Lubricating Grease Market Growth Drivers and Forecast by 2030

Lubricating Grease Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Base Oil [Mineral Oil, Synthetic Oil (Polyalkylene Glycol, Polyalphaolefin, and Esters), and Bio-based], Thickener Type (Lithium, Lithium Complex, Polyurea, Calcium Sulfonate, Anhydrous Calcium, Aluminum Complex, and Others), and End-Use Industry (Conventional Vehicles, Electric Vehicles, Building & Construction, Mining, Marine, Food, Energy & Power, and Others)

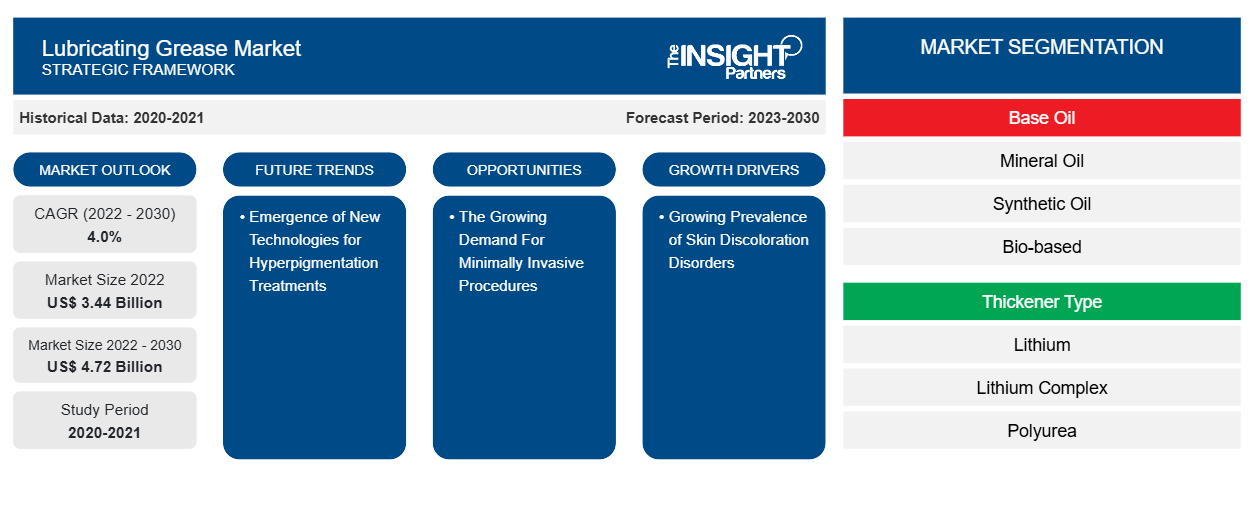

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00013643

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 317

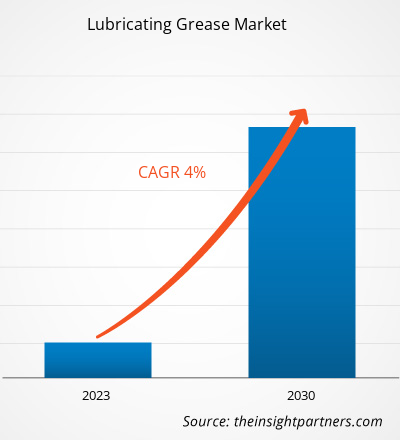

[Research Report] The lubricating grease market size was valued at US$ 3.44 billion in 2022 and is expected to reach US$ 4.72 billion by 2030; it is estimated to register a CAGR of 4.0% from 2022 to 2030.

Market Insights and Analyst View:

Lubricating grease is a semi-fluid or solid lubricant composed of a base oil, thickener, and additives. The base oil provides lubrication, the thickener gives the grease its consistency, and additives enhance its performance. Grease reduces friction, protects against wear, and provides sealing in various applications such as automotive, industrial machinery, and bearings. Its ability to adhere to surfaces makes it effective in situations where oil alone might not stay in place. Choosing the right grease depends on factors such as temperature, load, and operating conditions. This lubricant finds widespread application across industries, including automotive, manufacturing, and machinery. Its semi-solid nature allows it to adhere to surfaces, making it effective when liquid lubricants are not practical. Grease is particularly favored in applications involving bearings, gears, and other components exposed to challenging conditions. The appropriate grease selection depends on factors such as operating temperature, load, and the specific requirements of the equipment or machinery involved. All these factors are positively favoring the lubricating grease market.

Growth Drivers and Challenges:

Lubricating grease is one of the key components used in the industrial sector, which helps the equipment to run efficiently and offer maximum reliability. It is used in various industries, such as automotive, oil & gas, textile, glass, power generation, paper & pulp, chemicals, petrochemicals, agriculture, marine, industrial manufacturing, food & beverages, and pharmaceuticals. As developing economies undergo significant transformation, with burgeoning manufacturing, construction, and industrial sectors, the reliance on lubrication solutions becomes paramount. In the wake of this rapid industrialization, lubricating grease is experiencing heightened demand to ensure the optimal performance and longevity of industrial equipment. Lubricating greases cater to the seamless operation of manufacturing machinery and sustain industrial production momentum. In parallel, the construction industry, a cornerstone of industrialization, significantly influences the demand for lubricating grease. India is one of the most significant construction markets globally. The growth in construction activities in India is fueled by continuous industrialization, burgeoning population, increasing middle-class income, and infrastructure development. Thus, all these factors are driving the lubricating grease market growth.

