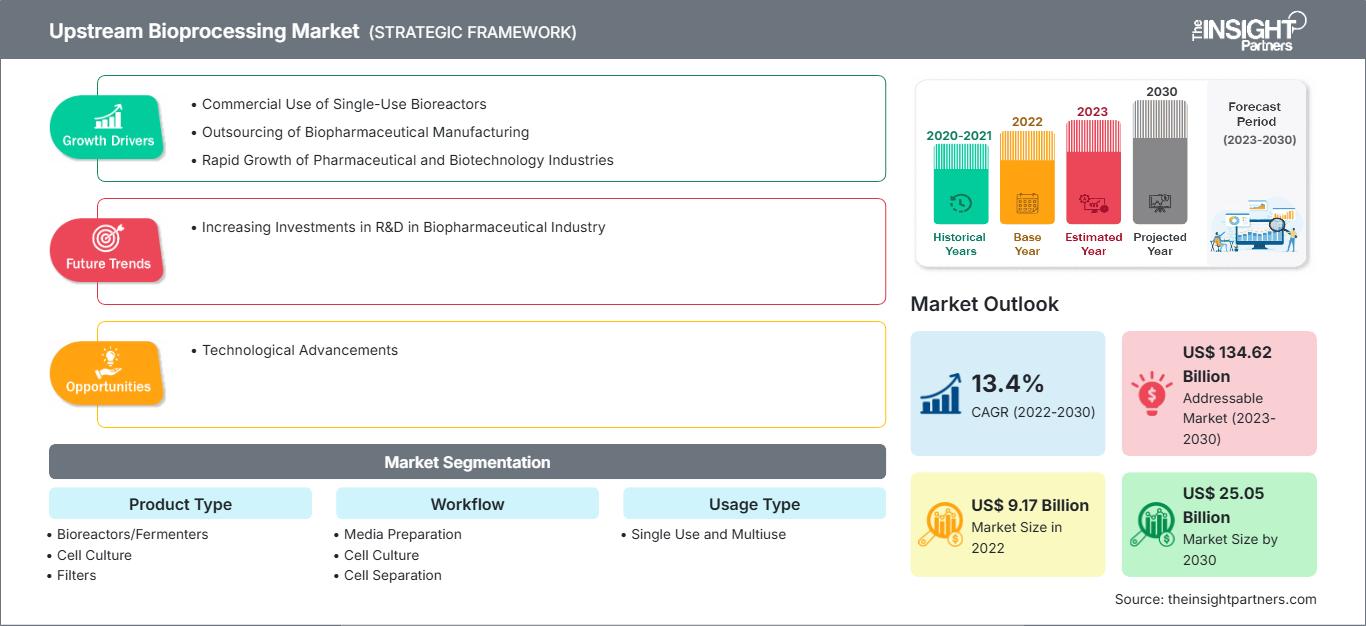

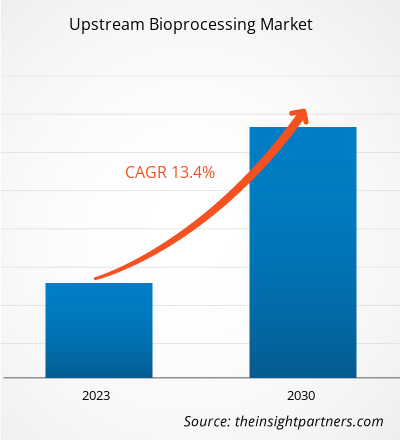

[研究报告] 上游生物加工市场规模预计将从2022年的91.7409亿美元增长到2030年的250.4669亿美元。预计上游生物加工市场在2022年至2030年间的复合年增长率将达到13.4%。

市场洞察与分析师观点:

上游生物加工是生物加工的第一阶段,包括细胞系开发、培养基开发和培养。推动上游生物加工市场增长的关键因素包括一次性生物反应器的商业化应用、生物制药制造的外包以及制药和生物技术行业的快速发展。然而,严格的监管框架阻碍了上游生物加工市场的增长。

增长动力与制约因素:

