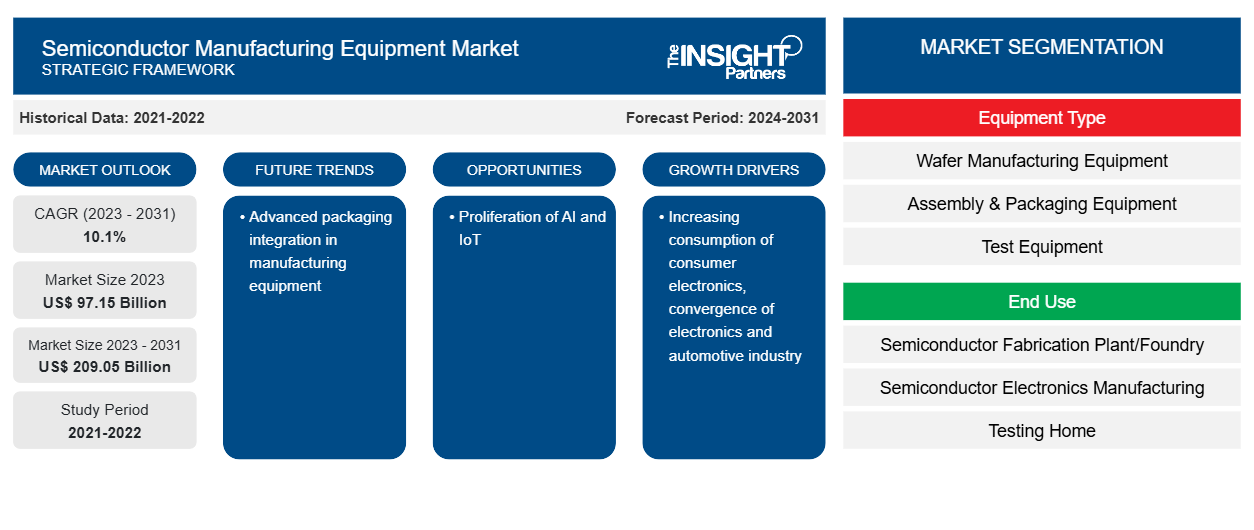

The semiconductor manufacturing equipment market size is expected to grow from US$ 97.15 billion in 2023 to US$ 209.05 billion by 2031; it is estimated to register a CAGR of 10.1% from 2023 to 2031. Advanced packaging integration in manufacturing equipment is likely to remain a key semiconductor manufacturing equipment market trend.

Semiconductor Manufacturing Equipment Market Analysis

This semiconductor manufacturing equipment market encompasses various players, including semiconductor equipment manufacturers, capital companies, tool manufacturers, metrology companies, and used semiconductor equipment suppliers. Semiconductor equipment manufacturers are at the forefront of developing cutting-edge equipment used in semiconductor manufacturing. These companies design and produce tools that enable various stages of semiconductor fabrication, such as lithography, etching, deposition, and wafer testing. Their innovations drive the advancements in semiconductor technology and enable the production of smaller, faster, and more powerful chips. Semiconductor capital companies play a vital role by providing financial resources and investments to semiconductor machinery manufacturers and equipment suppliers. These companies recognize the importance of the semiconductor industry and its growth potential, and they actively contribute to market development. Semiconductor tool manufacturers are specialized firms that produce specific tools and equipment used in semiconductor manufacturing. These tools include wafer processing systems, metrology equipment, packaging equipment, and testing solutions. They work closely with semiconductor manufacturers to meet their specific requirements and ensure the quality and efficiency of the manufacturing process.

