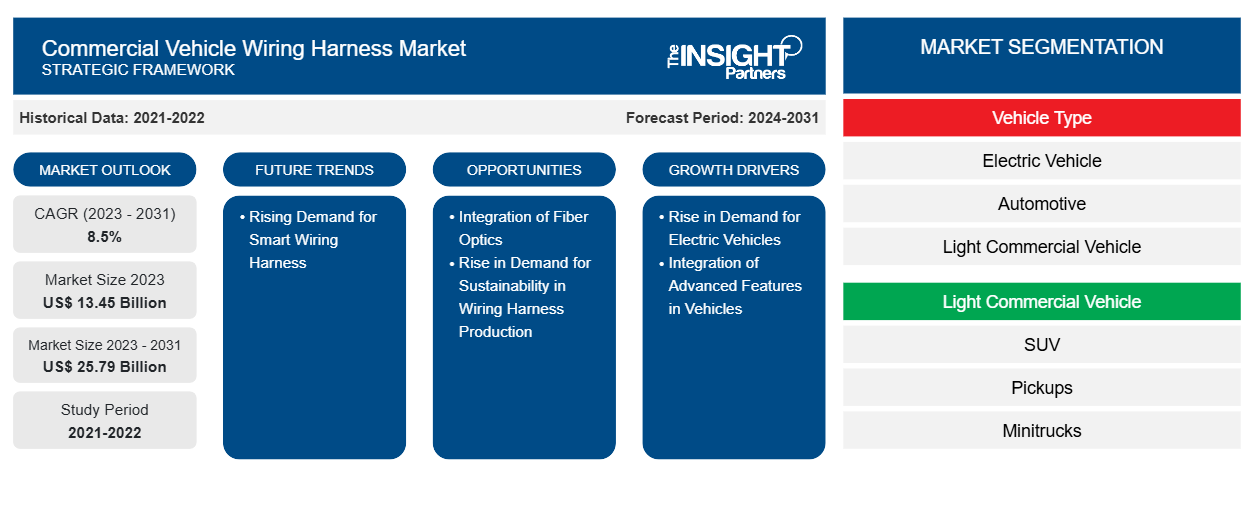

من المتوقع أن يصل حجم سوق تسخير الأسلاك للمركبات التجارية إلى 25.79 مليار دولار أمريكي بحلول عام 2031 من 13.45 مليار دولار أمريكي في عام 2023. ومن المتوقع أن يسجل السوق معدل نمو سنوي مركب بنسبة 8.5٪ من عام 2023 إلى عام 2031. ومن المرجح أن يؤدي ظهور تسخير الأسلاك الذكية إلى إحداث اتجاهات جديدة في السوق.

تحليل سوق أسلاك المركبات التجارية

يتزايد الطلب على المركبات الكهربائية ( EVs ) في جميع أنحاء العالم، وخاصة بسبب السياسات الحكومية القوية التي تدعم تبنيها والمخاوف البيئية المتزايدة. هذا الارتفاع في الطلب على المركبات الكهربائية يغذي نمو سوق تسخير الأسلاك للمركبات التجارية ، حيث تلعب تسخير الأسلاك دورًا حيويًا في التعامل مع تدفق الطاقة والمعلومات في المركبات. بالإضافة إلى ذلك، فإن التكامل المتزايد للميزات المتقدمة مثل السيارات ذاتية القيادة وأنظمة مساعدة السائق المتقدمة (ADAS) يغذي نمو السوق. علاوة على ذلك، من المتوقع أن يخلق التكامل المتزايد للألياف الضوئية للاتصال العالي والطلب المتزايد على الاستدامة في إنتاج تسخير الأسلاك فرصة لنمو سوق تسخير أسلاك المركبات التجارية. علاوة على ذلك، من المتوقع أن يؤدي الطلب المتزايد على تسخير الأسلاك الذكية، والتي يمكن أن تكون متوافقة مع أي مركبة، إلى دفع نمو السوق بشكل أكبر خلال فترة التنبؤ.

