The US decking market size is expected to reach US$ 11.96 billion by 2030 from US$ 8.84 billion in 2022; the market is estimated to register a CAGR of 3.8% from 2022 to 2030.

Market Insights and Analyst View:

Decking materials are used for various applications, such as flooring, railing, and walls, in distinct styles and configurations, including horizontal, vertical, and diagonal installations. Decking offers a versatile, durable, and visually appealing solution for various applications in both residential and commercial settings. It is designed to withstand outdoor environments, making it durable and suitable for outdoor settings. Moreover, integrating lighting fixtures, shelving, or other architectural elements into the decking design can further enhance functionality and visual appeal. The demand for decking in the US is driven by growing investment in housing projects, rising remodeling and repair expenditures, and rising preference for outdoor living spaces, thereby contributing notably to the US decking market growth.

Growth Drivers and Challenges:

Expansion in the housing market and rising demand for low-maintenance decking are among the major market drivers. As the housing market experiences growth, propelled by factors such as population increase, urbanization trends, and favorable economic conditions, the demand for decking materials rises in tandem. Newly constructed homes often feature outdoor living spaces as integral components of modern residential designs, with decks serving as focal points for leisure, entertainment, and relaxation. Likewise, renovation projects frequently include the addition or enhancement of outdoor areas, further fueling the demand for decking materials. The expansion in the housing market fosters innovation within the US decking market, prompting companies to develop new materials, designs, and technologies to meet evolving consumer preferences.

The rising demand for low-maintenance decking solutions is fundamentally reshaping the landscape of the US decking market. With an increasing emphasis on convenience, durability, and sustainability, homeowners are gravitating toward decking materials that offer long-term benefits with minimal upkeep. This shift in consumer preferences is fueled by several factors. Additionally, the desire for outdoor spaces that retain their aesthetics and structural integrity over time has led homeowners to seek out durable alternatives such as composite and PVC decking, which are resistant to rotting, warping, and insect damage. In February 2024, MoistureShield launched InstaDeck, an outdoor flooring system comprised of heavy-duty plastic tiles that easily snap together to create a foundation for a freestanding, ground-level deck. The growing awareness of environmental concerns has propelled the adoption of low-maintenance decking materials made from recycled plastics and other sustainable resources, aligning with eco-conscious consumer values.

Fluctuations in raw material prices can act as a deterrent for the market. The decking industry relies heavily on raw materials such as wood, composite resins, and plastics, the prices of which can be subject to volatility due to factors including market demand, supply chain disruptions, and global economic conditions. For instance, after reaching unprecedented highs in 2021, lumber prices have been steadily declining since then. As of February 2024, prices are approximately 37% lower compared to their peak 2 years ago. These fluctuations in material costs often translate into higher production expenses for manufacturers, leading to increased pricing pressures and reduced profit margins. Therefore, fluctuations in the material costs of decking pose a challenge to the US decking market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Decking Market: Strategic Insights

-

Market Size 2022

US$ 8.84 Billion -

Market Size 2030

US$ 11.96 Billion

Market Dynamics

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- United State

Market Segmentation

Material

Material

- Wood

- Composite

- Plastic

Application

Application

- Railing

- Floor

- Wall

End Use

End Use

- Residential

- Commercial

- Industrial

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The US decking market analysis and forecast to 2030 is a specialized and in-depth study with a significant focus on market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by material, application, and end use. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of decking in the US. In addition, the US decking market report provides a qualitative assessment of various factors affecting the market performance in the US. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses are conducted to help identify the key driving factors, the US decking market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The US decking market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The US decking market is segmented on the basis of material, application, and end use. Based on material, the market is segmented into wood, composite, plastic, and others. The composite segment was the fastest-growing segment in the US decking market in 2022. Composite decking is a popular alternative to conventional wood decking materials, offering a range of benefits and features that appeal to contractors and designers. A composite decking made from wood fibers and recycled plastics offers a natural wood appearance with durability and low-maintenance characteristics of synthetic materials. Longevity, low maintenance requirements, and overall performance of composite decking are some factors that make it a good investment option for contractors.