各制造商正在开发一次性生物反应器 (SUB),因为其结构坚固、性能卓越,是生物制药商业化生产所必需的。一次性反应器融合了生物膜形成、搅拌机制、生物反应器设计和传感器系统等相关技术,增加了实验室和生产规模对一次性反应器的采用。一次性生物反应器用于生产下一代细胞和基因疗法,并且适用于连续生物处理。细胞培养工艺的进步如今使得更高的滴度和细胞密度成为可能,这表明 SUB 的应用前景广阔。一次性生物反应器污染风险低,生产周转时间更短,验证时间更短。近年来,一次性生物反应器因其独特的优势,在现代生物制药工艺中的应用日益广泛,这得益于其能够提高灵活性、减少投资并降低运营成本的优势。此外,许多公司也开发了用于生产各种治疗药物的一次性生物反应器。2021年3月,赛默飞世尔科技公司推出了容量分别为3,000升和5,000升的HyPerforma DynaDrive一次性生物反应器。赛多利斯公司(Sartorius AG)也提供种类繁多的一次性生物反应器。该公司提供适用于10至15毫升微型生物反应器规模的ambr 15和适用于50至2,000升规模的Biostat STR。因此,一次性生物反应器在上游生物工艺中的应用也日益增多。因此,一次性生物反应器在治疗药物生产中的应用日益普及,推动了上游生物工艺市场的发展。

食品和药物管理局等监管机构美国药品管理局 (FDA) 和欧洲药品管理局 (EMA) 始终严格监控制药商的运营。因此,这些企业必须遵守最新的法规,以促进现行良好生产规范 (cGMP) 和良好实验室规范 (GLP),从而确保对生产流程和设施的控制和监控。目前,FDA 的 CBER 法规尚未提及一次性生物反应器。任何偏离该指南注册方案、要求和要求的行为都可能导致制造商或外包机构安排的临床试验终止。尽管与生物技术行业相关的严格法规刺激了对生物反应器的需求,但中国、印度和巴西等发展中国家缺乏明确的监管框架,阻碍了上游生物加工市场的整体增长。

从生物加工中获得的分子在临床试验中产生的结果可能与在实验室环境中产生的结果不同,这是与使用 SUB 相关的另一个重要问题。SUB 的混合机制也可能导致难以遵守法规,从而限制了其使用。例如,在波浪式SUB中,混合原理仅限于摇摆运动,这会导致混合不均匀并造成误差。因此,生物制剂的安全性和有效性可能会在SUB应用中引起人们的严重担忧。

趋势:

生物制药行业不断增加的研发投入可能会在未来几年为上游生物加工市场带来新的趋势。2020年3月,Culture Biosciences宣布在A轮融资中获得1500万美元(1340万欧元)的资金,并获得了新老风险投资的支持。据Culture Biosciences称,这笔资金已用于将生物反应器的容量提高两倍,并开发更多基于云的软件监控和开发工具,用于生物制造研发。该公司表示,这项投资将帮助科学家通过软件应用程序管理整个研发工作流程,从而支持生物制造研发的数字化。

随着研发投入持续激增,尤其是在新型生物制剂、先进疗法和个性化医疗领域,优化上游生物加工技术和方法也同样受到重视。这一趋势正在推动创新生物反应器系统、细胞培养基配方和过程自动化解决方案的开发,以提高生物制药生产运营的效率、可扩展性和生产力。此外,对研发投入的关注有利于开发尖端生物加工平台,以满足不断发展的生物制药格局,包括下一代治疗模式和生物仿制药。此外,为生物加工趋势(例如连续生物加工和用于过程监控的高级分析)投入研发资金预计将重塑上游生物加工的未来,推动最先进技术的采用,并为工艺性能、质量和法规遵从性设立新的基准。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

