The North America public safety and government agencies mission critical communication (MCX) market is expected to grow from US$ 1,984.96 million in 2021 to US$ 3.246.13 million by 2028; it is estimated to grow at a CAGR of 7.3% from 2021 to 2028.

The capacity of a solution to supply communication methods to end users in situations where traditional systems are unable to meet the end user's demands is known as mission-critical communication. It facilitates communication and supports operations that are fraught with danger to people and property. Crucial communication devices are used to educate people about a critical situation, such as in public locations. In addition, it is employed to promote public safety in disaster-prone locations. Oil and gas, coast guard, homeland security applications, transportation, and unmanned vehicles are a few other applications where mission-critical communication devices are used. The public safety and government agencies mission critical communication (mcx) market is growing because of the rise in terrorism, public safety, and desire for a reliable network during emergencies. Government investments in mission critical communication systems in the defense sector are likely to generate attractive prospects for the industry in the coming years.

The COVID-19 pandemic has significantly affected the mission-critical communication industry in North America, resulting in substantial financial losses for end-user industries, compelling them to postpone their MCX implementation plans. The pandemic impacted operations at key MCX hardware manufacturing sites, requiring a brief halt. As a result, several significant component suppliers and technology providers have shifted their focus on cutting costs and decreasing manufacturing scales. As the demand for electronics remained unaltered, it is helping the market players to resume growth during the recovery period. The increasing adoption of 5G smartphones had some positive impact on the market after the lockdown period. Due to continuous upgrades in technologies and increased acceptance of digital LMR products by the government and commercial sectors, North American countries are exhibiting high adoption of critical communications technology. The US government also created an interoperability standard to enable optimal use of LMR technology products, and fast and uninterrupted communication during disaster events.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America public safety and government agencies mission critical communication (MCX) market. Citizens expect 24 hours per day service and communication from government agencies. They desire easy access to correct, up-to-date information and a smooth connection with the appropriate government officials. They also want services to be delivered swiftly, effectively, and transparently and problems to be resolved quickly, effectively, and openly. Many government agencies still rely on outdated communications infrastructures, such as leased PBX systems or Centrex-type systems. These outdated systems do not match today's high standards. The systems are rigid, difficult to manage, and expensive to maintain, leading to slower response times and decreased production. Providing accurate information about government priorities, programs, and actions to citizens helps establish government legitimacy. Governments are developing and maintaining excellent communication systems to be respectable players in public spheres. The above factors enable them to assess residents' needs and preferences and promote a deliberative public arena for multi-stakeholder involvement, informed policy debate, and emergency development efficacy. All of these issues propel the demand for critical communication systems among government organizations.

North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Segmentation

North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Component

- Hardware

- Software

- Services

North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Technology

- Land Mobile Radio (LMR)

- Long-Term Evolution (LTE)

- WiFi Mesh

North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Country

- US

- Canada

- Mexico

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

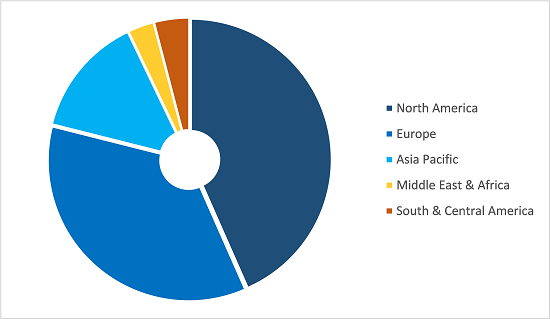

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Component

1.3.2 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Technology

1.3.3 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Public Safety and Government Agencies Mission Critical Communication (MCX) Market Ecosystem Analysis

4.3 Expert Opinion

4.4 Premium Insights

4.4.1 Insights on LMR, LTE, Wi-Fi Mesh and Satellite Technology

4.4.2 Future Prospects of LMR, LTE, Wi-Fi Mesh and Satellite technology

4.4.3 Insights on PTT/MCPTT

5. Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Demand for Reliable Network During Emergencies