نظرة عامة على سوق أسلاك المركبات التجارية

حزمة الأسلاك هي مجموعة من الكابلات الكهربائية أو مجموعات الأسلاك التي تربط جميع المكونات الكهربائية والإلكترونية في السيارة ، مثل أجهزة الاستشعار ووحدات التحكم الإلكترونية والبطاريات والمحركات. تدير حزمة الأسلاك تدفق الطاقة والمعلومات داخل النظام الكهربائي لتمكين المهام الرئيسية للسيارة، مثل التوجيه والكبح، بالإضافة إلى وظائف السيارة الثانوية، مثل التهوية والترفيه المعلوماتي. تربط حزم الأسلاك العديد من الأسلاك في حزم غير مرنة، مما يجعلها أكثر أمانًا من الأسلاك المفكوكة ويقلل من فرصة حدوث تماس كهربائي في الدوائر الكهربائية. بالإضافة إلى ذلك، تتكون حزم الأسلاك من مواد متينة. وهي مبنية بحيث يمكن لهذه الحزم أن تعمل بشكل جيد في الظروف القاسية أثناء حمل أحمال طاقة هائلة. علاوة على ذلك، تساعد حزم الأسلاك في تحسين كفاءة الوقود لأي سيارة، مما يزيد من الطلب عليها في صناعة السيارات.

قم بتخصيص هذا التقرير ليناسب متطلباتك

ستحصل على تخصيص لأي تقرير - مجانًا - بما في ذلك أجزاء من هذا التقرير، أو تحليل على مستوى الدولة، وحزمة بيانات Excel، بالإضافة إلى الاستفادة من العروض والخصومات الرائعة للشركات الناشئة والجامعات

- احصل على أهم اتجاهات السوق الرئيسية لهذا التقرير.ستتضمن هذه العينة المجانية تحليلاً للبيانات، بدءًا من اتجاهات السوق وحتى التقديرات والتوقعات.

محركات وفرص سوق تسخير الأسلاك للمركبات التجارية

ارتفاع الطلب على السيارات الكهربائية

تتزايد مبيعات المركبات الكهربائية بسبب المخاوف بشأن حماية البيئة والسياسات الحكومية التي تفضل اعتماد المركبات منخفضة الانبعاثات أو عديمة الانبعاثات. كما تقدم حكومات البلدان المختلفة إعانات وخصومات ضريبية للمواطنين لزيادة اعتماد المركبات الكهربائية . تتخذ السلطات الحكومية مبادرات مختلفة للترويج للسيارات الكهربائية على مستوى العالم. تتخذ العديد من الولايات الأمريكية مبادرات من خلال تقديم حوافز مالية، بما في ذلك الخصومات والائتمانات الضريبية وتخفيضات رسوم التسجيل، وبالتالي تعزيز اعتماد المركبات الكهربائية في البلاد. على سبيل المثال، في عام 2021، عرضت حكومة كولورادو ائتمانًا ضريبيًا بقيمة 4000 دولار أمريكي على شراء مركبة كهربائية خفيفة . وبالمثل، تقبل حكومة كونيتيكت رسوم تسجيل مركبة نصف سنوية مخفضة قدرها 38 دولارًا أمريكيًا للسيارات الكهربائية . تؤدي مثل هذه المبادرات الحكومية إلى زيادة مبيعات المركبات الكهربائية في جميع أنحاء العالم. وفقًا لتوقعات وكالة الطاقة الدولية السنوية للسيارات الكهربائية العالمية 2024، تم تسجيل حوالي 14 مليون سيارة كهربائية جديدة في عام 2023 في جميع أنحاء العالم.

في عام 2023، كانت مبيعات السيارات الكهربائية أعلى بمقدار 3.5 مليون عن عام 2022، بزيادة قدرها 35٪ على أساس سنوي. وفقًا لنفس المصدر، شكلت السيارات الكهربائية حوالي 18٪ من جميع السيارات المباعة في عام 2023، وهو ما يمثل زيادة من 14٪ في عام 2022. أيضًا، في عام 2023، من إجمالي عدد السيارات الكهربائية الجديدة المسجلة عالميًا، سجلت الصين حوالي 60٪ من السيارات الكهربائية الجديدة، وسجلت أوروبا 25٪ من السيارات الكهربائية الجديدة، وسجلت الولايات المتحدة 10٪ من السيارات الكهربائية الجديدة. بلغ عدد تسجيلات السيارات الكهربائية الجديدة 8.1 مليون في الصين في عام 2023، بزيادة قدرها 35٪ مقارنة بعام 2022. تعد الصين أكبر منتج للسيارات الكهربائية في العالم، حيث تنتج 64٪ من حجم السيارات الكهربائية العالمي . وبالتالي، فإن ارتفاع مبيعات السيارات الكهربائية يعزز الطلب على حزم الأسلاك لأنها تلعب دورًا حيويًا في التعامل مع تدفق الطاقة والمعلومات داخل السيارات الكهربائية .

