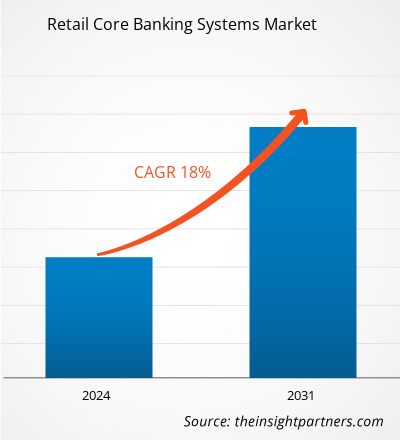

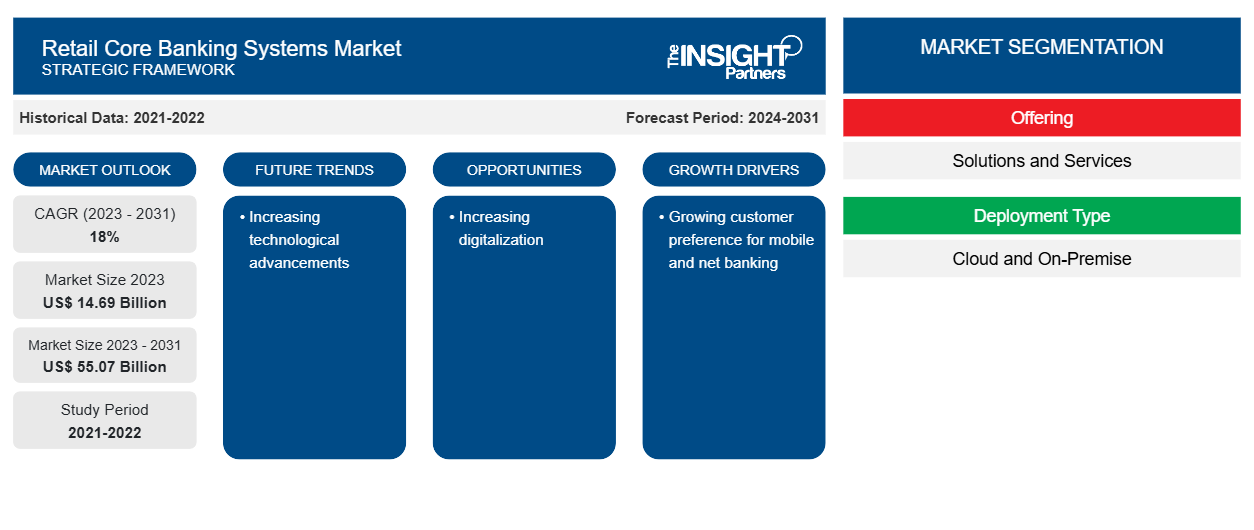

零售核心银行系统市场规模预计将从 2023 年的 146.9 亿美元增至 2031 年的 550.7 亿美元。预计 2023-2031 年市场复合年增长率为 18%。不断进步的技术可能会继续成为零售核心银行系统市场的关键趋势。

零售核心银行系统市场分析

由于银行系统快速采用尖端技术,零售核心银行解决方案的全球市场正在大幅增长,预计未来仍将如此。核心银行系统是一个银行分支机构网络,使客户能够从世界任何地方访问各种金融服务并关注他们的账户。

此外,银行和金融科技公司正在应用信息技术 (IT)来提高各自业务的可持续性和增长。核心银行技术提供了满足客户、提高银行交易绩效和快速适应不断变化的业务需求的方法。技术还使银行能够简化流程、减少延迟、改善报告和合规性并为客户提供简单的访问方式。

零售核心银行系统市场概览

零售核心银行系统为银行提供了通过数字渠道为客户提供更好的个人或消费银行服务所需的工具。通过允许客户获得信贷并安全地转移资金,这些技术改善了客户资金管理。零售银行系统的使用有助于银行以低成本筹集资金、建立稳定的客户群并维持有效的客户关系管理 ( CRM ) ,所有这些都有望推动零售核心银行系统市场的发展。此外,消费者对移动和网络银行日益增长的需求也支持了市场的扩张。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

零售核心银行系统市场驱动因素和机遇

客户对移动和网络银行的偏好日益增长

零售核心银行解决方案市场未来的增长将主要归因于客户对移动和网络银行日益增长的需求。借助移动银行,客户可以使用智能手机或平板电脑等便携式设备访问和管理银行账户以及执行其他财务任务。一种称为“网络银行”的银行服务使用户能够通过互联网访问各种银行资源并进行金融交易。为了保证更无缝的渠道运营,零售核心银行解决方案用于将网络银行服务与银行的传统运营渠道联系起来。

