Valve Actuator Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

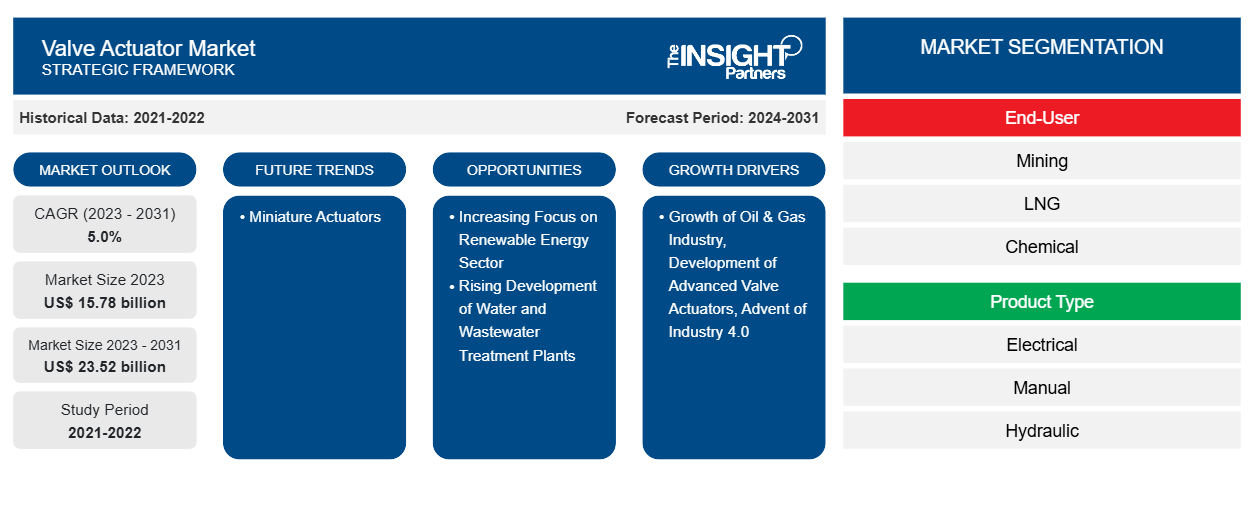

Valve Actuator Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Electrical, Pneumatic, Hydraulic, and Manual), Torque (Less than 50 Nm, 50 Nm to 1000 Nm, and Higher than 1000 Nm), Speed (Up to 10mm/s, 10 mm/s to 40 mm/s, 40 mm/s to 80 mm/s, and 80 mm/s and above), End User (Oil and Gas, Water and Wastewater, Mining, Power, Chemical, LNG, Pulp and Paper, Steel, Glass, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Apr 2025

- Report Code : TIPRE00039105

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 302

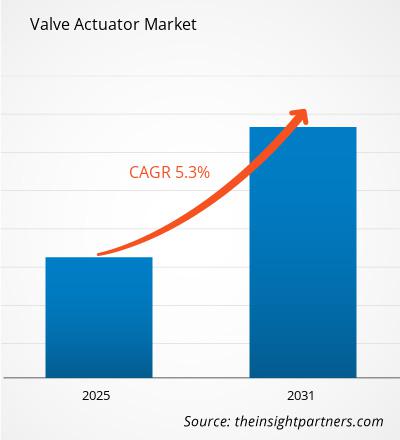

The valve actuator market size is expected to reach US$ 24.62 billion by 2031 from US$ 17.25 billion in 2024. The market is anticipated to register a CAGR of 5.3% during 2025–2031. Miniaturization of valve actuators is likely to bring new trends to the market in the coming years.

Valve Actuator Market Analysis

The valve actuator market growth is attributed to the automation of manufacturing processes, government investments in renewable energy, and flourishment of oil & gas industries. The oil & gas and power generation industries are key consumers of valve actuators. As global energy demand grows, the need for actuators to control fluid and gas flow in pipelines and plants is rising. The demand for smart cities and automated infrastructure, including water distribution systems, is growing significantly. In addition, the launch of water and wastewater plant construction projects is expected to drive the market in the coming years.

Valve Actuator Market Overview

An actuator is a component of a device or system that converts energy (generally electrical, air, or hydraulic) into mechanical force. A valve actuator is a component that actuates or moves a valve open or closed. Valve actuators are used in process plants for the automation of flow control processes. In process control applications, these regulate fluid flow by opening, shutting, or partially obstructing the fluid flow while managing the pressure. Food & beverages, mining, oil & gas, power generation (including nuclear power stations), automotive, wastewater, and LNG are among its major end users to control and automate processes.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONValve Actuator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Valve Actuator Market Drivers and Opportunities

Advent of Industry 4.0

Several governments are investing in the automation of manufacturing industries owing to the rise of Industry 4.0. For example, in January 2021, the US President announced to strengthen the US manufacturing sector under the initiative of Made in America, which focused on making technologically advanced and automated manufacturing sectors. He announced an investment of US$ 300 billion for the manufacturing sector to boost the country's production output. Moreover, in November 2022, the US Department of Energy (DoE) announced a funding of US$ 2 million, in partnership with the Clean Energy Smart Manufacturing Innovation Institute (CESMII), to increase productivity, save energy, and boost competitiveness across energy-intensive industries by adopting smart manufacturing technologies.

