Helicopter MRO Market Trends, Growth Factors and Forecast 2031

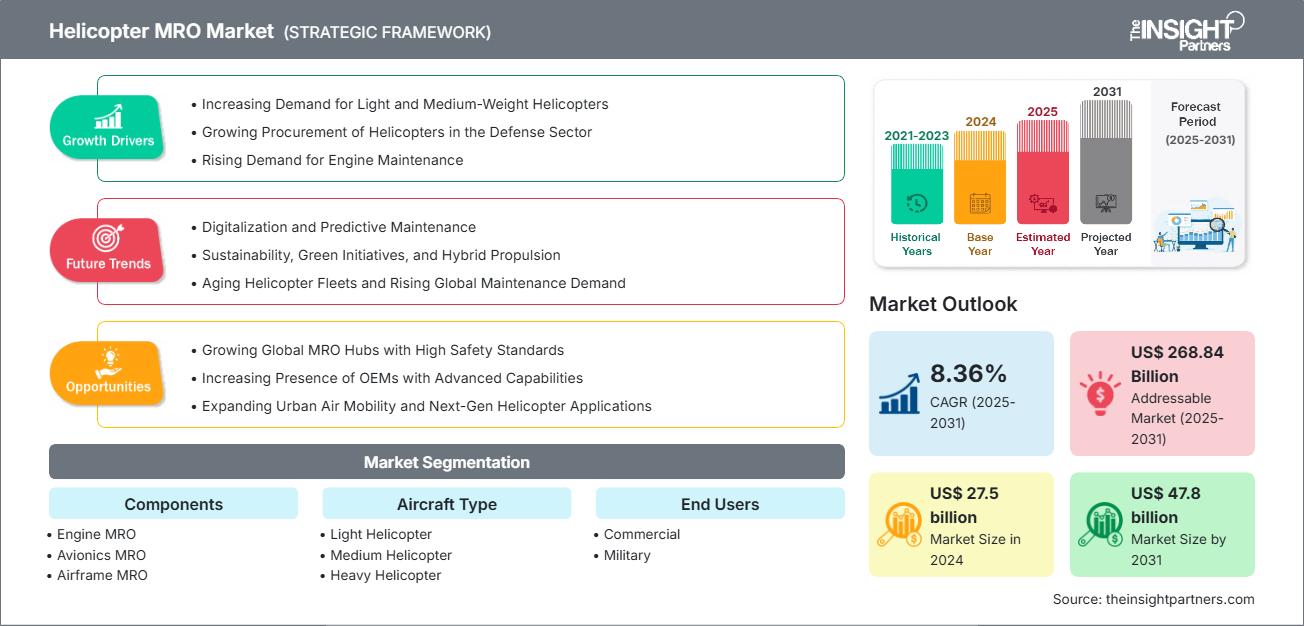

Helicopter MRO Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Components (Engine MRO, Avionics MRO, Airframe MRO, Cabin MRO, Landing Gear MRO, and Others), Aircraft Type (Light Helicopter, Medium Helicopter, and Heavy Helicopter), End Users (Commercial and Military), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPRE00019086

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 297

The helicopter MRO market size is expected to reach US$ 47.8 billion by 2031 from US$ 27.5 billion in 2024. The market is anticipated to register a CAGR of 8.36% during 2025–2031.

Helicopter MRO Market Analysis

The helicopter MRO market is expanding due to rising defense spending, aging fleet maintenance, and increasing commercial aviation demand, with digitalization and predictive maintenance technologies driving efficiency and cost optimization.

Helicopter MRO Market Overview

Technological partnerships, use of additive manufacturing, and OEM-independent service centers are reshaping the helicopter MRO market, enhancing component reliability, turnaround speed, and competitive aftermarket dynamics across global operators.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHelicopter MRO Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Helicopter MRO Market Drivers and Opportunities

Market Drivers:

- Aging Fleet Replacement Needs: A growing number of aging helicopters requires frequent overhauls, boosting demand for MRO services.

- Increased Defense and Homeland Security Spending: Governments expanding helicopter fleets for defense and surveillance drive consistent MRO requirements.

- Rising Demand for Air Medical and Rescue Services: More EMS and SAR operations increase helicopter flight hours, raising maintenance needs.

- Technological Advancements in Maintenance Tools: Use of digital twins, AI diagnostics, and predictive maintenance enhances efficiency and attracts operators.

- Stringent Safety and Regulatory Standards: Compliance with international aviation safety norms ensures recurring maintenance and inspections.

Market Opportunities:

- Emerging Markets Growth: Developing countries investing in helicopter infrastructure open up new MRO business opportunities.

- Aftermarket Partnerships Growth: Jointly developing solutions through OEM and independent MRO partnerships leads to more flexible service delivery models.

- Capitalizing on Sustainable Maintenance Practices: This can include eco-friendly materials and reducing service waste to incorporate into new service delivery models.

- 3D Printing Integrated: Manufacturing parts on demand can reduce downtime and lower supply chain management costs.

- Digitalization and Remote Monitoring Solutions: Data driven maintenance tracking reveals predictive insights and opportunities for service innovation.

Helicopter MRO Market Report Segmentation Analysis

The helicopter MRO market is categorized into distinct segments to understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Engine MRO: Relates to the maintenance, overhauling, and performance enhancement of helicopter engines to maintain reliability, fuel consumption, and operational life.

