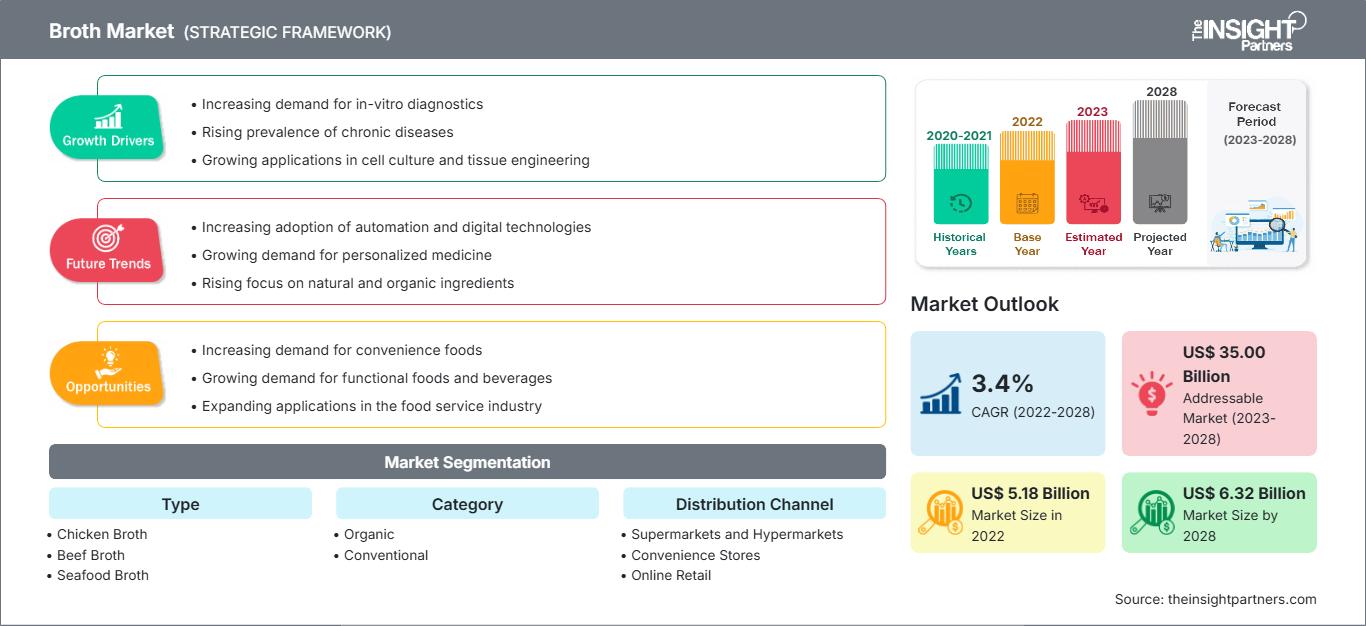

Broth Market Outlook and Strategic Insights by 2028

Broth Market Forecast to 2028 - Analysis by Type (Chicken Broth, Beef Broth, Seafood Broth, Vegetable Broth, and Others), Category (Organic, Conventional), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Status : Published

- Report Code : TIPRE00007537

- Category : Food and Beverages

- No. of Pages : 166

- Available Report Formats :

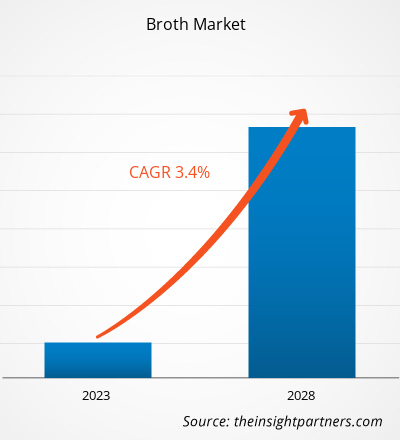

The broth market is projected to reach US$ 6,315.40 million by 2028 from US$ 5,180.51 million in 2022. It is expected to register a CAGR of 3.4% from 2022 to 2028.

Owing to hectic work schedules and extended working hours, people pay less attention to their daily diet, health, and fitness. As a result, awareness regarding health and nutrition has increased significantly in the last few years. Thus, there has been a rapid shift in consumer food preferences with increasing health concerns. According to the Nielsen Global Health and Wellness report, 2020, half of the global respondents were overweight while half were trying to lose weight. Thus, consumers have become more aware of what they eat. They seek fresh products that are natural, organic, and minimally processed. Youngsters are most willing to purchase premium goods with health claims, as this demographic group shows more flexibility toward adopting healthier food habits. Thus, increased consumption of premium products coupled with essential nutrients further drives the broth market growth.

In 2022, North America held the largest share of the global broth market, and Asia Pacific is estimated to register the fastest CAGR during the forecast period. A few of the key players operating in the North America broth market are Bare Bone Broth, Bonafide Provisions LLC, and Kettle Fire & Inc. Broth manufacturing companies in North America are continuously enhancing their product portfolio and adopting strategic development initiatives such as business expansions to be able to meet the customers' demands. For instance, in 2019, Lonolife, a California-based company, announced the launch of a new line of bone broth products. Such initiatives by the major players in the industry further drives the broth market growth during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBroth Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Broth Market

Countries in Asia Pacific, such as China, India, and Japan, faced significant challenges due to the shutdown of manufacturing units, disruption of supply chains, and shortage of raw materials during the COVID-19 pandemic; this resulted in a huge slump in product manufacturing and distribution. Nonetheless, the pandemic also brought some lucrative opportunities for key players in the broth market in Asia Pacific. Many companies in the broth market started implementing government protocols and norms to sell their product during or after the second wave of COVID-19 to grab this opportunity and increase sales.