Semiconductor Manufacturing Equipment Market Overview

The semiconductor manufacturing equipment market plays a critical role in supporting the production of semiconductors, including integrated circuits (ICs) manufacturing companies, which are the backbone of modern electronic devices. Semiconductor manufacturing equipment is the processing machinery utilized to form a variety of electrical and integrated circuits (ICs). The growth of telephony, computers, biotechnology, military technology, aviation, renewable energy, and other fields is made possible by semiconductors, which are a crucial part of electronic equipment. Circuits, memory chips, IC chips, and a wide range of other goods are all made using equipment for the fabrication of semiconductors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Manufacturing Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Manufacturing Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Semiconductor Manufacturing Equipment Market Drivers and Opportunities

Increasing Consumption Of Consumer Electronics to Favor Market Growth

The burgeoning consumption of consumer electronics is a pivotal factor driving robust growth within the semiconductor manufacturing equipment market. Devices such as smartphones, tablets, laptops, smart home appliances, and wearable technology have become indispensable in everyday life, propelling an ever-increasing demand for sophisticated semiconductor chips. As consumer electronics continuously evolve—integrating enhanced features, higher computing power, and expanded connectivity options—semiconductor manufacturers face escalating pressure to deliver chips that are smaller, faster, and more energy-efficient.

Meeting these rigorous demands requires semiconductor producers to embrace cutting-edge manufacturing technologies and invest in advanced equipment capable of fabricating next-generation chips. This dynamic creates substantial opportunities for semiconductor manufacturing equipment providers, who are instrumental in supplying the innovative machinery necessary to push the boundaries of chip design and production. Key segments within the manufacturing equipment landscape include lithography systems, etching tools, and deposition equipment. Lithography machines, employing optical and increasingly extreme ultraviolet (EUV) technologies, are essential for patterning highly intricate and miniaturized circuit designs onto silicon wafers. These systems enable the realization of smaller transistor geometries and higher transistor densities, which are critical to achieving superior device performance and energy efficiency. Etching equipment complements this process by facilitating precise removal of material layers with atomic-level accuracy, ensuring the integrity and functionality of the microstructures. Meanwhile, deposition tools enable the uniform application of thin films—crucial for insulating, conducting, or semiconducting layers—onto wafer surfaces, further enhancing device performance and reliability.

Beyond these core equipment categories, advancements in automation, real-time monitoring, and process control technologies are enhancing manufacturing precision and throughput. The integration of artificial intelligence (AI) and machine learning (ML) into equipment operation is optimizing yield rates and reducing defects, further reinforcing the value proposition for semiconductor fabricators. Additionally, the ongoing shift towards smaller nodes—such as 3nm and beyond—necessitates continuous innovation in manufacturing equipment to address complex challenges in material science and process engineering. Equipment suppliers investing in research and development to deliver solutions for these next-generation nodes stand to gain a competitive edge. In summary, the escalating demand for consumer electronics, coupled with technological advancements and miniaturization trends, is set to drive sustained growth in the semiconductor manufacturing equipment market. Vendors capable of providing state-of-the-art, reliable, and scalable equipment will be critical enablers of semiconductor innovation, fueling broader progress across the technology ecosystem.

Proliferation of AI and IoT - An Opportunity in the Semiconductor Manufacturing Equipment Market

AIoT in manufacturing refers to the intersection of IoT with AI. AI-infused IoT enables the semiconductor equipment to independently examine data, analyze it, and make decisions without any human involvement. Moreover, companies such as SAP, IBM, and PDF Solutions have joined forces to develop innovative solutions that leverage the Internet of Things (IoT), manufacturing solutions, and AI technologies to address the pain points of the semiconductor industry.

Semiconductor Manufacturing Equipment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the semiconductor manufacturing equipment market analysis are the equipment type, end use, and dimension.

- Based on equipment type, the semiconductor manufacturing equipment market is segmented into wafer manufacturing equipment, assembly & packaging equipment, test equipment, and others.

- Based on end use, the semiconductor manufacturing equipment market is segmented into semiconductor fabrication plant/foundry, semiconductor electronics manufacturing, and testing home.

- Based on dimension, the semiconductor manufacturing equipment market is segmented into 2D, 2.5D, and 3D.

