Tert Butanol Market Growth and Analysis by 2028

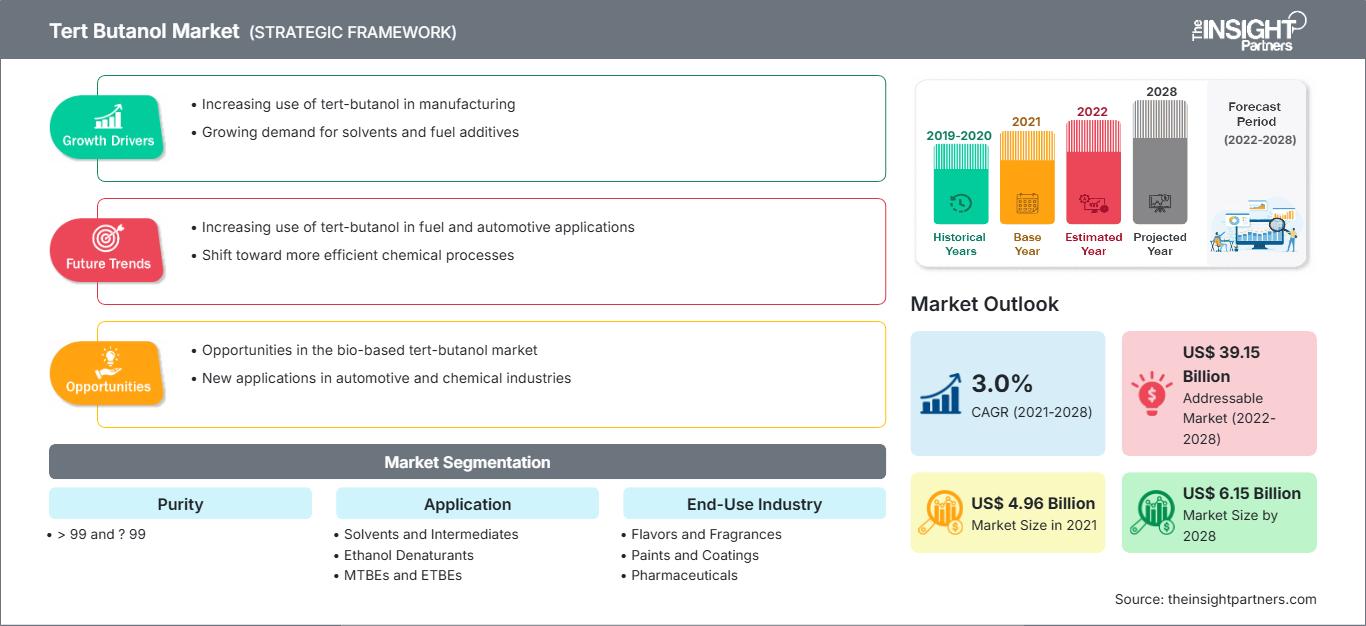

Tert Butanol Market Forecast to 2028 - Analysis By Purity (> 99 and ≤ 99), Application ((Solvents and Intermediates, Ethanol Denaturants, MTBEs and ETBEs, Methylmethacrylates (MMAs), and Others)), and End-Use Industry (Flavors and Fragrances, Paints and Coatings, Pharmaceuticals, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Sep 2021

- Report Code : TIPRE00006111

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 205

The tert butanol market is projected to reach US$ 6,149.11 million by 2028 from US$ 4,955.64 million in 2021; it is expected to grow at a CAGR of 3.0% from 2021 to 2028.

