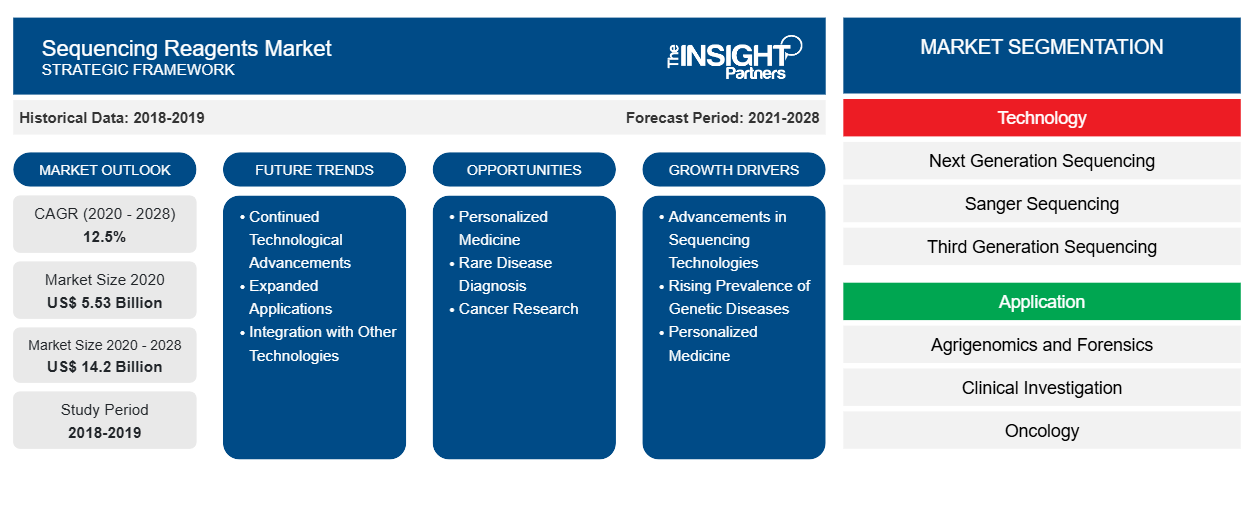

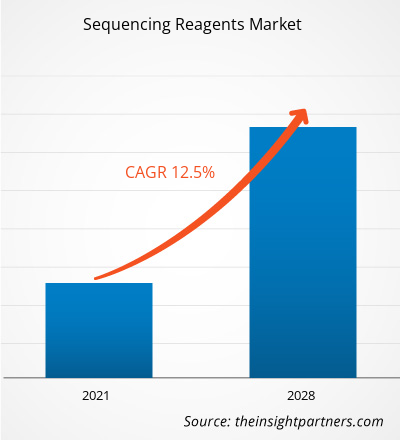

The sequencing reagents market was valued at US$ 5,530.32 million in 2020 and is projected to reach US$ 14,195.60 million by 2028; it is expected to grow at a CAGR of 12.5% from 2020 to 2028.

Sequencing reagents are used during the process of sequencing. The use of these reagents highly depends on the desired result to be obtained. They form an essential part of the sequencing reactions, which can be used across various other applications as well. An increase in R&D activities worldwide is expected to drive the growth of the market during the forecast period.

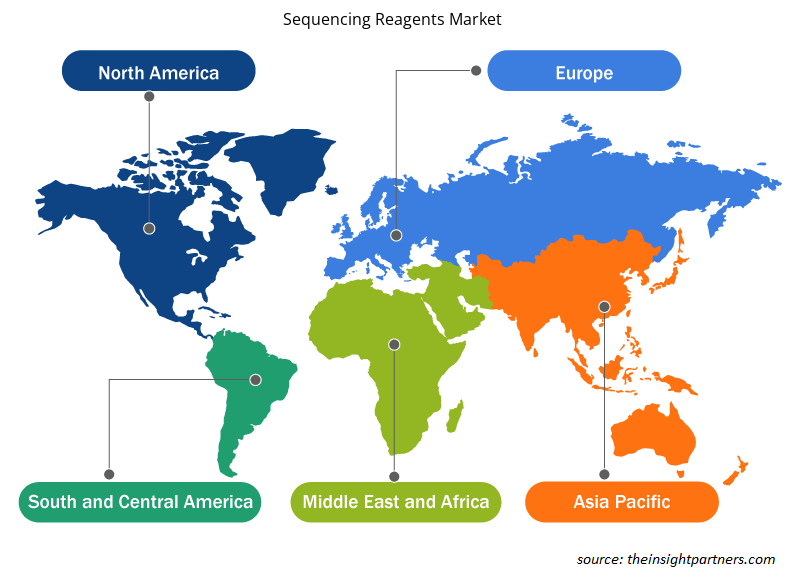

The sequencing reagents market is segmented on the basis of reagent type, technology, application, end user, and geography. By geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the sequencing reagents market, emphasizing on parameters such as market trends, technological advancements, and market dynamics along with the analysis of competitive landscape of world’s leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sequencing Reagents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sequencing Reagents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Five years ago, genomic sequencing was restricted to the research environment. Now, it is increasingly used in clinical practice, and over the next five years, genomic data from over 60 million patients is expected to be generated within healthcare. Genomic sequencing is rapidly transitioning into clinical practice, and implementation into healthcare systems has been supported by substantial government investment, totaling over US$ 4 billion in at least 14 countries. These national genomic-medicine initiatives are driving transformative change under real-life conditions while simultaneously addressing barriers to implementation and gathering evidence for broader adoption, thereby driving the market growth.