دمج الألياف الضوئية

إن الاعتماد المتزايد على كابلات الألياف الضوئية أصبح حجر الزاوية للابتكار والكفاءة في صناعة السيارات سريعة التغير. ومع تزايد ارتباط السيارات بالتكنولوجيا الجديدة، أصبح استخدام كابلات الألياف الضوئية للسيارات أمرًا بالغ الأهمية في تلبية الحاجة المتزايدة لنقل البيانات بشكل أسرع وتحسين الأداء. تعمل كابلات الألياف الضوئية على تعزيز أنظمة الترفيه والمعلومات داخل السيارة، مما يوفر للركاب والسائقين تجربة سمعية وبصرية لا مثيل لها تزيد بشكل كبير من سعادة المستخدم وتجربة القيادة الشاملة. بالإضافة إلى ذلك، يمكن للألياف الضوئية توفير تشخيصات المركبات في الوقت الفعلي، وأنظمة مساعدة السائق المحسنة، وقدرات القيادة الذاتية من خلال السماح بنقل البيانات بسرعة، وهو أمر بالغ الأهمية لاتخاذ القرارات في جزء من الثانية. يعمل تطبيقها في تصميم السيارات على تقليل وزن السيارة، مما يؤدي إلى مركبات أكثر كفاءة في استهلاك الوقود وصديقة للبيئة.

تعتبر الألياف الضوئية بالغة الأهمية في أنظمة مثل مثبت السرعة التكيفي، وتجنب الاصطدام، وتحذيرات مغادرة المسار، والتي تتطلب نقل البيانات بسرعة. ويضمن تطبيقها أن تكون تدابير السلامة ليس فقط أكثر فعالية ولكن أيضًا أكثر موثوقية، مما يمنح السائقين شعورًا أكبر بالثقة. وعلاوة على ذلك، فإن استخدام كابلات الألياف الضوئية في أنظمة الاتصالات داخل المركبات يسمح بتدفق أكثر سلاسة وكفاءة للمعلومات، وهو أمر بالغ الأهمية للأداء السليم لتدابير السلامة الحديثة. يعمل هذا الاتصال في الوقت الفعلي على تحسين أداء المركبات ويمثل خطوة مهمة في ابتكار سلامة السيارات، مما يمهد الطريق للتقدم التكنولوجي في المركبات في المستقبل وينقل الصناعة إلى مستويات أعلى من حماية الركاب. وبالتالي، من المتوقع أن يؤدي التكامل المتزايد للألياف الضوئية في المركبات إلى تعزيز الطلب على حزم الأسلاك خلال فترة التنبؤ.

تقرير تحليلي لتجزئة سوق أسلاك المركبات التجارية

إن القطاعات الرئيسية التي ساهمت في اشتقاق تحليل سوق تسخير الأسلاك للمركبات التجارية هي نوع المركبة، والمركبة التجارية الخفيفة، والمركبة التجارية المتوسطة والثقيلة.

- بحسب نوع السيارة، يتم تقسيم سوق تسخير الأسلاك للمركبات التجارية إلى المركبات الكهربائية والسيارات والمركبات التجارية الخفيفة (LCV) والمركبات التجارية المتوسطة والثقيلة (MHCVs). احتل قطاع السيارات الحصة الأكبر في سوق تسخير الأسلاك للمركبات التجارية في عام 2023.

- ينقسم سوق تسخير الأسلاك للمركبات التجارية الخفيفة إلى سيارات الدفع الرباعي والشاحنات الصغيرة والشاحنات الصغيرة. احتلت فئة سيارات الدفع الرباعي الحصة الأكبر في سوق تسخير الأسلاك للمركبات التجارية في عام 2023.