Tert butanol is produced commercially as a byproduct of isobutane during the propylene oxide production. Tert-butanol is used as a chemical intermediate in a variety of products. Further, it is primarily used as a solvent in various applications. It is also used as a paint remover, alcohol denaturant, and so on. Tert butanol is also used as an alkylating agent for aromatics and phenols, resulting in tert-butyl aromatics and tert-butyl esters, which are used as precursors in the synthesis of antioxidants, phenolic resins, pharmaceutical products, and perfumes. Europe is anticipated to hold the largest share of the tert butanol market during the forecast period. The increased demand for automotive refinish performance and architectural coatings is bolstering the demand for tert butanol in the automotive and construction paint and coating industries in the region. Further, consumer preference for masking flavors that are used in conjunction with antioxidants and vitamins to reduce off-tastes and off-odors is also boosting the demand for tert butanol in Europe. A rise in pharmaceutical R&D expenditure, increased popularity of niche fragrances, and surge in demand for premium fragrances, particularly in Western Europe, would continue to drive the tert butanol market growth in the region during the forecast period.

The COVID-19 pandemic has drastically altered the status of the chemicals and industrial sectors, and consequently hindered the growth of the tert butanol market. The implementation of measures to combat the spread of SARS-CoV-2 has aggravated the situation. The sudden distortion in operational efficiencies and disruptions in value chains due to sudden shutdown of national and international boundaries have hampered the performance of the flavors and fragrances, paints and coatings, and pharmaceuticals industries, among others. Further, the pandemic also led to discontinuations in product orders and deliveries, along with cancellations and order backlogs. The significant decline in the growth of several sectors has led to lowered demand for tert butanol. However, the compound is gradually emerging as a preferred freeze desiccant in the biomedicals industry. Moreover, continuous surge in research activities necessitates the preservation of vaccines, blood samples, purified proteins, and many other biological materials, which is contributing to the tert butanol market growth. Tert-butanol is a solvent with high vapor pressure, and low toxicity and melting point, and it is a trending freeze-drying agent. Nevertheless, as the economies are planning to revive their operations, the demand for tert butanol is expected to rise globally. However, the focus on just-in-time production is another concerning factor hindering the market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONTert Butanol Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market InsightsRising Demand for Tert Butanol from End-User Industries Drives Market Growth

Organic solvents such as tertiary butyl alcohol, i.e., tert butanol, benefit freeze-dried formulations by increasing hydrophobic drug solubility, reducing drying time, improving product stability, and enhancing reconstitution characteristics. Tert-butanol has a high freezing point of (24°C), and it crystallizes primarily at room temperature; it is sublime during the freezing process. Tert butanol, which crystallizes completely during the freezing stage, exhibits long, needle-shaped ice crystals. It produces a lower cake resistance during the drying stage and has a larger surface area. Tert-butanol is gradually becoming the tender freeze-drying agent in the biomedicals industry. The continuously evolving nature of the pharmaceuticals industry and increasing research activities in the same have necessitated the preservation of vaccines, blood samples, purified proteins, and many other biological materials. Tert-butanol is a solvent with high vapor pressure, and low toxicity and melting point, and it is a trending freeze-drying agent. Manufacturers are capitalizing on this trend by strengthening ties and partnerships with raw material suppliers and pharmaceuticals industry service providers. They place considerable emphasis on the development of high-purity tert butanol that is optimal for pharmaceuticals applications.Purity Insights

Based on purity, the global tert butanol market is segmented into >99 and ≤99. The ≤99 segment is expected to hold a larger market share of during the forecast period. Tert butanol with purity less than 99% is used as a solvent for paints and varnishes, and denaturant of ethanol and other alcohols. Tert butanol acts as an anti-knock agent, and is used in the production of flotation agents, and fruit essences and perfumes. It also acts as an active ingredient in paint removers.Application Insights.

Based on application, the tert butanol market is segmented into solvents and intermediates, ethanol denaturants, MTBEs and ETBEs, methylmethacrylates (MMAs), and others. The solvents and intermediates segment is anticipated to hold the largest share of the market during the forecast period. Tert Butanol is used as a nonreactive solvent to facilitate chemical reactions. It is used as a solvent for paints, lacquers, and varnishes. The compound is also used as an intermediate in the manufacturing of various pharmaceuticals and chemicals, including tert-butyl chloride, tert-butyl phenol, tert-butyl hydroperoxide, isobutylene, and methyl methacrylate. Tert butanol is used an intermediate in the synthesis of other flavors and perfumes as well.

