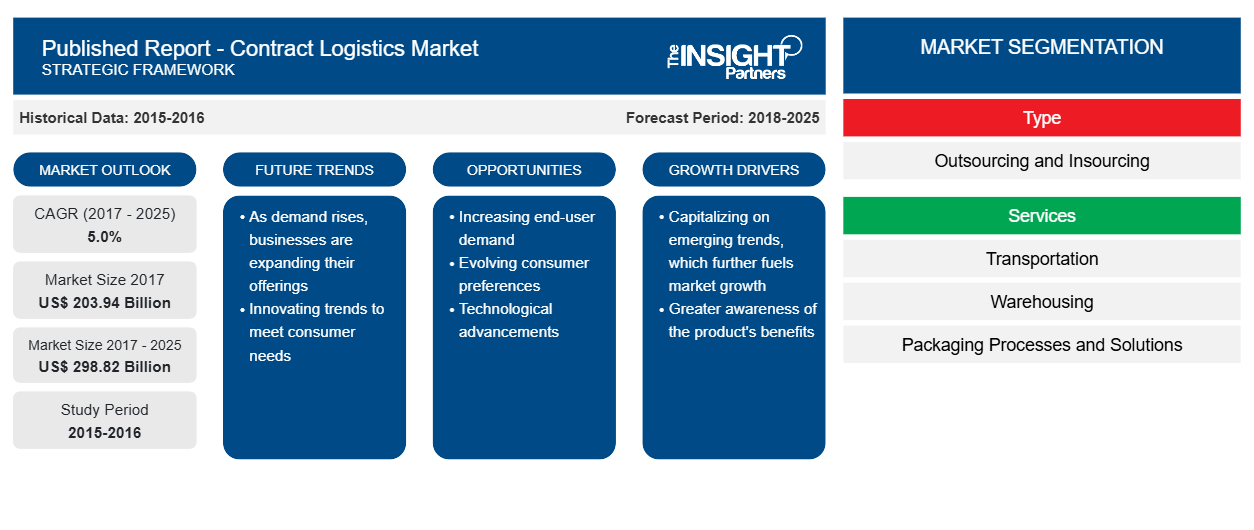

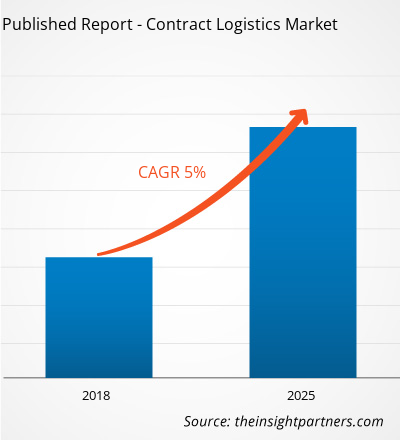

[Research Report] The contract logistics market was valued at US$ 203,938.8 million in 2017 and is projected to reach US$ 298,822.0 million by 2025; it is expected to grow at a CAGR of 5.0% from 2018 to 2025.

Analyst Perspective:

The contract logistics market is vital to the global supply chain industry, providing specialized services to companies across various sectors. Contract logistics involves outsourcing logistics activities to third-party providers, allowing businesses to focus on their core competencies while benefiting from the expertise and efficiency of logistics specialists. In recent years, the contract logistics market has experienced significant growth due to several factors. Firstly, globalization has increased international trade, resulting in higher demand for efficient and cost-effective logistics solutions. As companies expand their operations to new markets, they often rely on contract logistics providers to manage complex supply chains and ensure seamless distribution of goods.

The advancements in technology have revolutionized the logistics industry, driving the adoption of innovative solutions in contract logistics. Automated systems, including warehouse and transportation management systems, enable improved inventory management, real-time tracking, and streamlined operations. Technology integration has enhanced efficiency, visibility, and overall supply chain performance. Furthermore, the e-commerce boom has profoundly impacted the contract logistics market. With the rise of online retail, companies require robust logistics infrastructure to handle increasing volumes of orders, manage fulfillment centers, and execute last-mile deliveries. Contract logistics providers have offered tailored solutions, such as warehousing, order processing, and value-added services, to support e-commerce operations. Major companies in this sector offer various services, including transportation, warehousing, packaging, order fulfillment, and reverse logistics. They cater to diverse industries, such as retail, automotive, pharmaceuticals, consumer goods, and manufacturing. To meet the evolving demands of customers, contract logistics providers are increasingly focusing on sustainability and environmental responsibility. They strive to optimize transportation routes, reduce carbon emissions, and implement eco-friendly practices throughout the supply chain. This sustainability-oriented approach aligns with the growing environmental concerns and enhances the reputation and attractiveness of contract logistics providers in the market.

Market Overview:

The movement of commodities from one location to another is called logistics. Contract logistics is the whole procedure from production to distribution at the point of sale. It is a more comprehensive plan of action that incorporates supply chain management procedures with traditional logistics. The businesses that work in the contract logistics sector undertake tasks like managing the supply chain, warehousing, shipping, distributing products, processing orders, and collecting payments, keeping track of inventories, and even performing customer support. This is the practice of assigning work related to resource management to outside service providers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Contract Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Contract Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Exponential Growth Of E-Commerce to Drive Growth of Contract Logistics Market

The exponential growth of e-commerce has emerged as a powerful driver for the contract logistics market, fueling its expansion and development. This growth is attributable to several factors highlighting the symbiotic relationship between e-commerce and contract logistics. Firstly, the surge in online retail has resulted in increased demand for efficient logistics solutions. E-commerce companies require seamless order fulfillment, streamlined inventory management, and reliable last-mile delivery services to meet the expectations of digitally connected consumers.

