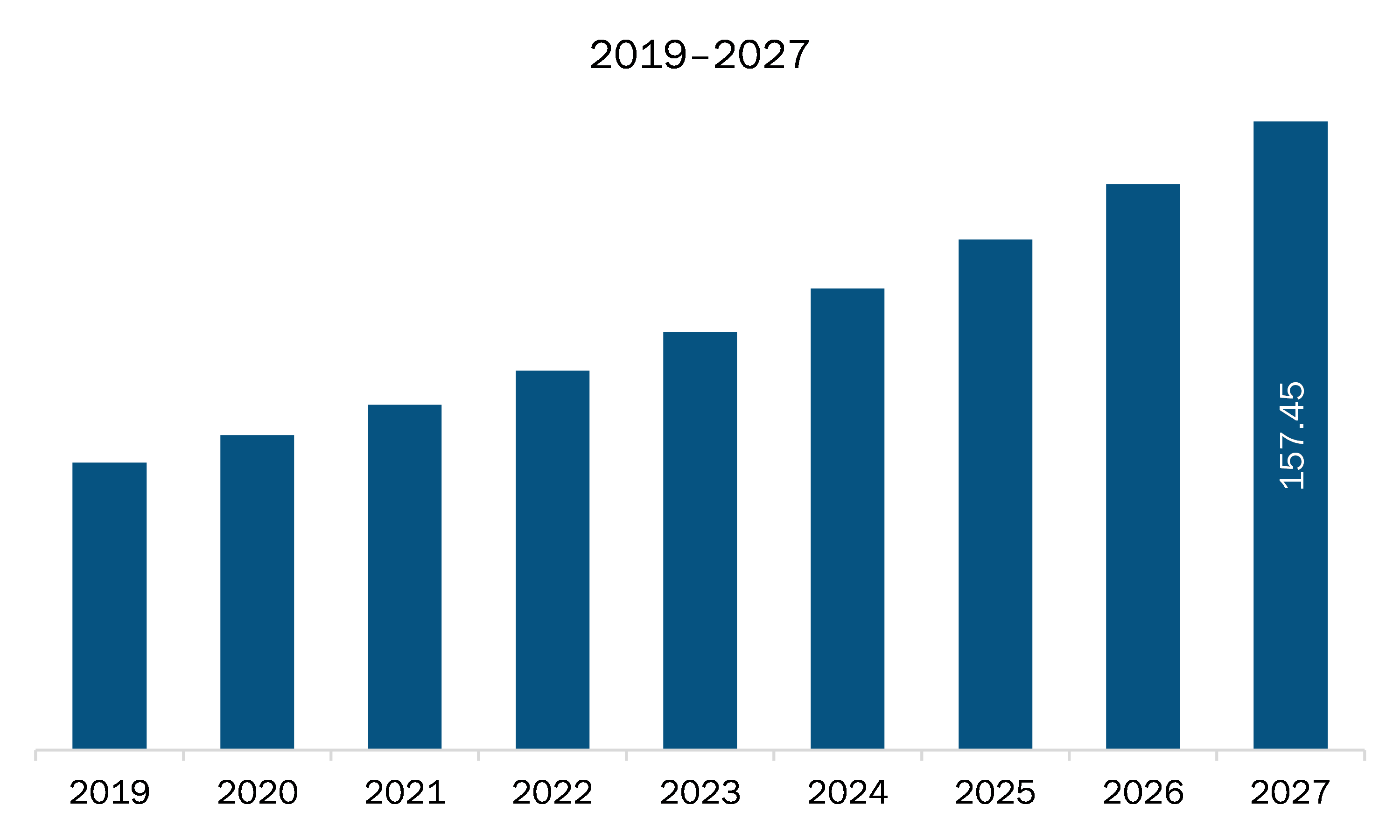

The medical affairs outsourcing market in SAM is expected to grow from US$ 78.83 million in 2020 to US$ 157.45 million by 2027; it is estimated to grow at a CAGR of 10.4% from 2020 to 2027.

Brazil and Argentina are major economies in SAM. Outsourcing activities becoming more popular and R&D spending is increasing is the major factor driving the growth of the SAM medical affairs outsourcing market. Research and development (R&D) is an essential and crucial part of the company’s business. Pharmaceutical, medical device and biotechnology companies focus on the research and development (R&D) to come up with new molecules for various therapeutic applications with the greatest medical and commercial potential. The companies invest majorly on the R&Ds with the aim of delivering high quality and innovative products to the market. Research and development expenditures relate to the processes of discovering, testing and developing new products, upfront payments and milestones, improving existing products, as well as demonstrating product efficacy and regulatory compliance prior to launch. According to the International Federation of Pharmaceutical Manufacturers & Associations, the R&D expenditures in 2014 by the pharmaceuticals and biotechnology industry grew by approximately 8.7% than that of the expenditures in 2013. The drug development and discovery is time-consuming and expensive process. The process from early discovery or design to development to regulatory approval can take more than 10 to 15 years. Throughout the development phase of a drug substance, various testing services are required to check the quality and efficacy of the product. Therefore, the pharmaceutical and biotechnology companies prefer to outsource the services to the contract research organizations (CROs) in order to save the cost and time, which is expected to drive the growth of the market.

On February 26, 2020, the first case of COVID-19 was detected in Brazil's São Paulo. Since then, the governments in this region have taken various steps to protect their people and reduce the spread of COVID-19. By July 26, Latin America was the region with the highest number of reported cases worldwide, accounting for more than a quarter of the world's cases. South America registered 16,810,346 cases as of February 12, 2021. On June 11, the Government of Sao Paulo, Brazil's Instituto Butantan, signed an agreement with the Chinese laboratory Sinovac Biotech to develop an experimental vaccine against COVID-19. On December 10, President Alberto Fernández launched a national vaccination initiative to distribute 60 million doses in the first six months of 2021. Older people, health care staff, and military personnel will be among the first to obtain immunization. The President also announced an initial procurement of 600,000 Russian Sputnik V vaccine doses to vaccinate 300,000 Argentinians.

Outsourcing is very local in Latin America. Latin America has always been known for its legal and regulatory knowledge, language skills, and compatible time zone with America. Latin America is not caught up with inflation regarding total cost, which promotes a powerful value proposition of providing cost-effective services. When it comes to Spanish and Portuguese language skills, Latin America is probably the only region globally that offers the combination of language skills at scale plus cost savings. This works in favor of US markets due to the huge Spanish population present in the US. Global companies are gaining several regional and business opportunities, especially in large countries such as Brazil and Argentina, where the domestic market is also large (nearly 60–70%). With established regional markets and promises of lower costs, Latin America is considered the fastest-growing destination for offshore services in the healthcare industry.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM medical affairs outsourcing market. The SAM medical affairs outsourcing market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South America Medical Affairs Outsourcing Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 78.83 Million |

| Market Size by 2027 | US$ 157.45 Million |

| CAGR (2020 - 2027) | 10.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Services

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For