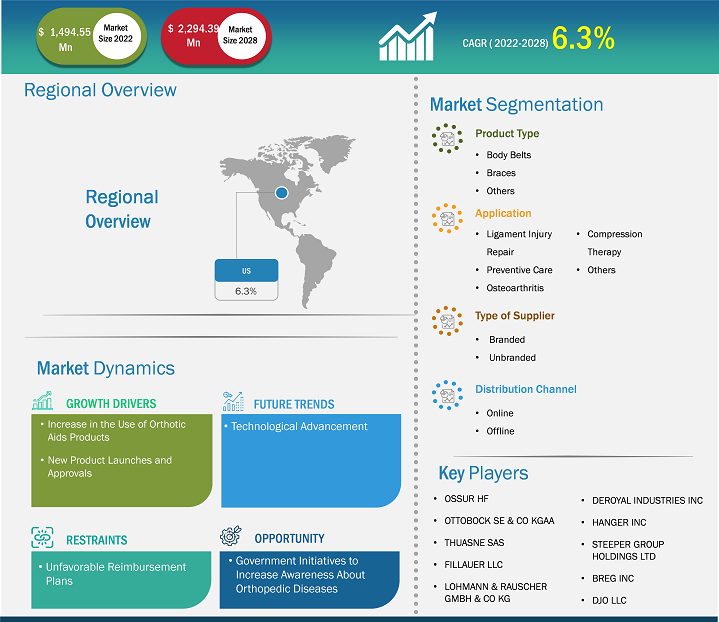

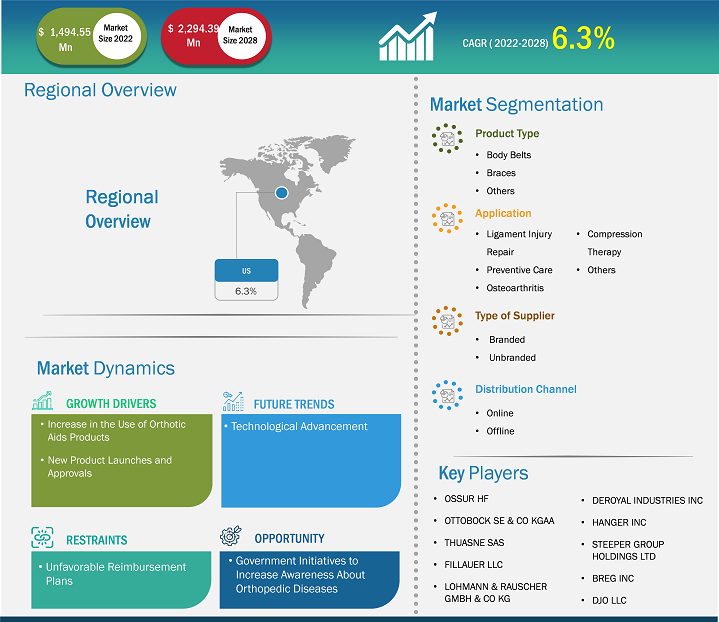

The orthotic aids market size was valued at US$ 1,494.55 million in 2022 and is projected to reach US$ 2,294.39 million by 2028. It is estimated to register a CAGR of 6.3% during 2022–2028.

Market Insights and Analyst View:

Orthotic aids are devices or supports intended to enhance the sustainability and functionality of the musculoskeletal system. These tools are frequently employed to address medical conditions such as pain, damage, or deformity. Common orthotic aids include orthotic insoles, ankle braces, knee braces, back braces, wrist braces, shoulder braces, neck braces, prosthetic limbs, spinal orthoses, etc. Orthotic devices have been shown to reduce pain and enhance the quality of life among users. Owing to these benefits, the demand for orthotic aids is increasing continuously in the populations affected by musculoskeletal diseases. Device manufacturers and healthcare providers consequently benefit significantly from this. Additionally, personalization to meet unmet needs, and innovations in materials and technologies are likely to open up sizable market opportunities in the coming years.

Growth Drivers and Challenges:

The US orthopedic aids market is continuously progressing at a substantial rate due to the burgeoning demand for orthotic aids from a large population, which also leads to an increase in new product developments and launches along with approvals. Orthotic aids market players invest in R&D activities to ensure the revolution and development of effective products. In February 2021, Breg Inc, a leading manufacturer of knee, hip, elbow, spine, foot, and ankle braces, announced the launch of Pinnacle and Ascend lines of spinal orthoses. With this product, Breg Inc. intended to elevate spinal care through more comfortable braces that encourage treatment adherence and promote healing. In May 2020, Össur, a developer and manufacturer of bracing, compression therapy, prosthetics, and other orthopedic products announced the launch of Unloader One X, the most recent model of its Unloader One knee braces.