The advent of Industry 4.0 boosted the adoption of various robotics solutions in the manufacturing and industrial sectors, where the actuators play a very crucial role in the linear or rotary movements in automated solutions. Automatically adjusting valve positions based on sensor data ensures that optimal conditions are maintained by continuously responding to real-time process measurements. Valve actuators generate the forces that robots employ to move themselves and other objects. Valve actuators are widely used in a multitude of manufacturing process control systems. Thus, the rise in automation in various industries, such as food & beverages, oil and gas, and automotive, fosters the demand for valve actuators and fuels the valve actuator market growth worldwide.

Increasing Focus on the Renewable Energy Sector

Government spending plays a pivotal role in the rapid progression of clean energy investment and the expansion of clean technology supply chains. According to the latest update of the International Energy Agency's (IEA's) Government Energy Spending Tracker, the amount of money allocated by governments to support investments in clean energy since 2020 has increased to US$ 1.34 trillion. Direct incentives for manufacturers aimed at bolstering domestic manufacturing of clean energy technologies total ~US$ 90 billion. As per the US Department of Energy, domestic solar energy generation is anticipated to grow by 75%, whereas wind energy is projected to grow by 11% by 2025. According to the IEA, global renewable electricity generation is projected to exceed 17,000 terawatt-hours (TWh) by the end of this decade, marking a ~90% increase compared to 2023 levels, and by 2025, electricity generation from renewable sources is expected to surpass that of coal. In 2026, both wind and solar power generation are forecasted to exceed nuclear power generation.

Regardless of the energy source, such as hydropower, wind, and solar, valve actuators play a critical role in managing fluid and gas flow within power plant operations. They are essential for initiating and halting flow, adjusting flow volumes, directing flow, regulating pressure, and ensuring safety by relieving pressure when it exceeds predefined limits. Valve actuators are increasingly being utilized to optimize solar power storage. Thus, government spending on renewable energy fuels the actuator market growth in the forecast period.

Valve Actuator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Valve Actuator Market analysis are product type, torque, speed, and end-user.

- Based on product type, the valve actuator market is segmented into manual, hydraulic, pneumatic, and electrical. The electrical segment dominated the market in 2024.

- Based on torque, the valve actuator market is segmented into less than 50 Nm, 50 to 1000 Nm, and higher than 1000 Nm. The 50 to 1000 Nm segment dominated the market in 2024.

- Based on speed, the valve actuator market is segmented into up to 10 mm/s, 10 mm/s to 40 mm/s, 40 mm/s to 80 mm/s, and above 80 mm/s. The 10 mm/s to 40 mm/s segment dominated the market in 2024.

- On the basis of end user, the market is segmented into oil and gas, chemical, mining, water and wastewater, LNG, glass, pulp and paper, steel, power, and others. The oil and gas segment dominated the market in 2024.

Valve Actuator Market Share Analysis by Geography

The Valve Actuator Market is segmented into five major regions: North America, Europe, Asia Pacific, Middle East & Africa (MEA), and South America. Asia Pacific dominated the market in 2024.

Asia Pacific has a robust oil and gas industry. The rise in population and industrial growth is propelling energy demands in the region. According to the International Energy Agency (IEA), energy demand in Southeast Asia increased by an average of 3% every year from 2000 to 2020. It is further expected to grow at an average of 5% every year till 2030. As a result, governments in Southeast Asian countries emphasize expanding their oil production units by introducing new refineries and expanding the production capacity of the existing oil refineries. According to the Energy Information Administration (EIA), at least nine refinery projects are scheduled for completion by the end of 2030 in Asia and the Middle East. Moreover, China and India are rapidly advancing their shift toward renewable energy sources such as wind, solar, and hydropower, driven by growing energy demand, government incentives, and the urgency to meet climate targets. For example, in December 2024, the Asian Infrastructure Investment Bank (AIIB) approved a multi-phase program with a total financing of US$ 500 million, including a Phase 1 loan of US$ 270 million, to assist Tajikistan in completing the Rogun Hydropower Plant Project (Rogun HPP). Thus, the need for valve actuators in renewable energy power plants and refineries increases with the expansion of oil production capacities in Asia Pacific.

Valve Actuator Market Regional Insights

The regional trends and factors influencing the Valve Actuator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Valve Actuator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Valve Actuator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 17.25 Billion |

| Market Size by 2031 | US$ 24.62 Billion |

| Global CAGR (2025 - 2031) | 5.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Valve Actuator Market Players Density: Understanding Its Impact on Business Dynamics

The Valve Actuator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Valve Actuator Market top key players overview

Valve Actuator Market News and Recent Developments

The Valve Actuator Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Valve Actuator Market are listed below:

- Rotork announced that new features had been added to the industry-leading IQ3 Pro range of intelligent actuators. The new features include increased speeds for the IQT3F Pro electric modulating actuators, independent open/close speeds for part-turn actuators, and closed-loop control for the multi-turn and part-turn actuators.

(Source: Rotork, Press Release, January 2024)

- Emerson has introduced the Fisher easy-Drive 200R Electric Actuator for use on Fisher butterfly and ball valves. When paired with these valves, the new actuator performs accurately and reliably under the extreme conditions found in many heavy industries, particularly oil and gas installations in cold, remote locations.

(Source: Emerson, Press Release, January 2024)

Valve Actuator Market Report Coverage and Deliverables

The "Valve Actuator Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Valve Actuator Market size and forecast at regional and country levels for all the key market segments covered under the scope

- Valve Actuator Market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Valve Actuator Market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Valve Actuator Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For