上游生物加工市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

上游生物加工市场根据产品类型、工作流程、使用类型和模式进行细分。根据产品类型,市场细分为生物反应器/发酵罐、细胞培养、过滤器、袋子和容器等。在工作流程方面,市场分为培养基制备、细胞培养和细胞分离。根据用途,上游生物加工市场分为一次性使用和多次使用。根据模式,上游生物加工市场分为内部和外包。在地域方面,上游生物加工市场细分为北美(美国、加拿大和墨西哥)、欧洲(德国、法国、意大利、英国、俄罗斯和欧洲其他地区)、亚太地区(澳大利亚、中国、日本、印度、韩国和亚太其他地区)、中东和非洲(南非、沙特阿拉伯、阿联酋、中东和非洲其他地区)以及南美和中美(巴西、阿根廷、南美和中美其他地区)。

分部分析:

按产品类型划分,2022 年,生物反应器/发酵罐细分市场占据上游生物加工市场的最大份额。预计 2022 年至 2030 年期间,细胞培养细分市场将在市场上实现显著的复合年增长率。生物反应器和发酵罐是核心容器,细胞和微生物在其中生长,用于各种治疗和生物加工应用,包括生物衍生化合物的表达和生产。这些系统经过精心设计,可为细胞生长提供最佳环境,并可精确控制温度、pH 值、溶解氧和搅拌等参数。这些参数对于在大规模生物加工操作中培养细胞和微生物至关重要。

根据工作流程,上游生物加工市场分为培养基制备、细胞培养和细胞分离。2022 年,细胞分离部分占据上游生物加工市场的最大份额。预计同一部分在 2022 年至 2030 年期间的市场复合年增长率将显著提高。细胞分离是从培养物中分离蛋白质产品(细胞)的初始阶段。生物反应器中收集的产品的数量和质量在是否停止细胞培养的决策中起着关键作用。

根据用途类型,全球上游生物加工市场分为一次性使用和多次使用。2022 年,一次性使用部分占据了更大的市场份额。预计该部分的市场在 2022 年至 2030 年期间将以显著的复合年增长率增长。随着一次性技术的广泛采用,上游生物加工市场经历了变革性转变。一次性系统(包括生物反应器、生物袋和连接器)因其灵活性、成本效益和较低的交叉污染风险而备受瞩目。这些一次性组件取代了传统的不锈钢设备,为生物生产提供了更灵活、更可扩展的方法。一次性趋势加速了工艺开发,最大限度地减少了清洁和验证工作,并促进了生产批次之间的快速切换。

上游生物加工市场根据模式细分为内部生产和外包生产。2022年,内部生产部分占据了更大的市场份额。预计外包生产部分在2022年至2030年期间的复合年增长率将更高。随着生物制药公司寻求对其生产流程进行更严格的控制,内部生产在上游生物加工市场中越来越受欢迎。建立内部上游生物加工设施使公司能够根据自身需求定制工艺,从而确保采用更加个性化和高效的生产方式。这一战略通常涉及对最先进的生物反应器、细胞培养系统和相关技术的投资。

区域分析:

上游生物加工市场按地区划分,包括北美、欧洲、亚太地区、南美和中美以及中东和非洲。2022 年,北美占据全球上游生物加工市场的最大份额。预计亚太地区在 2022 年至 2030 年期间的复合年增长率最高。

美国是最大的生物反应器市场——美国有多家市场参与者为制药和生物技术公司生产生物反应器。新型生物反应器的推出、地域扩张战略以及市场参与者之间的合作,共同推动了美国上游生物加工市场的增长。 2023年4月,BioMADE宣布了5个新项目,旨在弥补美国生物工业制造领域在生物反应器研究和应用方面的差距。这些项目承诺投入1050万美元,涵盖工程、硬件开发和可扩展性等领域,以解决规模经济带来的挑战。这些项目将专注于创新,引入由Schmidt Futures支持的先进生物反应器设计。2023年4月,Cytiva推出了X-Platform生物反应器,旨在通过一次性产品简化上游生物加工操作。最初,生物反应器有50升和200升两种规格。X-Platform生物反应器配备了Figurate自动化解决方案软件,可通过人体工程学改进、生产能力提升和供应链简化来提高工艺效率。

