Sewer Cable Market Dynamics, Recent Developments, and Strategic Insights by 2031

Sewer Cable Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Inner Core, Double Wound, and No Core), Application (Industrial, Municipal, Commercial, and Residential), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00019134

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 203

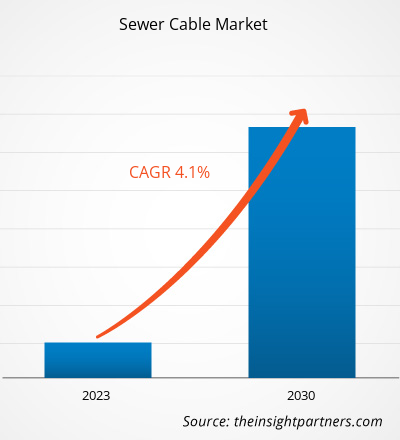

The sewer cable market was valued at valued at US$ 92.4 million in 2024 and is expected to reach US$ 121.6 million by 2031. The sewer cable market is estimated to record a CAGR of 4.1% from 2025 to 2031. The enhanced focus on distribution networks is likely to continue to be a key trend in the market.

Sewer Cable Market Analysis

The ongoing demand for efficient, reliable, and cost-effective solutions for wastewater management drives the utilization of sewer cables. These cables are used for the installation, maintenance, and repair of sewer pipelines and utility lines, offering an alternative to traditional excavation methods. The rising demand for sewer cleaning machines in developed and developing countries to eliminate manual cleaning operations propels the sewer cable market growth. The sewer cleaning industry focuses on developing new solutions to reduce human efforts with the deployment of advanced machinery. Governments are implementing initiatives to encourage the adoption of advanced machinery in sewer cleaning operations. In June 2023, Kochi corporation authorities introduced robotic excavators and suction-cum-jetting machines for cleaning the canals and drains of the city.

Sewer Cable Market Overview

A sewer cable (also known as a drain cleaning cable or auger cable) is used to clear blockages in sewer pipes or drains. It consists of a long, flexible cable that can be fed into pipes to dislodge or break up clogs caused by debris, grease, tree roots, or other obstructions. The cable is used with a sewer snake or drain auger machine, which helps rotate the cable through the pipe while applying mechanical force to break up the blockage. The end of the cable has a spiral or coiled shape designed to grab and break up the clog. These cables are commonly used by plumbers or maintenance workers when a drain or sewer line is too clogged for a plunger to fix or when the clog is deeper in the pipe system.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSewer Cable Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sewer Cable Market Drivers and Opportunities

Increasing Population and Urbanization Favors Market

According to the UNCTAD Handbook of Statistics, the world population surpassed 8 billion in 2022. The United Nations (UN) data states that 5 in every 6 people live in developing economies. The world population is projected to increase from 8.55 billion in 2030 to 9.71 billion by 2050. The global population is anticipated to increase by 1.6 billion in the next 25 years. Developing economies, particularly from Africa, Asia, and Oceania, are expected to experience a high population. According to the UN, the share of the population living in urban areas is projected to expand from 57% in 2022 to 68% by 2050. The urban population is highly concentrated in North America, Latin America & Caribbean, Europe, and Oceania, whereas approximately 52.3% of the population in Africa lives in rural areas. Hence, the increasing population there is an growing demand for the efficient sewar management which is expected to drive the sewer cable market over the forecast period.

Surging Awareness and Investments in Sewage Infrastructure Growth Opportunities in the Market

A poorly maintained sewage infrastructure negatively impacts the wellness and quality of health of individuals within the cities, especially in densely populated metropolitan cities. The lack of efficient waste management and collection practices could result in the spread of infections and diseases, and the generation of harmful components affecting individuals and compromising public safety. These issues have prompted government and non-government organizations to focus on educating the masses about the significance of efficient management of waste and the maintenance of sewerage infrastructure across commercial and residential units. Governments are investing heavily in the development of new sewage infrastructure and the upgrading of the old ones. In January 2024, the Guam Waterworks Authority (GWA) signed an agreement with the US to improve the quality of the sewer system of Guam; the improvement work is projected to cost approximately US$ 400 million, involving efforts that would be made to address the violations of the Clean Water Act and other unauthorized overflows of untreated sewage.

Sewer Cable Market Report Segmentation Analysis

Key segments that contributed to the derivation of the sewer cable market analysis are type and application.

- Based on type, the sewer cable market is categorized into inner core, double wound, and no core. The double wound segment dominated the market in 2024.

- By application, the sewer cable market is segmented into municipal, commercial, residential, and industrial. The industrial segment dominated the market in 2024.

Sewer Cable Market Share Analysis by Geography

The geographic scope of the sewer cable market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. North America accounted for a significant market share in 2024. The US, Canada, and Mexico are among the major economies in North America. The soaring population is expected to result in a substantial increase in daily sewage generation, which is likely to exert a significant burden on current infrastructure. According to the US Census Bureau, the number of residents in the US grew by 3,304,757 in 2024, raising the total population to 340,110,988. The population grew at a rate of 0.98% — the highest rate since 2001. Municipalities in the US, Canada, and Mexico work hard to keep their sewage and drainage systems clear of clogs. In October 2023, the Canadian government and British Columbia, the municipalities of Burns Lake, and the District of Mackenzie announced an investment of more than US$ 10 billion for water and wastewater treatment projects in the region. Such government investments trigger the demand for sewer cables in the region. The sewer cable market in North America is growing steadily, owing to the presence of well-established and emerging companies.

Sewer Cable Market Regional InsightsThe regional trends and factors influencing the Sewer Cable Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Sewer Cable Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Sewer Cable Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 92.4 Million |

| Market Size by 2031 | US$ 121.6 Million |

| Global CAGR (2025 - 2031) | 4.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Sewer Cable Market Players Density: Understanding Its Impact on Business Dynamics

The Sewer Cable Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Sewer Cable Market top key players overview

Sewer Cable Market News and Recent Developments

The sewer cable market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Sewer Cable market are listed below:

- Badger Meter, Inc. announced the acquisition of SmartCover® Systems (“SmartCover”) from XPV Water Partners for $185 million. The transaction adds real-time monitoring of utility water collection systems, with a focus on sewer line and lift station monitoring, to the network monitoring applications already offered under Badger Meter’s BlueEdge suite of water management solutions. (Source: Su Badger Meter, Inc, Press Release, January 2025)

Sewer Cable Market Report Coverage and Deliverables

The “Sewer Cable Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Sewer Cable market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Sewer Cable market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Sewer Cable market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Sewer Cable market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For