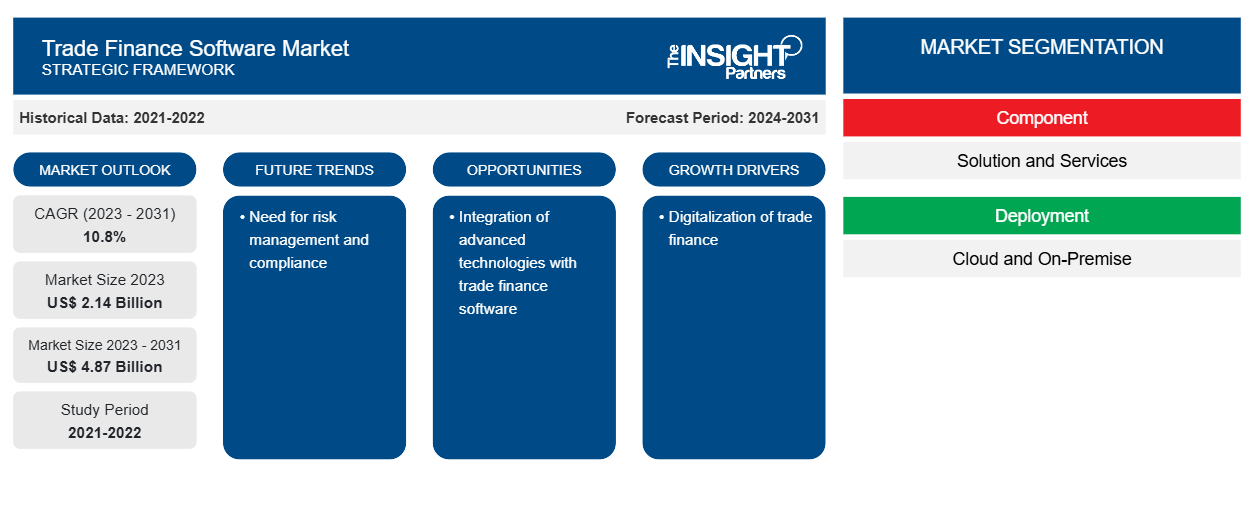

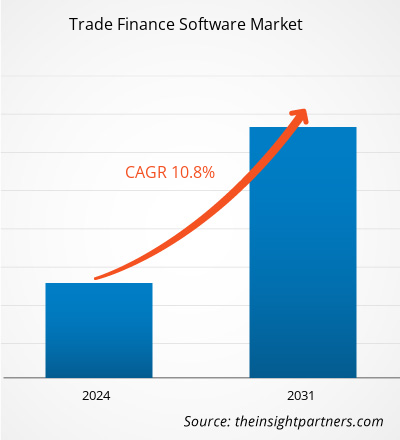

The trade finance software market size is projected to reach US$ 4.87 billion by 2031 from US$ 2.14 billion in 2023. The market is expected to register a CAGR of 10.8% in 2023–2031. Rising digitalization and adoption of cloud-based technologies are likely to remain key trade finance software market trends.

Trade Finance Software Market Analysis

The increasing digitization of trade finance processes is a major factor boosting the trade finance software market growth. With increased efficiency and lower costs, electronic documentation and cloud-based trade finance solutions are increasingly replacing traditional paper-based methods, contributing to market growth.

Trade Finance Software Market Overview

The need for transparency and adherence to international trade regulations has driven the adoption of software solutions with real-time monitoring and reporting features. With a focus on providing cutting-edge solutions that meet the changing needs of international trade, the trade finance software market is poised for further expansion as the global trade landscape continues to change and businesses seek more secure and efficient trade finance operations.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Finance Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Finance Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Trade Finance Software Market Drivers and Opportunities

Digitalization of trade finance to Favor Market

As companies from a variety of industries realize they need cutting-edge solutions to expedite and improve their international trade operations, the market is expanding significantly. This market includes software programs made to improve and automate trade finance procedures, such as supply chain financing, compliance management, invoice factoring, and credit management. Organizations have turned to trade finance software to reduce manual and time-consuming tasks, improve accuracy, and minimize risks associated with international trade as a result of the growing complexity and volume of trade transactions, which further leads to trade finance software adoption by market players. For example, in November 2023, Finastra, a global provider of financial software applications and marketplaces, announced that CQUR Bank, an international corporate bank, had partnered with Finastra to deliver on its technology strategy. With the implementation of Finastra’s market-leading solutions, Trade Innovation and Corporate Channels, CQUR Bank offers its corporate clients a new online banking portal for a seamless user experience, introduced new digital workflows, and provides host-to-host integration solutions.

Need for risk management and compliance

The growing need for improved risk management and compliance is another factor propelling the growth of the trade finance software market. Trade finance software offers sophisticated tools, such as fraud detection, anti-money laundering (AML) checks, and compliance with trade laws and sanctions, for tracking and reducing risks related to international trade. The need for these software solutions keeps growing as companies and financial institutions try to manage the challenges of international trade while maintaining legal and regulatory compliance.

Trade Finance Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the trade finance software market analysis are component, deployment, enterprise size, and end-use.

- Based on the component, the market is segmented into solution and services. The solution segment held a larger market share in 2023.

- By deployment, the market is segmented into cloud and on-premise. The cloud segment held a larger market share in 2023.

- By enterprise size, the market is segmented into large enterprises and SMEs. The SMEs segment is expected to grow with the highest CAGR.

- By end-use, the market is segmented into banks, traders, and others. The banks segment held a larger market share in 2023.

