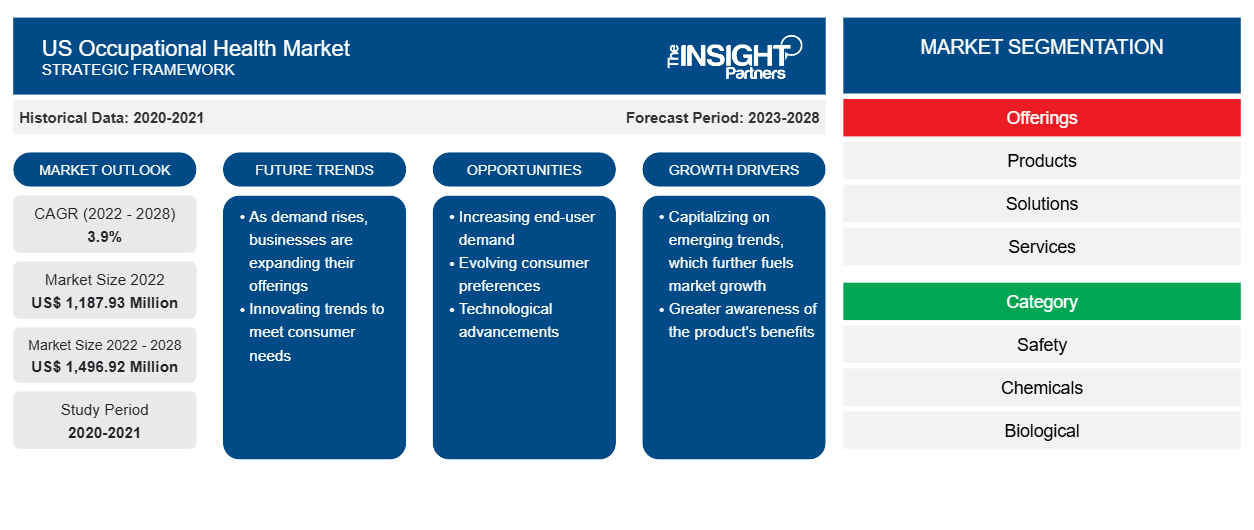

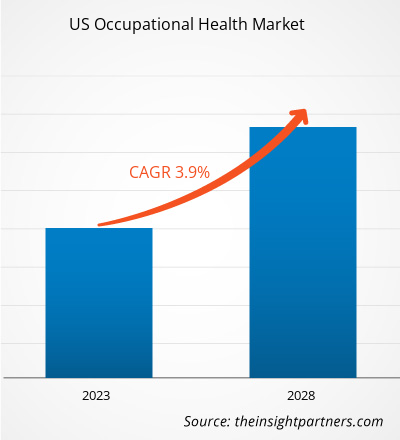

The US occupational health market size is expected to grow from US$ 1,187.93 million in 2022 to US$ 1,496.92 million by 2028; it is estimated to record a CAGR of 3.9% from 2022 to 2028.

The US occupational health market is segmented on the basis of offerings, category, employee type, site location, and type. The report offers insights and in-depth analysis of the market, emphasizing parameters such as dynamics, trends, and opportunities prevailing in the market. It also provides the competitive landscape analysis of leading market players in the US.

Market Insights

Accelerating Adoption of Workplace Wellness Programs Drives US Occupational Health Market Growth

As per the RAND report, over the past decade, the US has experienced an epidemic of occupational diseases. Work-induced stress, poor nutrition, high chemical exposure, among others, have resulted in chronic pulmonary conditions. Such illnesses add economic burden due to the loss of productivity caused by elevated absenteeism and reduced performance levels at work. Workplace wellness program provide advantage to employers’ access to employees at an age where involvement can change their long-term health trajectory. The Patient Protection and Affordable Care Act supports workplace wellness program is a trend with several provisions that promote health at the workplace.

Workplace wellness programs have been enthusiastically embraced as a potentially cost-effective way to promote health. For the employer, wellness programs can yield a happy, healthy workforce that sees decreased absenteeism, improved retention, and a thriving company culture. There is a positive connection between employee wellness and the performance of a business. As per the employer health benefits 2020 survey by KFF (Kaiser Family Foundation), most employers as of 2020 had wellness programs of some kind, including 53 percent of small firms (those with three to 200 employees) and 81 percent of large companies.

According to the RAND Employer Survey report for the US, 50% of employers in the US take wellness promotion initiatives, and larger employers have top-level wellness programs, which often include wellness screening activities, identifying health risks, and interventions reducing risks and promoting healthy lifestyles. 72% of the employers offering wellness programs in the US substantiate their programs with by combining screening activities and intervention support. The RAND Employer Survey data also states that employers direct their employees toward preventive intervention through workplace wellness programs, and 80% of employers offering wellness programs arrange screening programs for their employees for the primary identification of existing health risks. Thus, with growing adoption of these wellness programs, employers can maintain a better workplace with a focus on employee’s health.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Occupational Health Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Occupational Health Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Offerings-Based Insights

Based on offerings, the US occupational health market is segmented into products, solutions, and services. In 2022, the services segment held the largest share of the market, and it is anticipated to register the highest CAGR during the forecast period.

