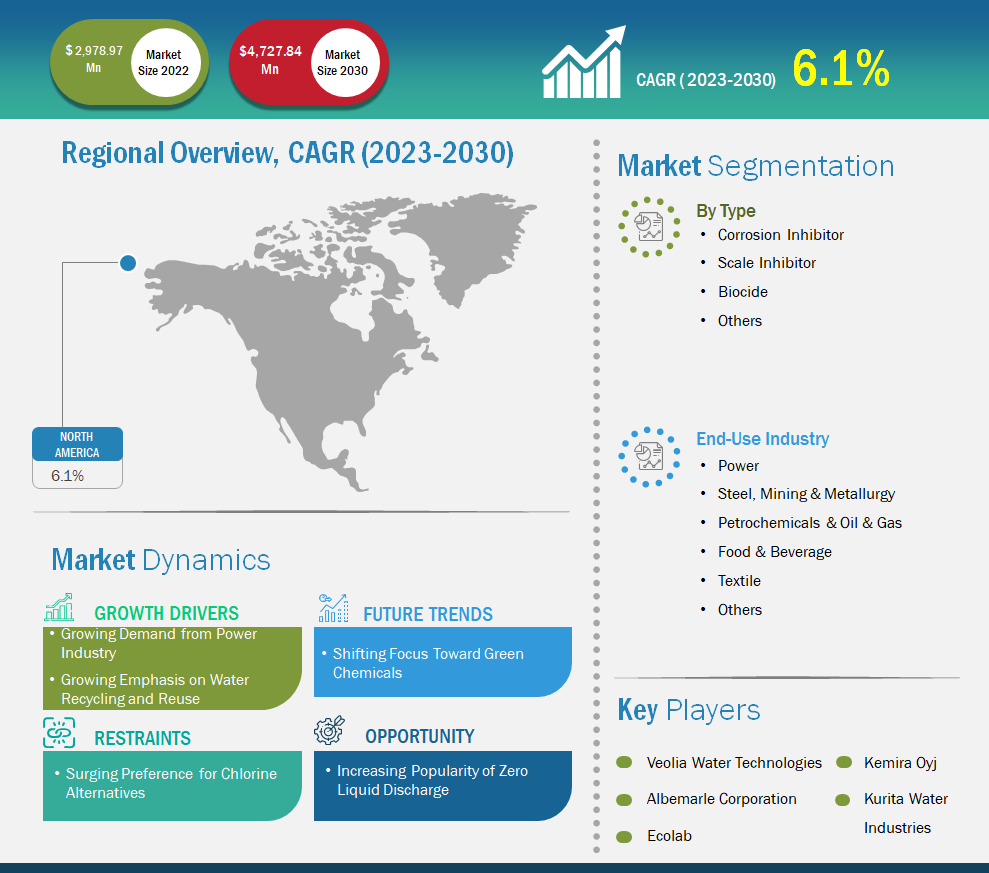

The North America cooling water treatment chemicals market size is expected to grow from US$ 2,978.97 million in 2022 to US$ 4,727.84 million by 2030; it is expected to register a CAGR of 6.1% from 2023 to 2030.

Market Insights and Analyst View:

Cooling water treatment chemicals help in removing unwanted, harmful bacteria from cooling systems. They are mainly used for protecting the system from corrosion, and control scale formation and fouling, in addition to prohibiting the growth of harmful bacteria. The North America cooling water treatment chemicals market is growing at a significant pace with the increasing demand due to the stringent regulations by the government on the conservation of water and wastewater management. Furthermore, the rising need for fresh water in several industries is likely to drive the market growth in this region.

Growth Drivers and Challenges:

The chemicals used in various industries for water treatment harm the environment to a great extent and lead to severe health hazards among people exposed to them. Industries are seeking ways to improve their operations and make them eco-friendly. Rising awareness about global warming and other environmental issues has forced several industries to shift their focus toward safer options. This has encouraged manufacturers of water treatment chemicals to innovate and develop more sustainable and reliable products. Green chemicals are extracted from vegetables and renewable feedstock, and they make use of the chemical and colloidal properties of certain plant extracts. They are devoid of harmful side effects to humans and are biodegradable. Moreover, they have functionality that is equivalent to synthetic ones. Thus, manufacturers providing water treatment chemicals are expanding their product lines with these green chemicals. For example, Thermax Limited, an engineering company involved in energy and the environment, offers a range of green scale and corrosion inhibitors, oxygen scavengers, and neutralizers for boiler water and cooling water treatment.

