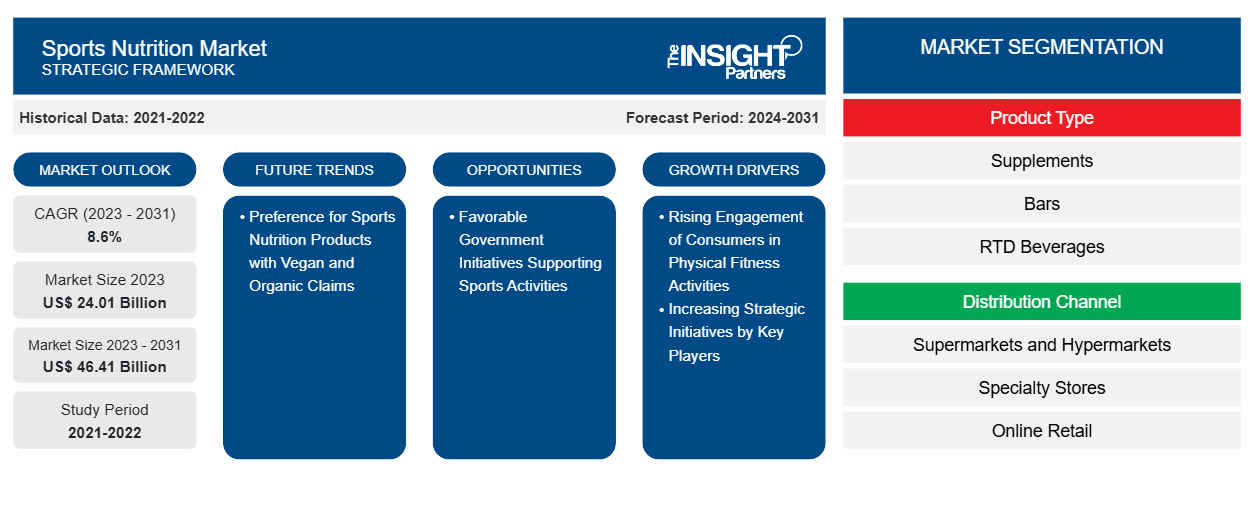

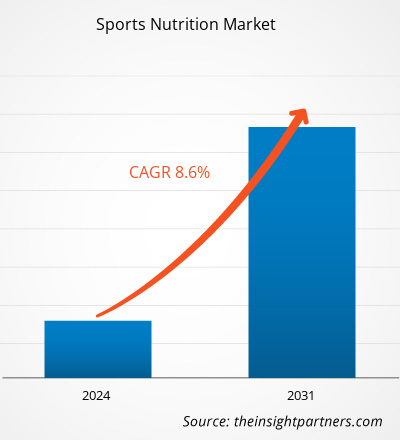

The sports nutrition market size is projected to reach US$ 46.41 billion by 2031 from US$ 24.01 billion in 2023. The market is expected to register a CAGR of 8.6% during 2023–2031. The increasing number of vegan consumers worldwide boosts the demand for sports nutrition products with vegan, organic, and plant-based ingredients. The growing awareness among consumers about plant-based sports nutrition products being more nutritious than traditional products is expected to propel the demand for plant-based sports nutrition products over the forecast period.

Sports Nutrition Market Analysis

There is an increase in the prevalence of health conditions such as diabetes and obesity worldwide. According to the WHO, as of 2022, 2.5 billion adults were overweight, out of which 890 million adults suffered from obesity. Owing to the rising health awareness and the increasing focus on a better physical appearance, consumers are increasingly shifting toward a healthy lifestyle with engagement in physical fitness activities. In addition, several sports events taking place across the globe, such as the Super Bowl, Asian Games, FIFA World Cup, and Olympics, result in increased involvement of youth in sports activities. Thus, the increasing adoption of sports activities leads to a rising demand for sports nutrition products, including protein powders, protein bars, and sports supplements, by athletes to increase their overall performance, especially during games and workouts.

