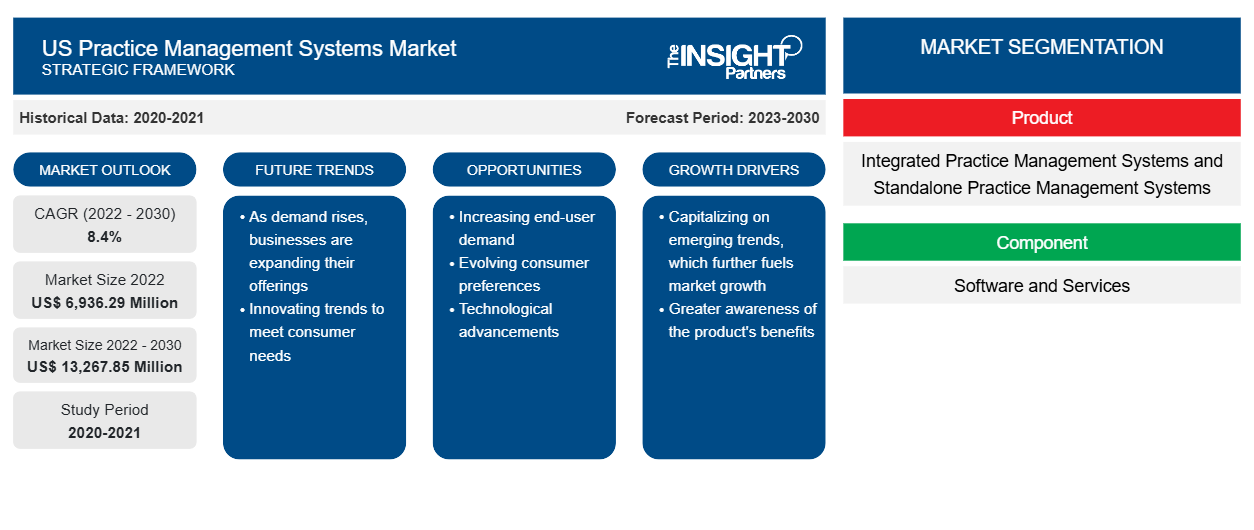

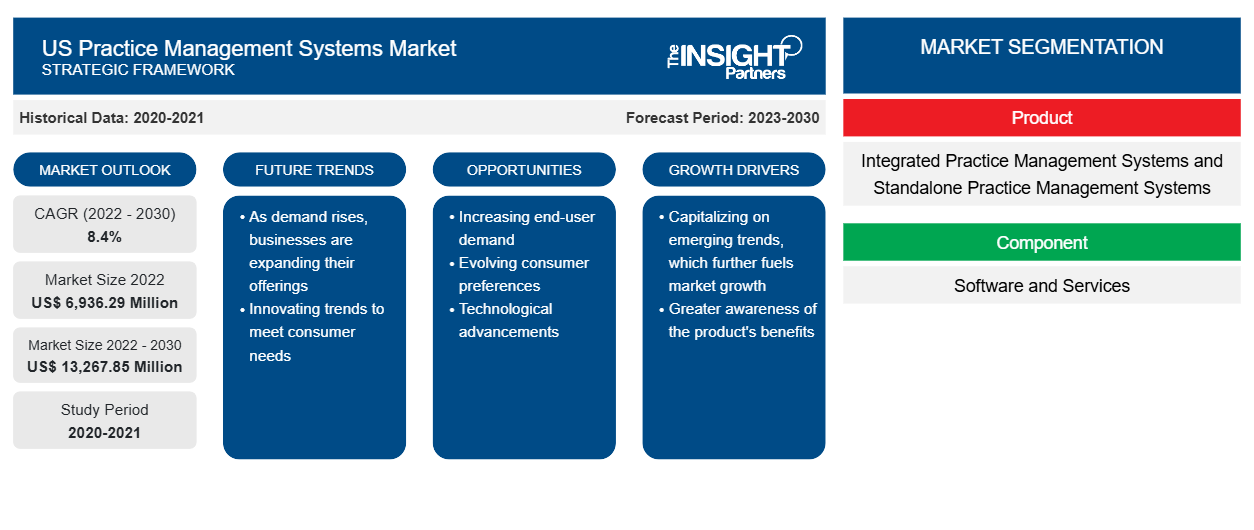

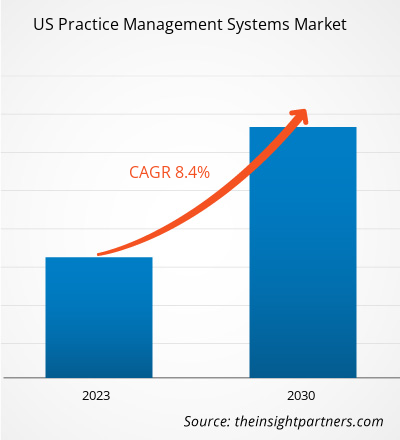

The US practice management systems market size is expected to grow from US$ 6,936.29 million in 2022 to US$ 13,267.85 million by 2030; it is estimated to register a CAGR of 8.4% from 2022 to 2030.

Chronic diseases such as heart disease, diabetes, and obesity are the leading causes of death worldwide. These conditions account for most of the healthcare costs in the US. Diabetes can be fatal and has no recognized treatment. According to the International Diabetes Federation (IDF), the number of diabetic people in North America is estimated to rise from ~46 million people in 2017 to 62 million by 2045.

According to a report by the American College of Cardiology Foundation, coronary heart disease (CHD) was the primary cause of death among all deaths caused by cardiovascular disease (CVD); ~695,000 people died from heart disease in the US in 2021; CHD was followed by stroke (16.8%), high BP (9.4%), heart failure (HF, 9.0%), and other CVDs (17.9%). Moreover, by 2035, ~130 million adults in the US are projected to have some form of CVD. Obesity rates have been rapidly increasing in developed as well as developing economies worldwide, mainly, due to an upsurge in unhealthy and sedentary lifestyles. The prevalence has increased rapidly in North American countries in the recent decade. Also, obesity levels are anticipated to be high in the US and Mexico, representing nearly 47% and 39% of their populations, respectively, by the end of 2030. Thus, the rising prevalence of chronic diseases bolsters the demand for healthcare services, leading to an increase in the adoption of practice management systems.

Market Insights

Rising Pressure on Healthcare Institutions to Provide High-Quality Services at Reduced Costs Drives US practice management systems Market Growth

Administrative tasks pose major challenges for healthcare providers, impacting their overall performance. Finding and implementing solutions to lower the functional and operational costs to deal with the increasing government pressure regarding the elevating prices of drugs and medical devices is a core objective of healthcare businesses, which allows them to provide value-based health care to patients. As a result, healthcare providers focus on offering enhanced, evidence-based patient care and health plans, improving their regulations management strategies, and consolidating healthcare systems simultaneously.

