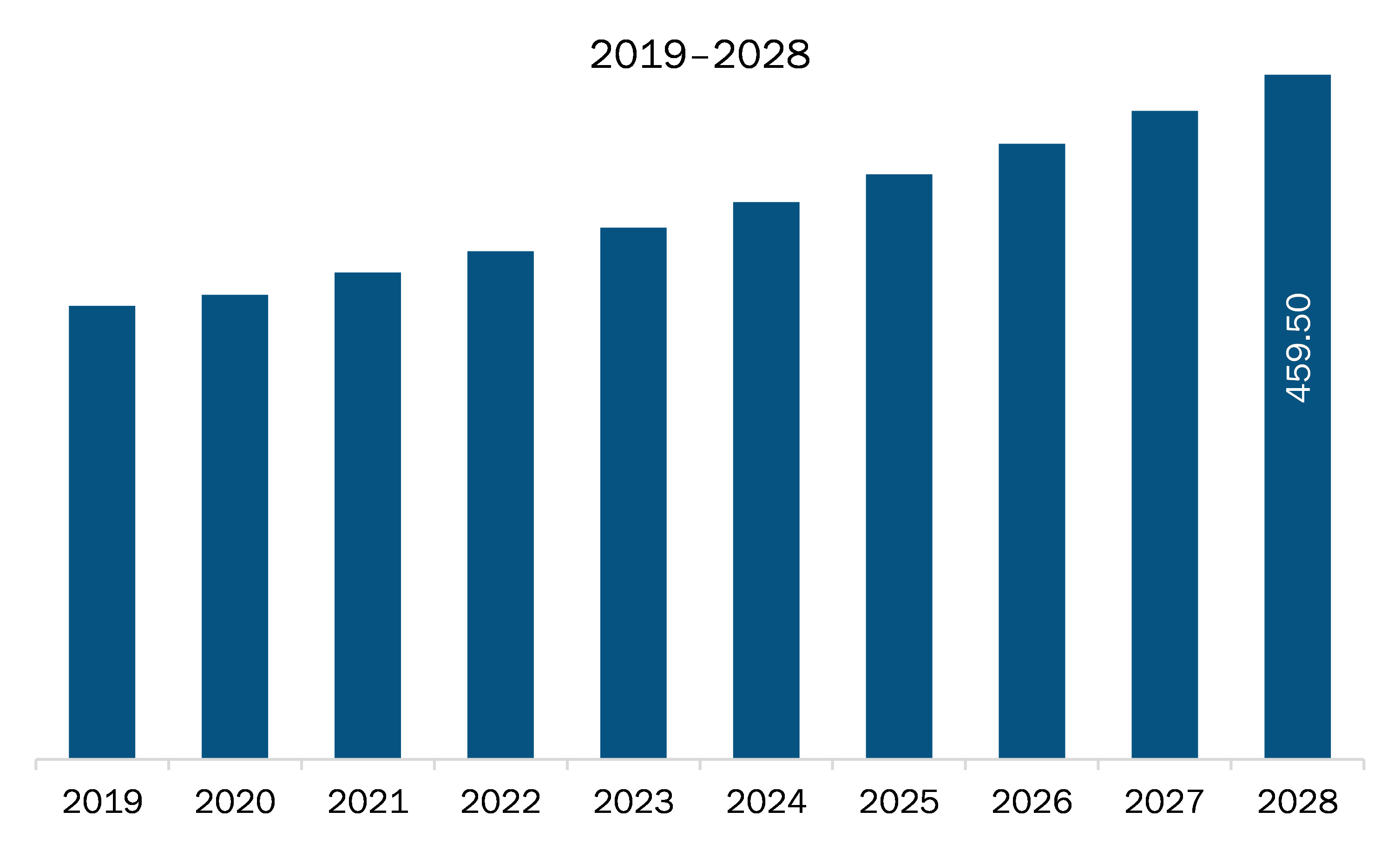

The Asia Pacific commercial aircraft maintenance tooling market is expected to grow from US$ 302.34 million in 2021 to US$ 459.50 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028.