数字化程度不断提高

零售核心银行解决方案市场未来的增长主要归因于银行业日益数字化。在银行、金融服务和保险 ( BFSI ) 领域,“数字化转型”是指整合数字技术和策略,以改善客户体验、简化业务流程和提高行业竞争力。零售核心银行解决方案支持多渠道银行业务,使用户可以通过各种渠道访问服务,包括ATM、移动应用程序、网上银行等。因此,在预测期内,日益数字化预计将为零售核心银行系统市场参与者带来新的机会。

零售核心银行系统市场报告细分分析

有助于得出零售核心银行系统市场分析的关键部分是产品和部署类型。

产品(解决方案和服务)、部署类型(云和本地)和地理位置

- 根据产品供应,零售核心银行系统市场分为解决方案和服务。

- 根据部署类型,市场分为云和本地。云部分在 2023 年占据了最大的市场份额。

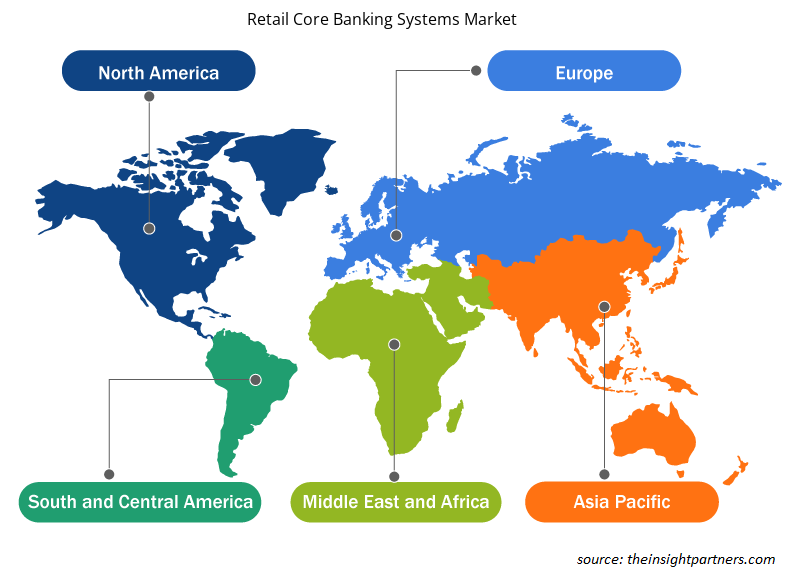

零售核心银行系统市场份额(按地区)分析

零售核心银行系统市场报告的地理范围主要分为五个区域:北美、亚太、欧洲、中东和非洲以及南美/南美和中美。就收入而言,北美占据了零售核心银行系统最大的市场份额。由于核心银行解决方案不断取得重大技术进步,并被加拿大西部银行和汇丰控股有限公司等主要公司采用,预计在预测期内,北美将保持主导地位。

零售核心银行系统市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响零售核心银行系统市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的零售核心银行系统市场细分和地理位置。

- 获取零售核心银行系统市场的区域特定数据

零售核心银行系统市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 146.9亿美元 |

| 2031 年市场规模 | 550.7亿美元 |

| 全球复合年增长率(2023 - 2031) | 18% |

| 史料 | 2021-2022 |

| 预测期 | 2024-2031 |

| 涵盖的领域 |

通过奉献

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

市场参与者密度:了解其对商业动态的影响

零售核心银行系统市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在零售核心银行系统市场运营的主要公司有:

- 甲骨文公司

- 思爱普

- 塔塔咨询服务有限公司

- 菲纳斯特拉国际有限公司

- 资本银行解决方案

- EdgeVerve 系统有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取零售核心银行系统市场顶级关键参与者概述

零售核心银行系统市场新闻和最新发展

零售核心银行系统市场通过收集一级和二级研究后的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。以下是言语和语言障碍市场的发展和策略列表:

- 2023 年 4 月,Oracle FS 与 Oracle FLEXCUBE 实施合作伙伴 Profinch 合作更新了埃塞俄比亚 OMO 银行的核心银行软件,并融入了新的反洗钱 (AML) 和欺诈预防技术。

(来源:Oracle,新闻稿)

- 2023 年 10 月,一家名为 Sopra Banking Software (SBS) 的金融科技初创公司推出了一款尖端的软件即服务 (SaaS) 核心银行平台。该平台是一款支持人工智能的完全云原生解决方案,可实时运行。

零售核心银行系统市场报告范围和交付成果

“零售核心银行系统市场规模和预测(2021-2031)”报告对市场进行了详细分析,涵盖以下领域:

- 范围内所有主要细分市场的全球、区域和国家层面的市场规模和预测

- 市场动态,如驱动因素、限制因素和关键机遇

- 未来主要趋势

- 详细的 PEST/波特五力分析和 SWOT 分析

- 全球和区域市场分析涵盖关键市场趋势、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热点图分析、知名参与者和最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 零售核心银行系统市场

获取免费样品 - 零售核心银行系统市场