Increasing Technological Advancements to Produce Lightweight and Eco-friendly Braking Systems Creating Growth Opportunities for Automotive Brake Pad Market

According to our latest market study, titled "Automotive Brake Pad Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Material Type, Vehicle Type, and Geography," the automotive brake pad market is expected to grow from US$ 2,580.57 million in 2021 to US$ 3,342.58 million by 2028. It is estimated to grow at a CAGR of 3.8% from 2021 to 2028.

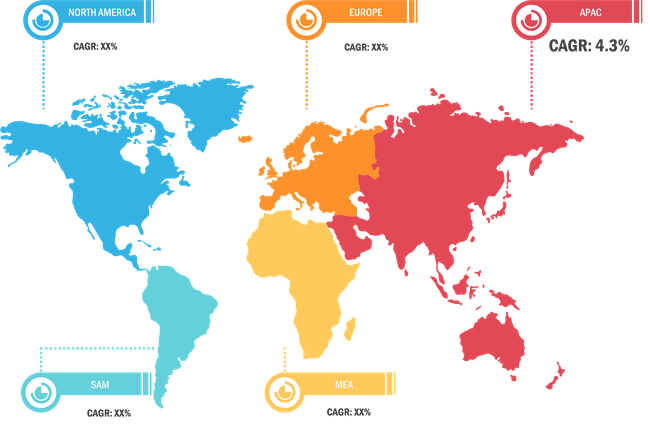

Asia Pacific is expected to be a prominent region in the automotive brake pad market over the projected period due to the region's rapidly rising automobile production and sales. Manufacturing companies in this region are focusing on developing better brake pads to help reduce brake pad size while also enhancing heat dissipation capability. Europe is expected to be another region to be monitored in the automotive brake pad market.

Lucrative Regions for Automotive Brake Pad Market

Automotive Brake Pad Market Size, Share & Industry Growth 2028

Download Free SampleAutomotive Brake Pad Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Material Type (Metallic Brake Pad, Semi-Metallic Brake Pad, Ceramic Brake Pad, Asbestos Brake Pad, and Non-Asbestos Organic Brake pad) and Vehicle Type (Commercial Vehicle and Passenger Cars)

The rising demand for passenger cars and stricter vehicle safety norms is driving the market significantly. Manufacturers are improving brake pads and disc systems due to the enforcement of stringent policies by various governments worldwide. They are improving the braking system to reduce stopping distance and incorporating various sensors for pedestrian impact prevention, such as visible light and infrared. Guidelines, such as panic stop braking with a shorter stopping distance, have been announced, affecting the brake pad business in general. As a result, brake pad producers are focusing on disc brake evolution to adhere to new rules on stopping distance. Consequently, the rising demand for brake pads is propelling the automotive brake pad market across the world.

Companies are primarily concerned with producing environmentally safe, dependable, and durable braking systems. Major players have made significant investments in research and development to enhance their market shares and assure healthy growth. For instance, Continental North America, a subsidiary of the US-based Continental AG, invested almost US$ 40 million to expand the Morganton auto plant. North Carolina has also given the corporation a US$ 1.6 million job development incentive grant. The additional production capacity would be used to produce MK C1 braking systems.

The global automotive brake pad market is analyzed on the basis of material type and vehicle type. Based on material type, the automotive brake pad market is segmented into metallic brake pads, semi-metallic brake pads, ceramic brake pads, asbestos brake pads, and non-asbestos organic brake pads. Based on vehicle type, the automotive brake pad market is segmented into commercial vehicles and passenger vehicles. Geographically, the automotive brake pad market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2020, Asia Pacific accounted for a significant share in the global automotive brake pad market.

Impact of COVID-19 Pandemic on Global Automotive Brake Pad Market

In 2020, due to the restriction on the manufacturing and the proclaimed lockdowns, vendors in the brake pad sector worldwide were being severely hampered, putting global automobile brake pad makers at a deficit. As governments worldwide have imposed lockdowns in the first half of 2020, several automotive brake pad manufacturers' demand and supply activities experienced a significant drop. From the beginning of 2021, the automotive industry regained its momentum and with important space due to the increasing demand for passenger vehicles from emerging countries. However, with the growing automotive industry, the brake pad manufacturers are regaining their pace with the resumption of operations at manufacturing units, which is anticipated to boost the uptake of automotive brake pads in the coming years.

Overall, in 2020, the COVID-19 outbreak acted as a significant limitation on the automobile parts and components business, as trade restrictions and consumption disrupted supply chains due to government lockdowns around the world. However, during the projected period of 2021–2028, government incentives, expanding regional demand, and the easy availability of raw materials are expected to boost the market's expansion. For instance, India's Automobile Mission Plan FAME-II prioritizes government assistance to the country's burgeoning automotive and component manufacturing industries. Automobile parts and accessories manufacturing businesses have undergone extensive renovation in recent years, resulting in the emergence of a highly competitive industry.

ACDelco; AKEBONO BRAKE INDUSTRY CO., LTD.; Brake Parts Inc. LLC.; Brembo S.p.A.; Hebei Huahua Friction Material CO., Ltd.; Nisshinbo Holdings Inc.; Robert Bosch GmbH; SANGSIN BRAKE; Util Industries S.p.A.; and ZF Friedrichshafen AG are the key companies operating in the automotive brake pad market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com