Healthcare IT systems improve the real-time monitoring of patients’ health, thereby allowing healthcare providers to reduce the costs associated with chronic diseases. As per the American Diabetes Association in 2023, the estimated cost burden associated with diagnosed diabetes cases rose to US$ 412.9 billion. Despite the steady prevalence of diabetes, direct medical costs associated with diabetes grew by 7% from 2017 to 2022. The price can be efficiently managed by a clinical decision support system that further helps manage diseases and keep track of individual dosage patterns, which enables patients to get assistance with disease and medication management, along with helping them overcome the disease.

A smartphone is one of the most dynamic and ubiquitous trends in communications and real-time location tracking. These devices also contribute to making healthcare practices more accessible and manageable by simplifying the process of collecting healthcare information or health data and offering services to patients. With the increasing adoption of smartphones, healthcare providers are looking for ways to streamline their practice management processes and improve patient engagement. Practice management systems are mobile-friendly and support appointment scheduling, billing, and patient communication, among other processes, through smartphone apps. Additionally, the use of smartphones also enables healthcare providers to remotely access patient records and manage their practices, leading to greater efficiency and flexibility. As a result, the practice management systems market is expected to experience substantial growth in the coming years. In addition to their well-established applications such as e-mail and Internet browsing, smartphones are used in real-time location system (RTLS) solutions for tracking and monitoring patients, staff, and medical equipment. With easy access to an array of smartphone applications (apps), people can use mobile health apps to manage chronic conditions and change health-related behaviors. The burgeoning use of smartphones among healthcare professionals and patients is expected to provide significant opportunities for the practice management systems market.

