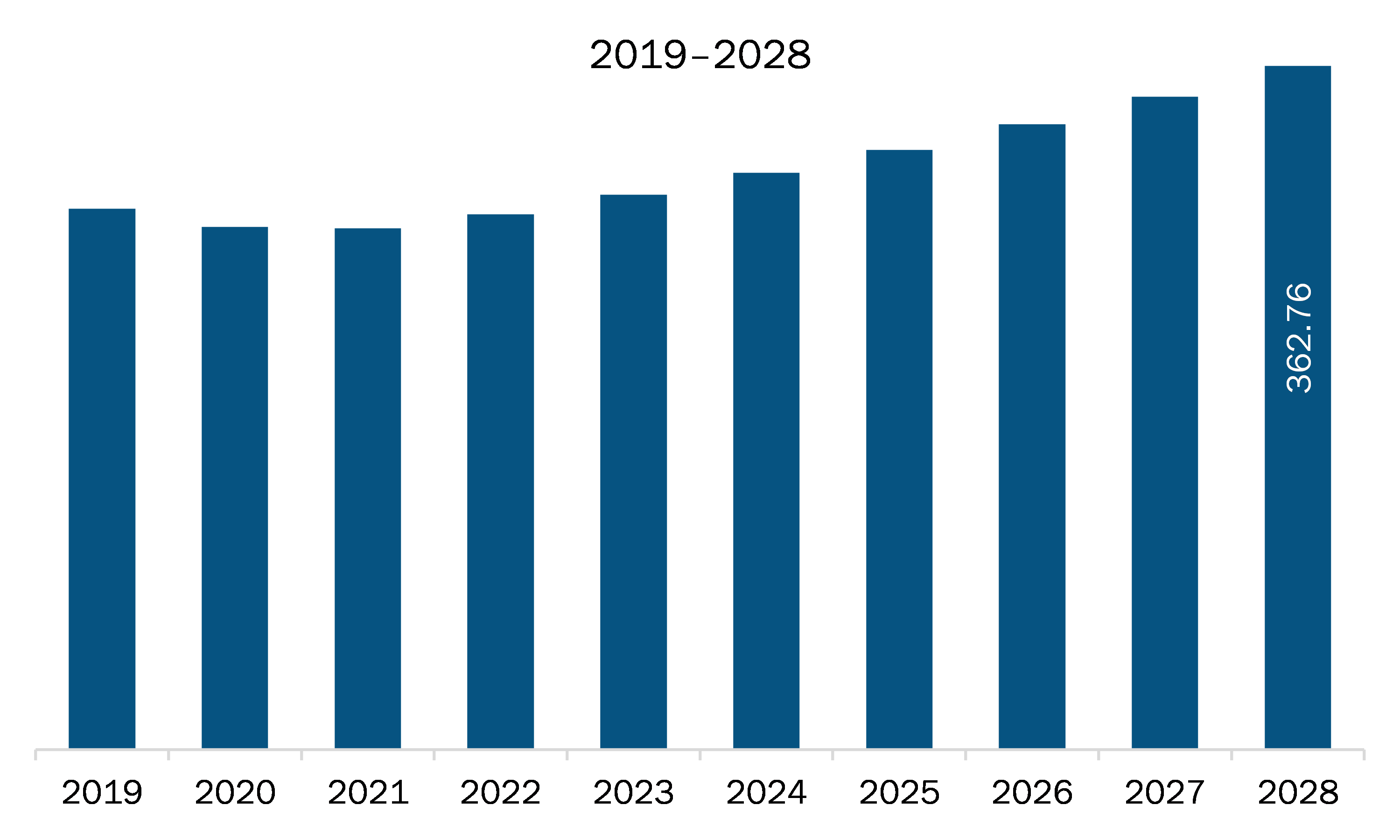

The Asia Pacific stevia market is expected to grow from US$ 204.59 million in 2021 to US$ 362.76 million by 2028; it is estimated to grow at a CAGR of 8.5% from 2021 to 2028.

Stevia basically acts as a natural sugar substitute. The production process of stevia sweetener starts with a herbal plant named stevia rebaudiana. The components of stevia leaves are responsible for the plant's sweetness, known as glycosides. Stevia further contains rebaudioside-A & stevioside, which are responsible for imparting an immense degree of sweetness without any side effects on health. This is the major reason for the growing demand for stevia over the past few years. Stevia is now predominantly used to control calorie, carbohydrate, and sugar intake. Liquid stevia is used as an alternative for cane sugar in sweetening coffee, tea, and smoothies. Stevia is gaining traction in the beverage industry and being preferred by leading beverage manufacturers for strategic approaches such as innovation, artificial sweetener replacement, sugar moderation for kids, and cost savings. Stevia can be applied as a flavor enhancer depending upon the type of beverage. Stevia can also be used for reducing the sugar levels in alcoholic beverages such as beer and cocktails. Thus, an increased application of stevia in the beverage industry is expected to drive the stevia market across the region.

In Asia Pacific, India reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including stevia production activities. Downfall of other food and beverage producing sectors negatively impacted the demand for stevia during the early months of 2020. However, the pandemic has been a reason for major shifts in consumer preferences with an increased awareness about having a healthy lifestyle. Consumers are substituting conventional ingredients with healthier alternatives, which, in turn, is increasing the demand for natural sweeteners such as stevia. An increase in the diet preference for no added sugars and low carbohydrates among consumers has led to an increase in the demand for stevia. During the pandemic, there has been a rapid surge in the demand for immunity-boosting products owing to people seeking solutions to improve their overall health and wellbeing. Hence, increasing health consciousness and high demand for low sugar alternatives among the population in Asia Pacific has had a positive impact on the stevia market.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific stevia market. The manufacturers are developing innovative products to reduce sugar levels and improve the overall consumer experience. Manufacturers such as Cargill have developed EverSweet stevia sweetener through the process of fermentation, which produces Reb M and Reb D at a practical scale and cost. Reb M and Reb D are the best tasting glycosides but comprise less than 1% of stevia leaf. The EverSweet stevia sweetener also has a low impact score on land, ozone depletion, climate change, and ecotoxicity. In 2018, Tate and Lyle introduced two new no-calorie sweeteners—Optimizer Stevia 4.10 and Intesse Stevia 2.0—extracted from stevia leaves. The taste of Optimizer Stevia 4.10 is designed to be similar to RebA 99 – RebA 100, but at a more cost-effective price. Intesse Stevia 2.0 is designed to substantially reduce sugar levels at an affordable price without compromising on taste. Thus, an increase in innovations by the major manufacturers in the stevia market provides various opportunities for the market to grow.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Stevia Market Segmentation

Asia Pacific Stevia Market – By Type

- Whole Leaf

- Powder

- Liquid

Asia Pacific Stevia Market – By Application

- Dairy and Frozen Dessert

- Bakery and Confectionery

- Tabletop Sweetener

- Beverages

- Others

Asia Pacific Stevia Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Stevia Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 204.59 Million |

| Market Size by 2028 | US$ 362.76 Million |

| Global CAGR (2021 - 2028) | 8.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For