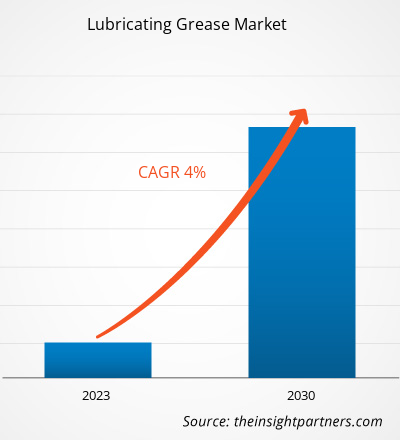

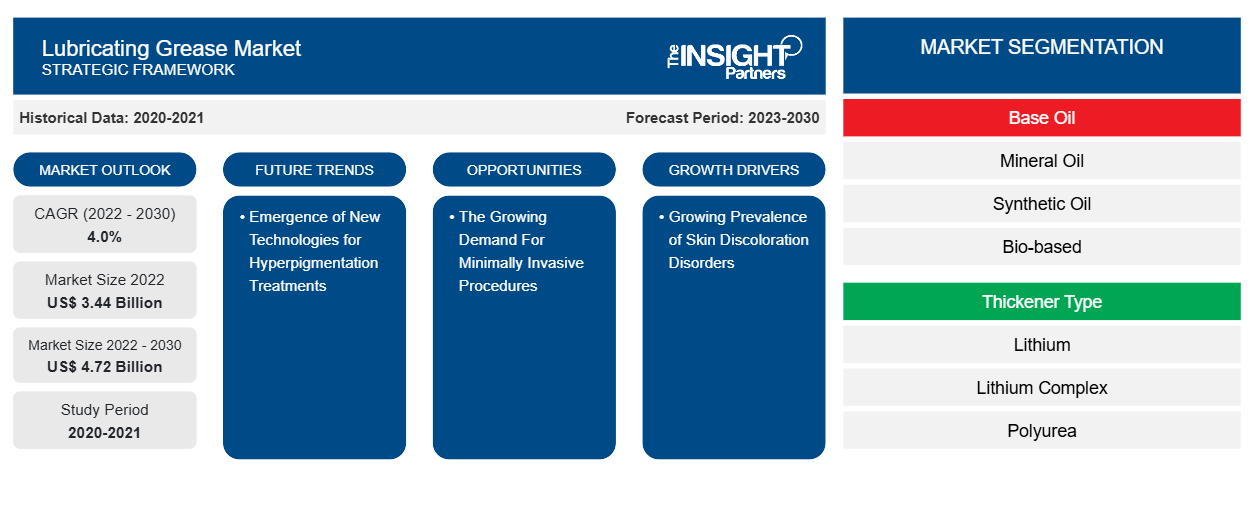

[研究报告] 2022 年润滑油市场规模价值 34.4 亿美元,预计到 2030 年将达到 47.2 亿美元;预计 2022 年至 2030 年的复合年增长率为 4.0%。

市场洞察和分析师观点:

润滑脂是一种半流体或固体润滑剂,由基础油、增稠剂和添加剂组成。基础油提供润滑,增稠剂赋予润滑脂稠度,添加剂增强其性能。润滑脂可减少摩擦、防止磨损,并在汽车、工业机械和轴承等各种应用中提供密封。它能够粘附在表面上,这使得它在单靠油可能无法保持原位的情况下非常有效。选择合适的润滑脂取决于温度、负载和操作条件等因素。这种润滑剂广泛应用于汽车、制造和机械等行业。它的半固体性质使其能够粘附在表面上,当液体润滑剂不实用时,它就很有效。润滑脂在涉及轴承、齿轮和其他暴露在恶劣条件下的部件的应用中特别受欢迎。合适的润滑脂选择取决于工作温度、负载和所涉及设备或机械的具体要求等因素。所有这些因素都对润滑脂市场有利

增长动力和挑战:

