SLC NAND Flash Memory Market Analysis and Forecast by Size, Share, Growth, Trends 2031

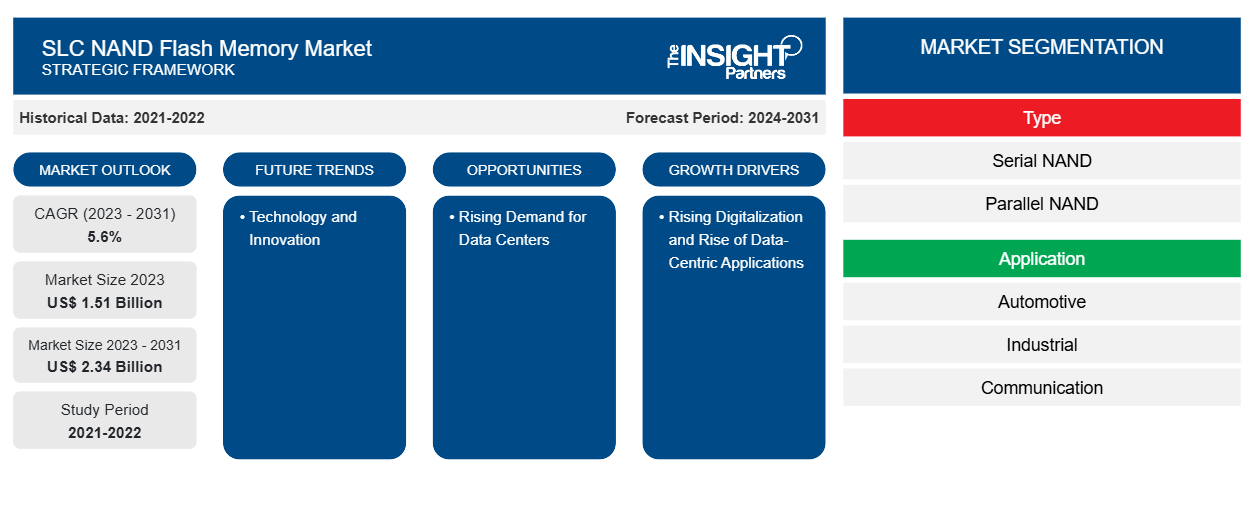

SLC NAND Flash Memory Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Parallel and Serial), Application (Industrial, Automotive, Consumer Electronics, Computers and IT, Communication, and Others), Density (Above 8 GB, 8 GB, 4 GB, 2 GB, and 1 GB), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00006134

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 221

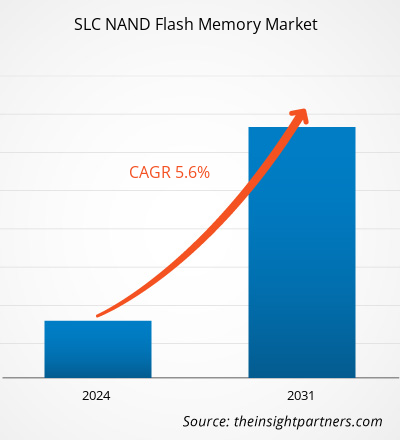

The SLC NAND flash memory market size was valued at US$ 11.29 billion in 2024 and is expected to reach US$ 16.40 billion by 2031; it is estimated to register a CAGR of 5.3% during 2025–2031. The emergence of 4D NAND technology is likely to bring new market trends.

SLC NAND Flash Memory Market Analysis

The increasing adoption of consumer electronics, rising penetration of IoT devices, and faster communication protocols drive the SLC NAND flash memory market growth. However, the high cost of SLC NAND flash memory hinders the growth of the market. Further, the advent of autonomous vehicles and miniaturization of electronics is expected to create opportunities for the growth of the market during the forecast period. The emergence of 4D NAND technology is expected to bring new trends to the market in the coming years.

SLC NAND Flash Memory Market Overview

NAND flash memory is nonvolatile and stores data even when the power is turned off. This feature makes NAND an excellent choice for internal, external, and portable devices. There are several types of NAND. The single-level cell (SLC) NAND provides the best performance and the highest endurance with a 100,000 program/erase cycle (P/E cycle). SLC NAND stores only 1 bit of information per cell. The cell stores either a 0 or 1. As a result, the data can be written and retrieved faster, which makes it last longer than the other types of NAND. The high endurance of SLC NAND makes it ideal for a broad range of consumer and industrial applications that require dependable and long-lasting supply. Internet of Things (IoT) devices, automobiles, networking equipment, set-top boxes, DSL and cable modems, digital television, mobile phones, printers, and other industrial products are equipped with SLC NAND flash memory. Because of its higher reliability, it has found applications in enterprises requiring high performance and data integrity, such as industrial automation, medical devices, and aviation systems. Major advantages of SLC NAND flash memory are the longest erase and program cycle lifespan, rapid read and write speeds, and lower probability of read/write errors.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSLC NAND Flash Memory Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SLC NAND Flash Memory Market Drivers and Opportunities

Increasing Adoption of Consumer Electronics

The world has witnessed a remarkable surge in the adoption of consumer electronics. As per the International Trade Administration (ITA) Southeast Asia Region eCommerce Forecast 2020–2027, consumer electronics continues to lead the region’s soaring e-commerce revenue growth. According to the World Economic Forum, as of January 2023, India had more than 700 million smartphone users, 425 million of whom lived in rural areas. More than 50% of the population in the region uses smartphones, and the number of active internet users has increased by 45% since 2019, putting rural India at the forefront of the world's smart revolution. As per the International Trade Administration (ITA), the market for healthcare IT, including wearable healthcare equipment (such as smartwatches), is expected to reach US$ 16 billion by 2025.