The number of aircraft fleets in commercial aviation has increased significantly over the years. Airlines and regional carriers with a fleet of ATR and Embraer Commercial have been procuring a noteworthy number of aircraft fleets over the past few years. A surge in the procurement of various commercial aircraft fleets has led to a substantial rise in the number of aircraft MRO shops or hangars in the region. The construction of new aircraft MRO hangars and MRO bays is directly proportional to the demand for various maintenance tools, which is one of the critical catalyzers of the commercial aircraft maintenance tooling market. In addition, the continuous investments by companies in the commercial aircraft MRO industry in the expansion of their existing MRO hangars with new bays fuel the commercial aircraft maintenance tooling market growth. According to the International Air Transport Association’s (IATA) report published in June, Asia Pacific airlines faced the worst challenges. The Q4 of 2020 had been turbulent for the Asia Pacific aviation industry as Southeast Asia recorded exorbitant number of COVID-19 cases that forced lockdowns, hampering travel plans. Due to the massive spread of more contagious strains of the COVID-19, several nations such as Singapore, Thailand, Malaysia, and Vietnam have reimposed strict movement restrictions. This has severely affected the Southeast Asian airlines, and the future of some airlines is uncertain, which is subsequently hampering the adoption of new maintenance tools.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific commercial aircraft maintenance tooling market. Commercial aircraft line maintenance service providers and engine maintenance service providers focusing on the procurement of advanced maintenance tools to perform their tasks efficiently. Both line maintenance and engine maintenance are of utmost importance for any aircraft operator. The engine maintenance needs are growing steadily as modern engines are equipped with advanced technologies, while the maintenance cycles are defined by the engine manufacturers. An engine is the highest revenue generation stream for aircraft MRO service providers due to a continuous rise in the production and installation of engines as well as maintenance requirements of the existing engines. The engine segment in aircraft MRO is expected to continue generating significant revenues in the years to come. This is majorly due to the constant rise in production and installation of engines coupled with existing engines. Attributing to the continuous growth of engine usage, the maintenance frequencies, as well as maintenance bays, are also expected to surge in the coming years. Thus, an increase in engine maintenance frequencies and bay. As a result, the engine MRO segment generates noteworthy demand for various maintenance tools, which would bolster the commercial aircraft maintenance tooling market during the forecast period.

Asia Pacific Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Asia Pacific Commercial Aircraft Maintenance Tooling Market Segmentation

Asia Pacific Commercial Aircraft Maintenance Tooling Market – By Tool Type

- Speed Handle

- Wrenches

- Safety Wire Pliers

- Vibration Meters

- Metal Working Tools

- NDT Tools

- Others

Asia Pacific Commercial Aircraft Maintenance Tooling Market – By Users

- MRO Service Providers

- Airline Operator

Asia Pacific Commercial Aircraft Maintenance Tooling Market – By Application

- Engine

- Airframe

- Landing Gear

- Line Maintenance

- Others

Asia Pacific Commercial Aircraft Maintenance Tooling Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

3.4 Data Sources:

4. Asia Pacific Commercial Aircraft Maintenance Tooling Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Premium Insights