Numerous illnesses impacting the musculoskeletal system of the body necessitate medical attention. Rheumatoid arthritis, osteoarthritis, and arthritis are a few examples of orthopedic diseases frequently affecting people. The government of the US is taking necessary steps to raise awareness of orthopedic diseases and to increase people’s access to orthopedic products. In response to the increasing burden of osteoarthritis, the Centers for Disease Control and Prevention funded the Osteoarthritis Action Alliance (OAAA). The OAAA promotes actions to prevent and control OA and its progression through tried-and-true interventions, public policies, communication strategies, and improved research initiatives for osteoarthritis. During National Arthritis Awareness Month, the Arthritis Foundation runs an awareness campaign to raise awareness of arthritis. The Arthritis Foundation has been hosting various awareness events as part of its 2023 campaign. With these activities, the Arthritis Foundation mainly focuses on raising money and awareness among the masses. Thus, the government’s initiatives to nurture the awareness of orthopedic diseases among people drive the adoption of orthopedic aids.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Orthotic Aids Market: Strategic Insights

Market Size Value in US$ 1,494.55 million in 2022 Market Size Value by US$ 2,294.39 million by 2028 Growth rate CAGR of 6.3% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Orthotic Aids Market: Strategic Insights

| Market Size Value in | US$ 1,494.55 million in 2022 |

| Market Size Value by | US$ 2,294.39 million by 2028 |

| Growth rate | CAGR of 6.3% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Dynamic functional knee brace designs offer superior knee joint protection after injuries or surgeries compared to conventional static functional knee braces. Recently developed dynamic posterior cruciate ligament (PCL) knee braces counteract posterior translation of the tibia caused by an anterior force on the posterior proximal tibia. As a result, these braces help reduce the impact of any unfavorable force on the PCL and lessen the final posterior lag. Standard braces such as functional knee braces, unloader braces, and neoprene sleeves are being used more frequently in the treatment of chronic knee pain. They are also used to prevent injuries, accelerate recovery, and enhance physical and athletic performance. The widespread application of these braces is attributed to their consistent form for a long time. Although standard knee braces are widely used as a prevention and management aid against injuries and diseases, their primary purpose is to provide lateral stability or correct misaligned knee joint structures. These braces can go beyond structural support or alignment correction to increase leg muscular strength with technological advancements. Their application can improve knee joint function among healthy and injured people by employing modern technologies, making any movement—from basic daily tasks to weightlifting and cross-country skiing—easier. The knee extensor assist (KEA) design is one example of a new bracing technology. Recently, efforts have been made to address and improve the role of musculature in promoting healthy knee function through knee bracing with augmented assistive device technology. Improved muscle strength can help lessen wearer fatigue, which may improve performance in athletes, land-based arm forces, and manual laborers.

Inconsistent insurance coverage or limited product coverage results in an increased cost burden on patients. The high cost of orthotic treatments and aids, along with unfavorable reimbursement policies, impedes the growth of the orthotic aids market. Older adults suffering from chronic pain or injuries can benefit significantly from back braces. Durable arm, leg, neck, and back braces are covered by Medicare Part B, with some restrictions. The Medicare Braces Benefit covers knee orthoses. The orthosis must be a semi-rigid or rigid device that is used to support a weak or deformed body part or to limit or completely rule out motion in a diseased or injured part of the body to qualify for coverage under this benefit. The statutory definition of the Braces Benefit does not apply to items that are not sufficiently rigid to be able to immobilize or support the body part for which they are intended. Items that don't fit the description of a brace aren’t covered and don't qualify for benefits under this Medicare benefit.

Report Segmentation and Scope:

The orthotic aids market is divided on the basis of product type, application, type of supplier, and distribution channel. Based on product type, the orthotic aids market is segmented into body belts, braces, and others. The braces segment is further segmented into neck & cervical braces, knee braces, foot support & braces, elbow support & braces, and others. The others segment includes pouch arm slings, cast covers, and cast shoes. Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. Based on the type of supplier, the orthotic aids market is classified into branded and unbranded. Based on distribution channel, the orthotic aids market is bifurcated into online and offline.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on product type, the orthotic aids market is segmented into body belts, braces, and others. The braces segment is further bifurcated into neck & cervical braces, knee braces, foot support & braces, elbow support & braces, and others. The others segment is further classified into pouch arm slings, cast covers, and cast shoes. Body belts such as back traction belts, elastic back braces, copper belts, back pain belts, and back braces are commonly used to treat joint sprain, muscle strain, and injuries. Most people are likely to experience back pain at some point in their lives. According to Cross River Therapy, 8 out of 10 Americans report having back issues at least once or more frequently in a year. While injuries and illnesses are among several causes of back pain, a vast percentage of cases result from improper lifting of heavy objects and poor posture. Wearing a back brace is a standard method of preventing back pain and improving posture.