5.1.2 Rising Demand from Various Government Agencies

5.2 Market Restraints

5.2.1 Limited Spectrum Bandwidth

5.3 Market Opportunities

5.3.1 Growing Need for Reliable and High-Quality Public Safety Communication in Emerging Economies

5.4 Future Trends

5.4.1 Mission Critical IoT

5.5 Impact Analysis of Drivers and Restraints

6. Public Safety and Government Agencies Mission Critical Communication (MCX) Market – North America Analysis

6.1 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Overview

6.2 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Forecast and Analysis

7. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Analysis by Component

7.1 Overview

7.2 Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, by Component, 2020 and 2028

7.3 Hardware

7.3.1 Overview

7.3.2 Hardware: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

7.4 Software

7.4.1 Overview

7.4.2 Software: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

7.5 Services

7.5.1 Overview

7.5.2 Services: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

8. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Analysis by Technology

8.1 Overview

8.2 Public Safety and Government Agencies Mission Critical Communication (MCX) Market, by Technology (2020 and 2028)

8.3 Land Mobile Radio (LMR)

8.3.1 Overview

8.3.2 Land Mobile Radio (LMR): Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Long-Term Evolution (LTE)

8.4.1 Overview

8.4.2 Long-Term Evolution (LTE): Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Wi-Fi Mesh

8.5.1 Overview

8.5.2 Wi-Fi Mesh: Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Country Analysis

9.1 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028

9.1.1 Overview

9.1.2 North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Country

9.1.2.1 US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Mn)

9.1.2.1.1 US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Component

9.1.2.1.2 US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Technology

9.1.2.2 Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Mn)

9.1.2.2.1 Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Component

9.1.2.2.2 Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Technology

9.1.2.3 Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Mn)

9.1.2.3.1 Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Component

9.1.2.3.2 Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Technology

10. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market- COVID-19 Impact Analysis

10.1 North America

11. Public Safety and Government Agencies Mission Critical Communication (MCX) Market - Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

12. Company Profiles

12.1 Ascom Holding AG (Ascom)

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Globalstar

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Inmarsat Global Limited

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Iridium Communications Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 SES S.A.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Telesat

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Thuraya Telecommunications Company

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 AT&T Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 SPACEX

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary

LIST OF TABLES

Table 1. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market, Revenue and Forecast, 2019–2028 (US$ Mn)

Table 2. US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Component (US$ Mn)

Table 3. US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Technology (US$ Mn)

Table 4. Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Component (US$ Mn)

Table 5. Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Technology (US$ Mn)

Table 6. Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Component (US$ Mn)

Table 7. Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 – By Technology (US$ Mn)

Table 8. Glossary of Terms, Public Safety and Government Agencies Mission Critical Communication (MCX) Market

LIST OF FIGURES

Figure 1. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Segmentation

Figure 2. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Segmentation - Country

Figure 3. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Overview

Figure 4. Public Safety and Government Agencies Mission Critical Communication (MCX) Market, By Component

Figure 5. Public Safety and Government Agencies Mission Critical Communication (MCX) Market, By Technology

Figure 6. Public Safety and Government Agencies Mission Critical Communication (MCX) Market, By Country

Figure 7. North America PEST Analysis

Figure 8. Expert Opinion

Figure 9. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Impact Analysis of Drivers and Restraints

Figure 10. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market, Forecast and Analysis (US$ Mn)

Figure 11. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue Share, by Component (2020 and 2028)

Figure 12. Hardware & Software: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. Software: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Services: Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue Share, by Technology (2020 and 2028)

Figure 16. Land Mobile Radio (LMR): Public Safety and Government Agencies Mission Critical Communication (MCX) Market– Revenue and Forecast to 2028 (US$ Million)

Figure 17. Long-Term Evolution (LTE): Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Wi-Fi Mesh: Public Safety and Government Agencies Mission Critical Communication (MCX) Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America: Public Safety and Government Agencies Mission Critical Communication Market, by Key Country – Revenue (2020) (USD Million)