Continuous chlorination can affect non-target organisms in once-through cooling frameworks, which can disrupt the population of some of the valuable organisms. Industrial facilities must dechlorinate their cooling water before release to adhere to discharge water quality standards. This requires the feed of a reducing agent, e.g., sodium bisulfite, into the emission, which adds extra cost to the process. Asa result, companies have shifted their focus to chlorine alternatives for cooling water treatment. Bromine, bromo- chloro-dimethyl-hydantoin (BCDMH), sodium hypochlorite, chlorine dioxide, and ozone are among the popular chlorine alternatives used in this process. They are cost-effective, more stable, and safer than chlorine, and they exhibit a wide scope of applications. Thus, the growing inclination toward chlorine alternatives hinders the cooling water treatment chemicals market to a certain extent.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Cooling Water Treatment Chemicals Market: Strategic Insights

Market Size Value in US$ 2,978.97 million in 2022 Market Size Value by US$ 4,727.84 million by 2030 Growth rate CAGR of 6.1% from 2023 to 2030 Forecast Period 2023-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Cooling Water Treatment Chemicals Market: Strategic Insights

| Market Size Value in | US$ 2,978.97 million in 2022 |

| Market Size Value by | US$ 4,727.84 million by 2030 |

| Growth rate | CAGR of 6.1% from 2023 to 2030 |

| Forecast Period | 2023-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

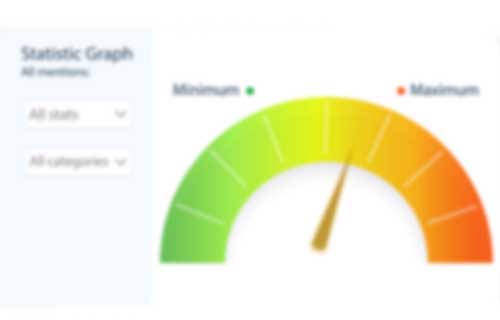

The “North America Cooling Water Treatment Chemicals Market” is segmented based on type, end-use industry, and geography. Based on type, the cooling water treatment chemicals market is segmented into corrosion inhibitors, scale inhibitors, biocides, and others. Based on end-use industry the cooling water treatment chemicals market is segmented into power; steel and mining & metallurgy; petrochemicals and oil & gas; food & beverages; textiles; and others. The cooling water treatment chemicals market based on geography is segmented into North America (US, Canada, and Mexico).

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

Based on type, the cooling water treatment chemicals market is segmented into corrosion inhibitors, scale inhibitors, biocides, and others. Based on end-use industry the cooling water treatment chemicals market is segmented into power; steel and mining & metallurgy; petrochemicals and oil & gas; food & beverages; textiles; and others. The power segment held the significant share in the cooling water treatment chemicals market and mining & metallurgy segment is expected to register the significant growth over the forecast period. The power industry is the largest consumer of cooling water treatment chemicals owing to the high-water requirement of the industry and the need to preserve freshwater resources. Water is utilized in high-pressure boilers, turbines, and cooling towers to generate power. Water treatment is a crucial procedure for the power industry. High-virtue water guarantees legitimate activity of the steam age framework, and lessens blowdown recurrence and utilization of heater synthetic substances. Effective cooling water treatment is necessary for ensuring maximum profitability and nonstop activity of the power industry. Moreover, power industries involving nuclear and thermal plants often use seawater for cooling and are equipped with anticorrosion heat exchange equipment. The increasing number of nuclear plants across the region, coupled with the need to maintain the existing plants, is expected to propel the demand for cooling water treatment chemicals in the coming years.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Country Analysis:

Based on geography, the cooling water treatment chemicals market is divided into three key countries: the US, Canada, and Mexico. The North America cooling water treatment chemicals market is dominated by the US which accounted for 2,978.97 million in 2022. Canada is a second major contributor holding more than 13% share in the North America market. Mexico is expected to register the considerable growth at a CAGR of 6.3% over the forecast period. The power and food & beverages industries are the major consumers of cooling water treatment chemicals in Canada. Canada has well-established food & beverages and power generation industries. The country is home to leading food and beverage industrial players and ~6,500 food and beverage processing companies in total. Top food & beverage industry players having strong presence in Canada include Kellogg’s, Quaker, Nestle, Pepsico, Molson, McCain, Maple Leaf, Saputo, and Lassonde. Therefore, the flourishing food & beverages and power industries are likely to continue to propel the growth of the cooling water treatment chemicals market in Canada in the future.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the cooling water treatment chemicals market are listed below:

- In November 2022, Albemarle Corporation announced planned investments of up to US$540 million to expand and modernize two bromine facilities in Magnolia, Arkansas, designed to meet the growing demand for fire safety and specialty products in several industries, including technology, safety, transportation, and green energy.

- In April 2019, Chemtreat, Inc. opened new applied technology laboratory in Ashland, Virginia. Its 25,000-square-foot facility will be built across the street from an existing ChemTreat manufacturing plant in the Hanover County Airpark. This laboratory will provide advanced capabilities to support ChemTreat’s global base of industrial water treatment customers with industry-leading water analysis.

Covid-19 Impact:

The COVID-19 pandemic has affected economies and industries in various countries due to lockdowns, travel restrictions, and business shutdowns. The chemical & materials industry suffered serious disruptions in supply chains and shutdowns of production plants in the initial phases of the pandemic. The shutdown of manufacturing plants in leading countries in North America, Europe, and Asia Pacific disrupted the supply chains, manufacturing, delivery schedules, and goods sales. Further, various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various countries in Europe, Asia, and North America on international travel compelled enterprises to temporarily suspend their collaboration and partnership plans. All these factors hampered the chemical & materials industry growth in 2020 and early 2021, thereby restraining the growth of various markets related to this industry such as cooling water treatment chemicals market.

Before the emergence of the COVID-19 pandemic, the cooling water treatment chemicals market in North America was mainly driven by factors such as the high demand from industries such as food & beverages, oil & gas, textile, steel, and power. The COVID-19 outbreak in North America hampered the operations of these industries. Raw material and labor shortages due to supply chain disruptions caused by lockdowns and trade bans halted the production of various packaged food and beverages. Due to the shortage of raw materials, there was a sudden spike in their prices, which negatively impacted the pricing strategies of various small-scale and large-scale players operating in the North America cooling water treatment chemicals market. The manufacturers were forced to shut down their manufacturing plants, which created supply challenges and widened the demand–supply gap. All these factors hampered the chemical & materials industry growth in 2020 and early 2021, thereby restraining the growth of various markets related to this industry such as the cooling water treatment chemicals market. The market was also hampered by disrupted supply chains and limited operational efficiencies. In March 2020, US crude oil production fell by 8%, recording the largest annual decrease in the US. The oil prices decreased because of the sudden drop in the demand for petroleum amid the social restrictions imposed by governments.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the North America cooling water treatment chemicals market include Accepta, Albemarle Corporation, Buckman, Chemtex Speciality Limited, ChemTreat, Inc., DuBois Chemicals, Ecolab, Veolia Water Technologies, Kemira Oyj, and Kurita Water Industries LTD among others. These market players are highly focused on developing innovative products to serve their customers better.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, Mexico, United States

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Cooling Water Treatment Chemicals Market – By Type

1.3.2 North America Cooling Water Treatment Chemicals Market – By End-Use Industry

1.3.3 North America Cooling Water Treatment Chemicals Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Cooling Water Treatment Chemicals Market Landscape