End-Use Industry Insights

Based on end-use industry, the tert butanol market is segmented into flavors and fragrances, paints and coatings, pharmaceuticals, and others. The paints and coatings segment is expected to hold the largest share of the market during the forecast period. Tert butanol is used as a solvent in paints and paint coatings. It is used in formulating defoaming agents that used in the preparation of coatings for paper and paperboards. Further, with the growing building and construction sectors in various countries, the demand for tert butanol is increasing in the solvent and paint remover industries. Alfa Aesar; Evonik Industries Ag; Finar Limited; Kuraray Co., Ltd.; Lotte Chemical Titan Corporation; Lyondellbasell Industries Holdings B.V.; Merck Kgaa; Sisco Research Laboratories Pvt. Ltd.; Tiande Chemical Holdings Limited; Tokyo Chemical Industry Co., Ltd. (TCI) are among the well-established players operating in the global tert butanol market. These companies offer their products worldwide, which help them in catering to a wider customer base. The major market players are highly focused on the development of high-quality and innovative products to meet the customer’s requirements. Key companies in the term butanol market are adopting strategies such as mergers and acquisitions, and product launches. For instance, in 2020, Evonik announced an investment in three product areas, namely Tert butanol (TBA), di-isobutene (DiB) and 3,5,5-trimethylhexanal (TMH). Evonik announced an investment of approximately €15 (US$ 17.72) million in its C4 production network in Marl which will boost the local production capacity for so-called isobutene derivatives by well more than 50% by December 2021.

Tert Butanol

Tert Butanol Market Regional InsightsThe regional trends influencing the Tert Butanol Market have been analyzed across key geographies.

Tert Butanol Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.96 Billion |

| Market Size by 2028 | US$ 6.15 Billion |

| Global CAGR (2021 - 2028) | 3.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Purity

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Tert Butanol Market Players Density: Understanding Its Impact on Business Dynamics

The Tert Butanol Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Report Spotlights

- Progressive tert butanol industry trends, which help players develop effective long-term strategies

- Business growth strategies adopted by companies in developed and developing markets

- Quantitative analysis of the global tert butanol market from 2019 to 2028

- Estimation of the demand for tert butanol across various industries

- Recent developments to understand the competitive market scenario and the demand for tert butanol

- Tret butanol market trends and outlook as well as market drivers and restraints

- Understanding on strategies that underpin commercial interest with regard to the global market growth

- Tert butanol market size at various nodes

- Detailed overview and segmentation of the global tert butanol market as well as its industry dynamics

- Tert butanol market size in various regions with corresponding promising growth opportunities

Tert Butanol Market by Purity

- >99

- ≤ 99

Tert Butanol Market by Application

- Solvents and Intermediates

- Ethanol Denaturants

- MTBEs and ETBEs

- Methylmethacrylates (MMAs)

- Others

Tert Butanol Market by End-Use Industry

- Flavors and Fragrances

- Paints and Coatings

- Pharmaceuticals

- Others

Company Profiles

- Alfa Aesar

- Evonik Industries Ag

- Finar Limited

- Kuraray Co., Ltd.

- Lotte Chemical Titan Corporation

- Lyondellbasell Industries Holdings B.V.

- Merck Kgaa

- Sisco Research Laboratories Pvt. Ltd.

- Tiande Chemical Holdings Limited

- Tokyo Chemical Industry Co., Ltd. (TCI)

Frequently Asked Questions

Based on purity, the tert butanol market is segmented into ≥ 99 and ≤ 99. Based on application, the market is segmented into solvents and intermediates, ethanol denaturants, MTBEs and ETBEs, Methylmethacrylates (MMAs), and others. The end-user segmentation includes flavors and fragrances, paints and coatings, pharmaceuticals, and others.

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For