Contract logistics providers specialize in offering these services, leveraging their expertise and infrastructure to support the growing needs of e-commerce operations. The complexity of managing e-commerce logistics has prompted businesses to seek specialized assistance. E-commerce supply chains involve multiple touchpoints, including product sourcing, inventory storage, order processing, packaging, and transportation. Contract logistics providers have the knowledge and resources to navigate these intricacies effectively. They offer tailored solutions to optimize e-commerce logistics processes, ensuring smooth operations and customer satisfaction. Moreover, the time-sensitive nature of e-commerce requires fast and reliable delivery. Contract logistics providers are critical in optimizing last-mile logistics, which involves transporting goods from distribution centers to end consumers. They utilize their extensive transportation networks, route optimization techniques, and real-time tracking capabilities to ensure timely and efficient deliveries. By meeting the increasing expectations for quick and reliable shipping, contract logistics providers contribute to the success of e-commerce businesses.

The scalability and flexibility offered by contract logistics providers align with the dynamic nature of the e-commerce sector. As online retailers experience seasonal spikes, promotional campaigns, or market expansions, they require a logistics partner capable of adapting to changing demands. Contract logistics providers can rapidly scale their operations, adjust storage capacity, and optimize resources to accommodate fluctuations in e-commerce volumes, providing businesses with the agility needed to thrive in a fast-paced digital marketplace.

Segmental Analysis:

Based on type, the contract logistics market is segmented into outsourcing and insourcing. The insourcing segment held the largest share of the market in 2020 and is anticipated to register the highest CAGR in the market during the forecast period. The insourcing segment in the contract logistics market has emerged as the largest share. This indicates that many businesses have managed their logistics operations internally rather than outsourcing them to third-party providers. Factors contributing to this trend include the desire for operational control and flexibility, possessing the necessary resources and infrastructure, safeguarding intellectual property, and meeting industry-specific requirements. While insourcing dominates the market, outsourcing remains significant as companies recognize the benefits of specialized expertise, technology-driven solutions, and focusing on core competencies.

Regional Analysis:

The Asia Pacific contract logistics market was valued at US$ 80.96 billion in 2017 and is projected to reach US$ 126.10 billion by 2025; it is expected to grow at a CAGR of 5.8% during the forecast period. The Asia Pacific region has occurred as the dominant force in the contract logistics market, showcasing robust growth and a significant market share. Several factors contribute to the region's dominance in the market.

The Asia Pacific region is home to some of the world's largest economies, including China, Japan, India, and South Korea. These countries have witnessed rapid industrialization, urbanization, and a surge in consumer demand, driving the need for efficient logistics services. As businesses expand their operations in these growing markets, the demand for contract logistics providers to manage complex supply chains and distribution networks has soared. Moreover, the Asia Pacific region has established itself as a global manufacturing hub, with many multinational companies establishing production facilities and sourcing operations in countries like China and India. This manufacturing strength has increased demand for contract logistics services, as companies require efficient transportation, warehousing, and distribution solutions to manage the movement of goods within the region and across international borders.

The e-commerce boom in the Asia Pacific region has also contributed to its dominance in the contract logistics market. The region has witnessed a rapid increase in online retail activities, driven by a large consumer base, rising internet penetration, and changing consumer preferences. E-commerce companies in the region require robust logistics infrastructure to handle the growing volumes of online orders and ensure timely customer deliveries. Contract logistics providers play a crucial role in supporting the e-commerce ecosystem by offering specialized services tailored to the unique needs of online retail. The Asia Pacific region has diverse and fragmented markets, infrastructure, and complex regulatory environments. Navigating these challenges requires in-depth local knowledge and expertise, which local contract logistics providers possess. These providers deeply understand the region's logistics landscape, cultural nuances, and regulatory requirements, enabling them to offer custom resolutions that fulfill the specific needs of businesses in the Asia Pacific region.

Key Player Analysis:

The contract logistics market analysis consists of the players such as Deutsche Post AG, XPO Logistics Inc., Kuehne + Nagel International AG, CEVA Logistics AG, DB Schenker, Hitachi Transport System Ltd, Geodis, Neovia Logistics Services, UPS Supply Chain Solutions, and Ryder System. Among the players in the contract logistics Neovia Logistics Services and Deutsche Post AG are the top two players owing to the diversified product portfolio offered.

Contract Logistics Published Report - Contract Logistics Market Regional Insights

The regional trends and factors influencing the Published Report - Contract Logistics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Published Report - Contract Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Published Report - Contract Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 203.94 Billion |

| Market Size by 2025 | US$ 298.82 Billion |

| Global CAGR (2017 - 2025) | 5.0% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Published Report - Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Published Report - Contract Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Published Report - Contract Logistics Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the contract logistics market. A few recent key market developments are listed below:

- In January 2022, Penske collaborated with Röhlig Logistics, a provider of logistics services to form a new joint venture company called Rohlig Penske Logistics GmbH, operating primarily in Germany and the Netherlands.

- In December 2021, A.P. Moller – Maersk one of contract logistics market leader announced the signing of an international freight supply chain management partnership with Unilever, which is a significant player in the FMCG space to combine the execution of its global ocean and air transport, intending to enhance visibility, increase efficiency, and drive reductions in emissions across its operations.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies

1. Deutsche Post AG

2. GEODIS

3. DB Schenker

4. Hitachi Transport System, Ltd.

5. Kuehne + Nagel International AG

6. XPO Logistics, Inc.

7. Ryder System, Inc.

8. CEVA Logistics AG

9. Neovia Logistics Services, LLC

10. UPS Supply Chain Solutions

Get Free Sample For

Get Free Sample For