- Avionics MRO: Entails the maintenance and upgrade of navigation, communication, and flight control systems to enhance safety and operational capability.

- Airframe MRO: Related to the inspection, structural repairs, and corrosion control of the helicopter fuselage and rotor systems to maintain airworthiness.

- Cabin MRO: Concerned with the refurbishment, reconfiguration, and maintenance of cabin interiors to improve passenger comfort and adaptability for the mission.

- Landing Gear MRO: Related to maintenance, testing, and replacement of components in the land systems to ensure safety in takeoff and landing operations.

- Others: Refers to any auxiliary systems, including hydraulics, fuel systems, and electrical circuits that enable safe performance of the helicopter.

By Aircraft Type:

- Light Helicopter

- Medium Helicopter

- Heavy Helicopter

By End Users:

- Commercial

- Military

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Helicopter MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 27.5 billion |

| Market Size by 2031 | US$ 47.8 billion |

| Global CAGR (2025 - 2031) | 8.36% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Components

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Helicopter MRO Market Players Density: Understanding Its Impact on Business Dynamics

The Helicopter MRO Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Helicopter MRO Market Share Analysis by Geography

The helicopter MRO market in Asia Pacific is experiencing rapid growth driven by rapid growth driven by expanding defense budgets, increasing civil aviation activities, and rising demand for emergency and offshore operations. Emerging markets in South & Central America, the Middle East, and Africa present untapped opportunities for helicopter MRO, enabling healthcare providers to expand access to advanced treatments and improve patient outcomes in these regions.

The helicopter MRO market growth differs in each region due to variations in fleet size, operational intensity, regulatory frameworks, technological adoption, and defense versus commercial sector demand. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- High Utilization Across Sectors: Extensive helicopter use in EMS, law enforcement, and offshore operations boosts maintenance demand.

- Strong OEM and MRO Presence

- Investment in Advanced Maintenance Technologies

- Trends: Predictive Maintenance Adoption.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

-

Key Drivers:

- Aging Helicopter Fleet: Older aircraft in Europe require frequent maintenance and overhauls, boosting MRO demand.

- Strict Safety and Regulatory Standards

- Growth in Offshore and Emergency Services

- Trends: Digitalization and Predictive Maintenance.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

-

Key Drivers:

- Rapid Expansion of Helicopter Fleets: Increasing civil, commercial, and defense helicopter operations drive higher maintenance demand.

- Growing Offshore Oil & Gas Activities

- Increasing Defense Modernization Programs

- Trends: Adoption of 3D Printing for Components.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Expanding Oil & Gas and Energy Sectors: Increased offshore and onshore operations drive higher helicopter usage and maintenance demand.

- Rising Defense Expenditure

- Growth in Emergency Medical and Tourism Services.

- Trends: Integration of Advanced Diagnostics and Predictive Maintenance.

5. South & Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Growing Oil & Gas and Mining Operations: Expanding extractive industries increase helicopter utilization and maintenance requirements.

- Rising Demand for Emergency Medical and Disaster Relief Services

- Fleet Modernization Initiatives.

- Trends: Adoption of Mobile and Remote Maintenance Solutions.

Helicopter MRO Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as StandardAero, Inc.; Leonardo SpA; Fokker Services Group; BIGAS GRUP HELICOPTERS S.L.U.; NHV Group NV; Rotortrade Services; Patria Group; Lockheed Martin Corp; Hindustan Aeronautics Limited (HAL); and Honeywell International Inc.

This high level of competition urges companies to stand out by offering:

- Advanced Predictive Maintenance Solutions

- Faster Turnaround Times

- Comprehensive Service Offerings

- Customization and Flexible Contracts

- Use of Innovative Technologies.

Opportunities and Strategic Moves

- Adoption of digital and predictive maintenance solutions opens new service revenue streams.

- Investing in advanced technologies such as 3D printing and AI-driven diagnostics to reduce turnaround time and costs.

Note: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Patria Group

- Rotortrade Services

- NHV Group NV

- BIGAS GRUP HELICOPTERS S.L.U.

- Fokker Services Group

- Leonardo SpA

- StandardAero, Inc.

- Sjöfartsverket

- Airbus SE

- HeliService International GmbH

Helicopter MRO Market News and Recent Developments

- Leonardo SpA selected PHI MRO Services as an approved supplier, October 2024: Leonardo SpA has announced that they have selected PHI MRO Services as an approved supplier. Moreover, this multi-year agreement will enhance the operational capabilities of Leonardo, further solidifying the partnership between the two organizations.

- Fokker Services Group signed a Memorandum of Understanding (MOU) with Airbus Helicopters for MRO services, November 2024: Fokker Services Group announced that they have signed a Memorandum of Understanding (MOU) with Airbus Helicopters for MRO services on H225M helicopters. The agreement covers MRO services for 12 Airbus H225M helicopters to be operated by the Dutch Ministry of Defense. Under the MOU, Airbus Helicopters and FSG will collaborate to establish the H225M base maintenance capabilities in the Netherlands, enabling the Royal Netherlands Air Force (RNLAF) to access comprehensive aircraft maintenance capabilities whenever needed.

Helicopter MRO Market Report Coverage and Deliverables

The "Helicopter MRO Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Helicopter MRO Market size and forecast at global, regional, and country levels for key market segments covered under the scope

- Helicopter MRO Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time Location Systems Market For Healthcare analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the helicopter MRO market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For