Based on application, the market is segmented into railing, floor, wall, and others. The floor segment held the largest US decking market share in 2022. Decking materials are commonly utilized for floor applications, primarily in outdoor settings such as decks, patios, balconies, and terraces. Decking provides a functional and aesthetic flooring solution for outdoor living spaces. It creates a smooth and comfortable surface for walking, dining, and outdoor events. Decking material can be utilized for railing applications to provide both functionality and aesthetic appeal to outdoor spaces. Using the same material for both decking and railing creates a cohesive and unified look for the outdoor spaces. Utilizing decking materials for railing applications offers numerous benefits in terms of design flexibility, durability, and cost-effectiveness, allowing customers to create stylish and functional outdoor spaces.

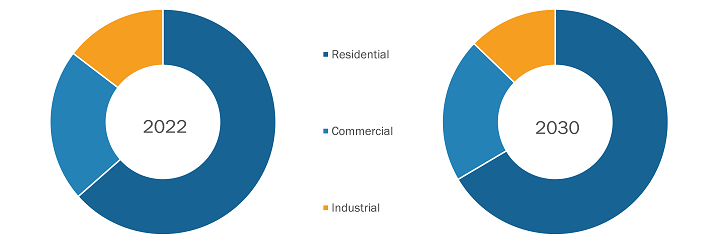

In terms of end use, the market is segmented into residential, commercial, and industrial. The residential segment dominated the US decking market share in 2022. Decking in residential settings has gained significant attention in recent years, majorly due to the growing trend of outdoor living spaces that encourage homeowners to invest in decking as a way to extend their indoor living areas and create functional and aesthetically pleasing outdoor environments. In addition, there is a significant demand for renovation and remodeling projects as customers invest in upgrading and improving their existing properties.

US Decking Market – by End Use, 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The US decking market was valued at US$ 8.84 billion in 2022 and is expected to reach US$ 11.96 billion by 2030. Historically, wood decking has been the primary choice for living spaces in the US, largely preferred for its natural beauty, versatility, and affordability. Pressure-treated lumber, cedar, and redwood are among the most common wood species used in decking, offering a classic aesthetic that blends seamlessly with various architectural styles and landscapes. However, in recent years, there has been a notable shift toward alternative decking materials, driven by concerns over durability, maintenance, and environmental impact. According to the International Casual Furnishings Association and American Home Furnishings Alliance, 90% of Americans opted to refurnish their outdoor spaces for activities such as exercising, grilling, gardening, and playing. Additionally, around 58% of Americans purchased outdoor furniture and related accessories. Composite decking has emerged as a leading contender in the market, offering a blend of wood fibers and recycled plastic that delivers superior performance and longevity compared to traditional wood options. Composite decking is renowned for its resistance to rot, mold, and insect infestation, making it a preferred choice for homeowners seeking a low-maintenance outdoor solution. The rising investments in residential construction and remodeling & upgradation activities are projected to boost the US decking market during the forecast period.

Industry Developments and Future Opportunities:

A few initiatives by key players operating in the US decking market, as per press releases, are listed below:

- In 2023, NewTechWood America Inc launched an innovative capped composite material for outdoor and interior living applications. This product is used for decking, siding, fence, and railing applications.

- In 2023, Trex Co Inc launched Trex Select T-Rail to increase its footprint in the deck railing market. Trex Select T-Rail adaptable design offers frames, maintains its sleek appearance, and requires minimal maintenance.

- In 2021, Fiberon launched promenade PVC decking. The product boasts embossing, improved streaking, and a next-generation surface finish with weather resistance.

Competitive Landscape and Key Companies:

Trex Co Inc, The Azek Co Inc, Nova USA Wood Products LLC, General Woodcraft Inc, Advantage Lumber LLC, Ipe Woods USA LLC, Iron Woods, Fortune Brands Innovations Inc, NewTechwood America Inc, and Barrette Outdoor Living Inc are among the key players profiled in the US decking market report. The market players focus on providing high-quality products to fulfill customer demand.

US Decking Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.84 Billion |

| Market Size by 2030 | US$ 11.96 Billion |

| CAGR (2022 - 2030) | 3.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

United State

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For