze (EMEA) are contributing to a dynamic and competitive landscape.

This high level of competition urges companies to stand out by offering:

- Advanced investigation technologies (e.g., AI-driven analytics, automated evidence processing)

- Cross-platform forensic support (cloud, mobile, network, IoT, and endpoint forensics)

- Compliance-centric solutions for regulations like GDPR, HIPAA, and CCPA

- Rapid incident response capabilities and user-friendly forensic workflows

Opportunities and Strategic Moves

- Strategic alliances with cybersecurity firms, law enforcement agencies, and enterprise IT teams are becoming crucial for market penetration and innovation

- Cloud-native forensics and Digital Forensics-as-a-Service (DFaaS) are gaining traction to meet scalability and cost-efficiency needs

- Expansion into emerging regions (Asia Pacific, Middle East, Latin America) is creating room for growth, especially in mobile and remote forensics

- R&D investments in AI, machine learning, and blockchain traceability are enabling faster, more accurate forensic investigations

- Integration with SIEM, EDR, and threat intelligence platforms is enhancing end-to-end security and response capabilities.

Major Companies operating in the Digital Forensics Market are:

- Microsoft Corp

- International Business Machines Corp

- Open Text Corp

- Cisco Systems Inc

- Cellebrite DI Ltd.

- Nuix Limited

- Magnet Forensics

- Paraben Corporation

- Exterro

- Oxygen Forensics

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Kroll, LLC.

- GuidePoint Security LLC

- CYFOR Forensics

- Belkasoft

- SalvationDATA Technology

- Cyber Triage

- Autopsy

- DomainTools

- MailXaminer

- MSAB

- ProDiscover

- Tata Consultancy Services

- Digital Forensics Corporation

- Digital Intelligence, Inc.

- Aon

- IntaForensics Ltd

- Cyber Centaurs

- Alvarez & Marsal Holdings, LLC

- GRAMAX

- TransPerfect Legal

- ArcherHall

- ANA Cyber Forensic Pvt. Ltd.

- 12 Points Technologies, LLC

- Redpoint Cyber

- Withum

Digital Forensics Market News and Recent Developments

-

Microsoft launched Microsoft Purview

In March 2024, Microsoft Purview is a comprehensive set of solutions that can help your organization govern, protect, and manage data, wherever it lives. Microsoft Purview provides integrated coverage and helps address the fragmentation of data across organizations, the lack of visibility that hampers data protection and governance, and the blurring of traditional IT management roles. -

IBM unveiled its new security suite designed

In April 2023, IBM unveiled its new security suite designed to unify and accelerate the security analyst experience across the full incident lifecycle. The IBM Security QRadar Suite represents a major evolution and expansion of the QRadar brand, spanning all core threat detection, investigation and response technologies, with significant investment in innovations across the portfolio. Delivered as a service, the IBM Security QRadar Suite is built on an open foundation and designed specifically for the demands of the hybrid cloud. It features a single, modernized user interface across all products. It is embedded with advanced AI and automation designed to empower analysts to work with greater speed, efficiency and precision across their core toolsets. -

OpenText announced the release of OpenText Forensic

In November 2024, OpenText announced the release of OpenText Forensic (EnCase Forensic) CE 24.4 and EnCase Mobile Investigator CE 24.4. OpenText Forensic CE 24.4 is designed to enhance the usability of the artifacts-based workflow, helping digital forensic investigation teams more easily access forensic artifacts across a wider range of platforms. EnCase Mobile Investigator CE 24.4 offers additional mobile data collection capabilities with support for Apple iOS 18. With the CE 24.4 release, OpenText EnCase Forensic is now OpenText Forensic. -

Cisco announced new capabilities across the Cisco Security Cloud

In June 2024, Cisco (NASDAQ: CSCO), the leader in enterprise networking and Security, announced new capabilities across the Cisco Security Cloud that extend its security architecture in the age of AI. With Cisco's unified, AI-driven, cross-domain security platform, customers will experience the balance of power tipping in favor of the defenders

Digital Forensics Market Report Coverage and Deliverables

The "Digital Forensics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Digital Forensics Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Digital Forensics Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Digital Forensics Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Digital Forensics Market

- Detailed company profiles

Frequently Asked Questions

1. Investigating breaches and cyberattacks

2. Tracing unauthorized access

3. Gathering legally admissible evidence

4. Supporting incident response and SOC operations

Asia-Pacific, especially India and China, are witnessing the fastest growth due to digital transformation and regulatory mandates

1. Computer Forensics

2. Mobile Device Forensics

3. Network Forensics

1. Hardware

2. Software

3. Services

1. Government and Defense

2. Banking, Financial Services, and Insurance (BFSI)

3. Healthcare

4. Telecom and IT

5. Law Enforcement

6. Retail

1. EnCase

2. FTK (Forensic Toolkit)

3. Cellebrite

4. Magnet AXIOM

5. X-Ways Forensics

6. Autopsy (open-source)

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For