Sports Nutrition Market Overview

The trend of sports and physical activities is growing considerably across the globe. Various developed and developing countries are witnessing an increase in demand for protein powders and RTD beverages as these sports nutrition products offer a wider range of health benefits. Several sports nutrition product manufacturers are opting for new sources of plant-based and organic protein ingredients, such as spirulina microalgae, to differentiate themselves from their competitors in the sports nutrition market. The ingredients such as amino acids and creatine in these sports nutrition products target specific body functions, including weight loss, energy balance, and muscle repair. For instance, in November 2023, FrieslandCampina, a sports nutrition company, announced the launch of a new whey protein powder with protein ingredients catered to boost medical nutrition, support athletic performance, and promote gut health. These factors are expected to propel the global sports nutrition market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sports Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sports Nutrition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sports Nutrition Market Drivers and Opportunities

Rising Engagement of Consumers in Physical Fitness Activities

The increasing number of fitness enthusiasts is leading to the launch of several fitness centers, gyms, and sports clubs globally. For instance, Basic-Fit, a leading gym chain, had over 1,400 gyms across Europe in 2023. Also, since the COVID-19 pandemic, there has been a rise in the population using fitness apps and taking online courses for fitness activities. This increase in fitness lifestyle results in a rise in demand for sports nutrition products, such as protein powders and other sports supplements, to enhance overall performance and energy efficiency during workouts. Moreover, social media is playing a crucial role in influencing a wide range of audiences to adopt healthy lifestyles and supporting their journey of fitness goals. Exercise, workout, and food ideas are accessible through platforms such as YouTube, Instagram, and Facebook which further grabs the attention of consumers in physical fitness activities. Thus, the increasing engagement of consumers in physical fitness activities augments the demand for sports nutrition products worldwide.

Favorable Government Initiatives Supporting Sports Activities

The sports nutrition market is driven by several favorable government initiatives and programs worldwide promoting engagement in sports and physical activities. For instance, the US government promotes the engagement of young adults in sports activities through its National Youth Sports Strategy and The International Sports Programming Initiative (ISPI) programs. In addition, the government is supporting women's participation in sports activities, giving the key players an opportunity to expand their consumer base to women. For instance, the US government supports the women's sports team through the Women's Sports Foundation. Several women's sports teams have been launched, including FIFA Women's Football Team and United States Women's National Soccer Team. In addition, the government of UK is supporting women athletes by launching a new sports strategy to get 1.25 million active women athletes in the country by 2030. The government of South Australia is supporting the girls and women in the country to pursue careers as athletes by committing an investment of US$ 18 million to build sports infrastructures and programs dedicated to women by 2027. Such factors can be considered as a market opportunity for sports nutrition product manufacturers, helping them differentiate from their competitors and strengthen their market position in the sports nutrition market over the forecast period.

Sports Nutrition Market Report Segmentation Analysis

Key segments that contributed to the derivation of the sports nutrition market analysis are product type and distribution channel

- Based on product type, the sports nutrition market is segmented into supplements, bars, RTD beverages, and others. The supplements segment accounted for the largest share in 2023.

- In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held the largest share in 2023.

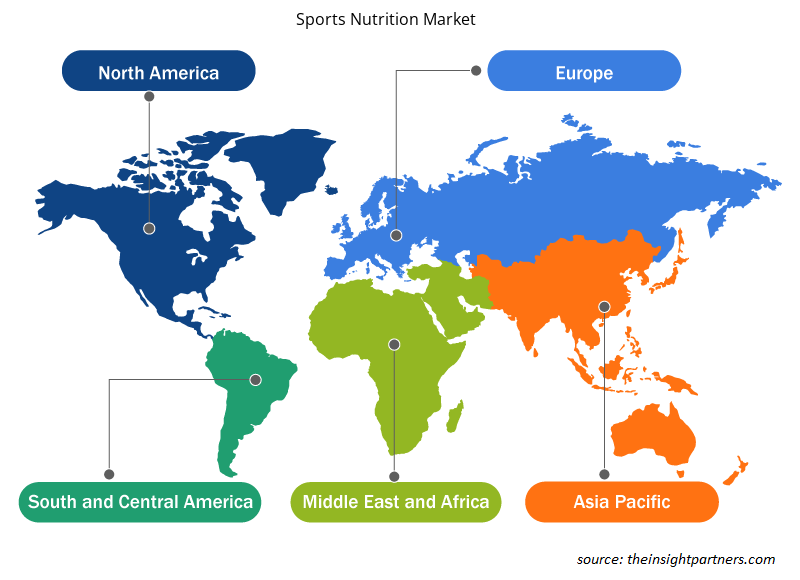

Sports Nutrition Market Share Analysis by Geography

The geographic scope of the sports nutrition market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held the largest share in 2023, while the market in Asia Pacific is expected to register the fastest CAGR during the forecast period.