Figure 20. North America Public Safety and Government Agencies Mission Critical Communication (MCX) Market Breakdown, By Country, 2020 & 2028(%)

Figure 21. US Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue And Forecast to 2028 (US$ Mn)

Figure 22. Canada Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue And Forecast to 2028 (US$ Mn)

Figure 23. Mexico Public Safety and Government Agencies Mission Critical Communication (MCX) Market Revenue And Forecast to 2028 (US$ Mn)

Figure 24. Impact of COVID-19 Pandemic in North American Country Markets

- Ascom Holding AG (Ascom)

- Globalstar

- Inmarsat Global Limited

- Iridium Communications Inc.

- SES S.A.

- Telesat

- Thuraya Telecommunications Company

- AT&T Inc.

- SPACEX

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jan 2022

GNSS Chips for Timing and Synchronization Market

Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: by Device (Cellular Network Devices, Small Cells, PMR (Public Mobile Radios), Phazor Measurement Units (PMU), and Others), Industry Vertical (Telecom and IT, Energy, BFSI, Consumer Electronics, Automotive and Transportation, and Others), and Geography

Jan 2022

Optical Measuring Machine Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Equipment [Profile Projectors, Optical Digitizers and Scanners (ODSs), Coordinate Measuring Machines (CMMs), Measuring Microscopes, Video Measuring Machines (VMM) or Vision Measuring Systems, Profilometers, and Others], Optical Digitizers And Scanners (ODSS) Type (3D Laser Scanners, Structured Light Scanners and Laser Trackers), Application (Straight (Prismatic) Parts and Turned Parts), Turned Parts Type (Shafts, Bushings, Rings, and Others), Type (Contact and Noncontact), Industry Vertical (Automotive, Aerospace and Defense, Energy and Power, Electronics Manufacturing, Industrial, Medical, and Others), and Geography

Jan 2022

Room AC Market

Size and Forecast (2021-2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Split AC, Window AC, and Portable AC), Technology (Inverter Technology and Non-Inverter Technology), End User (Residential and Commercial), and Geography

Jan 2022

Smart Casing Running Tools Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Hardware [Remote Display, Sensor Kit (Torque and Tension Sensor, Position Sensor, Data Transmission Sensor, and Others), Head Assembly, Gripping Assembly, Circulator Assembly, Power Supply, and Other Accessories], Software (Inbuilt and Optional), Sales [Direct Sales and Aftermarket (Parts and Accessories and Service and Rental)], Application (Onshore and Offshore), Technology (Fully Automated CRT, Remotely Operated CRT, and Hybrid CRT), and Geography

Jan 2022

Spark Detection System Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Infrared Spark Detection Systems and Ultraviolet (UV) Spark Detection Systems], Application (Wood-Based Panel Industry, Textile Industry, Pulp and Paper Industry, Bioenergy, Food Industry, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2022

Remote Access Solution Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Secure Remote Access-VPN, Identity and Access Management (IAM) Solutions, Multi-Factor Authentication, Single Sign-On (SSO), Endpoint Security, and Others], Mode of Deployment (Cloud and On-Premise), End-Use Industry (IT and Telecommunications, BFSI, Healthcare, Government, Manufacturing, and Others), and Geography

Jan 2022

Process Instrumentation Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Flow Meter, Pressure and Temperature Sensor, Analytical Instrument, and Level Meter), Flow Meter (Mass Flow, EMF, Vortex, Ultrasonic, and Others), Level Meter (High Frequency Radar, TDR, and Others), Application (Oil and Gas, Energy and Power, Water and Wastewater, Food and Beverage, Marine, Petrochemical, Chemical, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2022

Hall Effect Teslameter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Analog Hall Effect Teslameters and Digital Hall Effect Teslameters), End Users (Automotive, Industrial, Healthcare, Aerospace, Laboratory, and Others), and Geography

Get Free Sample For

Get Free Sample For