4.1 Market Overview

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End Use Industry

4.4 Expert Opinions

5. Cooling Water Treatment Chemicals Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Demand from Power Industry

5.1.2 Growing Emphasis on Water Recycling and Reuse

5.2 Market Restraints

5.2.1 Surging Preference for Chlorine Alternatives

5.3 Market Opportunities

5.3.1 Increasing Popularity of Zero Liquid Discharge

5.4 Future Trends

5.4.1 Shifting Focus Toward Green Chemicals

5.5 Impact Analysis

6. Cooling Water Treatment Chemicals – North America Market Analysis

6.1 North America Cooling Water Treatment Chemicals Market Overview

6.2 Cooling Water Treatment Chemicals Market Forecast and Analysis

6.3 Market Positioning – Key Market Players

7. Cooling Water Treatment Chemicals Market Analysis – By Type

7.1 Overview

7.2 Cooling Water Treatment Chemicals Market, By Type (2022 and 2030)

7.3 Scale Inhibitor

7.3.1 Overview

7.3.2 Scale Inhibitor: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Corrosion Inhibitor

7.4.1 Overview

7.4.2 Corrosion Inhibitor: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Biocide

7.5.1 Overview

7.5.2 Biocide: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Other Type

7.6.1 Overview

7.6.2 Other Type: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

8. Cooling Water Treatment Chemicals Market Analysis – By End Use Industry

8.1 Overview

8.2 Cooling Water Treatment Chemicals Market, By End Use Industry (2022 and 2030)

8.3 Power

8.3.1 Overview

8.3.2 Power: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Steel, Mining, & Metallurgy

8.4.1 Overview

8.4.2 Steel, Mining, & Metallurgy: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Petrochemicals, Oil, & Gas

8.5.1 Overview

8.5.2 Petrochemicals, Oil, & Gas: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Food & Beverages

8.6.1 Overview

8.6.2 Food & Beverages: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Textile

8.7.1 Overview

8.7.2 Textile: Cooling Water Treatment Chemicals Market– Revenue and Forecast to 2030 (US$ Million)

8.8 Other End Use

8.8.1 Overview

8.8.2 Other End Use: Cooling Water Treatment Chemicals Market– Revenue and Forecast to 2030 (US$ Million)

9. Cooling Water Treatment Chemicals Market – Geographic Analysis

9.1 North America: Cooling Water Treatment Chemicals Market

9.1.1 North America: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

9.1.2 North America: Cooling Water Treatment Chemicals Market, by Key Country

9.1.2.1 US: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

9.1.2.1.1 US: Cooling Water Treatment Chemicals Market, by Type

9.1.2.1.2 US: Cooling Water Treatment Chemicals Market, by End Use

9.1.2.2 Canada: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

9.1.2.2.1 Canada: Cooling Water Treatment Chemicals Market, by Type

9.1.2.2.2 Canada: Cooling Water Treatment Chemicals Market, by End Use

9.1.2.3 Mexico: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

9.1.2.3.1 Mexico: Cooling Water Treatment Chemicals Market, by Type

9.1.2.3.2 Mexico: Cooling Water Treatment Chemicals Market, by End Use

10. Impact of COVID-19 Pandemic on North America Cooling Water Treatment Chemicals Market

10.1 North America: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Strategy and Business Planning

11.2 Product News

12. Company Profiles

12.1 Albemarle Corp

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Buckman Laboratories lnternational Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Chemtex Speciality LTD

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 ChemTreat Inc

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 DuBois Chemicals Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Ecolab Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Veolia Water Solutions & Technologies SA

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Kemira Oyj

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Kurita Water Industries Ltd

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Accepta Ltd

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. North America Cooling Water Treatment Chemicals Market Revenue Forecast to 2030 (US$ Mn)

Table 2. North America Cooling Water Treatment Chemicals Market, by Type – Revenue and Forecast to 2030 (US$ Million)

Table 3. North America Cooling Water Treatment Chemicals Market, by End Use Industry– Revenue and Forecast to 2030 (US$ Million)

Table 4. US Cooling Water Treatment Chemicals Market, by Type – Revenue and Forecast to 2030 (US$ Million)

Table 5. US Cooling Water Treatment Chemicals Market, by End Use – Revenue and Forecast to 2030 (US$ Million)

Table 6. Canada: Cooling Water Treatment Chemicals Market, by Type – Revenue and Forecast to 2030 (US$ Million)

Table 7. Canada Cooling Water Treatment Chemicals Market, by End Use – Revenue and Forecast to 2030 (US$ Million)

Table 8. Mexico Cooling Water Treatment Chemicals Market, by Type – Revenue and Forecast to 2030 (US$ Million)

Table 9. Mexico Cooling Water Treatment Chemicals Market, by End Use – Revenue and Forecast to 2030 (US$ Million)