Semiconductor Manufacturing Equipment Market Share Analysis by Geography

The semiconductor manufacturing equipment market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023. Asia Pacific has some of the largest chip manufacturers globally. These companies, often called "biggest chip manufacturers," drive the demand for semiconductor manufacturing equipment. Their large-scale production facilities require advanced equipment and technologies to meet the growing needs of various industries, including consumer electronics, automotive, and telecommunications. The region has witnessed rapid growth in the consumption of consumer electronics. With a rising population and increasing disposable incomes, countries in the Asia Pacific region have become major markets for smartphones, tablets, laptops, and other electronic devices. This surge in demand for consumer electronics directly translates into increased demand for semiconductor chips, thereby driving the need for semiconductor manufacturing equipment.

Semiconductor Manufacturing Equipment Market Regional Insights

The regional trends and factors influencing the Semiconductor Manufacturing Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Semiconductor Manufacturing Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Semiconductor Manufacturing Equipment Market

Semiconductor Manufacturing Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 97.15 Billion |

| Market Size by 2031 | US$ 209.05 Billion |

| Global CAGR (2023 - 2031) | 10.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Equipment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Semiconductor Manufacturing Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Semiconductor Manufacturing Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Semiconductor Manufacturing Equipment Market are:

- Advantest Corporation

- Applied Materials, Inc.

- ASML Holding N.V.

- Hitachi High-Technologies Corporation

- KLA Corporation

- Lam Research Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Semiconductor Manufacturing Equipment Market top key players overview

Semiconductor Manufacturing Equipment Market News and Recent Developments

The semiconductor manufacturing equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the semiconductor manufacturing equipment market:

- In April 2023, Hitachi High-Tech Corporation announced plans to construct a new production facility in the Kasado Area of Kudamatsu City, Yamaguchi Prefecture, with a view to increasing the production capacity of etching systems for its semiconductor manufacturing equipment business, with production scheduled to begin in FY2025.(Source: Hitachi, Press Release)

- In October 2023, Canon announced the launch of the FPA-1200NZ2C nanoimprint semiconductor manufacturing equipment, which executes circuit pattern transfer, the most important semiconductor manufacturing process. The new product employs newly developed environment control technology that suppresses the contamination with fine particles in the equipment.(Source: Canon, Press Release)

Semiconductor Manufacturing Equipment Market Report Coverage and Deliverables

The "Semiconductor Manufacturing Equipment Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sexual Wellness Market

- Clear Aligners Market

- Vessel Monitoring System Market

- Clinical Trial Supplies Market

- Hot Melt Adhesives Market

- Health Economics and Outcome Research (HEOR) Services Market

- Malaria Treatment Market

- Bathroom Vanities Market

- Water Pipeline Leak Detection System Market

- Precast Concrete Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Equipment Type ; End Use ; Dimension

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

What is the estimated market size for the global semiconductor manufacturing equipment market in 2023?

The global semiconductor manufacturing equipment market was estimated to be US$ 97.15 billion in 2023 and is expected to grow at a CAGR of 10.1% during the forecast period 2024 - 2031.

What are the driving factors impacting the global semiconductor manufacturing equipment market?

Increasing consumption of consumer electronics, convergence of electronics and automotive industry are the major factors driving the semiconductor manufacturing equipment market.

What are the future trends of the global semiconductor manufacturing equipment market?

Advanced packaging integration in manufacturing equipment is anticipated to play a significant role in the global semiconductor manufacturing equipment market in the coming years.

Which region is expected to hold the highest market share in the semiconductor manufacturing equipment market?

Asia Pacific is expected to hold the highest market share in the semiconductor manufacturing equipment market.

Which are the key players holding the major market share of the semiconductor manufacturing equipment market?

The key players holding majority shares in the global semiconductor manufacturing equipment market areASML Holding N.V., Hitachi High-Technologies Corporation, Rudolph Technologies, Inc., Advantest Corporation, and Applied Materials, Inc.

Get Free Sample For

Get Free Sample For