The major factors driving the demand for consumer electronics are the rising disposable incomes of consumers, technological advancements, and a growing need for digital connectivity. According to Trading Economics, India, China, and Japan experienced a rise in consumer disposable income in 2023 compared to 2022. Rapid urbanization in the region further led to the adoption of consumer electronics. According to the India Brand Equity Foundation (IBEF), the premiumization trend has accelerated in the consumer electronics sector, which led to a rise in smartphone, appliance, and television sales in the first half of 2024. Thus, the rising adoption of consumer electronics drives the SLC NAND flash memory market growth.

Advent of Autonomous Vehicles

The automotive sector is undertaking measures to transform the driving experience for its users. In the last few years, electric vehicles have attracted consumers, coupled with government support, due to the environmentally friendly nature of these cars. Automobiles are becoming smarter and more capable of self-diagnostics, with the launch of advanced driver assistant systems (ADAS), infotainment systems, and car telematics, which support connectivity within automobiles. At present, the penetration of automated cars is moderately low worldwide, which is projected to spur in the coming years. The growth in super-intelligent autonomous cars, especially in India and China, is rising owing to increasing incidences of fatal car crashes. Also, connected cars offer innovative safety features integrated with ADAS and other connected car technologies. Next-generation infotainment systems and ADAS will be integrated with memory technologies, offering higher performance and low power consumption capabilities. For effective implementation and functioning of the advanced connected car technologies, manufacturers require memory technology that supports the advanced technologies as well as the flexibility to support fluctuating data rates. Therefore, the advent of autonomous vehicles is expected to create future growth opportunities for the SLC NAND flash memory market.

SLC NAND Flash Memory Market Report Segmentation Analysis

Key segments that contributed to the derivation of the SLC NAND flash memory market analysis are type, application, and density.

- Based on type, the SLC NAND flash memory market is divided into series and parallel. The parallel segment dominated the market in 2024.

- By application, the SLC NAND flash memory market is segmented into automotive, industrial, communication, computers and IT, consumer electronics, and others. The industrial segment dominated the market in 2024.

- In terms of density, the SLC NAND flash memory market is categorized into 1GB, 2GB, 4GB, 8GB, and above 8 GB. The above 8GB segment dominated the market in 2024.

SLC NAND Flash Memory Market Share Analysis by Geography

- The SLC NAND flash memory market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the SLC NAND flash memory market in 2024. North America is the second-largest contributor to the global SLC NAND flash memory market, followed by Europe.

- The SLC NAND flash memory market in North America is segmented into the US, Canada, and Mexico. In terms of revenue, the US held the largest market share in North America's SLC NAND flash memory market in 2024.

- According to the Motor Intelligence report, more than 3.2 million electrified vehicles were sold in the US in 2023. As of 2024, there were 2,442,270 electric vehicles (EVs) registered in the US. As the automotive industry shifts toward EVs and more autonomous features, the amount of data processed and stored in vehicles grows, driving the demand for robust memory solutions such as SLC NAND. With the increasing popularity of mobile applications and services, the demand for smartphones continues to grow. According to the GSM Association, the smartphone penetration rate in North America is estimated to reach 91% by 2030. The association stated that ~352 million people subscribed to mobile services in 2022. Smartphones continue to contribute to the regional economy. The booming consumer electronics industry pushes advancements in all types of flash memory, including SLC. North America has a large number of SLC NAND flash memory market players who have been increasingly focusing on developing innovative solutions. Key players in the market are Micron Technology Inc., Greenliant Systems, and Western Digital Corp.

The regional trends and factors influencing the SLC NAND Flash Memory Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses SLC NAND Flash Memory Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

SLC NAND Flash Memory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 11.29 Billion |

| Market Size by 2031 | US$ 16.40 Billion |

| Global CAGR (2025 - 2031) | 5.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

SLC NAND Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

The SLC NAND Flash Memory Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the SLC NAND Flash Memory Market top key players overview

SLC NAND Flash Memory Market News and Recent Developments

The SLC NAND flash memory market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the SLC NAND flash memory market are listed below:

- Macronix launched its new 19nm SLC NAND flash. The 19nm SLC NAND family includes two subcategories: SLC NAND with full support for the Open NAND Flash Interface (ONFI) and Serial NAND. These products are designed for smart speakers, set-top boxes, streaming devices, smart home technology, and high-end network communications, including broadband access equipment.

(Source: Macronix, Press Release, January 2025)

- Flexxon, a global leader in hardware-based cybersecurity and industrial NAND storage solutions, announced its new strategic partnership with SC Zone Consulting Pte Ltd, headquartered in Romania. This collaboration marks a major step for Flexxon as SC Zone Consulting to become the first company in the region to introduce Flexxon's innovative memory solutions and cybersecurity products, including the X-PHY AI-embedded endpoint solutions.

(Source: Flexxon, Press Release, November 2024)

SLC NAND Flash Memory Market Report Coverage and Deliverables

The "SLC NAND Flash Memory Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- SLC NAND flash memory market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- SLC NAND flash memory market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- SLC NAND flash memory market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the SLC NAND flash memory market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For