Table 10. List of Abbreviation

LIST OF FIGURES

Figure 1. Cooling Water Treatment Chemicals Market Segmentation

Figure 2. Cooling Water Treatment Chemicals Market Segmentation – By Region

Figure 3. North America Cooling Water Treatment Chemicals Market Overview

Figure 4. The Power Industry is The Biggest Consumer of Cooling Water Treatment Chemicals

Figure 5. The US Held Largest Share of Cooling Water Treatment Chemicals Market in 2022

Figure 6. North America Cooling Water Treatment Chemicals Market, Industry Landscape

Figure 7. Porter's Five Forces Analysis: Cooling Water Treatment Chemicals Market

Figure 8. Ecosystem: Cooling Water Treatment Chemicals Market

Figure 9. Expert Opinion

Figure 10. Impact Analysis of Drivers and Restraints

Figure 11. Geographic Overview of Cooling Water Treatment Chemicals Market

Figure 12. North America Cooling Water Treatment Chemicals Market Forecast and Analysis, 2020–2030 (US$ Mn)

Figure 13. Cooling Water Treatment Chemicals Market Revenue Share, By Type (2022 and 2030)

Figure 14. Scale Inhibitor: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 15. Corrosion Inhibitor: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 16. Biocide: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 17. Other Type: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 18. Cooling Water Treatment Chemicals Market Revenue Share, By End Use (2022 and 2030)

Figure 19. Power: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 20. Steel, Mining, & Metallurgy: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 21. Petrochemicals, Oil, & Gas: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 22. Food & Beverages: Cooling Water Treatment Chemicals Market – Revenue and Forecast To 2030 (US$ Million)

Figure 23. Textile: Cooling Water Treatment Chemicals Market– Revenue and Forecast To 2030 (US$ Million)

Figure 24. Other End Use: Cooling Water Treatment Chemicals Market– Revenue and Forecast To 2030 (US$ Million)

Figure 25. North America: Cooling Water Treatment Chemicals Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. North America: Cooling Water Treatment Chemicals Market Revenue Share, by Key Country (2022 and 2030)

Figure 27. US: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

Figure 28. Canada: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

Figure 29. Mexico: Cooling Water Treatment Chemicals Market –Revenue and Forecast to 2030 (US$ Million)

Figure 30. Impact of COVID-19 Pandemic on North American Country Markets

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jul 2023

Rhamnolipids Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Mono-rhamnolipids and Di-rhamnolipids), Application [Daily Chemicals (Laundry Detergents, Dishwashers, Surface Cleaners, and Others), Personal Care and Cosmetics, Agriculture, Food, Pharmaceuticals, Oilfield and Petroleum, Environmental Protection, and Others] and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jul 2023

Europe Spray Marking Paints Market

Size and Forecast (2021 - 2035), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propellant Type [LPG, Dimethyl Ether (DME), and Others], By Technology (Solvent-Based, Water-Based, and Others), By Application [Construction (Geodesy and Topography in Building and Construction, Railway Marking, Landscaped/Agricultural/Military Site Marking, and Others), Forestry [Tree Marking, Log Marking, Plank Marking, and Others], Line Marking (Information Marking and Signaling, Parking Spaces, Safety Marking and Signage, and Space Delimitation), Packaging, and Others], and Country

Jul 2023

Adhesives Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Resin Type (Epoxy, Polyurethane, Acrylic, and Others), By End-Use Industry (Automotive, Aerospace, Paper and Packaging, Building and Construction, Electrical and Electronics, Medical, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jul 2023

Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Others Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Jul 2023

Synthetic Ester Lubricants for the Telecommunications Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, and Grease), End Use (Data Centers, Telecommunication Infrastructure, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America

Jul 2023

Synthetic Ester Lubricants for Electrical and Electronics Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others) and End Use (General Air Conditioners, Automotive Air Conditioners, Refrigerators, and Others)

Jul 2023

Synthetic Ester Lubricants for Construction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (Construction Machinery, Concrete and Construction Tools, Wire Ropes and Chains, and Others)

Jul 2023

Synthetic Ester Lubricants for Energy and Power Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (River Dam, Offshore Wind Power, Energy Storage Systems, and Others)

Get Free Sample For

Get Free Sample For