In North America, the incidence of health conditions such as diabetes and chronic diseases caused by high obesity is constantly rising. According to the Trust for America's Health, as of September 2023, 41.9% of Americans in the US were suffering from obesity and shifting toward healthier diets. To overcome the ongoing health issues, the majority of the population is adopting an active lifestyle with involvement in physical exercise and sports. In response to this trend, several key players in the region are offering a wide product portfolio of sports nutrition products. For instance, in December 2023, Barebells expanded its protein bars product portfolio by launching the Soft Bar Banana Caramel protein bar to cater to the growing trend of consumers' preference for healthy and functional foods. Additionally, the increasing demand for convenient and on-the-go healthier beverages propels the requirement for sports nutrition products such as RTD sports drinks and protein bars. Also, to boost their performance in workouts or for quick recovery, consumers are inclined toward the consumption of sports supplements. Thus, the shift in consumer lifestyle is boosting the demand for sports nutrition products such as protein bars, RTD sports drinks, and sports nutrition supplements in North America.

Sports Nutrition Market Regional Insights

The regional trends and factors influencing the Sports Nutrition Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sports Nutrition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sports Nutrition Market

Sports Nutrition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 24.01 Billion |

| Market Size by 2031 | US$ 46.41 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Sports Nutrition Market Players Density: Understanding Its Impact on Business Dynamics

The Sports Nutrition Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sports Nutrition Market are:

- Glanbia plc

- NOW Foods

- Garden of Life

- PepsiCo Inc.

- Quest Nutrition LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sports Nutrition Market top key players overview

Sports Nutrition Market News and Recent Developments

The sports nutrition market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key recent development in the sports nutrition market is mentioned below:

- Amway's XS Energy and Sports Nutrition entered into an exclusive partnership with The Orlando Squeeze and became the exclusive sponsor of The Orlando Squeeze with a focus on delivering positive energy and making the most of every moment for professional and non-professional pickleball athletes. (Source: Amway Corp, Company Website, March 2024)

- GNC's PRO Performance and Beyond Raw expanded their portfolios to include two new Vitapak programs to support entry-level, active, and advanced fitness performance to help consumers at any stage achieve their goals. (Source: GNC Holdings, LLC, Press Release, January 2024)

Sports Nutrition Market Report Coverage and Deliverables

The "Sports Nutrition Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Sports nutrition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Sports nutrition market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Sports nutrition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the sports nutrition market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the sports nutrition market in 2023?

North America accounted for the largest share of the market in 2023.

What are the driving factors impacting the sports nutrition market?

Rising engagement of consumers in physical fitness activities and increasing strategic initiatives by key players are major factors contributing to the growth of the market.

What are the future trends of the sports nutrition market?

Preference for sports nutrition products with vegan and organic claims is likely to emerge as a key trend in the market in the future.

Which are the leading players operating in the sports nutrition market?

Glanbia plc; NOW Foods; Garden of Life; PepsiCo Inc.; Quest Nutrition LLC; Abbott Laboratories; Amway Corp; GNC Holdings, LLC; Worldwide Sport Nutritional Supplements; Inc.; and Herbalife Nutrition Ltd. are a few of the key players operating in the market.

What would be the estimated value of the sports nutrition market by 2031?

The market size is projected to reach US$ 46.41 million by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Sports Nutrition Market

- Glanbia Plc

- PepsiCo Inc

- The Coca-Cola Co

- Iovate Health Sciences International Inc.

- Abbott Laboratories

- Yakult Honsha Co., Ltd.

- NOW Health Group Inc

- Garden of Life LLC

- Quest Nutrition LLC

- Herbalife Nutrition Ltd

Get Free Sample For

Get Free Sample For