US Occupational Health Market, by Offerings – 2022–2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Category-Based Insights

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on category, the US occupational health market is divided into safety, chemicals, biological, physical and environment, ergonomic, vaccination and immunizations, and others. In 2022, the physical and environment segment held the largest share of the market. However, the ergonomic segment is anticipated to register the highest CAGR during the forecast period.

Employee Type-Based Insights

Based on employee type, the US occupational health market is segmented into remote, physical presence, and hybrid. The remote segment held the largest share of the market in 2022, and it is expected to record the highest CAGR during the forecast period.

Site Location-Based Insights

Based on site location, the US occupational health market is divided into on-site, off-site, and shared-site. In 2022, the off-site segment held the largest share of the market, and it is anticipated to register the highest CAGR during the forecast period.

Type-Based Insights

Based on type, the US occupational health market is bifurcated into physical wellbeing and social and mental wellbeing. The physical wellbeing segment held a larger share of the market in 2022. However, the social and mental wellbeing segment is anticipated to register a higher CAGR during the forecast period.

The US occupational health market players adopt organic strategies, such as product launch and expansion, to expand their footprint and product portfolio and meet growing demands. Inorganic growth strategies witnessed in the market are partnerships and collaborations. These growth strategies have allowed the market players to expand their businesses and enhance their geographic presence. Additionally, acquisitions, partnerships, and other growth strategies help them strengthen their customer base.

- In February 2023, Occucare, a US-based healthcare company specializing in occupational health services, expanded into Saudi Arabia. The company partnered with Saudi-based Saudi Drilling to provide a range of occupational health services to companies and individuals in the Kingdom. The company plans to establish occupational medical services throughout the country, offering services such as pre-employment exams, drug and alcohol testing, and workplace injury care.

- In January 2022, Examinetics and 3M announced that Examinetics became a 3M Preferred Fit Test Service Provider in the US. 3M and Examinetics are working together to emphasize the importance of respirator fit and to help increase the availability of high-quality fit testing for 3M’s occupational respirator customers. Together, 3M and Examinetics are helping US employers and workers improve workplace safety by ensuring that respirators are worn correctly, and that respirator fit testing is performed correctly.

Company Profiles

- Premise Health Holding Corp

- Occucare International LLC

- Examinetics Inc

- Concentra Inc

- Ascension Health Alliance

- Adventist Health System Sunbelt Healthcare Corp

- WorkCare Inc

- e3 Diagnostics Inc

- Icahn School of Medicine at Mount Sinai

- Workwell Occupational Medicine LLC.

US Occupational Health Market Regional Insights

The regional trends and factors influencing the US Occupational Health Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Occupational Health Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Occupational Health Market

US Occupational Health Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,187.93 Million |

| Market Size by 2028 | US$ 1,496.92 Million |

| Global CAGR (2022 - 2028) | 3.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Occupational Health Market Players Density: Understanding Its Impact on Business Dynamics

The US Occupational Health Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Occupational Health Market are:

- Premise Health Holding Corp

- Occucare International LLC

- Examinetics Inc

- Concentra Inc

- Ascension Health Alliance

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Occupational Health Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offerings, Category, Employee Type, Site Location, and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

United States

Frequently Asked Questions

Occupational health is an area of work in public health to promote and maintain the loftiest degree of physical, psychological, and social well- being of workers in all occupations. The knowledge and practice of occupational health involve several disciplines such as, ergonomics, psychology, hygiene, safety, and others. It focuses on the forestallment, assessment, treatment, and resolution of health conditions caused by the workplace terrain and reduces the burden of healthcare expenditure performing in increased productivity.

The hearing loss due to noise segment held the largest revenue share of 30.46% in 2021

The occupational health market majorly consists of the players such as Premise Health, Concentra, Inc., NOHS Medical Centre, Holzer Health System, MBI Industrial Medicine Inc., Occucare International and Examinetics among others.

As per type, the disorders caused due to chemicals and vibrations segment is accounted to grow at the CAGR of over 4% during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Occupational Health Market

- Premise Health Holding Corp

- Occucare International LLC

- Examinetics Inc

- Concentra Inc

- Ascension Health Alliance

- Adventist Health System Sunbelt Healthcare Corp

- WorkCare Inc

- e3 Diagnostics Inc

- Icahn School of Medicine at Mount Sinai

- Workwell Occupational Medicine LLC.

Get Free Sample For

Get Free Sample For