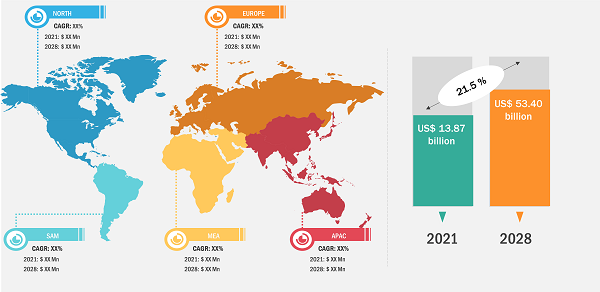

The cloud orchestration market size expected to reach US$ 53.40 billion by 2028; registering at a CAGR of 21.5% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Rising Demand for Cloud-Based Solutions due to COVID-19 Outbreak Catalyzes Cloud Orchestration Market Growth

Cloud Orchestration Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Service (Reporting & Analytics, Cloud Service Automation, Support & Maintenance, Training & Consulting, and Integration), Deployment (Public Cloud, Hybrid Cloud, and Private Cloud), Application (Autoscaling, Compliance Auditing, Provisioning, and Others), Enterprise Size (Small and Medium Enterprise and Large Enterprise), Industry (BFSI, Education, Manufacturing, Government, Media & Entertainment, IT & Telecommunication, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Cloud Orchestration Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Download Free Sample

Source: The Insight Partners Analysis

The onset of the COVID-19 outbreak in 2020 accelerated the Information & Technology (ICT) and its infrastructure activities across the world. Strict government regulations have led many industrial verticals to shift their business models. Thus, many enterprises across verticals adopted work-from-home model during the pandemic to maintain operational efficiency and employee safety, which propelled the demand for collaboration-based solutions, such as Software-as-a-Service (SaaS), contributing to the growth of cloud orchestration market. Furthermore, the global lockdowns, caused by the outbreak, forced a large share of population to stay at home, which fueled the popularity of video-on-demand (VoD). Therefore, the need for infrastructure as a service (IaaS) is increasing. In the cloud orchestration market ecosystem, companies that provide VoD services, such as YouTube, Netflix, Amazon, Hulu, Twitch, Disney+, and Apple TV, are expanding their offerings to meet the customers’ needs. Many organizations are increasing their cloud spending budget by more than 50% amid COVID-19 pandemic. Thus, the COVID-19 crisis is leading to an increased pace of cloud adoption, supporting the cloud orchestration market growth substantially.

Many organizations across the world accept cloud services as a viable IT deployment model. The most popular rationale for cloud adoption continues to be its flexibility and data security of the cloud as a delivery platform. Many businesses have already migrated to one or more cloud services, influencing others to uptake the cloud to gain a competitive advantage, is catalyzing the cloud orchestration market growth. For instance, in July 2019, Amazon Web Services (AWS), a cloud computing business of Amazon, launched its cloud solutions in Bahrain. Through the debut of its services in this region, the company hopes to tap into the technical potential of Middle Eastern businesses.

Cloud is now recognized as a credible deployment model in the organization’s IT strategy. Two-thirds of total end users across the world utilizing a cloud service are expecting to expand their footprint over the next year. In 2021, the combined market share of Amazon, Microsoft, and Google in the global public cloud services market was more than 50%. Cloud service providers are well-positioned to expand their global footprint while maintaining their innovation and commercial leadership. Thus, the high adoption of cloud-based solution and services, contributing to the cloud orchestration market growth.

Several investments in cloud orchestration market ecosystem are as follows:

- In September 2021, cloud deployment service provider Qovery raised US$4 million in funding. The company intends to support Google Cloud Platform as well.

- In September 2021, RunX raised US$4.1 million to make cloud infrastructure deployment easier for developers.

- In July 2019, Google LLC acquired Elastifile, an enterprise cloud storage provider, to expand its cloud-based file storage capabilities for enterprise-grade applications. The former company’s current file storage offerings, third-party partner offerings, and Cloud Filestore were all broadened due to this acquisition.

Thus, the rise in investments in global cloud-based technologies would fuel the growth of the cloud orchestration market during the forecast period.

Amazon Web Services, Inc.; BMC Software, Inc.; Cisco Systems, Inc.; DXC Technology Company; Hewlett Packard Enterprise Company; IBM Corporation; Oracle Corporation; Rackspace US, Inc.; ServiceNow, Inc.; and VMware, Inc. are among the key cloud orchestration market players profiled during the market study. Several other major companies were studied and analyzed during this research study to get a holistic view of the cloud orchestration market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com