However, government regulations and standards play a pivotal role in shaping the landscape of the lubricating grease market. According to the International Journal of Innovative Science, Engineering & Technology, it is estimated that, at present, ~50% of all lubricants sold worldwide end up in the environment via total loss applications, volatility, spills, or accidents. The increasing focus on environmental sustainability and safety has led to the implementation of stringent policies that aim to regulate the composition, production processes, and usage of lubricating greases. This has posed significant implications for manufacturers as they are required to navigate a complex regulatory environment to ensure compliance. Governments worldwide are imposing stricter standards on lubricating grease composition to reduce environmental impact. Requirements for biodegradability, reduced toxicity, and limitations on certain additives contribute to the need for continuous reformulation and adoption by manufacturers. These factors could limit the lubricating grease market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLubricating Grease Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Lubricating Grease Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities across the globe. The report aims to provide an overview of the market with detailed market segmentation in terms of base oil, thickener type, and end-use industry. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of lubricating grease globally. In addition, the global lubricating grease market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The lubricating grease market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

By base oil, the market is segmented into mineral oil, synthetic oil (polyalkylene glycol, polyalphaolefin, and esters), and bio-based. In terms of thickener type, the market is segmented into lithium, lithium complex, polyurea, calcium sulfonate, anhydrous calcium, aluminum complex, and others. In terms of end-use industry, the market is divided into conventional vehicles, electric vehicles, building & construction, mining, marine, food, energy & power, and others. The conventional vehicles segment registered a significant lubricating grease market share in 2022. Automotive grease is used in conventional vehicles to enhance engine performance. Flourishing automotive industries in developing economies and ongoing R&D for advanced grease products benefit the lubricating grease market for automotive applications. Grease plays a crucial role in the automotive industry. They help reduce friction, transfer heat, prevent corrosion, and protect against wear. Advancements in grease have resulted in compositions that support longer service intervals, increased machine longevity, higher fuel efficiency, and reduced pollutant levels. The grease used in conventional vehicles for the lubrication of bearings, joints, or gears is composed mainly of synthetic or mineral oil. All these factors are driving the lubricating grease market for the conventional vehicles segment.

Regional Analysis:

The market scope focuses on five key regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In terms of revenue, Asia Pacific dominated the lubricating grease market share, which accounted for ~US$ 2 billion in 2022. As end-use industries such as automotive, manufacturing, building & construction and energy & power, continue to grow and adopt advanced technologies, there is a heightened need for efficient and reliable lubrication solutions to ensure optimal performance and longevity of machinery and equipment. The automotive sector in the Asia Pacific region plays a pivotal role in driving lubricating grease market trends, with a rising demand for specialty greases tailored to meet the unique requirements of modern vehicles. This includes grease formulated for electric vehicles, which are gaining popularity amid the global push towards sustainable transportation. In addition, greases are used in aerospace applications for the lubrication of aircraft bearings, engine accessories, slides, and joints to protect them from corrosion and extreme conditions. Governments of countries in Asia Pacific have significantly invested in technology and research programs in the aerospace sector. All these factors are driving the market in Asia Pacific.

Europe is expected to register a CAGR of over 4% from 2022 to 2030. The lubricating grease market in Europe is majorly driven by a combination of technological advancements, stringent regulatory standards, and the region's robust industrial infrastructure. Additionally, Europe's construction sector has consistently expanded, fueled by a rising population. Also, rapid shifts in the remodeling business trends, such as remodeling for accessibility, style mashing-up, customizations, and technological integrations, are likely to support the business expansion. Further, the market in North America is estimated to reach ~US$ 900 million by 2030. The region holds extensive growth opportunities for lubricating grease manufacturers owing to the increasing demand for grease from end-use industries such as construction, automotive, aerospace, and mining. The construction industry is flourishing in North America due to government investments in residential construction projects and increasing renovation activities. Lubricating grease also enhances the performance of machines and components used in the construction industry. A rise in the number of wind turbine installations owing to the increased demand for renewable energy is expected to create lucrative opportunities for lubricating grease market players. According to the Office of Energy Efficiency & Renewable Energy, the US wind industry installed 13,413 megawatts (MW) of new wind capacity in 2021. Greases are used to protect critical components such as the main shaft, yaw, pitch, and generator bearing from extreme weather conditions and other contaminants in the wind power industry.

Lubricating Grease Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.44 Billion |

| Market Size by 2030 | US$ 4.72 Billion |

| Global CAGR (2022 - 2030) | 4.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lubricating Grease Market Players Density: Understanding Its Impact on Business Dynamics

The Lubricating Grease Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Industry Developments and Future Opportunities:

A few initiatives taken by the key players operating in the lubricating grease market are listed below:

- In March 2023, ExxonMobil announced the investment of nearly US$ 110 million (INR 900 crore) to build a lubricant manufacturing plant at the Maharashtra Industrial Development Corporation's Isambe Industrial Area in Raigad.

- In March 2021, The FUCHS Group invested US$ 26 million (EUR 25 million) in its Kaiserslautern site and officially inaugurated a production facility.

- In December 2022, Pennzoil-Quaker State Company d/b/a SOPUS Products, a wholly owned subsidiary of Shell USA, Inc. that comprises Shell's US lubricants business, acquired TFH Reliability Group, LLC, the parent company of Allied Reliability Inc.

Competitive Landscape and Key Companies:

Exxon Mobil Corp, Fuchs SE, Petroliam Nasional Bhd, Shell Plc, Kluber Lubrication GmbH & Co KG, TotalEnergies SE, BP Plc, Chevron Corp, Valvoline Inc, and Axel Christiernsson AB are among the key players profiled in the lubricating grease market report. The global market players focus on providing high-quality products to fulfill customer demand.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For