4.4.1 Commercial Aircraft Maintenance Specialty Tools, by Airbus and Boeing

4.4.2 Licensed Manufacturers of Airbus and Boeing Tools

4.4.3 Airbus and Boeing Maintenance Tools – Distributors

5. Commercial Aircraft Maintenance Tooling – Market Dynamics

5.1 Market Drivers

5.1.1 Incrementing Number of Aircraft MRO Hangars

5.1.2 Upsurge in the Need for Vibration Meters

5.2 Market Restraints

5.2.1 Less Availability of Skilled Laborers

5.3 Market Opportunities

5.3.1 New Aircraft Fleet Deliveries to Enhance the Market Growth

5.4 Future Trends

5.4.1 Increase in the Usage of Tools for Engine and Line Maintenance

5.5 Impact Analysis of Drivers and Restraints

6. Commercial Aircraft Maintenance Tooling Market – Asia Pacific Analysis

6.1 Asia Pacific Commercial Aircraft Maintenance Tooling Market Overview.

6.2 Asia Pacific Commercial Aircraft Maintenance Tooling Market Revenue Forecast and Analysis

7. Asia Pacific Commercial Aircraft Maintenance Tooling Market Analysis – By Tool Type

7.1 Overview

7.2 Commercial Aircraft Maintenance Tooling Market Breakdown, By Tool Type (2020 and 2028)

7.3 Speed Handle

7.3.1 Overview

7.3.2 Speed Handle: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.4 Wrenches

7.4.1 Overview

7.4.2 Wrenches: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.5 Safety Wire Pliers

7.5.1 Overview

7.5.2 Safety Wire Pliers: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.6 Vibration Meter

7.6.1 Overview

7.6.2 Vibration Meter: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.7 Metalworking Tools

7.7.1 Overview

7.7.2 Metalworking Tools: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.8 NDT Tools

7.8.1 Overview

7.8.2 NDT Tools: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

7.9 Others

7.9.1 Overview

7.9.2 Others: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

8. Asia Pacific Commercial Aircraft Maintenance Tooling Market Analysis – By Users

8.1 Overview

8.2 Commercial Aircraft Maintenance Tooling Market Breakdown, By Users (2020 and 2028)

8.3 MRO Service Providers

8.3.1 Overview

8.3.2 MRO Service Providers: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

8.4 Airline Operators

8.4.1 Overview

8.4.2 Airline Operators: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

9. Asia Pacific Commercial Aircraft Maintenance Tooling Market Analysis – By Application

9.1 Overview

9.2 Commercial Aircraft Maintenance Tooling Market Breakdown, By Application (2020 and 2028)

9.3 Engine

9.3.1 Overview

9.3.2 Engine: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

9.4 Airframe

9.4.1 Overview

9.4.2 Airframe: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

9.5 Landing Gear

9.5.1 Overview

9.5.2 Landing Gear: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

9.6 Line Maintenance

9.6.1 Overview

9.6.2 Line Maintenance: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

10. Asia Pacific Commercial Aircraft Maintenance Tooling Market – Country Analysis

10.1 Asia-Pacific: Commercial Aircraft Maintenance Tooling Market

10.1.1 Asia-Pacific: Commercial Aircraft Maintenance Tooling Market, By Country

10.1.1.1 Australia: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Australia: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.1.2 Australia: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.1.3 Australia: Commercial Aircraft Maintenance Tooling Market, By Application

10.1.1.2 China: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 China: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.2.2 China: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.2.3 China: Commercial Aircraft Maintenance Tooling Market, By Application

10.1.1.3 India: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 India: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.3.2 India: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.3.3 India: Commercial Aircraft Maintenance Tooling Market, By Application

10.1.1.4 Japan: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.4.1 Japan: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.4.2 Japan: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.4.3 Japan: Commercial Aircraft Maintenance Tooling Market, By Application

10.1.1.5 South Korea: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.5.1 South Korea: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.5.2 South Korea: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.5.3 South Korea: Commercial Aircraft Maintenance Tooling Market, By Application

10.1.1.6 Rest of Asia-Pacific: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.6.1 Rest of Asia-Pacific: Commercial Aircraft Maintenance Tooling Market, By Tool Type

10.1.1.6.2 Rest of Asia-Pacific: Commercial Aircraft Maintenance Tooling Market, By User

10.1.1.6.3 Rest of Asia-Pacific: Commercial Aircraft Maintenance Tooling Market, By Application

11. Asia Pacific Commercial Aircraft Maintenance Tooling Market - COVID-19 Impact Analysis

11.1 Overview

11.2 APAC: Impact Assessment of COVID-19 Pandemic

12. Asia Pacific Commercial Aircraft Maintenance Tooling Market-Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Launch

12.4 Merger and Acquisition

13. Company Profiles

13.1 HYDRO SYSTEMS KG

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Red Box Aviation

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Stanley Black & Decker, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Shanghai kaviation Techology Co., Ltd

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 STAHLWILLE Eduard Wille GmbH & Co. KG

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Field International Group Limited

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Henchman Products

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Dedienne Aerospace

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Tronair Inc.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Snap-On Incorporated

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. Asia Pacific Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Table 2. Australia Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 3. Australia Commercial Aircraft Maintenance Tooling Market, By User – Revenue and Forecast to 2028 (US$ Million)

Table 4. Australia Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 5. China Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 6. China Commercial Aircraft Maintenance Tooling Market, By User – Revenue and Forecast to 2028 (US$ Million)

Table 7. China Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 8. India Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 9. India Commercial Aircraft Maintenance Tooling Market, By User – Revenue and Forecast to 2028 (US$ Million)

Table 10. India Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 11. Japan Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 12. Japan Commercial Aircraft Maintenance Tooling Market, By User– Revenue and Forecast to 2028 (US$ Million)

Table 13. Japan Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 14. South Korea Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 15. South Korea Commercial Aircraft Maintenance Tooling Market, By User – Revenue and Forecast to 2028 (US$ Million)

Table 16. South Korea Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 17. Rest of Asia-Pacific Commercial Aircraft Maintenance Tooling Market, By Tool Type– Revenue and Forecast to 2028 (US$ Million)

Table 18. Rest of Asia-Pacific Commercial Aircraft Maintenance Tooling Market, By User – Revenue and Forecast to 2028 (US$ Million)

Table 19. Rest of Asia-Pacific Commercial Aircraft Maintenance Tooling Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 20. List of Abbreviation

LIST OF FIGURES

Figure 1. Commercial Aircraft Maintenance Tooling Market Segmentation

Figure 2. Commercial Aircraft Maintenance Tooling Market Segmentation – By Country