US Orthotic Aids Market by Product Type – 2022 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. The medial collateral ligament (MCL), posterior cruciate ligament (PCL), anterior cruciate ligament (ACL), and lateral collateral ligament (LCL) are the four major ligaments in the knee. Ligaments are instrumental to keeping a person's knee moving, and moderately minor injuries can also cause much discomfort to persons. Knee braces can decrease the load on the knee. If a person has a partial tear, a doctor may recommend repairing the ACL tear non-surgically by using an ACL brace and physical therapy for muscle strengthening. However, for patients undergoing surgery, doctors recommend wearing post-operative knee braces and crutches until they are adequately healed. The rehab procedure for an ACL tear is relatively lengthy, as it can take 6 months to 1 year for completion. After recovery, the patient may be advised to wear an ACL knee brace while playing sports. PCL tears are classified as Grade 1 tear, Grade 2 tear, Grade 3 tear, and Healthy PCL. If the tear is severe enough, the patient may have to have PCL surgery. After surgery, they are recommended to wear a PCL knee brace for post-surgical recovery. Brace Ability offers many braces and supports for preventing and treating PCL tears. The majority of MCL injuries can be treated at home with ice application, anti-inflammatory medication, and rest. A doctor may suggest a brace that helps protect the patient's knee and enables some movement. If the tear is significantly severe, patients may need surgery.

Based on distribution channels, the orthotic aids market is divided into online and offline. The offline segment is further segregated into hospitals, pharmacies, and retail. A retail pharmacy typically offers community guidance to encourage the product's safe and efficient use. The care and services provided by medical centers include a particular area of pharmacy practice known as hospital pharmacy. The availability of advanced technologies and facilities at hospitals increases the preference for managing orthopedic diseases at hospitals. This, in turn, increases the distribution of orthopedic aid products, such as braces, belts, and arm slings through hospital pharmacies.

Competitive Landscape and Key Companies:

Ossur hf, Ottobock SE & Co KGaA, Thuasne SAS, Fillauer LLC, Lohmann & Rauscher GmbH & Co KG, DeRoyal Industries Inc, Hanger Inc, Steeper Group Holdings Ltd, Breg Inc and DJO LLC are a few prominent players operating in the orthotic aids market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their widescale presence allows them to serve a large base of customers, subsequently allowing them to expand their market share.

US Orthotic Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in | |

| Market Size by | |

| Global CAGR () | |

| Historical Data | |

| Forecast period | |

| Regions and Countries Covered | |

| Market leaders and key company profiles |

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Type of Supplier, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies - US Orthotic Aids Market

- Ossur hf

- Ottobock SE & Co KGaA

- Thuasne SAS

- Fillauer LLC

- Lohmann & Rauscher GmbH & Co KG

- DeRoyal Industries Inc

- Hanger Inc

- Steeper Group Holdings Ltd

- Breg Inc

- DJO LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to US Orthotic Aids Market

Oct 2023

Colonoscopes Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Fiber Optic Colonoscopy Devices, Video Colonoscopy Devices); Application (Colorectal Cancer, Lynch Syndrome, Ulcerative Colitis, Crohn's Disease, Polyp); End User (Hospitals, Ambulatory Surgery Center, Others), and Geography

Oct 2023

Noninvasive Fat Reduction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Cryolipolysis, Laser Lipolysis, Ultrasound, and Others), End User (Hospitals, Dermatology Clinics & Cosmetic Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Medical Ultrasound Flow Meter Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Implementation Type (Clamp-On, Inline, and Others), Technology (Doppler, Transit Time, and Hybrid), Application (Heart and Lung Machines, Extracorporeal Membrane Oxygenation, Perfusion, Organ Transportation Systems, and Others), End User (Hospitals and Clinics, Ambulatory Surgical Centers, Research Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Rapid Test Kits Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rapid Antigen Testing, Rapid Antibody Testing, and Others), Product (Over-the-Counter Rapid Testing Kit and Professional Rapid Testing Kit), Technology (Lateral Flow Assay, Solid Phase, Agglutination, Immunospot Assay, and Cellular Component-Based), Application (Blood Glucose Testing, Infectious Disease Testing, Pregnancy and Fertility, Cardiometabolic Testing, and Others), End User (Hospital and Clinics, Home Care, Diagnostics Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Osteoarthritis Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Therapy Type [Transcutaneous Electrical Nerve Stimulation (TENS), Occupational Therapy, Physical Therapy, Platelet-Rich Plasma Therapy and Stromal Vascular Fraction, Prolotherapy, and Others], Disease Indication (Knee Osteoarthritis, Spine Osteoarthritis, Foot and Ankle Osteoarthritis, Shoulder Osteoarthritis, Hand Osteoarthritis, and Others), End User (Hospitals & Clinics, Specialty Clinics, Ambulatory Surgical Centers, Homecare, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Bariatric Surgeries Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Adjustable Gastric Bands (AGB), Sleeve Gastrectomy, Gastric Bypass, Biliopancreatic Diversion with Duodenal Switch (BPD-DS), and Others], End User (Hospitals and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Post-Acute Care Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Service Type (Skilled Nursing Facilities, Inpatient Rehabilitation Facilities, Long-Term Care Hospitals, Home Health Agency, and Others), Age (Elderly, Adult, and Others), Disease Conditions (Amputations, Wound Management, Brain Injury and Spinal Cord Injury, Neurological Disorders, and Others), and Geography

Oct 2023

Lung Cancer Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Therapy Type (Noninvasive and Minimally Invasive), Indication (Non-Small Cell Lung Cancer and Small Cell Lung Cancer), End User (Hospitals, Oncology Clinics, Research Centers, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)