润滑脂是工业领域使用的关键部件之一,可帮助设备高效运行并提供最大可靠性。它用于汽车、石油和天然气、纺织、玻璃、发电、造纸和纸浆、化学品、石化产品、农业、海洋、工业制造、食品和饮料以及制药等各个行业 。随着发展中经济体经历重大转型,制造业、建筑业和工业部门蓬勃发展,对润滑解决方案的依赖变得至关重要。在这种快速工业化的过程中,润滑脂的需求不断增加,以确保工业设备的最佳性能和使用寿命。润滑脂可满足制造机械的无缝运行并维持工业生产势头。与此同时,作为工业化基石的建筑业对润滑脂的需求有很大影响。印度是全球最重要的建筑市场之一。印度建筑活动的增长受到持续的工业化、人口激增、中产阶级收入增加和基础设施发展的推动。因此,所有这些因素都在推动润滑油脂市场的增长。

然而,政府法规和标准在塑造润滑脂市场格局方面发挥着关键作用。据《国际创新科学、工程与技术杂志》估计,目前全球销售的所有润滑剂中约有 50%最终因全损应用、挥发、泄漏或事故而进入环境。对环境可持续性和安全性的日益关注导致了严格政策的实施,旨在规范润滑脂的成分、生产过程和使用。这对制造商构成了重大影响,因为他们需要在复杂的监管环境中应对以确保合规。世界各国政府正在对润滑脂成分实施更严格的标准,以减少对环境的影响。对生物降解性、降低毒性和限制某些添加剂的要求促使制造商不断重新配制和采用。这些因素可能会限制润滑脂市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

“2030 年全球润滑脂市场分析”是一项专业而深入的研究,主要关注全球市场趋势和增长机会。该报告旨在概述市场,并根据基础油、增稠剂类型和最终用途行业对市场进行详细细分。市场在最近经历了高增长,预计在预测期内将继续保持这一趋势。该报告提供了全球润滑脂消费的关键统计数据。此外,全球润滑脂市场报告对影响全球市场表现的各种因素进行了定性评估。该报告还包括对市场主要参与者及其关键战略发展的全面分析。还包括对市场动态的几项分析,以帮助确定关键驱动因素、市场趋势和有利可图的机会,进而有助于确定主要收入来源。

润滑脂市场预测是根据各种二手和一手研究结果估算的,例如主要公司出版物、协会数据和数据库。此外,生态系统分析和波特五力分析提供了对市场的 360 度视角,有助于了解整个供应链和影响市场表现的各种因素。

节段分析:

按基础油,市场细分为矿物油、合成油(聚亚烷基二醇、聚α烯烃和酯)和生物基。按增稠剂类型,市场细分为锂、锂复合物、聚脲、磺酸钙、无水钙、铝复合物等。按最终用途行业,市场分为传统汽车、电动汽车、建筑和施工、采矿、海洋、食品、能源和电力等。传统汽车部门在 2022 年占据了重要的润滑脂市场份额。汽车润滑脂用于传统车辆以提高发动机性能。发展中经济体汽车工业的蓬勃发展和先进润滑脂产品的持续研发使汽车应用的润滑脂市场受益。润滑脂在汽车工业中起着至关重要的作用。它们有助于减少摩擦、传递热量、防止腐蚀和防止磨损。润滑脂的进步产生了支持更长维修间隔、延长机器寿命、提高燃油效率和降低污染物水平的成分。传统车辆中用于润滑轴承、接头或齿轮的润滑脂主要由合成油或矿物油组成。所有这些因素都推动了传统车辆领域的润滑脂市场的发展。

区域分析:

市场范围集中在五个关键地区——北美、欧洲、亚太地区、中东和非洲以及南美和中美洲。就收入而言,亚太地区占据了润滑脂市场份额的主导地位,2022 年的市场份额约为 20 亿美元。随着汽车、制造、建筑和能源与电力等终端使用行业不断发展并采用先进技术,对高效可靠的润滑解决方案的需求日益增加,以确保机械设备的最佳性能和使用寿命。亚太地区的汽车行业在推动润滑脂市场趋势方面发挥着关键作用,对满足现代车辆独特要求的特种润滑脂的需求不断增加。这包括为电动汽车配制的润滑脂,在全球推动可持续交通的背景下,电动汽车越来越受欢迎。此外,润滑脂还用于航空航天应用,用于润滑飞机轴承、发动机附件、滑轨和接头,以保护它们免受腐蚀和极端条件的影响。亚太地区各国政府已在航空航天领域的技术和研究项目上投入了大量资金。所有这些因素都在推动亚太市场的发展。

预计 2022 年至 2030 年期间欧洲的复合年增长率将超过 4%。欧洲润滑油脂市场主要受技术进步、严格的监管标准和该地区强大的工业基础设施的共同推动。此外,受人口增长的推动,欧洲建筑业一直在不断扩张。此外,改造业务趋势的快速变化,例如为方便使用而进行的改造、风格混搭、定制和技术集成,可能会支持业务扩张。此外,到 2030 年,北美市场预计将达到约 9 亿美元。由于建筑、汽车、航空航天和采矿等终端行业对润滑脂的需求不断增加,该地区为润滑油脂制造商提供了广泛的增长机会。由于政府对住宅建设项目的投资和不断增加的翻新活动,北美的建筑业蓬勃发展。润滑油脂还可以提高建筑行业使用的机器和部件的性能。由于对可再生能源的需求增加,风力涡轮机安装数量增加,预计将为润滑脂市场参与者创造丰厚的机会。根据能源效率和可再生能源办公室的数据,美国风电行业在 2021 年安装了 13,413 兆瓦 (MW) 的新风电容量。润滑脂用于保护风电行业中的关键部件,例如主轴、偏航、俯仰和发电机轴承免受极端天气条件和其他污染物的影响。

润滑脂市场区域洞察

Insight Partners 的分析师已详尽解释了预测期内影响润滑脂市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的润滑脂市场细分和地理位置。

- 获取润滑脂市场的区域特定数据

润滑脂市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2022 年市场规模 | 34.4 亿美元 |

| 2030 年的市场规模 | 47.2亿美元 |

| 全球复合年增长率(2022 - 2030 年) | 4.0% |

| 史料 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 |

按基础油分类

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

润滑脂市场参与者密度:了解其对业务动态的影响

润滑脂市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在润滑脂市场运营的主要公司有:

- 埃克森美孚公司

- 福克斯

- 国家石油公司

- 壳牌公司

- 克鲁勃润滑剂有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解润滑脂市场主要参与者概况

行业发展和未来机遇:

以下列出了润滑油市场主要参与者采取的一些举措:

- 2023 年 3 月,埃克森美孚宣布投资近 1.1 亿美元(90 亿印度卢比)在马哈拉施特拉邦工业发展公司位于赖加德的 Isambe 工业区建设润滑油制造厂。

- 2021 年 3 月,福斯集团在凯泽斯劳滕工厂投资 2600 万美元(2500 万欧元),正式启用生产设施。

- 2022 年 12 月,Pennzoil-Quaker State Company d/b/a SOPUS Products(壳牌美国公司的全资子公司,负责壳牌的美国润滑油业务)收购了 Allied Reliability Inc. 的母公司 TFH Reliability Group, LLC。

竞争格局和重点公司:

埃克森美孚公司、Fuchs SE、Petroliam Nasional Bhd、壳牌公司、克鲁勃润滑剂有限公司、道达尔能源公司、英国石油公司、雪佛龙公司、Valvoline Inc 和 Axel Christiernsson AB 是润滑脂市场报告中介绍的主要参与者。全球市场参与者专注于提供高质量的产品以满足客户需求。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 润滑脂市场

获取免费样品 - 润滑脂市场