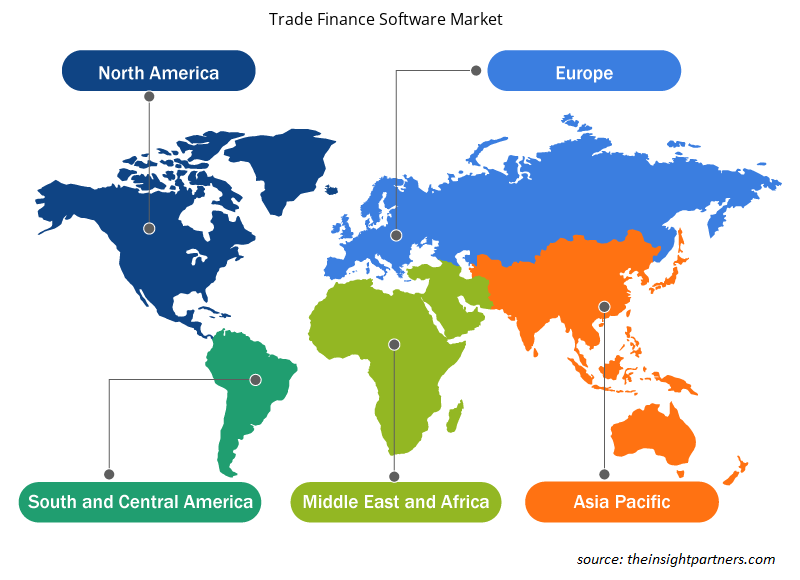

Trade Finance Software Market Share Analysis by Geography

The geographic scope of the trade finance software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest trade finance software market share in 2023. North America is an early adopter of technological solutions which leads to its soaring market share. The adoption of cloud-based technologies by SMEs leads to market growth. Soaring digitalization in the banks further demands trade finance software, which drives North America trade finance market share.

Trade Finance Software Market Regional Insights

The regional trends and factors influencing the Trade Finance Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Trade Finance Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Trade Finance Software Market

Trade Finance Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.14 Billion |

| Market Size by 2031 | US$ 4.87 Billion |

| Global CAGR (2023 - 2031) | 10.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

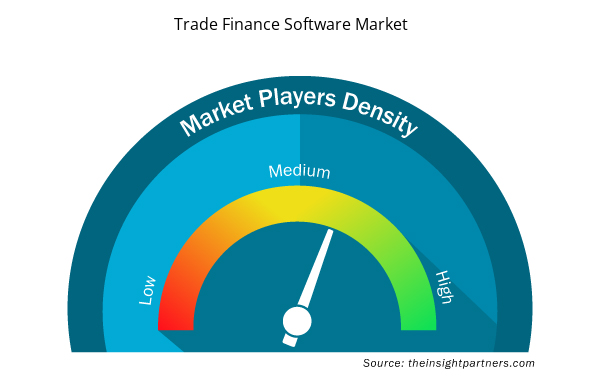

Trade Finance Software Market Players Density: Understanding Its Impact on Business Dynamics

The Trade Finance Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Trade Finance Software Market are:

- CGI Inc

- Comarch SA

- IBSFINtech

- ICS FINANCIAL SYSTEMS LTD

- MITech - Make Intuitive Tech SA

- Newgen Software Technologies Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Trade Finance Software Market top key players overview

Trade Finance Software Market News and Recent Developments

The Trade Finance Software Marketis evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In September 2022, Newgen Software, a leading global provider of digital transformation products, launched the world’s first low-code Trade Finance platform at the customer meet in Mumbai. Trade finance is a complex process as it involves a lot of paperwork, multiple stakeholders, and compliance requirements. Newgen’s comprehensive, configurable, and future-ready trade finance platform helps banks go paperless and streamline their end-to-end trade processes while ensuring compliance with domestic and international regulations. (Source: CXOtoday, Press Release, 2022)

- In February 2024, Finastra, a global provider of financial software applications and marketplaces, and Tesselate, a global digital transformation consultancy and integrator, announced the launch of an end-to-end pre-packaged service for faster and easier trade finance digitalization. Tegula Trade Finance as a Service, powered by Finastra Trade Innovation and Corporate Channels, enables US banks to automate manual processes and adapt to new demands with a quicker time to market and value. Via Finastra’s FusionFabric.cloud, banks can also seamlessly integrate fintech applications that use the latest technologies such as artificial intelligence, blockchain, and automation tools. (Source: Finastra, Press Release, 2024)

Trade Finance Software Market Report Coverage and Deliverables

The “Trade Finance Software Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Deployment , Enterprise Size , and End-Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the estimated market size for the global trade finance software market in 2023?

The global trade finance software market was estimated to be US$ 2.14 billion in 2023 and is expected to grow at a CAGR of 10.8% during the forecast period 2023 - 2031.

What are the driving factors impacting the global trade finance software market?

Rising digitalization and adoption of cloud-based technologies are the major factors that propel the global trade finance software market.

What are the future trends of the global trade finance software market?

Integration of advanced technologies with trade finance software is anticipated to play a significant role in the global trade finance software market in the coming years.

Which are the key players holding the major market share of the global trade finance software market?

The key players holding majority shares in the global trade finance software market are CGI Inc, Comarch SA, IBSFINtech, ICS FINANCIAL SYSTEMS LTD, and Finastra.

What will be the market size of the global trade finance software market by 2031?

The global trade finance software market is expected to reach US$ 4.87 billion by 2031.

What is the incremental growth of the global trade finance software market during the forecast period?

The incremental growth expected to be recorded for the global trade finance software market during the forecast period is US$ 2.73 billion.

Get Free Sample For

Get Free Sample For