- تم تقسيم سوق تسخير الأسلاك للمركبات التجارية المتوسطة والثقيلة (MHCV) إلى شاحنات متوسطة وثقيلة، ومركبات تعدين ثقيلة، ومركبات بناء ثقيلة، ومركبات زراعية ثقيلة، ومركبات/جرارات زراعية متوسطة. هيمن قطاع الشاحنات المتوسطة والثقيلة على سوق تسخير الأسلاك للمركبات التجارية في عام 2023.

تحليل حصة سوق تسخير الأسلاك للمركبات التجارية حسب المنطقة الجغرافية

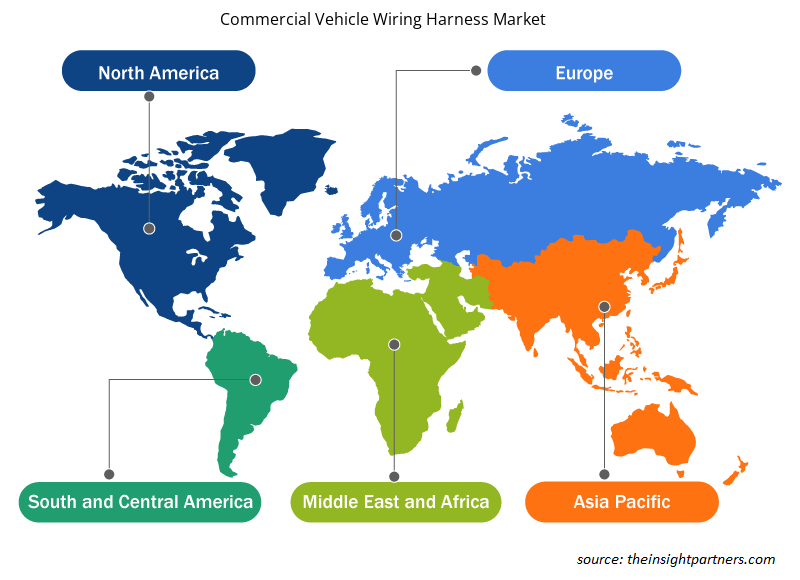

- تم تقسيم سوق تسخير الأسلاك للمركبات التجارية إلى خمس مناطق رئيسية - أمريكا الشمالية وأوروبا وآسيا والمحيط الهادئ (APAC) والشرق الأوسط وأفريقيا (MEA) وأمريكا الجنوبية والوسطى. سيطرت منطقة آسيا والمحيط الهادئ على السوق في عام 2023، تليها أمريكا الشمالية وأوروبا.

- شهدت أمريكا الشمالية نموًا هائلاً في مبيعات السيارات الكهربائية في عام 2023. ووفقًا لتقرير وكالة الطاقة الدولية السنوي عن السيارات الكهربائية العالمية لعام 2024، فقد وصلت تسجيلات السيارات الكهربائية الجديدة في الولايات المتحدة إلى 1.4 مليون في عام 2023، وهو ما يمثل ارتفاعًا يزيد عن 40٪ مقارنة بعام 2022. يتخذ العديد من اللاعبين في سوق أسلاك توصيل المركبات التجارية في المنطقة مبادرات مختلفة لزيادة الوعي بفوائد هذه المكونات. على سبيل المثال، بناءً على نجاح المؤتمرات التي استضافتها في عامي 2022 و2023، تخطط Süddeutscher Verlag Events GmbH لاستضافة مؤتمرها الثالث لأسلاك توصيل المركبات في الولايات المتحدة ومؤتمر EDS في ديربورن بولاية ميشيغان، في الفترة من 28 إلى 29 أكتوبر 2024. تم التخطيط لهذه الأحداث لتثقيف وتزويد الشركات المصنعة للمعدات الأصلية ومطوري أسلاك التوصيل وموردي Tier1 وTier2 ومتخصصي الجهد العالي والموردين المبتكرين الآخرين بالمعرفة حول تصنيع وتصميم أسلاك توصيل المركبات التجارية جنبًا إلى جنب مع فوائدها في الظروف القاسية.