In Asia Pacific, China was the first country to recover from losses incurred during the global health crisis. This is mainly due to the introduction of rapid vaccination drives and implementation of effective government regulations in the country. In 2021, governments of Asia Pacific countries eased out various restrictions and permitted manufacturers in the food & beverages industry to operate at full capacities. This helped them overcome the demand and supply gaps, which allowed them to recover from the financial losses. They also redirected their focus on developing and launching innovative healthier, natural, and immunity-boosting products to cater to customers’ buying preferences. This factor is expected to favor the broth market growth in Asia Pacific in the coming years.

Market Insights

Consumer Inclination Toward Nutritional Food Drive Broth Market

Broth products made from fresh vegetables, bones, and meat have gained tremendous popularity due to various health benefits and nutritional value associated with them. The demand for different broth types is increasing as they help improve immunity, hydration, and muscle protein synthesis; support joint and bone health; and exhibit antiaging properties. The inclusion of macronutrients and micronutrients in a good proportion with a high concentration of proteins drives the popularity of bone broth among consumers as an alternative to other protein sources. According to the report of EClinicalMedicine, 2020, more than 22% of people aged 40 and above in the world have knee osteoarthritis. Bone broth is a source of gelatin, which may break down into collagen in the body. The collagen produced through the breakdown of the gelatin content can improve knee joint symptoms in osteoarthritis, such as pain, stiffness, and poorer physical function. Furthermore, glutamine and a few more amino acids present in bone broth may also aid in effective digestion. This may help with conditions such as leaky gut, which is characterized by the irritation of the mucosal lining in the intestines and interference with the body’s ability to digest food. Hnece, the benefits associated with the consumption of broth propels the broth market growth.

The consumption of broth may also help people lose weight. It is high in protein, which helps the body feel fuller for longer spans alongside meeting calorie requirements. Moreover, drinking broth or making a simple soup may be perceived as a beneficial way to enhance protein content in the diet, without feeling unsatisfied with a meal. Thus, consumer inclination toward nutritious food is contributing to the broth market growth.

Type-Based Insights

Based on type, the broth market is categorized into chicken broth, beef broth, seafood broth, vegetable broth, and others. The chicken broth segment held the largest share of the market in 2022, and the vegetable broth segment is expected to register the highest CAGR during the forecast period. Vegetable broth is made by simmering vegetables in water. Vegetable broth offers various health benefits as it is a rich source of fiber and contains essential nutrients such as vitamins, minerals, and proteins. Vegetable broth contains a high amount of Vitamin A that will enhance vision and help prevent eye diseases such as cataracts and glaucoma. In addition, the presence of macro and micronutrients, along with high protein concentration, in vegetable broth is expected to fuel its demand in the coming years. Therefore, increased awareness of ingredients content in the products further drives the broth market growth.

Category-Based Insights

Based on category, the broth market is segmented into organic and conventional. The conventional segment held a larger share of the market in 2022, and the organic segment is projected to register a higher CAGR during the forecast period. Conventional products are grown using powerful chemicals to help manage fertility, prevent contamination by pests, and reduce the risks of diseases. Animals raised on conventional and grass-fed farms can be exposed to toxins from fertilizers, pesticides, and insecticides sprayed on pastures. Furthermore, consumption of water and other products from nonorganic or conventional farms can result in lead toxicity, which causes headaches, impaired growth, behavioral problems, lack of energy, and learning difficulties. Broth is free of toxins and helps treat specific health ailments such as autoimmunity and allergies. Further, the processing of conventional broth is simpler than organic broth. It is easily available and more affordable. These factors are boosting the demand for conventional broth, which is driving the broth market growth.

Distribution Channel-Based Insights

Based on distribution channel, the broth market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment accounted for the largest market share in 2022 Supermarkets and hypermarkets are large retail establishments that offer a wide range of products, such as groceries, beverages, and household goods. Products from various brands are available at reasonable prices in these stores, allowing shoppers to find the required product quickly. Moreover, these stores offer attractive discounts, multiple payment options, and a pleasant customer experience. Supermarkets and hypermarkets focus on maximizing product sales to increase their profit. Due to their vast customer base, broth manufacturers usually prefer to sell their products through supermarkets and hypermarkets. Increasing urbanization, rising working-class population, and competitive pricing boost the popularity of supermarkets and hypermarkets in developed and developing regions. Moreover, such stores have modern storage facilities, which provide ideal storage conditions for broth and other nonperishable products.

The major players operating in the broth market include The Manischewitz Co.; Barebones Ventures LLC.; Bonafide Provisions LLC; The Hain Celestial Group, Inc.; Look's Gourmet Food Company Inc.; Kettle & Fire Inc.; Del monte Foods Inc.; Zoup Specialty Products LLC.; Campbell Soup Co.; and Epic Provisions LLC. These companies are emphasizing on new product launches and geographical expansions to meet the growing consumer demand worldwide. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share. These market players focus heavily on new product launches and regional expansions to increase their product range in specialty portfolios.

Broth Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.18 Billion |

| Market Size by 2028 | US$ 6.32 Billion |

| Global CAGR (2022 - 2028) | 3.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Broth Market Players Density: Understanding Its Impact on Business Dynamics

The Broth Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Report Spotlights

- Progressive industry trends in the broth market to help companies develop effective long-term strategies

- Business growth strategies adopted by the market players in developed and developing countries

- Quantitative analysis of the market from 2019 to 2028

- Estimation of global demand for broth

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the broth market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and growth drivers and restraints in the broth market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the broth market at various nodes

- A detailed overview and broth industry dynamics

- Size of the broth market in various regions with promising growth opportunities

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For