The incorporation of digital solutions makes healthcare facilities a lucrative target for cyberattacks. The healthcare sector is at a greater risk of data breaches than many other sectors. According to a study published in the HIPPA Journal, shedding light on data breaches reported on the Privacy Rights database during 2015–2022, the healthcare sector accounted for 32% of total data breaches, which is nearly twice as many as the incidents reported in the manufacturing and finance industries. Electronic health record (EHR) systems are used to exchange and analyze the patient's clinical information. EHR has a combined setting with an all-in-one operation, which depends primarily on sustaining data integrity as well as uninterrupted communication between the EHR and practice management system. Hence, practice management systems need to adhere to knowledge management, information safety, complexity management, and interoperability requirements. Practice management systems facilitate enhanced patient care by improving efficiency as well as accessibility to data, leading to faster decision-making regarding treatments. Patients' information can be accessed by unauthorized people, such as internet hackers to gain access to these data. The fraud can also involve cases of data duplication, as well as information export without the patient's knowledge and consent. Thus, concerns regarding data privacy and cybersecurity hinder the progress of the US practice management systems market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Practice Management Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Practice Management Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Future Trend

Elimination of Need for Routine Visits to Hospitals With Remote Monitoring

Remote patient monitoring (RPM) involves the remote monitoring and analysis of physiological parameters such as heart rate, pulse rate, blood pressure, blood oxygen levels, and blood sugar. An efficient RPM setup can help reduce the number of routine checkups before or after a visit to a healthcare professional. Also, patients can be discharged early after treatments as healthcare professionals can monitor them remotely. This helps decrease the additional costs required for visiting hospitals, thereby reducing the overall medical expenditure of individuals. Also, improved internet connectivity with simultaneous cost reductions is likely to complement the US practice management systems market in the coming years.

Report Segmentation and Scope

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product-Based Insights

Based on product, the US practice management systems market is bifurcated into integrated practice management systems and standalone practice management systems. The standalone practice management systems segment held a larger market share in 2022. It is anticipated to register a higher CAGR from 2022 to 2030. Standalone systems comprise only one module and are designed to address specific needs of healthcare settings. As the system deals with only one process, the installation and maintenance cost of this system is less compared to integrated systems. Additionally, an expanding range of physician setting options provided in standalone systems, considering specific needs and cost concerns in emerging nations, propel the adoption of standalone practice management systems.

Component-Based Insights

Based on component, the US practice management systems market is segmented into software and services. The software segment held a larger market share in 2022. The services segment is anticipated to register a higher CAGR during 2022–2030. Practice management software is used for performing clinical operations such as appointment scheduling, personal management, patient management, coding and billing, and medical record management. Currently, the healthcare sector is focused on offering value-based care and enhanced services to patients. As a result, healthcare providers allocate their resources for effective practice management to avoid dissatisfaction among patients, errors in medical billing, and additional labor charges, which drives the adoption of medical practice management software in the US. The use of intelligent algorithms also allows physicians to make informed decisions. Some of the practice management software solutions available in the market provide real-time analysis of patient data, waiting time, patient visits, and analysis of payers. Additionally, emphasis on the reduction of manual work and optimization of human resources would continue the growth of the market for practice management software.

Delivery Mode-Based Insights

In terms of Delivery Mode, the US practice management systems market is categorized into web-based practice management systems, cloud-based practice management systems, and on-premise practice management systems. The on-premise practice management systems segment held a larger market share in 2022. Hospitals or other healthcare entities use on-premise practice management systems to record and store the patient’s data while implementing a point-of-care system. These solutions are installed and operated on computers within the premises of facilities. An on-premise delivery mode offers a cost-efficient (in the long term) and portable solution for all types of healthcare practices. Additionally, the expanding networks of corporate hospital chains generate a high demand for on-premises practice management systems.

Application-Based Insights

The US practice management systems market, by application, is categorized into patient record tracking, administrative tasks, processing insurance claims, coding & billing, and others. The administrative tasks segment accounted for the largest market share in 2022. Administrative tasks are crucial in the healthcare sector as they help streamline day-to-day operations. These tasks include appointment scheduling, patient registration, insurance verification, billing and invoicing, and managing electronic health records. By implementing a practice management system, healthcare providers can automate these administrative tasks, reducing the likelihood of human error and improving overall efficiency. This allows staff to focus more on patient care and less on paperwork, ultimately leading to better health outcomes and increased productivity within medical practices. Additionally, practice management systems can provide valuable data analytics and reporting capabilities.