生物制药行业的增长主要得益于技术进步、灵活性提升和运营成本降低,这也使美国上游生物加工市场受益。根据国际贸易管理局(ITA)的数据,美国是全球最大的生物制药市场,也是全球生物制药研发领域的领导者。美国药品研究与制造商协会(PhRMA)的数据显示,美国公司承担了全球近50%的医药研发工作,并成功研发出许多拥有自主知识产权的新型药物。新型生物制剂的开发持续增长,导致监管机构批准了更多新分子实体(NME),这为美国上游生物加工市场的增长创造了机会。据《化学与工程新闻》报道,美国食品药品监督管理局(FDA)分别在2022年、2021年和2020年批准了约37个、50个和53个新的NME。此外,美国制药和生物技术公司加大研发投入,以改善临床试验结果并确保患者安全,也促进了美国上游生物加工市场的增长。随着美国政府加大对精准医疗的投资,精准医疗的吸引力也随之增强,这可能会在未来几年促进市场的增长。

上游生物加工

上游生物加工市场区域洞察The Insight Partners 的分析师已详尽阐述了预测期内影响上游生物加工市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的上游生物加工市场细分和地域分布。

上游生物加工市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2022 | US$ 9.17 Billion |

| 市场规模 2030 | US$ 25.05 Billion |

| 全球复合年增长率 (2022 - 2030) | 13.4% |

| 历史数据 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 |

By 产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

上游生物加工市场参与者密度:了解其对业务动态的影响

上游生物加工市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 上游生物加工市场 主要参与者概述

行业发展与未来机遇:

全球上游生物加工市场知名企业的不同举措如下:

- 2023年12月,默克收购了总部位于马萨诸塞州的Erbi Biosystems公司,该公司开发了“Breez”2毫升微型生物反应器平台技术。此次收购增强了默克的上游治疗性蛋白质产品组合,使其能够快速开发实验室规模的可扩展细胞灌注生物反应器工艺方案,其容量范围从2毫升到2000升。此外,此次收购也为进一步研究和推进细胞疗法等尖端医疗应用提供了机会。

- 2023年10月,Getinge AB以1.2亿美元收购了High Purity New England, Inc.。到2024年底,公司将全面整合High Purity New England, Inc.。此次收购帮助Getinge AB获得了从药物研发、上下游加工到灌装的一系列专有和分销产品。

- 2023年1月,赛多利斯与RoosterBio Inc.合作,共同应对纯化挑战,并为基于外泌体的疗法建立可扩展的下游生产工艺。通过此次合作,赛多利斯和RoosterBio将为基于人类间充质干细胞/基质细胞(hMSC)的外泌体生产平台提供一流的解决方案和专业知识,该平台可提供业界领先的产量、纯度和效力。

- 2022年2月,赛多利斯宣布扩大其生物加工业务。该公司已投资4000万美元在宾夕法尼亚州米勒斯堡建造和维护一座一次性技术制造工厂。此次扩建是多年期 6.5 亿美元投资的一部分,旨在提高公司以灵活、可扩展和可靠的方式生产生物加工的能力。

- 2021 年 3 月,赛默飞世尔科技公司推出了不同容量的 HyPerforma DynaDrive SUB,分别为 3,000 L 和 5,000 L 型号。赛默飞世尔科技 (Thermo Fisher Scientific) 最大的商用 SUB,也是同类产品中首款 5,000 升 SUB,使生物制药企业能够将一次性技术融入大规模生物工艺,例如在极高细胞密度下进行 cGMP 生产和灌注细胞培养。

竞争格局和主要公司:

赛默飞世尔科技 (Thermo Fisher Scientific Inc)、Esco Micro Pte Ltd、Cellexus International Ltd、Sartorius AG、丹纳赫 (Danaher Corp)、Getinge AB、默克 (Merck KGaA)、康宁 (Corning Inc)、Entegris Inc 和 PBS Biotech Inc 是上游生物工艺市场的杰出参与者。这些公司专注于开发和应用新技术、改进现有产品并扩展其地域覆盖范围,以满足全球不断增长的消费者需求。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 上游生物加工市场

获取免费样品 - 上游生物加工市场