The UK has announced the world’s largest genome project as a part of 200 million public–private collaboration between charities and pharma. The UK has already developed the largest genome database in the world through the 100,000 Genomes Project. Led by Innovate UK as a part of UK Research and Innovation, the project will fund researchers and industry to combine data and real-world evidence from the UK health services and create new products and services that diagnose diseases earlier and more efficiently.

In November 2018, Stilla Technologies announced that it had completed a US$ 18.3 million (EUR 16 million) Series A financing round led by Illumina Ventures. The company will use the funds to commercialize its Naica digital PCR system and develop clinical applications.

In August 2018, Boston, a Massachusetts-based company, announced that it landed US$ 4.3 million in seed funding, and it would be partnering with Veritas Genetics, a genome sequencing company. The funds will support the company’s mission to usher in the era of personal genome sequencing by creating a trusted, secure, and decentralized marketplace for genomic data.

In April 2020, MedGenome—a Bengaluru-based genetic diagnostics, research, and data company—announced that it had raised US$ 55 million (about INR 419 crore) in a new round of funding, led by global impact investment firm LeapFrog Investments. Also, MedGenome claims to have built the largest database of South Asian genetic variants in genetic diagnostics in India and research partnerships. It has completed over 200,000 genomic tests to date and obtained samples from more than 550 hospitals and 6,000 clinicians across India.

Thus, due to the continuous funding by the manufacturers and government in the field of genomics, the sequencing reagent market is expected to witness growth during the forecast period.

Declining Cost of Sequencing Procedures Contributes Significantly to Market Growth

The cost of genome sequencing has been dropping radically, nearly a million-fold in the past six-seven years. In the recent years, next generation sequencing price have declined substantially. For instance, first whole human genome sequencing cost over US$ 3.7 billion in 2000 and took more than a decade for the completion. However, the costs for the same in recent years has reduces to US$ 1,000 and the process requires a smaller number of days. In 2000, cost for sequencing was US$ 3.7 billion, which dropped down to US$ 10 million in 2006 and declined to US$ 5,000 in 2012. The decline in the cost can be checked by the cost to sequence a genome diverging drastically around 2008, falling from approximately US$ 10 million to nearly US$ 1,000 at the present date.

Many of the testing services cost a couple hundred dollars and the lowered cost and higher speed could not only give them a larger margin in profits but the ability to process faster and possibly bring in a higher load of consumers. The latest machines offered by Illumina are lower priced devices and available in two models—NovaSeq 5000 for US$ 850,000 and the NovaSeq 6000 for US$ 985,000.

The rapid reduction in costs has now helped in clinical research, but even greater speed and a lowered price point will likely be enticing to health startups for the help of consumers. In 2003, the first sequencing of the whole human genome cost approximately US$ 2.7 billion; however, DNA sequencing company, Illumina has launched the latest and advanced machine for the whole genome sequencing, and it costs less than US$ 100. The price for genome sequencing has been in continuous free fall since the establishment. In 2006, Illumina’s first machine, which was used for the sequencing of a human genome, cost US$ 300,000, and in 2014, the company revealed that the cost of the same sequencing has been reduced to US$ 1,000. Major market players such as Illumina and Roche have introduced breakthrough technologies that have enabled the cost and time reduction in the sequencing.

In 2003, the International Human Genome Sequencing Consortium started genome analysis by sequencing a complete human genome. The sequencing cost approximately US$ 2.6 billion (EUR 2.3 billion). By 2008, costs dropped to lower than US$ 1.4 million (EUR 1 million) per genome. The cost of the exome sequencing has also become cheaper. It costs US$ 400 to US$ 500 to sequence an exome, and US$ 1,000 to US$ 1,200 to sequence a genome. Owing to factors such as advances in the field of genomics, development in different methods and strategies for sequencing, there is a notable decline in the cost of sequencing.

Technology Insights

Based on technology, the global sequencing reagents market is segmented into next generation sequencing, sanger sequencing, and third generation sequencing. In 2020, the next generation sequencing segment held the largest share in the market. Moreover, the market for the same segment is expected to grow at the highest rate by 2028. Next-generation sequencing is a technique that provides massive parallel decoding of RNA or DNA fragments, based on single molecule sequencing principles or sequencing-by-synthesis. It produces the massive quantities of sequencing data, which can only be analyzed with using dedicated bioinformatics tools. This factor is likely to boost the demand for sequencing reagents across the world during the forecast period

Reagent Type Insights

Based on reagent type, the global sequencing reagents market is segmented into control kits, library kits, template kits, sequencing kits, and other reagent types. The control kits segment held the largest market share in 2020, and it is further expected to dominate the market by 2028. Quality control for cluster generation, sequencing, and alignment, as well as calibration control for cross-talk matrix generation, phasing, and prephasing are provided by control kits.