End User-Based Insights

Based on end user, the US practice management systems market is categorized into hospitals and clinics, physician’s offices and labs, insurance companies, and others. The hospitals and clinics segment dominated the market, in terms of revenue share, in 2022. The market for this segment is anticipated to grow at the highest CAGR during 2022–2030. Practice management systems tailored to the specific needs of hospitals and clinics play a pivotal role in streamlining a wide range of administrative tasks, from appointment scheduling, patient registration, and resource allocation to billing and claims processing. The implementation of practice management systems confers the seamless coordination of patient care across departments and specialties in these facilities. These systems aid in centralized scheduling, resource management, and patient data accessibility, allowing for efficient patient flow, reduced wait times, and improved care coordination. Additionally, integrated billing and claims management functionalities support accurate reimbursement processes, revenue cycle management, and regulatory compliance, empowering hospitals and clinics to optimize financial performance while delivering high-quality care. By streamlining administrative workflows, these systems allow clinicians to focus more on patient care.

US Practice Management Systems Market, by Product – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The report profiles leading players operating in the US practice management systems market. These include WRS Health; PracticeEHR; AdvancedMD Inc.; Azalea Health Innovations, Inc.; DrChrono Inc; PracticeSuite Inc; Meditab Software Inc; Microwize Technology Inc; MedicalMine Inc; Henry Schein Medical Systems Inc; and MEDENT.

- In June 2023, AdvancedMD released more than 25 product enhancements to the EHR and practice management functions of its software. Its practice management updates include check-in enhancements, claim status 277 download updates, unsolicited claim attachment updates, solicited claim attachments by fax and mail update, and preferred language code set updates.

- In August 2023, Meditab Software Inc. partnered with Mental Health Technologies to provide medical professionals with advanced tools for simplifying patient assessments with a smart EHR, practice management, billing, and comprehensive office management software in a single integrated and seamless system.

US Practice Management Systems Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6,936.29 Million |

| Market Size by 2030 | US$ 13,267.85 Million |

| Global CAGR (2022 - 2030) | 8.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bioremediation Technology and Services Market

- Health Economics and Outcome Research (HEOR) Services Market

- Third Party Logistics Market

- Print Management Software Market

- Dry Eye Products Market

- Skin Graft Market

- USB Device Market

- Antibiotics Market

- Long Read Sequencing Market

- Medical Enzyme Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Component, Delivery Mode, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What are the driving factors for the US practice management system market worldwide?

Factors such as the rising pressure on healthcare institutions to provide high-quality services at reduced costs and rising prevalence of chronic diseases drives the growth of market. However, concerns regarding data privacy hinders the market growth.

Which segment is dominating the US practice management system market?

Based on product, the US practice management systems market is bifurcated into integrated practice management systems and standalone practice management systems. The standalone practice management systems segment held a larger market share in 2022. It is anticipated to register a higher CAGR from 2022 to 2030. Standalone systems comprise only one module and are designed to address specific needs of healthcare settings. As the system deals with only one process, the installation and maintenance cost of this system is less compared to integrated systems. Additionally, an expanding range of physician setting options provided in standalone systems, considering specific needs and cost concerns in emerging nations, propel the adoption of standalone practice management systems.

Who are the major players in the US practice management system market worldwide?

The US practice management system market majorly consists of the players such WRS Health, PracticeEHR, AdvancedMD Inc, Azalea Health Innovations Inc, DrChrono Inc, PracticeSuite Inc, Meditab Software Inc, Microwize Technology Inc, MedicalMine Inc, Henry Schein Medical Systems Inc, MEDENT.

What are Practice Management System?

Software called a Practice Management System, or PMS, assists medical practices with billing and administrative duties. It can be used for insurance claim processing, patient record tracking, and appointment scheduling. For healthcare companies, a practice management system (PMS) is a vital tool. By facilitating work automation, enhancing patient communication, and offering data-driven insights, PMSs can contribute to the effectiveness and efficiency of practices.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List Companies - US Practice Management Systems Market

- WRS Health

- PracticeEHR

- AdvancedMD Inc

- Azalea Health Innovations Inc

- DrChrono Inc

- PracticeSuite Inc

- Meditab Software Inc

- Microwize Technology Inc

- MedicalMine Inc

- Henry Schein Medical Systems Inc

- MEDENT

Get Free Sample For

Get Free Sample For