Figure 3. Asia Pacific Commercial Aircraft Maintenance Tooling Market Overview

Figure 4. Commercial Aircraft Maintenance Tooling Market, by Tool Type

Figure 5. Commercial Aircraft Maintenance Tooling Market, by Application

Figure 6. Commercial Aircraft Maintenance Tooling Market, By Country

Figure 7. Commercial Aircraft Maintenance Tooling Market– Porter’s Analysis

Figure 8. Ecosystem Analysis

Figure 9. Aircraft Delivery by Airbus and Boeing in 2019, 2020, and 2021 (Till Q2)

Figure 10. Commercial Aircraft Maintenance Tooling Market: Impact Analysis of Drivers and Restraints

Figure 11. Asia Pacific Commercial Aircraft Maintenance Tooling Market Revenue Forecast and Analysis (US$ Million)

Figure 12. Commercial Aircraft Maintenance Tooling Market Breakdown, By Tool Type (2020 and 2028)

Figure 13. Speed Handle: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Wrenches: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Safety Wire Pliers: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. Vibration Meter: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Metalworking Tools: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. NDT Tools: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. Others: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Commercial Aircraft Maintenance Tooling Market Breakdown, By Users (2020 and 2028)

Figure 21. MRO Service Providers: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Airline Operators: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Commercial Aircraft Maintenance Tooling Market Breakdown, By Application (2020 and 2028)

Figure 24. Engine: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. Airframe: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. Landing Gear: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 27. Line Maintenance: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 28. Others: Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

Figure 29. Asia Pacific: Commercial Aircraft Maintenance Market, by Key Country – Revenue (2020) (USD Million)

Figure 30. Asia-Pacific: Commercial Aircraft Maintenance Tooling Market Revenue Share, By Country (2020 and 2028)

Figure 31. Australia: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. China: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. India: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Japan: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. South Korea: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Rest of Asia-Pacific: Commercial Aircraft Maintenance Tooling Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic in APAC Country Markets

- HYDRO SYSTEMS KG

- Red Box Aviation

- Stanley Black & Decker, Inc.

- Shanghai kaviation Techology Co., Ltd.

- STAHLWILLE Eduard Wille GmbH & Co. KG

- Field International Group Limited

- Henchman Products

- Dedienne Aerospace

- Tronair Inc.

- Snap-On Incorporated

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Asia Pacific Commercial Aircraft Maintenance Tooling Market

Dec 2021

Aerospace Stainless Steel And Superalloy Fasteners Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type [Stainless Steel, Superalloy (A286, Inconel 718, Waspaloy, and Others)], Application (Airframe, Engine, Interior, and Others), Aircraft Type (Fixed Wing and Rotary Wing), Product Type (Screws, Rivets, Nut/Bolts, and Others), and Geography

Dec 2021

Military Antenna Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Aperture Antennas, Dipole Antennas, Travelling Wave Antennas, Monopole Antennas, Loop Antennas, Array Antennas, Others); Frequency (High Frequency, Very High Frequency, Ultra-High Frequency); Platform (Marine, Ground, Airborne); Application (Communication, Telemetry, Electronic Warfare, Surveillance, Navigation); and Geography

Dec 2021

Helicopter MRO Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Airframe Maintenance, Engine Maintenance, Component Maintenance, Line Maintenance); Helicopter Type (Light Helicopter, Medium Helicopter, Heavy Helicopter); End User (Commercial, Military); and Geography

Dec 2021

Airport Infrastructure Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Airport Type (Commercial Airport, Military Airport, General Aviation Airport); Infrastructure Type (Terminal, Control Tower, Taxiway & Runway, Hangar, Others); and Geography

Dec 2021

Airport Fueling Equipment Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5000 litres, 5000-20000 litres, Above 20000 litres); Aircraft Type (Civil Aircraft, Military Aircraft); Power Source (Electric, Non-Electric); and Geography

Dec 2021

Dec 2021

Airborne Pods Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Combat Aircraft, Helicopters, UAVs and Others); Pod Type (ISR, Targeting, and Countermeasure); Sensor Technology (EO/IR, EW/EA, and IRCM); Range (Short, Long, and Intermediate); and Geography

Dec 2021

Air Defense Radar Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Range (Long Range, Medium Range, Short Range); Product Type (Synthetic Aperture and Moving Target Indicator Radar, Surveillance Radar, Airborne Early Warning Radar, Multi-functional Radar, Weather Radar, Others); System Type (Fixed, Portable); Platform (Ground-based, Aircraft-mounted, Naval-based); Application (Ballistic Missile Defense, Identification Friend or Foe, Weather Forecasting, Others); and Geography

Get Free Sample For

Get Free Sample For