Application Insights

Based on application, the global sequencing reagents market is segmented into agrigenomics and forensics, clinical investigation, oncology, reproductive health, and other applications. The oncology segment held the largest market share in 2020, and it is further expected to dominate the market by 2028. The combination of next-generation sequencing (NGS) and bioinformatics tools has an ability to transform oncology research, diagnosis, and treatment.

End User Insights

Based on end user, the global sequencing reagents market is segmented into hospitals and clinics, research institutes, and pharmaceutical and biotechnology companies, and others. The hospitals and clinics segment held the largest market share in 2020, and it is further expected to dominate the market by 2028. Hospitals and clinics are primary contact points for patients to get their diagnosis done and opt for treatment options and alternatives.

Product launches, and mergers and acquisitions are highly adopted strategies adopted by the players operating in the global sequencing reagents market. A few of the recent key product developments are listed below:

In April 2021, QIAGEN N.V. launched QIAseq DIRECT SARS-CoV-2 Kit, a viral genome enrichment and library preparation solution that significantly reduces library turnaround times and plastics use compared with ARTIC project protocols [primer-based approaches for next-generation sequencing (NGS)].

In December 2018, Abcam plc, a global innovator in life science reagents and tools, and QIAGEN (Suzhou) Translational Medicine Co., Ltd. (QIAGEN (Suzhou)) signed a Memorandum of Understanding (MoU) agreement to jointly develop a pipeline of Companion Diagnostic (CDx) and In Vitro Diagnostic reagents and kits to meet the specific needs of the Chinese market.

The COVID-19 pandemic is having the positive impact on the sequencing reagents market. Vaccine for COVID-19 has been developed by several pharmaceutical companies and vaccination has also been started in most of the countries. The genome sequencing has increasingly become an important tool for studying disease outbreaks, which is anticipated to have a positive impact on the other segments of the market in the coming months. On the other side, disruptions in the supply chain caused due to the halt in global operations are hindering the market growth.

Sequencing Reagents Market Regional Insights

The regional trends and factors influencing the Sequencing Reagents Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sequencing Reagents Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sequencing Reagents Market

Sequencing Reagents Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 5.53 Billion |

| Market Size by 2028 | US$ 14.2 Billion |

| Global CAGR (2020 - 2028) | 12.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Sequencing Reagents Market Players Density: Understanding Its Impact on Business Dynamics

The Sequencing Reagents Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sequencing Reagents Market are:

- BGI Group

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Illumina, Inc.

- LGC Biosearch Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sequencing Reagents Market top key players overview

Sequencing Reagents – Market Segmentation

By Technology

- Next Generation Sequencing

- Sanger Sequencing

- Third Generation Sequencing

By Reagent Type

- Control Kits

- Library Kits

- Template Kits

- Sequencing Kits

- Other Reagent Types

By Application

- Agrigenomics and Forensics

- Clinical Investigation

- Oncology

- Reproductive Health

- Other Applications

By End User

- Hospitals and Clinics

- Research Institutes

- Pharmaceutical and Biotechnology Companies

- Other End Users

By Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- BGI Group

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Illumina, Inc.

- LGC Biosearch Technologies

- Pacific Biosciences of California, Inc.

- Qiagen

- Takara Bio, Inc.

- Thermo Fisher Scientific, Inc.

- Trilink Biotechnologies

Frequently Asked Questions

Who are the major players in the sequencing reagents market?

The sequencing reagents market majorly consists of the players such BGI Group, F. Hoffmann-La Roche Ltd., Fluidigm Corporation, Illumina, Inc., LGC Biosearch Technologies, Pacific Biosciences of California, Inc., Qiagen, Takara Bio, Inc., Thermo Fisher Scientific, Inc., and Trilink Biotechnologies among others.

What are the driving factors for the sequencing reagents market across the globe?

The factors that are driving growth of the market are growing funding for genomics, declining cost of sequencing procedures and increasing prevalence of chronic diseases are anticipated to drive the growth of the global sequencing reagents market during the forecast period. However, dearth of skilled professionals is hindering the market growth.

What are sequencing reagents?

Sequencing reagents are used during the process of sequencing. The use of these reagents highly depends on the desired result to be obtained. They form an essential part of the sequencing reactions, which can be used across various other applications as well. An increase in R&D activities worldwide is expected to drive the growth of the market during the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Sequencing Reagents Market

- BGI Group

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Illumina, Inc.

- LGC Biosearch Technologies

- Pacific Biosciences of California, Inc.

- Qiagen

- Takara Bio, Inc.

- Thermo Fisher Scientific, Inc.

- Trilink Biotechnologies

Get Free Sample For

Get Free Sample For