رؤى إقليمية حول سوق أسلاك المركبات التجارية

لقد قام المحللون في Insight Partners بشرح الاتجاهات والعوامل الإقليمية المؤثرة على سوق تسخير الأسلاك للمركبات التجارية طوال فترة التوقعات بشكل شامل. يناقش هذا القسم أيضًا قطاعات سوق تسخير الأسلاك للمركبات التجارية والجغرافيا في جميع أنحاء أمريكا الشمالية وأوروبا ومنطقة آسيا والمحيط الهادئ والشرق الأوسط وأفريقيا وأمريكا الجنوبية والوسطى.

- احصل على البيانات الإقليمية المحددة لسوق أسلاك المركبات التجارية

نطاق تقرير سوق تسخير الأسلاك للمركبات التجارية

| سمة التقرير | تفاصيل |

|---|---|

| حجم السوق في عام 2023 | 13.45 مليار دولار أمريكي |

| حجم السوق بحلول عام 2031 | 25.79 مليار دولار أمريكي |

| معدل النمو السنوي المركب العالمي (2023 - 2031) | 8.5% |

| البيانات التاريخية | 2021-2022 |

| فترة التنبؤ | 2024-2031 |

| القطاعات المغطاة | حسب نوع السيارة

|

| المناطق والدول المغطاة | أمريكا الشمالية

|

| قادة السوق وملفات تعريف الشركات الرئيسية |

|

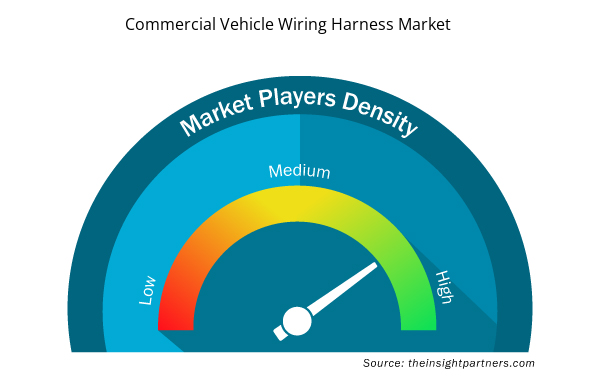

كثافة اللاعبين في السوق: فهم تأثيرها على ديناميكيات الأعمال

يشهد سوق تسخير الأسلاك للمركبات التجارية نموًا سريعًا، مدفوعًا بالطلب المتزايد من المستخدم النهائي بسبب عوامل مثل تفضيلات المستهلكين المتطورة والتقدم التكنولوجي والوعي الأكبر بفوائد المنتج. ومع ارتفاع الطلب، تعمل الشركات على توسيع عروضها والابتكار لتلبية احتياجات المستهلكين والاستفادة من الاتجاهات الناشئة، مما يؤدي إلى زيادة نمو السوق.

تشير كثافة اللاعبين في السوق إلى توزيع الشركات أو المؤسسات العاملة في سوق أو صناعة معينة. وهي تشير إلى عدد المنافسين (اللاعبين في السوق) الموجودين في مساحة سوق معينة نسبة إلى حجمها أو قيمتها السوقية الإجمالية.

الشركات الرئيسية العاملة في سوق تسخير الأسلاك للمركبات التجارية هي:

- شركة ماذرسون سومي سيستمز المحدودة

- شركة AME Systems (VIC) المحدودة.

- شرارة العقل

- شركة يازاكي

- شركة سوميتومو للصناعات الكهربائية المحدودة

- نيكسانز إس إيه

إخلاء المسؤولية : الشركات المذكورة أعلاه ليست مرتبة بأي ترتيب معين.

- احصل على نظرة عامة على أهم اللاعبين الرئيسيين في سوق تسخير الأسلاك للمركبات التجارية

أخبار سوق أسلاك المركبات التجارية والتطورات الأخيرة

يتم تقييم سوق أسلاك التوصيل للمركبات التجارية من خلال جمع البيانات النوعية والكمية بعد البحث الأولي والثانوي، والتي تتضمن منشورات الشركات المهمة وبيانات الجمعيات وقواعد البيانات. فيما يلي بعض التطورات في سوق أسلاك التوصيل للمركبات التجارية:

- أعلنت شركة Lear Corporation، إحدى الشركات العالمية الرائدة في تكنولوجيا السيارات في مجال المقاعد والأنظمة الإلكترونية، أنها استحوذت على شركة M&N Plastics، وهي شركة خاصة مقرها ميشيغان متخصصة في قولبة الحقن ومصنعة لمكونات البلاستيك الهندسي لتطبيقات توزيع الكهرباء في السيارات.

(المصدر: شركة لير، بيان صحفي، مارس 2024)

- وقعت شركة سوميتومو اليابانية لأنظمة الأسلاك الكهربائية اتفاقية مبدئية مع الهيئة العامة للاستثمار والمناطق الحرة في مصر لإنشاء أكبر مصنع في العالم لتوصيلات أسلاك السيارات الكهربائية في مصر. وسيتم إنشاء المصنع في المنطقة الحرة بمدينة العاشر من رمضان على مساحة 150 ألف متر مربع. ويتضمن المشروع استثمارات تقدر بنحو 100 مليون دولار لتصدير المنتجات إلى شركات تصنيع السيارات العالمية في أوروبا والشرق الأوسط.

(المصدر: شركة سوميتومو لأنظمة الأسلاك الكهربائية، بيان صحفي، أبريل 2023)

تقرير سوق أسلاك المركبات التجارية والتغطية والنتائج المتوقعة

يوفر "حجم سوق أسلاك المركبات التجارية والتوقعات (2021-2031)" تحليلاً مفصلاً للسوق يغطي المجالات المذكورة أدناه:

- حجم سوق أسلاك المركبات التجارية وتوقعاته على المستويات العالمية والإقليمية والوطنية لجميع قطاعات السوق الرئيسية المغطاة ضمن النطاق

- اتجاهات سوق أسلاك المركبات التجارية بالإضافة إلى ديناميكيات السوق مثل السائقين والقيود والفرص الرئيسية

- تحليل مفصل لـ PEST و SWOT

- تحليل سوق تسخير الأسلاك للمركبات التجارية يغطي اتجاهات السوق الرئيسية والإطار العالمي والإقليمي واللاعبين الرئيسيين واللوائح والتطورات الأخيرة في السوق

- تحليل المشهد الصناعي والمنافسة الذي يغطي تركيز السوق، وتحليل خريطة الحرارة، واللاعبين البارزين، والتطورات الأخيرة لسوق تسخير الأسلاك للمركبات التجارية

- ملفات تعريف الشركة التفصيلية

- التحليل التاريخي (سنتان)، السنة الأساسية، التوقعات (7 سنوات) مع معدل النمو السنوي المركب

- تحليل PEST و SWOT

- حجم السوق والقيمة / الحجم - عالميًا وإقليميًا وقطريًا

- الصناعة والمنافسة

- مجموعة بيانات Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

الأسئلة الشائعة

Rising demand for smart wiring harness are expected to drive the growth of the commercial vehicle wiring harness market in the coming years.

The key players holding majority shares in the commercial vehicle wiring harness market include Motherson Sumi Systems Ltd., AME Systems (VIC) Pty Ltd., Spark Minda, Yazaki Corp, Sumitomo Electric Industries Ltd, Nexans SA, Furukawa Electric Co Ltd, Lear Corp, DRÄXLMAIER Group, and ECOCABLES.

Rise in demand for electric vehicles and integration of advanced features in vehicles are driving factors in the commercial vehicle wiring harness market.

The commercial vehicle wiring harness market was estimated to be valued at US$ 13.45 billion in 2023 and is anticipated to grow at a CAGR of 8.5% over the forecast period.

The automotive segment led the commercial vehicle wiring harness market with a significant share in 2023.

The commercial vehicle wiring harness market is expected to reach US$ 25.79 Billion by 2031.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

The List of Companies - Commercial Vehicle Wiring Harness Market

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Spark Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

- Furukawa Electric Co Ltd

- Lear Corp

- DRÄXLMAIER Group

- ECOCABLES

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

احصل على عينة مجانية لهذا التقرير

احصل على عينة مجانية لهذا التقرير